Corporate Overview

CFGLOBALPTYLTD Is A Professional Brokerage Firm Specializing In Providing Global Execution And Outsourced Trading Services To Institutional Investors. Founded In 2000 By Veteran Financial Professionals Scott Chace And Robert Fleming, The Company Is Headquartered In Australia And Has Branches In New York, London And Hong Kong. The Company Mainly Provides Full-process Trading Solutions For Hedge Funds, Asset Managers And Pension Funds.

Core Business And Services

The Company Mainly Provides Outsourced Trading Services And Multi-asset Execution Capabilities. In Terms Of Outsourced Trading Services, We Provide Fully Outsourced Trade Execution For Start-up And Mid-sized Hedge Funds, Including Order Routing And Execution, Post-trade Services And Compliance Support. Multi-asset Execution Capabilities Cover Multiple Asset Classes Such As Equities, Fixed Income, Derivatives And Private Securities, And The Scope Of Services Covers Major Global Financial Marekts.

Client Group

CFGLOBALPTYLTD's Clients Mainly Include Hedge Funds, Pension Funds And Family Offices. The Asset Management Scale Of The Service Clients Ranges From 50 Million US Dollars To 50 Billion US Dollars, Covering A Variety Of Investment Strategies Such As Quantitative, Long-short Strategies, Macro Funds, Etc.

Global Branches

The Company Has Branches In New York, London And Hong Kong. The New York Office Is Located At 60East42ndStreet, Suite1455; The London Office Is Located At 1LancasterPlace; The Hong Kong Office Is Located At 2103 TheCentrium, 60Wyndham Street. Each Branch Provides Localized Service Support.

Competitive Advantage

The Company's Founding Team Has A Deep Industry Background. ScottChace Served As The Head Of Asian Trading At Tiger Fund, And Robert Fleming Served As The Head Of Sales Trading At ING Baring (Hong Kong). The Company's Execution Quality Is Excellent, With An Order Fill Rate Of Over 90% And An Average Execution Delay Of Less Than 5 Milliseconds. In Addition, The Company Adopts A Platform Royalty-free Model And Only Charges Commissions Based On Transaction Volume, Which Has Significant Cost Advantages.

Risk Control System

The Company Has Established A Three-level Risk Control Level, Including Pre-transaction Inspection, Real-time Monitoring And Post Audit. In Terms Of Technical Support, An AI-driven Anomaly Detection System Has Been Deployed. All Data Is Stored In An ISO27001 Certified Data Center To Ensure Transaction Security And Compliance. Future Development Direction The Company Plans To Expand Into The Asia Pacific Market, Add Offices In Singapore And Tokyo, And Develop A Carbon Emission Trading Execution Module. At The Same Time, The Application Of Blockchain Technology In Bond Transaction Settlement Will Be Piloted To Continuously Improve Service Capabilities.

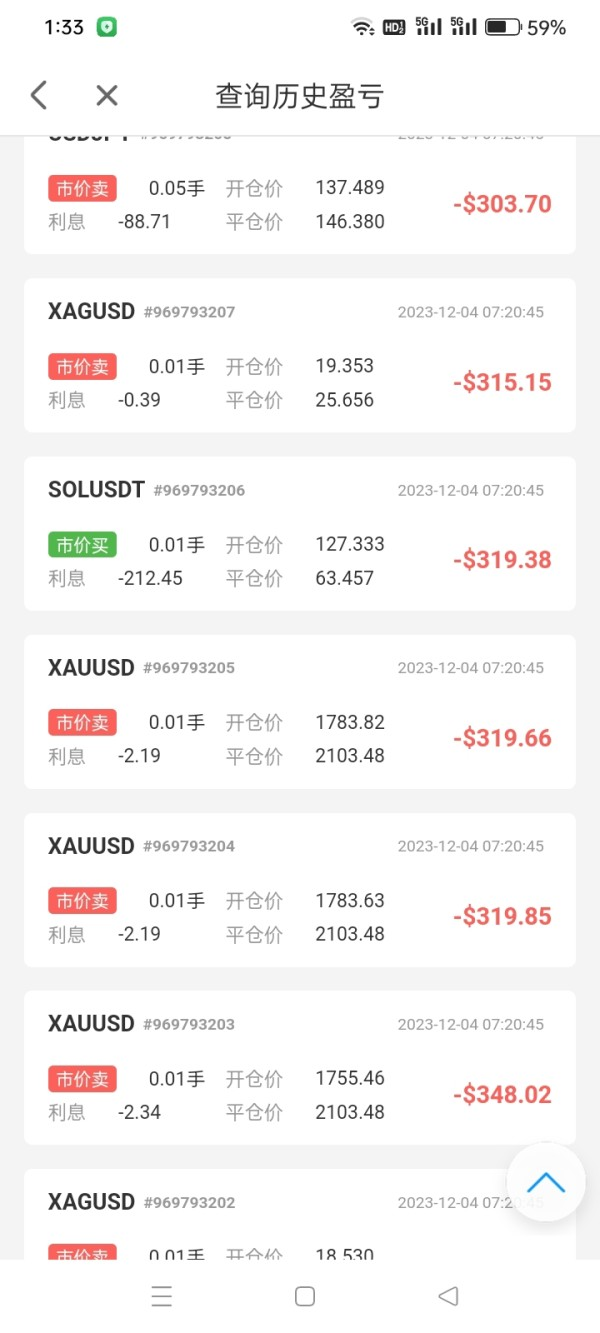

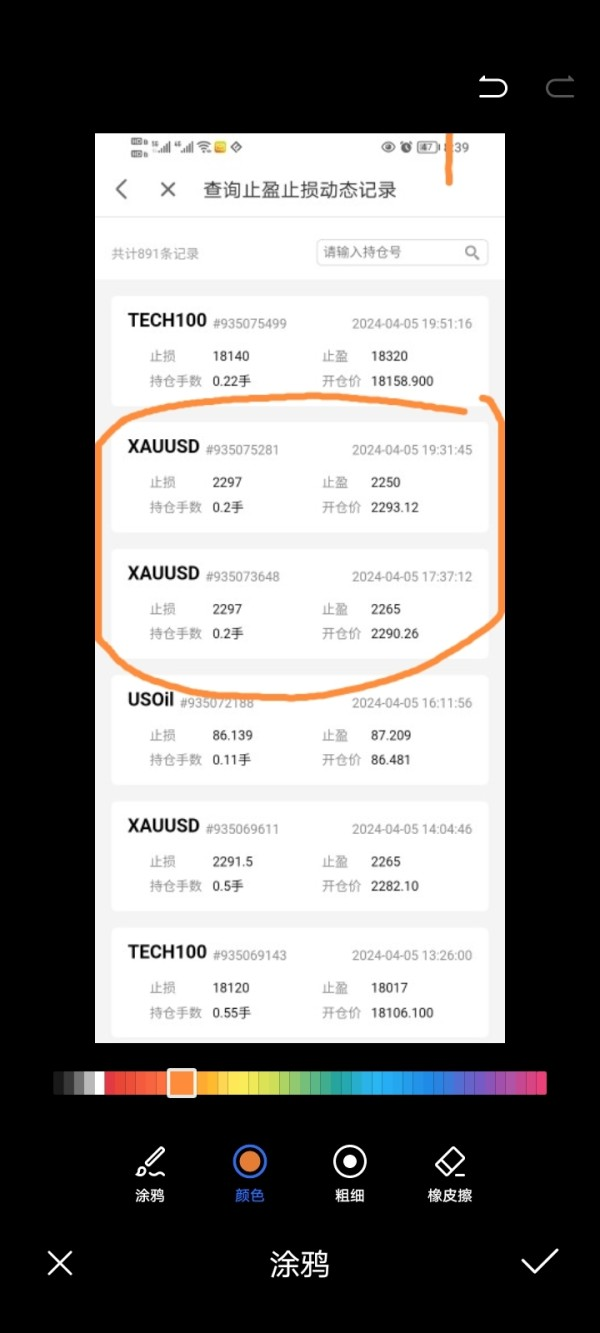

Inducement Fraud

Inducement Fraud