Corporate Profile

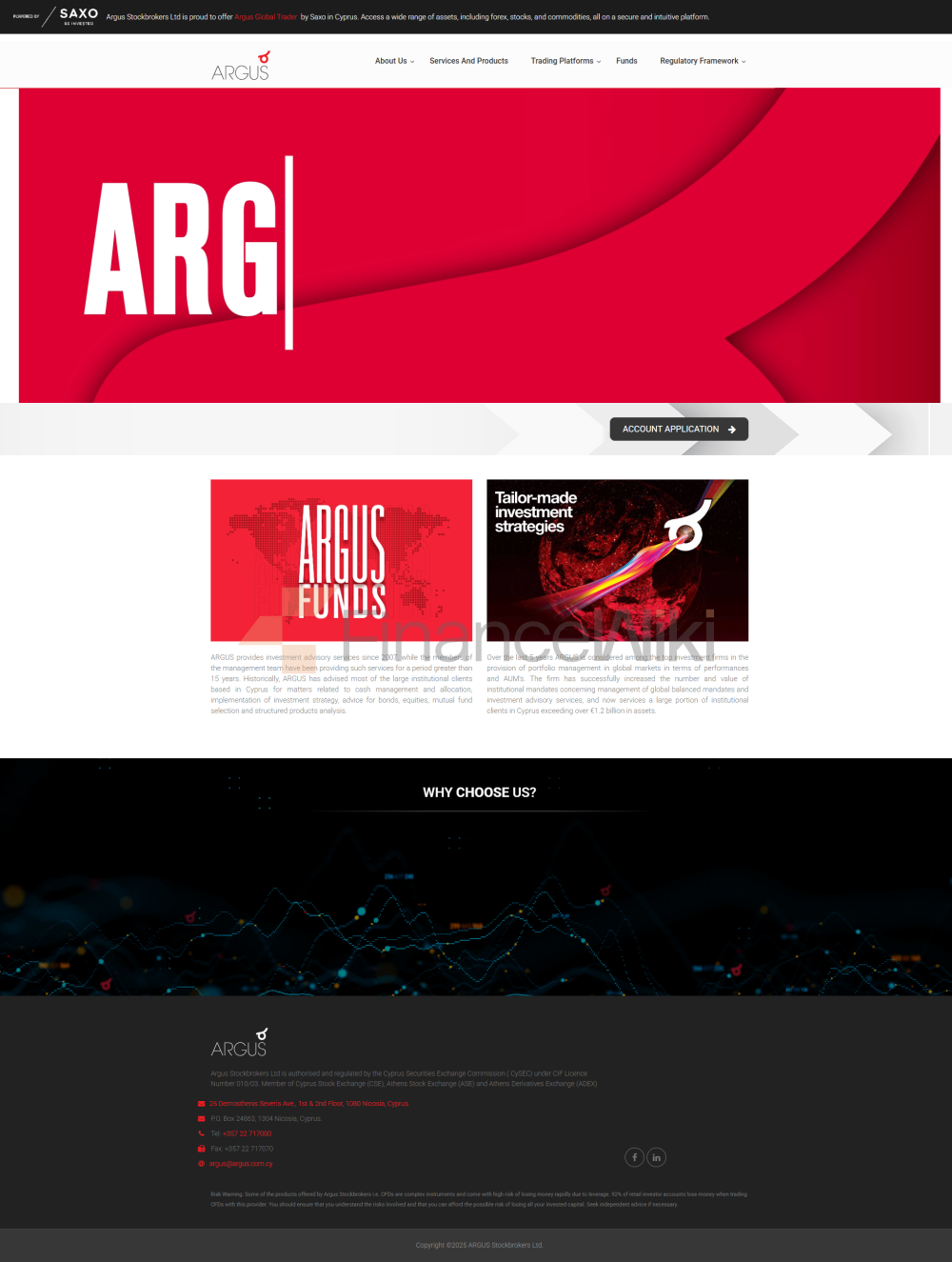

ARGUS Is A Financial Brokerage Company Located In Cyprus . It Was Established In 2003 And Is Dedicated To Providing Convenient Financial Trading Services To Traders Around The World. The Company Is Headquartered In Nicosia, Cyprus, And Aims To Meet The Diverse Needs Of Clients With Different Capital Levels And Trading Preferences.

ARGUS's Core Strength Lies In Its Low Threshold Access , With Only A Minimum Deposit Of $100 And A Leverage Ratio Of Up To 1:1000 , Providing A Wide Range Of Traders With Flexible Money Management And Trading Opportunities. As A Cyprus Securities And Exchange Commission (CySEC) Regulated Financial Institution Group, ARGUS Ensures That Its Operations And Services Comply With The Stringent Financial Standards Of The European Union.

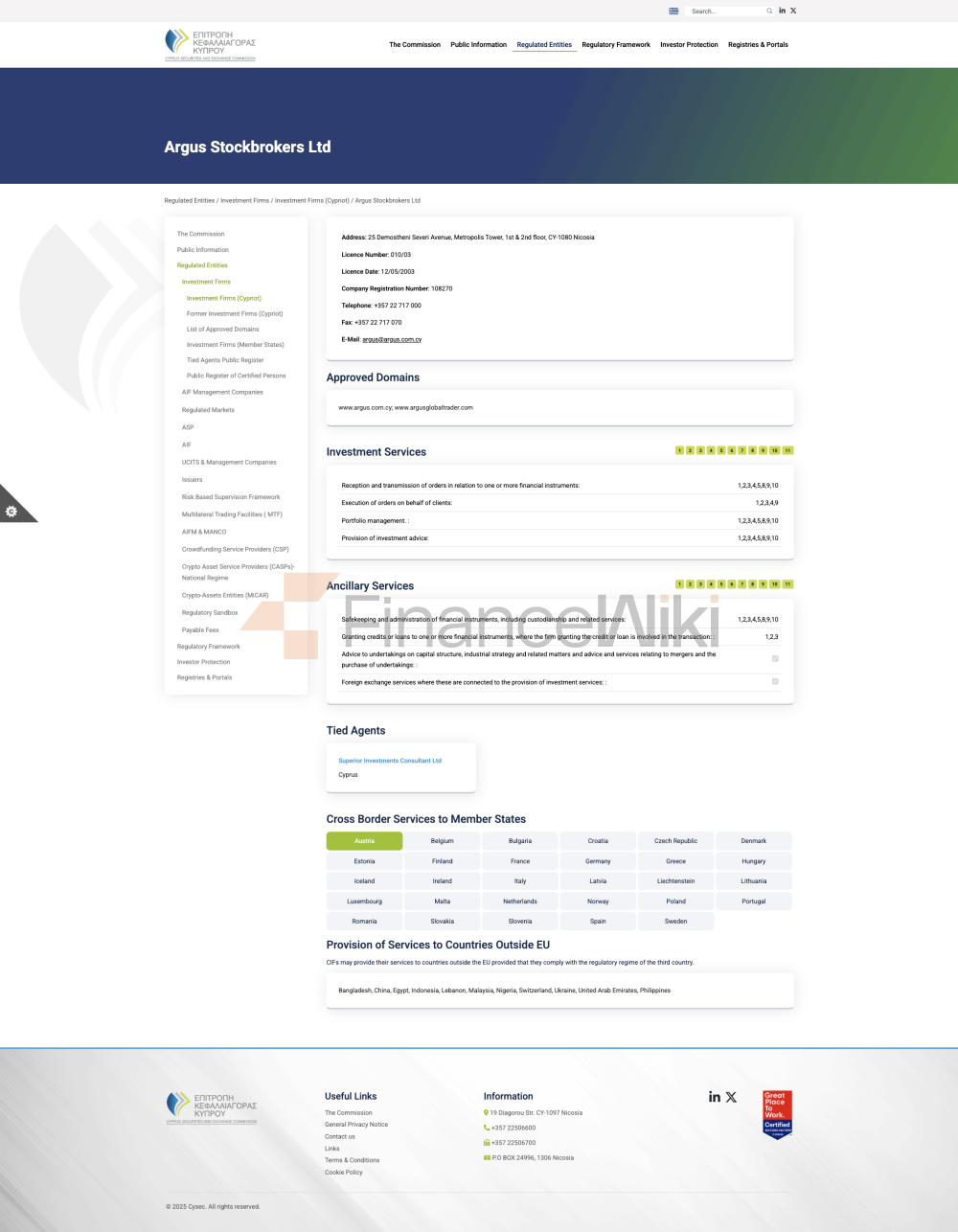

Regulatory Information

ARGUS Is A Cyprus Securities And Exchange Commission (CySEC) Regulated Financial Brokerage With A Straight-through Processing (STP) License. The Regulatory License Is Number: 109/11 , Which Means That ARGUS Must Comply With Strict Rules On Capital Adequacy, Risk Management And Protection Of Client Funds.

CySEC's Regulatory Framework Ensures The Transparency Of ARGUS's Operations, Providing Traders With High Financial Security And Legal Protection. At The Same Time, ARGUS's Operations Comply With The Requirements Of The European Union Markets In Financial Instruments Directive (MiFID II), Further Enhancing Its Compliance And Market Credibility.

Trading Products

ARGUS Offers A Diverse Range Of Trading Products Covering Major Financial Marekts Around The World. Here Is A Specific Description Of Its Trading Products:

-

Stocks : ARGUS Offers Trading Opportunities On Major Global Stock Markets, Allowing Clients To Trade Shares Of Listed Companies From Different Countries. Investors Can Receive Capital Appreciation And Dividend Income Through Stock Trading.

-

Bonds : Trading Involving Government And Corporate Bonds, Providing Investors With Fixed Income Investment Opportunities.

-

Exchange Traded Funds (ETFs) : ARGUS Offers ETF Trading On Different Asset Classes, Including Stocks, Bonds, Commodities, Etc., Providing Investors With A Diverse Portfolio Of Options.

-

Contracts For Difference (CFDs) : A Derivative Based On Price Fluctuations In Financial Assets That Allows Traders To Trade Without Holding The Actual Asset.

-

Futures : Trading Involving Standardized Contracts That Allow Multiple Parties To Buy Or Sell A Particular Asset At A Predetermined Price In The Future.

-

Forex : Provides Access To The Global Forex Market, Where Traders Can Trade Major Currency Pairs And Other Emerging Market Currencies.

Trading Software

ARGUS Provides Traders With Two Main Trading Platforms:

-

Argus Global Trader Platform : This Is A User-friendly Online Trading Platform That Supports Multiple Device (desktop, Laptop, Mobile) Access. The Platform Offers Real-time Market Data, Order Execution Functions, And Intuitive Charting Tools, Suitable For Both Novice And Experienced Traders.

-

CSE-ASE Platform : The Platform Is Designed For Trading On The Cyprus Stock Exchange (CSE) And The Athens Stock Exchange (ASE), Providing Electronic Order Execution Services. Through The Platform, Traders Can Access Listed Securities On Both Exchanges.

Deposit And Withdrawal Methods

ARGUS Offers A Variety Of Deposit And Withdrawal Methods To Ensure That Traders' Funds Can Arrive Quickly And Securely:

-

Deposit Methods :

- Bank Transfers : Supports International And Local Bank Transfers, Usually Taking 2-5 Business Days .

- Credit/Debit Cards : Including Mainstream Payment Methods Such As Visa And MasterCard, Funds Arrive Quickly.

- Skrill : A Convenient Electronic Payment Method For Fast Deposits And Withdrawals.

-

Minimum Deposit Requirement : The Minimum Deposit For A Forex Trading Account Is $100 .

-

Withdrawal Method : Supports The Same Payment Methods As Deposits, Including Bank Transfers, Credit/debit Cards, And Skrill.

Customer Support

ARGUS Provides 24/7 Customer Support To Meet The Needs Of Traders:

-

Support Channels :

- 24/5 Online Chat : Traders Can Get Help At Any Time Through The Online Chat Function Of The Official Website.

- Email Support : The Support Team Responds To Traders' Inquiries At Any Time Via Email Argus@argus.com.cy.

- Telephone Support : Customers Can Contact ARGUS's Customer Service Team At + 357 22 717000.

-

Headquarters Information : ARGUS Is Headquartered In Cyprus Nicosia , Providing Traders With Reliable Physical Contact Details.

Core Business And Services

ARGUS's Core Business Is To Provide Traders With Personalized Financial Trading Services. Its Main Services Include:

-

Standard Account : Suitable For Novice And Low To Medium Capital Traders, Offering Commission-free Trading With Floating Spreads.

-

ECN Account : Suitable For Advanced Traders, Offering Direct Access To The Interbank Market With Spreads As Low As 0 Pips And Commissions Of $0.03 Per Lot.

-

Demo Account : All Traders Can Use The Demo Account For Free Virtual Trading In Order To Become Familiar With The Platform And Strategies.

Technical Infrastructure

ARGUS's Technical Infrastructure Is Characterized By Security, Stability And Efficiency:

-

Trading Platform : Both Trading Platforms Support A Multi-language Interface, Ensuring The Secure Transmission Of Trading Data Through SSL Encryption.

-

Server Architecture : An Efficient Server Architecture Ensures Low-latency Order Execution And Real-time Market Data Transmission.

-

Data Protection : Advanced Encryption Technology Is Used To Protect The Security Of Traders' Personal Information And Trading Data.

Compliance And Risk Control System

ARGUS Takes A Multi-layered Approach To Compliance And Risk Control:

-

Regulatory Compliance : Strict Compliance With CySEC Regulatory Requirements, Including Customer Funds Segregation, Anti-money Laundering (AML) And Counter-terrorism Financing (CTF) Measures.

-

Leverage Control : Provides Leverage Ratios Up To 1:1000 , But Requires Traders To Adopt Strict Risk Management Strategies When Using High Leverage.

-

Spread Management : The Transparent Calculation Mode Of Floating Spreads Reduces The Potential Costs For Traders.

Market Positioning And Competitive Advantage

ARGUS Has A Significant Competitive Advantage In The Market:

-

Low Threshold Entry : Only Requires A Minimum Deposit Of $100 , Attracting A Large Number Of Small And Medium Capital Traders.

-

High Leverage : Provides 1:1000 Leverage, Providing Traders With Greater Position Control.

-

Endorsed By Regulators : CySEC's Supervision Provides Traders With A High Degree Of Trust And Safety Of Funds.

-

Diversified Trading Products : Covering Stocks, Bonds, ETFs, CFDs, Futures And Foreign Exchange, Meeting The Needs Of Different Investors.

Customer Support And Empowerment

Although ARGUS Is Limited In Terms Of Educational Resources, Its Customer Support System Is Still Reliable:

-

24/7 Support : Multi-channel Support Through Live Chat, Email, And Phone Calls Ensures That Traders Can Get Help At Any Time.

-

Educational Resource Limitations : The Current Lack Of Comprehensive Educational Materials, Video Tutorials, And Webinars May Cause Some Distress For Novice Investors.

Social Responsibility And ESG

ARGUS Does Not Explicitly Mention Social Responsibility And ESG Practices In Its Public Information, And Further Relevant Information May Be Required In The Future.

Strategic Cooperation Ecology

ARGUS's Development Strategy Focuses On Providing High-quality Trading Services, But Currently Does Not Disclose Its Main Strategic Cooperation Information.

Financial Health

ARGUS, As A Regulated Financial Institution Group, Meets CySEC's Capital Adequacy And Risk Management Level Requirements In Its Financial Position. But As Of Now, No Specific Financial Performance Data Has Been Made Public.

Future Roadmap

The Future Development Direction Of ARGUS May Include Further Expansion Of Trading Products, Optimization Of Customer Education Resources And Strengthening Cooperation With Financial Institution Group To Enhance Its Market Competitiveness.

The Above Is A Detailed Introduction Of ARGUS Enterprises, Covering Its Core Business, Regulatory Framework, Trading Products, Customer Support And Market Positioning, Etc., Providing A Comprehensive Reference Information For Potential Traders.