Overview Of CedarFX

CEDARFX Offers A Wide Range Of Tradable Assets, Including Digital Assets, Currencies, Stocks, And Commodities. The Company Offers Multiple Account Types, Including Unlimited Demo Accounts, 0% Commission Accounts, And Eco-accounts. Traders Have Access To The Trading Platform MetaTrader4 And The Web-based Platform. The Minimum Deposit Required To Start Trading Is $10 And The Maximum Leverage Offered Is 1:500. CEDARFX Operates Unregulated And Provides Customer Support 24/7 Live Chat And Web Forms Through. Deposit And Withdrawal Options Include Bitcoin, Credit Cards, And Bank Telegraphic Transfers.

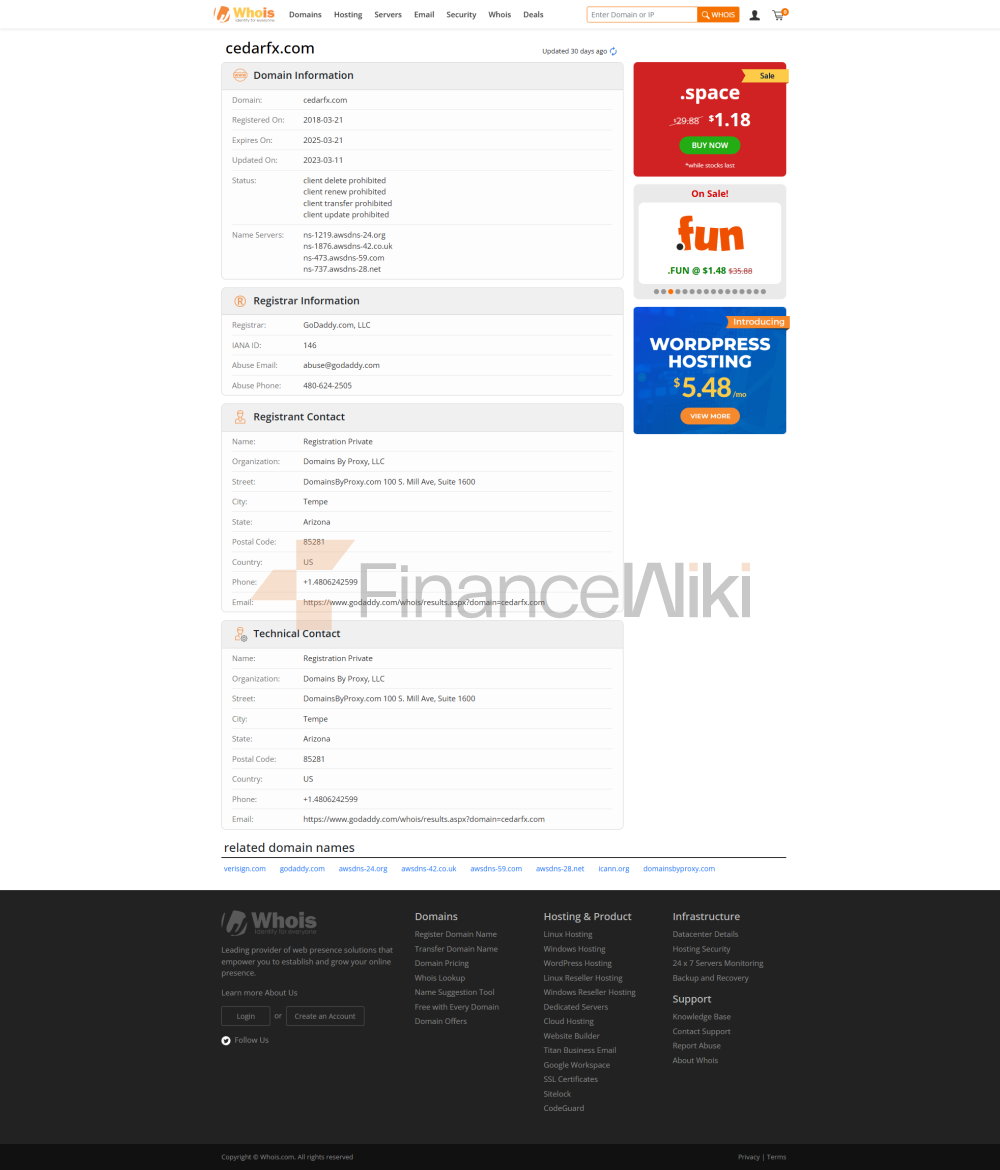

Is CEDARFX Legal Or A Scam?

An Important Aspect To Consider When Evaluating The Security Of A Broker, For Example CEDARFX Is The Regulatory Oversight Of Its Operation. However, It Should Be Noted That Cedar Fx, Headquartered In St. Louis. Saint Vincent And The Grenadines, Is Not Currently Regulated By Any Government Regulatory Agency. Lack Of Regulation Means That There May Be Less Safeguards And Protection For Clients Compared To Brokers Regulated By Reputable Agencies. Traders Should Exercise Caution And Carefully Consider The Latent Risks Involved When Choosing To Trade With An Unregulated Broker.

Pros And Cons

On The Positive Side, CEDARFX Offers 0% Commission Accounts With Low Spreads, Allowing Traders To Enjoy Cost-effective Trading. In Addition, The Broker Offers Multiple Account Types To Suit Different Trading Preferences And Needs. Lower Minimum Deposit Requirements Allow Traders To Start Their Journey With Small Investments. CEDARFX Offers A Diverse Range Of Trading Assets, Enabling Clients To Access A Variety Of Markets And Investment Opportunities. However, A Significant Drawback Is The Lack Of Regulatory Oversight, As CEDARFX Is Currently Not Regulated By Any Government Entities, Which May Raise Concerns About Client Protection And Safeguards. Client Support Channels And Educational Resources May Be Limited.

Advantages

Diversified Trading Assets, 0% Commission Accounts With Low Spreads, Low Minimum Deposit Requirements, Multiple Account Types, Two Trading Platforms Available, Convenient Deposit And Withdrawal Options

Disadvantages

Lack Of Regulatory Oversight, Limited Customer Support Channels, Limited Educational Resources, No Specific Details On Payment Methods, Limited Trading Platform Functionality

Market Tools

CEDARFX Offers Clients A Diverse Range Of Trading Assets. These Assets Include:

1. Digital Assets: CEDARFX Offers The Opportunity To Trade Popular Cryptocurrencies Such As Bitcoin, Ethereum, Litecoin, Ripple, Etc. Trading Digital Assets Enables Investors To Take Advantage Of The Volatility Of The Cryptocurrency Market And Potential Profit Opportunities.

2. Currencies: Customers Can Trade Multiple Currency Pairs On The Forex Market. Major Currency Pairs Such As EUR/USD, GBP/USD, And USD/JPY, As Well As Minor And Exotic Currency Pairs, Can Be Traded. Currency Trading Allows Participants To Speculate On Exchange Rate Fluctuations Between Different Currencies.

3. Stocks: CedarFX Offers The Option To Trade Shares Of Listed Companies. Clients Can Speculate On The Price Movements Of Individual Stocks Without Holding Them. Stock Trading Provides The Opportunity To Participate In The Performance Of Specific Companies And Industries.

4. Commodities: Clients Can Also Trade A Range Of Commodities, Including Precious Metals Such As Gold And Silver, Energy Commodities Such As Crude Oil And Natural Gas, Agricultural Commodities, And Others. Trading Commodities Allows Investors To Take Advantage Of Price Movements In These Physical Commodities.

Account Types

A Forex Account CEDARFX Functions Similar To A Bank Account, But Is Designed Specifically For Trading Currencies. Forex Islamic Accounts, Also Known As Swap-free Accounts, Do Not Charge Any Interest Or Rollover Fees On Overnight Positions. Availability And Types Of Accounts Offered By Brokers May Vary Depending On The Country And The Regulatory Authority That Governs Their Business. CEDARFX Offers The Following Account Types: Unlimited Demo Accounts, Which Require Regular Use To Remain Active, And Two Real Account Options - 0% Commission Accounts And Eco-accounts.

0% Commission Accounts

The Main Standard Account Preferred By Most Traders Is The 0% Commission Account. It Has No Commissions Or Additional Fees And Ultra-low Spreads. There Are No Deposit Or Withdrawal Fees, And Cryptocurrency Withdrawal Requests Are Processed On The Same Day And Reflected In The User's Wallet.

EcoAccount

EcoAccount Is Designed To Allow Traders To Help Reduce Humanity's Carbon Footprint On The Planet. EcoAccount Does Charge A $1 Commission Per Transaction. CEDARFX Matches This Commission And Sends Each Month's Proceeds To Ecology, A Non-profit Entity That Plants Trees And Works To Reduce The Planet's Carbon Footprint. For Every Batch Traded, 10 New Trees Are Planted.

How Do I Open An Account?

To Open An Account With Cedar FX, Follow These Steps:

1. Visit The Official Website CEDARFX In Https://www.cedarfx.com/.

2. On The Home Page, Find And Click On The "Open, Reside, Account" Button. This Will Usually Appear Prominently On The Website.

3. You Will Be Redirected To The Account Opening Page. Here You Will Need To Provide Personal Information Such As Your Name, Email Address, Phone Number And Country Of Residence.

4. Select The Type Of Account You Want To Open. CEDARFX Offers Different Account Types Such As Individual, Joint Or Corporate Accounts.

5. Agree To The Terms And Conditions. Read The Terms And Conditions Carefully To Make Sure You Understand And Accept Them Before Proceeding.

6. Complete The Verification Process. CEDARFX May Require You To Verify Your Identity And Address. This Usually Involves Submitting A Copy Of Your Identification Documents (e.g. Passport Or Driver's License) And Proof Of Address (e.g. Utility Bill Or Bank Statement).

7. Fund Your Account. Once Your Account Has Been Approved And Verified, You Will Receive Instructions On How To Deposit Funds Into Your Trading Account. CEDARFX Supports Multiple Deposit Methods, Including Bank Transfers, Credit/debit Cards, And Cryptocurrency Deposits.

8. Start Trading. Once Your Account Has Been Funded, You Can Visit CEDARFX And Start Trading. CEDARFX Offers A User-friendly Interface And A Range Of Trading Tools, Including Digital Assets, Currencies, Stocks And Commodities.

Minimum Deposit

The Minimum Deposit Requirement For CEDARFX To Open A Trading Account Is $10, Which Is Comparable To What Legitimate Brokers Typically Require For Micro Accounts. While This May Seem Attractive, It Is Important To Consider That CEDARFX Is Currently An Unregulated Broker. Therefore, Traders Are Advised Not To Register For A Real Trading Account CEDARFX Due To The Lack Of Regulation. Trading With An Unregulated Broker Carries Inherent Risks, As There Is No Official Body Overseeing Its Operations To Ensure Fair Practices And Investor Protection. It Is Recommended To Choose A Regulated Broker That Provides Additional Safeguards And Protection For Clients' Funds And Trading Activities.

Leverage

Leverage Is A Tool That Allows Traders To Have Greater Market Risk Than The Initial Deposit They Open A Trade With. CEDARFX Offers Different Leverage Ratios Depending On The Type Of Trading Instrument. For Indices And Commodities, Leverage Is Set To 1:200. Cryptocurrency Pairs Have Leverage Of 1:100. Forex And Metals Enjoy The Highest Leverage Of 1:500, While Stocks Have Leverage Of 1:20. It Is Important To Note That While Leverage Can Amplify Potential Profits, It Also Increases The Risk Of Loss. When Using Leverage In Trading Strategies, Traders Should Exercise Caution And Manage Risks Carefully.

Spreads And Commissions

Cedarfx Does Not Charge Deposit And Withdrawal Fees. However, Clients May Be Required To Pay Fees Charged By Payment Systems, Cryptocurrency Miners, And Blockchain Networks. As For Trading Fees, CEDARFX Applies Floating Spreads, And The Lowest Value Recorded By Traders' Union Analysts Is EUR/USD/USD/0.6 Pips. Other Spreads Include USD/JPY 0.7 Pips, AUD/USD 1.3 Pips, And GBP/USD 1.4 Pips. 0% Commission Accounts Do Not Have Any Additional Trading Fees, While Eco Accounts Charge $1 Per Trade Lot.

CUSTOMER SUPPORT

CEDARFX Offers 24/7 Customer Support Via Live Chat, While Customer Support Channels Are Limited. Customers Can Only Contact The Support Team Through: Live Chat And Web Form.

1. ONLINE CHAT: CEDARFX Offers A Live Chat Feature On Their Website That Allows Customers To Have A Live Conversation With A Support Representative. This Instant Messaging Option Allows Quick Response To Queries And Immediate Help To Resolve Any Issues.

2. Web Form: CEDARFX Offers A Web Form On Their Website That Customers Can Fill Out To Submit Their Queries Or Requests. This Form Usually Asks The User To Provide Their Contact Details And A Description Of Their Problem Or Query. The Support Team Will Then Review The Submitted Form And Respond Accordingly.

Conclusion

Comprehensive, CEDARFX Is A Broker With Fast Withdrawals, Low Spreads And Zero Commissions On 0% Commission Accounts. CEDARFX Offers Traders A Suite Of Meta Trader Platforms As Well As Basic Web And Mobile Applications. CEDARFX Has A Maximum Leverage Of 1:500. However, It Is Worth Noting That CEDARFX Is Not Regulated By Any Reputable Regulatory Authority. Traders Should Pay Attention To The Absence Of Regulatory Licenses And Trade With Caution.

FAQ

Q: Is It A CEDARFX Legitimate Broker Or A Scam?

A: When Evaluating The Security Of Cedar FX, It Is Important To Take Into Account That The Broker Is Not Currently Regulated By Any Government Regulatory Agency.

Q: What Account Types Are Offered By Cedar FX?

A: CEDARFX Offers Three Account Types: An Unlimited Demo Account For Practice, A 0% Commission Account With No Additional Fees And Ultra-low Spreads, And An Eco Account That Takes $1 Commission Per Trade And Contributes To Tree Planting Efforts.

Q: What Is The Minimum Deposit Required By Cedar FX?

A: CEDARFX Has A Minimum Deposit Requirement Of $10 For Bitcoin Deposits And $50 For Fiat Deposits.

Q: What Is The Leverage Ratio CEDARFX Offers?

A: CEDARFX Offers Different Leverage Ratios Depending On The Instrument Being Traded. Leverage Ranges From 1:20 For Stocks To 1:500 For Forex And Metals.

Q: What Trading Platforms Are Offered By Cedar FX?

A: CEDARFX Provides Access To Two Platforms: A Custom Version Of Metatrader4 (mt4) And A Web-based Platform That Includes Some Of The Features Of Mt4.

Q: How Do I Contact CEDARFX Customer Support?

A: CEDARFX Provides 24/7 Customer Support Via Live Chat And Web Forms.