Corporate Profile

Sucden Financial Limited (hereinafter Referred To As "Sucden Financial") Was Established In 1973 And Is Headquartered In The City Of London, UK. It Is A Leading Global Provider Of Foreign Exchange, Fixed Income And Commodity Multi-asset Execution, Clearing And Liquidity. The Company Has A Capital Base Of More Than US $190 Million And A Global Business Network With Offices In Moscow And Subsidiaries In Hong Kong And New York. The Parent Company Of Sucden Financial Is The Sucden Group, Which Was Established In 1952 And Is Headquartered In Paris, France. It Is A Privately Held Company With Operations Covering Sugar, Coffee, Cocoa, Ethanol Trading, Maritime Transportation, And Financial Marekt Products And Services.

Sucton Financial Serves Traders, Manufacturers, Producers, Consumers, Merchants, Investment Institutions, Hedge Funds, Commodity Companies And Retail Brokers Worldwide, Becoming One Of The Leaders In The Field Of Independent Brokers. The Company Provides Clients With Efficient And Secure Trading Solutions Through Its Global Business Network And Professional Technical Support.

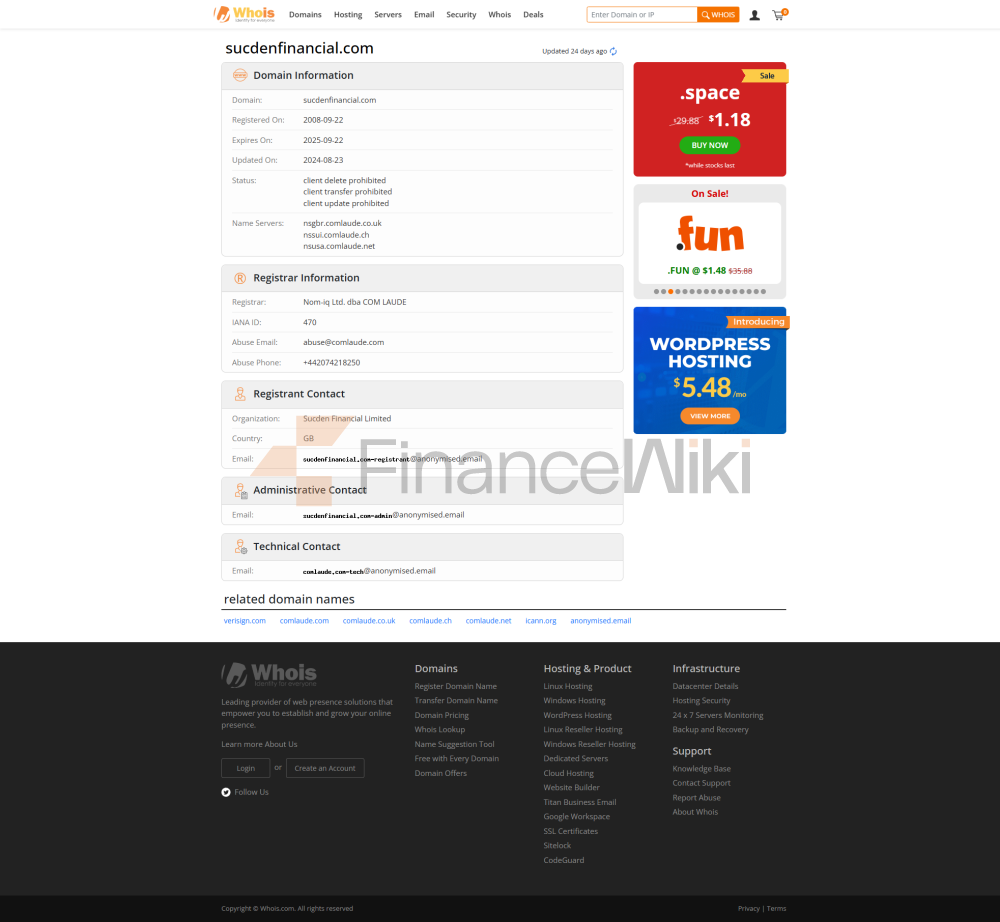

Regulatory Information

Sucton Financial Is Authorised And Regulated By The Following Regulatory Bodies:

- UK Financial Conduct Authority (FCA) : Company License Number 114239 , License Type Is Investment Adviser License, Regulated By The UK Financial Conduct Authority, Providing Compliance Protection For Its UK Business.

- Hong Kong Securities And Futures Commission (SFC) : Sucton Financial (Hong Kong) Limited Holds A Hong Kong SFC License To Provide Compliance For Its Business In Hong Kong.

- National Futures Association (NFA) : Sucden Futures Inc. Is Registered With The NFA In The United States Under License Number 0403214 , But It Is Worth Noting That The NFA Lists Its Regulatory Status As "Unauthorized".

Sucden Financial Always Follows International Financial Regulatory Standards To Ensure The Legitimacy And Compliance Of Its Business Operations.

Trading Products

Sucton Financial Offers A Wide Range Of Trading Products Covering The Following Asset Classes:

- Forex (Forex) : Includes Spot, Forwards, Swaps, Over The Counter Options, Non-deliverable Foreign Exchange Options (NDO), Non-deliverable Foreign Exchange Forwards (NDF) And Deliverable Foreign Exchange, Etc.

- Metals : Includes Precious Metals Such As Gold, Silver, Platinum, Palladium, Copper, Aluminum, Lead, Nickel, Tin And Zinc, And Base Metals.

- Commodities : Covers Soft Commodities Such As Coffee, Sugar, Cocoa, And Cotton.

- Energy : Includes Crude Oil, Natural Gas, And Other Energy-related Products.

- Fixed Income : Provides Access To Global Fixed Income Markets, Including Government Bonds, Corporate Bonds, And More.

Suktown Financial Offers Clients Direct Access To Electronic Markets And Professional Hedging And Risk Management Support Through Major Exchanges Such As ICE Futures Europe And NYMEX.

Trading Software

Sucton Financial Offers Its Clients A Variety Of Trading Platforms, Including:

- STAR Platform : This Is Sucton Financial's Proprietary Trading Platform That Supports Windows, MAC, IOS And Android Devices, Providing A User-friendly Interface And A High Degree Of Customizability. The Platform Is Connected To Several Major Global Exchanges, Including CME, ICE And The London Metal Exchange (LME).

- Other Third-party Trading Platforms : Including CQG, Star And TT, Among Others, Providing Clients With A Diverse Range Of Options.

Through These Platforms, Sucton Financial Provides Customers With Real-time Market Data, Efficient Trade Execution, And Comprehensive Risk Management Tools.

Deposit And Withdrawal Methods

Sucton Financial Provides Customers With A Variety Of Deposit And Withdrawal Methods, Including:

- Bank Telegraphic Transfer : Deposit And Withdrawal Of Funds Through International Bank Telegraphic Transfer, Supporting Multiple Currencies.

- Electronic Payment : Supports Credit Cards, Debit Cards, And Other Electronic Payment Methods.

The Specific Deposit And Withdrawal Fees And Arrival Time Can Be Consulted By The Customer Support Team.

Customer Support

Suktown Financial Provides Customers With 24/7 Customer Support Services, Covering The Following Channels:

- Telephone Support : + 44 (0) 20 3207 5310

- Email Support : Info@sucfin.com

- Social Media : Interact With Customers Through Twitter, Instagram And Other Platforms.

Sucton Financial's Customer Support Team Is Able To Provide Clients With Professional Market Analysis, Trading Strategies And Operational Guidance To Ensure A Smooth Experience During The Trading Process.

Core Business And Services

Sucton Financial's Core Business Includes:

- Multi-Asset Execution Services : Provide Clients With Trade Execution Services In Multiple Asset Classes Such As Foreign Exchange, Metals, Commodities, Energy And Fixed Income.

- Clearing & Liquidity Provision : Providing Clients With Efficient Clearing Services And Market Liquidity Through Its Global Business Network.

- Customized Solutions : Providing Tailored Trading Solutions For Financial Institution Groups, Corporations And Brokers To Meet The Specific Needs Of Clients.

With Its Rich Industry Experience And Professional Technical Support, Sucton Financial Has Become The Broker Of Choice For Clients Worldwide.

Technology Infrastructure

Sucton Financial Has An Advanced Technology Infrastructure That Supports The Efficient Operation Of Its Global Business. Its Technical Features Include:

- Low-latency Trading Network : Ensures Low Latency And High Reliability Of Transaction Execution Through An Optimized Network Architecture.

- Integrated Clearing System : Seamless Integration With Major Clearing Houses And Exchanges Worldwide To Ensure Efficient Clearing And Settlement Of Transactions.

- Risk Management Tools : Provide Real-time Risk Monitoring And Management Tools To Help Customers Effectively Control Trading Risks.

Compliance And Risk Control System

Sucton Financial Attaches Great Importance To The Construction Of Compliance And Risk Management System, Including:

- Compliance Statement : The Company Strictly Abides By The Laws And Regulations Of The Host Country To Ensure The Legitimacy And Transparency Of Its Business Operations.

- Risk Management : Provide Clients With Comprehensive Threat And Risk Assessment And Management Services Through A Professional Risk Management System.

- Internal Control : Establish A Sound Internal Control System To Ensure The Security Of The Company's Assets And The Integrity Of Transactions.

Market Positioning And Competitive Advantage

Sucton Financial Occupies An Important Position In The Market With The Following Advantages:

- Broad Product Coverage : Offers Products Covering Multiple Asset Classes Such As Foreign Exchange, Metals, Commodities, Energy And Fixed Income. Global Business Network : Provides Efficient Trading And Clearing Services To Clients Through Its Presence In Major Financial Marekts Around The World.

- Professional Technical Support : Ensure The Efficiency And Reliability Of Trade Execution Through Advanced Trading Platforms And Low-latency Trading Networks.

Customer Support And Empowerment

Suktown Financial Is Committed To Providing Customers With A Full Range Of Support And Empowerment Services, Including:

- Market Analysis And Research : Provide Customers With Professional Market Analysis And Research Reports To Help Customers Develop Effective Trading Strategies.

- Education And Training : Provide Professional Trading Training And Investment Knowledge To Clients Through Online Courses And Market Seminars.

- Customized Solutions : Provide Clients With Tailor-made Trading Solutions According To Their Specific Needs.

Social Responsibility And ESG

Sucton Financial Actively Participates In Social Responsibility And ESG (environmental, Social, Governance) Related Activities, Including:

- Environmental Protection : Reduce The Environmental Impact Of The Company's Business By Supporting Sustainable Development Projects.

- Social Good : Support Social Good Causes Such As Education And Medical Care Through Donations And Volunteering.

- Governance And Transparency : Ensure The Fairness And Transparency Of The Company's Operations Through Transparent Corporate Governance And Internal Controls.

Strategic Cooperation Ecology

Sucton Financial Has Established Strategic Partnerships With A Number Of Financial Institution Groups And Enterprises Around The World To Expand Its Business Network Through:

- Exchange Membership : Become A Member Of Major Exchanges Such As ICE European Futures Exchange And London Metal Exchange To Ensure Its Influence In The Global Market.

- Technology Partnership : Establish Partnerships With Well-known Technology Suppliers To Provide Their Customers With Advanced Trading Platforms And Technical Support.

Financial Health

Sucton Financial Has A Healthy Financial Position With A Capital Base Exceeding $190 Million , Providing A Solid Financial Guarantee For The Operation Of Its Global Business. The Company Ensures Its Financial Stability And Sustainability Through Strict Financial Management And Risk Control.

Future Roadmap

Sucton Financial Will Continue To Be Guided By Customer Needs And Continue To Expand Its Business Scope And Market Influence. In The Future, The Company Plans To Focus On The Following Areas:

- Digital Transformation : Further Promote The Digital Transformation Of Trading And Clearing Business, Improve Transaction Efficiency And Service Quality.

- New Product Development : Develop More Innovative Financial Products And Services According To Market Changes And Customer Needs.

- Globalization Layout : Continue To Expand Its Business Layout In Major Global Financial Marekts And Enhance Its Competitiveness In The Global Market.

Sucton Financial Will Always Focus On The Interests Of Its Clients And Provide Them With An Excellent Trading Experience Through Professional Services And Technological Innovation.