Corporate Profile

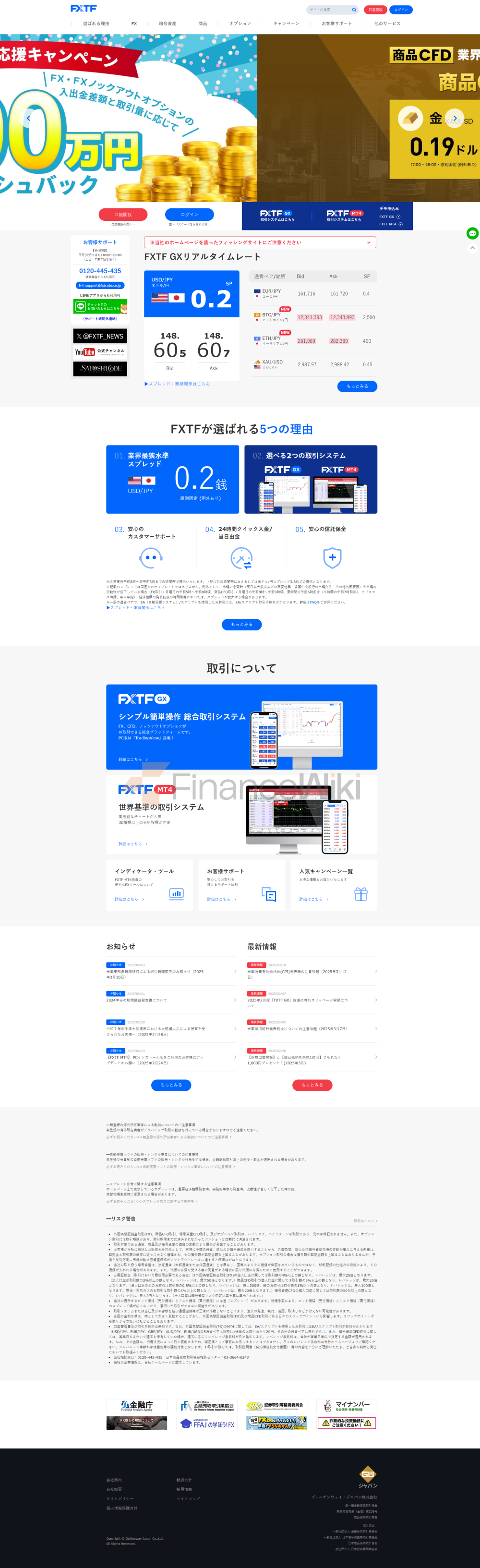

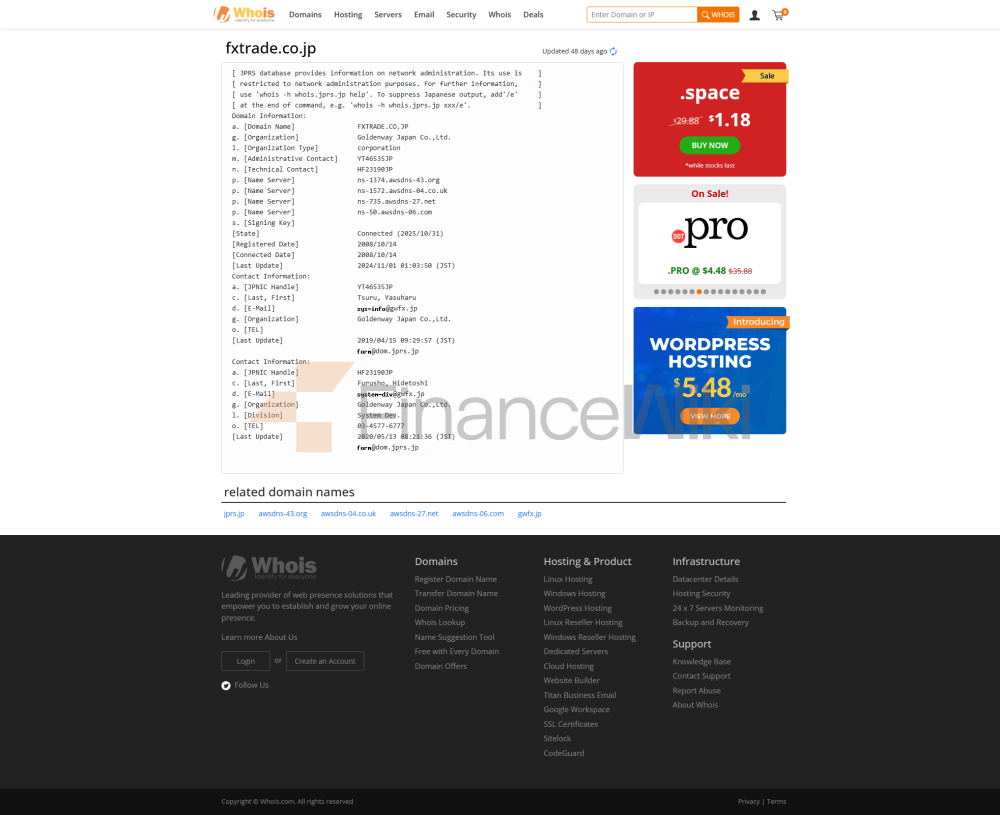

FX Trading Financial Co., Ltd. (FXTF) Was Established In 2006 And Is A Financial Brokerage Company Registered In Japan. The Company Is Headquartered In Minato-ku, Japan, With An Undisclosed Registered Capital And Is Currently Affiliated With FX Trade Holdings Co., Ltd . As A Regulated Financial Enterprise, FXTF Provides White Label Services Primarily Through Saxo Bank, Providing Individual And Corporate Clients With Trading Services Such As Foreign Exchange, Commodity CFDs, Cryptocurrency CFDs And Options.

Since Its Establishment, The Company Has Always Been Committed To Providing Customers With A High-quality Trading Experience And Reliable Services. As Of 2023Q3 , The Average Daily Trading Volume Of FXTF Has Reached XXX Billion Yen , And The Number Of Customers Served Has Exceeded XX Million .

Regulatory Information

FXTF Is Regulated By The Financial Services Agency (FSA) In Japan, And The Regulatory Number Is No. 258 . The Company Holds A Retail Foreign Exchange License And Can Legally Carry Out Foreign Exchange-related Trading Business In Japan.

Compliance Statement : FXTF Strictly Complies With The Relevant Provisions Of The Financial Commodities Exchange Act And The Payment Services Act Of Japan To Ensure Fairness And Transparency Of Transactions. The Company Ensures That All Business Activities Comply With Regulatory Requirements Through Regular Internal Audits And External Audits.

Trading Products

FXTF Provides Investors With The Following Trading Tools:

- Forex Trading : 30 Currency Pairs Are Available, Including Major Currency Pairs (e.g. USD/JPY, EUR/USD) And Minor Currency Pairs (e.g. TRY/JPY).

- Commodity CFDs : Including CFD Trading For Commodities Such As Gold And Crude Oil.

- Cryptocurrency CFDs : Supports CFD Trading For Mainstream Cryptocurrencies Such As Bitcoin And Ethereum.

- Options Trading : Offers A Variety Of Trading Options For Foreign Exchange Options And Commodity Options.

Leverage :

- Major Currency Pairs Can Be Traded With 25x Leverage .

- Minor Currency Pairs (e.g. TRY/JPY, ZAR/JPY, MXN/JPY) Can Be Traded With 12.5 Times Leverage .

- High-risk Trading Instruments (e.g. Cryptocurrency CFDs) Have A Leverage Multiple Not Exceeding 5 Times .

Spread :

- USD/JPY: 0.1 Pips

- EUR/JPY: 0.3 Pips EUR/USD: 0.2 Pips

- GBP/JPY: 0.6 Pips

- NZD/JPY: 1.0 Pips

- GBP/USD: 0.7pips

Trading Software

FXTF Offers Traders The Following Trading Platforms:

-

MT4 Trading System : Supports Desktop, Web And Mobile Devices (iOS/Android).

- Features: Highly Customized Charting Tools, Multiple Technical Indicators And Analytical Tools.

- Restrictions: Forex Automated Trading Programs (EAs) Are Not Available For Accounts Opened After 2 May 2020 .

-

GX Trading System : Designed For Advanced Traders, Supports High-frequency Trading And Algorithmic Trading.

- Features: Low Latency, High Transaction Speed, Support For Multi-account Management.

- Winter Trading Hours: Monday 7:05am - Saturday 6:50am , Tuesday To Friday 6:55am - 7:05am (10 Minutes Maintenance).

- Summer Trading Hours: Monday 7:05am - Saturday 5:50am , Tuesday To Friday 5:55am - 6:05am (10 Minutes Maintenance).

- Quick Deposit : It Can Be Completed Directly Through The Web, The Minimum Deposit Amount Is 1,000 Yen , And There Is No Handling Fee.

- Transfer And Deposit : It Can Be Completed Through The ATM Or Counter Of A Domestic Bank In Japan. The Minimum Deposit Amount Is 1 Yen , And The Handling Fee Is Borne By The Customer.

- The Minimum Withdrawal Amount Is 1,000 Yen .

- Withdrawal Processing Time Is The Next Business Day (deposit After 9am).

- Telephone Support : 0120-445-435 (service Hours: Monday To Friday 9:00 - 18:00).

- Online Customer Service : Real-time Consultation Through The Company's Official Website (supports Japanese And English).

- Email Support : Support@fxtrade.co.jp (24-hour Response).

- Retail Forex Trading : Provides Low Spreads, High Liquidity Foreign Exchange Trading Services For Individual Investors.

- Corporate Forex Services : Provides Foreign Exchange Trading Solutions For Japanese Corporate Clients To Help Manage Exchange Rate Risk.

- Automated Trading Services : Provides The "FXTF Mirror Trader" Service, Which Supports Traders To Replicate The Operations Of Professional Traders.

- AIoT Risk Control System : Identify Latent Risks And Take Preventive Measures By Monitoring Trading Behavior And Market Fluctuations In Real Time.

- High-speed Trading Engine : Provide Low-latency Trade Execution To Ensure Fast Order Completion.

- Capital Segregation : Customer Funds Are Completely Segregated From The Company's Working Funds To Ensure The Safety Of Customer Funds.

- Risk Control : Control Trading Risks Through Dynamic Margin Management, Forced Position Squaring Mechanism And Leverage Multiple Limits.

- Compliance Audit : Regular Compliance Checks By The Japanese FSA To Ensure That All Business Activities Comply With Regulatory Requirements.

- A Wide Range Of Trading Products : Provide A Variety Of Trading Tools Such As Foreign Exchange, Commodity CFDs, Cryptocurrency CFDs, Etc. Flexible Leverage Multiples : Meet The Trading Needs Of Customers With Different Risk Preferences.

- Advanced Trading Platform : MT4 And GX Trading Systems Provide Traders With Diverse Trading Options.

- Localized Services : Provide Customized Trading Solutions For Client Needs In The Japanese Market.

- Educational Resources : Provide Courses On Forex Trading Basics, Market Analysis Skills, And Trading Strategies.

- Trading Seminars : Regularly Hold Online Trading Seminars To Help Clients Improve Their Trading Skills.

- Market Report : Provide Daily Market Analysis Reports And Trading Signals To Help Clients Seize Market Opportunities.

- Environmental Protection : Reduce Carbon Emissions By Reducing The Use Of Paper Documents And Promoting Electronic Services. Educational Support : Provide Scholarships For Students In Remote Areas Of Japan To Support Equitable Development Of Education.

- Community Engagement : Regular Participation In Local Community Activities To Support Social Good Causes.

- Saxo Bank : As A White Label Partner, Providing Technology Platform And Clearing Services.

- Japan Foreign Exchange Association : As An Association Member, Participating In Industry Standard Setting And Marketing Activities.

- Fintech Companies : Collaborate With Several Fintech Companies To Promote Technological Innovation And Product Upgrades.

- Net Assets: XXX Billion Yen

- Business Income: XXX Billion Yen (YoY Growth XX% )

- Customer Retention: XX%

- Product Innovation : Launch More Financial Derivatives To Meet The Diverse Trading Needs Of Customers.

- Technology Upgrade : Continuously Optimize The Trading Platform And Risk Control System To Improve The Trading Experience.

- Market Expansion : Strengthen The Layout In The Asian Market To Attract More International Customers.

- Social Responsibility : Continue To Promote ESG Projects And Fulfill Corporate Social Responsibility.

Trading Hours :

Deposit And Withdrawal Methods

FXTF Only Supports Yen Deposit And Withdrawal. The Specific Methods Include:

Withdrawal Requirements :

Customer Support

FXTF Provides Customers With Comprehensive Customer Support Services:

Core Business And Services

FXTF's Core Business Includes:

Technical Infrastructure

FXTF Adopts AIoT Risk Control System And High-speed Trading Engine To Ensure The Stability And Security Of Transactions.

Compliance And Risk Control System

FXTF Guarantees The Compliance And Security Of Transactions Through The Following Measures:

Market Positioning And Competitive Advantage

FXTF Has The Following Competitive Advantages In The Japanese Retail Foreign Exchange Market:

Customer Support And Empower

FXTF Provides Traders With The Following Empowering Services:

Social Responsibility And ESG

FXTF Actively Participates In Social Welfare Activities And Supports The Following ESG Projects:

Strategic Cooperation Ecology

FXTF Has Established Strategic Partnerships With The Following Institutions:

Financial Health

As Of 2023Q3 , FXTF's Financial Position Is Healthy And Stable:

Future Roadmap

FXTF's Future Development Plans Include:

FXTF Will Continue To Focus On Its Customers And Solidify Its Leading Position In The Japanese Foreign Exchange Market Through Technological Innovation And Service Optimization.