Basic Information & Regulation

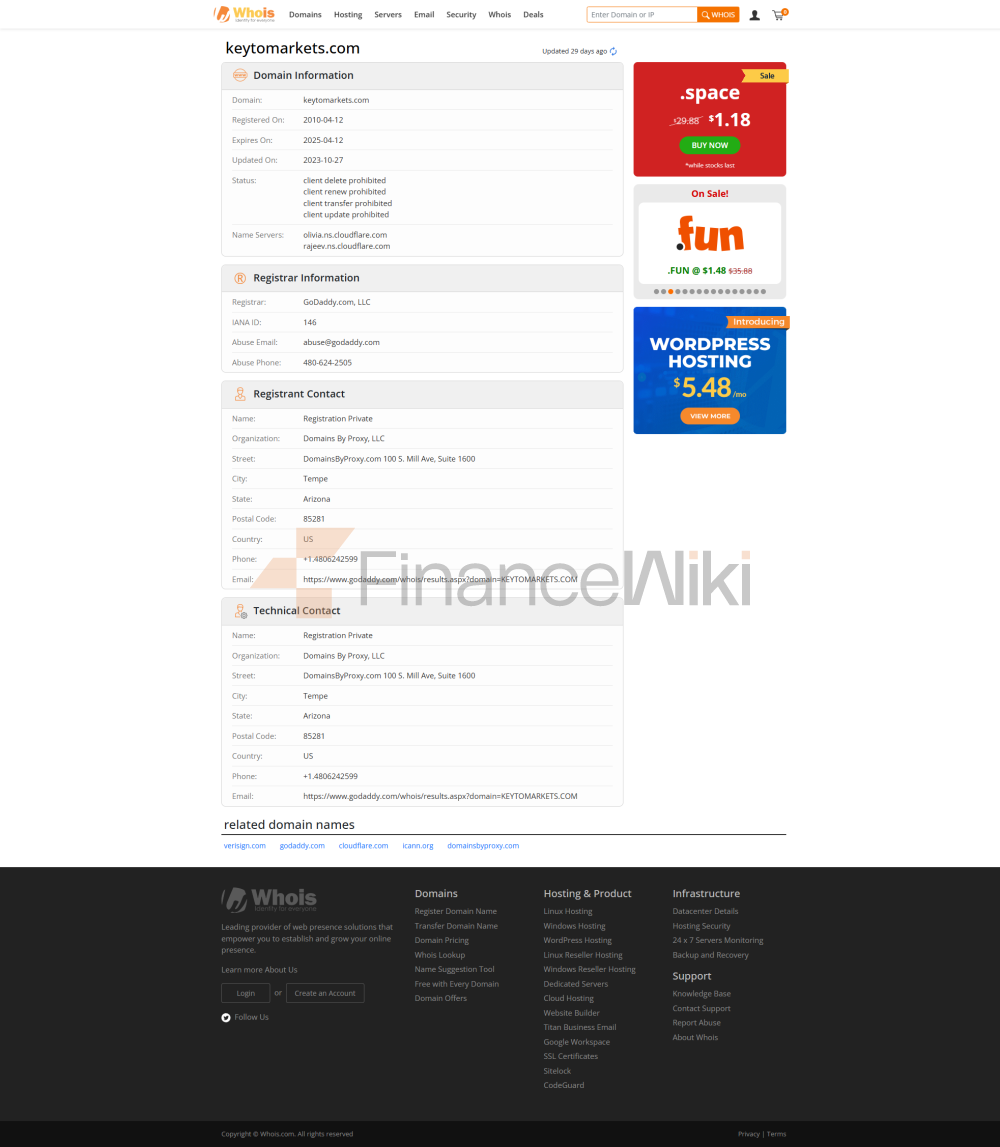

Key To Markets Was Established In 2010 And Is Headquartered In London, UK. It Also Has Entities In New Zealand And Mauritius (Key To Markets International Ltd And Key To Markets NZ Ltd). Key To Markets Is Currently Regulated By The UK Financial Conduct Market Authority (FCA) And The Mauritius Financial Services Commission (FSC).

Security Analysis

The UK FCA License Held By Key To Markets Is An Investment Advisory License. Please Note That This Type Of License Cannot Hold Client Funds And Can Only Do Advisory Financial Services. Therefore, The Trading Activities Of Foreign Exchange And CFDs Brokered By Key To Markets Are Beyond The Limit. Investors Should Use Key To Markets As A Trader With Caution.

Financial Instruments

Key To Markets Provides Investors With A Range Of Popular Financial Trading Tools, Mainly Foreign Exchange Currency Pairs, Indices, Stocks, Commodities And Cryptocurrencies.

Accounts & Leverage

Key To Markets Provides Investors With Two Types Of Accounts, Namely Standard Account And Professional Account. The Minimum Deposit For Both Accounts Is 100 Euros, And The Minimum Trading Lot Is 0.01 Lots. The Trading Leverage For Both Accounts Is 1:500.

Spreads & Commissions

Spreads On The Key To Markets Platform Depend On Two Different Accounts. Standard Accounts Are Commission-free Accounts, But Require An Additional 1 Pip Spread On The Basis Of The Original Spread. Professional Accounts Are Original Spreads, But Charge A Commission Of $8/lot. Major Currency Pairs Such As EUR USD Have An Original Spread Of Around 0.4 Pips And Gold Has An Original Spread Of 2.8 Pips. Overnight Interest Is Charged On Both Accounts For Overnight Positions.

Trading Platform

Key To Markets Offers Investors The MT4 Trading Platform, As Well As MT4 For Windows, MT4 For Mac, MT4 For Android And MT4iOS. In Addition, There Are FIX APIs, As Well As Free VPS For Traders To Use.

Deposit And Withdrawal

Key To Markets Offers 10 Payment Options, Including Telegraphic Transfer, SEPA Transfer (EUR), Card Payment, UnionPay, Alipay, E-wallet. Except For Telegraphic Transfer Payment Which Takes 2-4 Days And SEPA Payment Which Takes 1-2 Days, All Other Payment Methods Arrive Instantly. Traders Who Deposit And Withdraw Funds Through E-wallet Need To Pay A 2.5% Processing Fee, And There Is No Processing Fee For Other Methods.

Advantages & Disadvantages

Key To Markets's Main Advantages Are:

1. FCA And FCS Regulation;

2. Myfxbook Automated Trading;

3 Competitive Spreads;

3. Fast Withdrawal;

4. MT4 Trading Platform;

5. Free VPS;

Key To Markets' Main Drawbacks Are:

1. Limited Teaching Resources;

2. No Live Customer Support;

3. No Trader Forum;