Company Profile

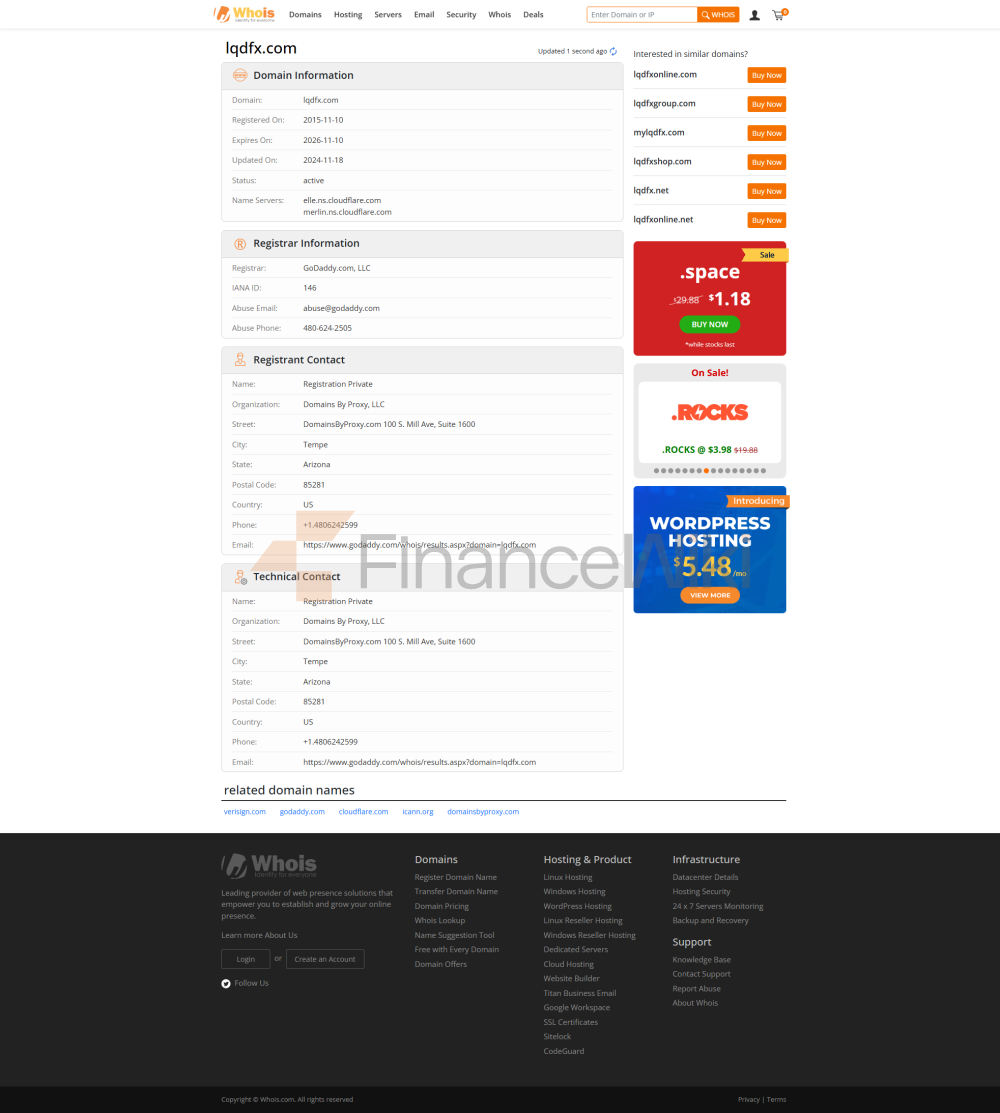

Company Name : LQDFX Established : End Of 2015 Headquarters Location : Saint Lucia Registered Capital : Undisclosed Main Business : Forex And CFD Broker, Providing A Variety Of Financial Instruments Including Currencies, Commodities, Indices, Metals, Cryptocurrencies And Stocks

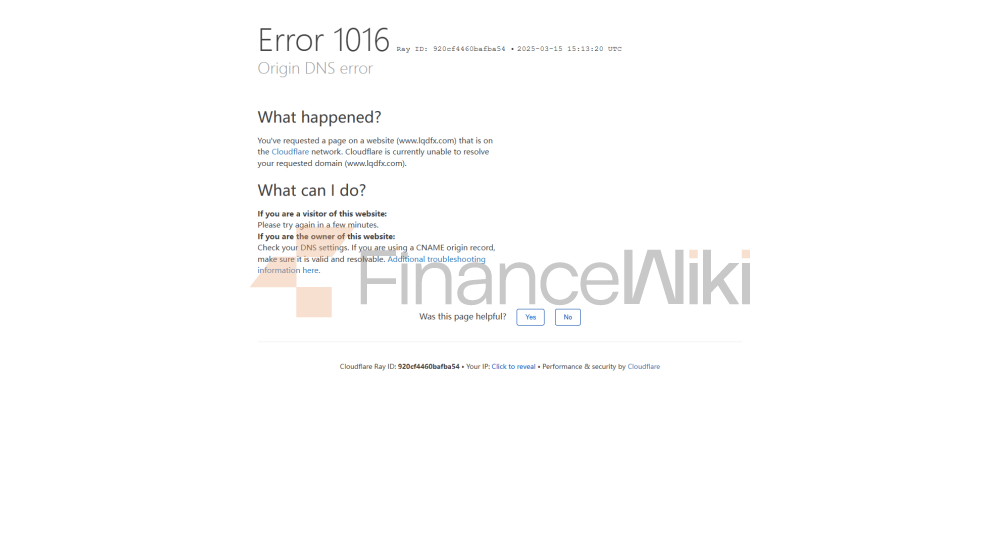

Founded At The End Of 2015 And Headquartered In Saint Lucia, LQDFX Is An Online Broker Specializing In Forex And Contracts For Difference (CFD) Trading. The Company Is Committed To Providing Traders With A Diverse Range Of Financial Instruments And A Convenient Trading Experience. Although LQDFX Stands Out In Certain Markets, Its Does Not Have A License From Any Of The Major Financial Regulators , Which May Pose A Risk To Some Traders.

Regulatory Information

Regulatory License : No Compliance Statement : LQDFX Indicates That Clients' Funds Are Held In Segregated Accounts And Are Held In Custody By Top European Banks. However, Due To The Absence Of A Regulatory License, The Security Of Clients' Funds And The Fairness Of Trading Activities Cannot Be Guaranteed By External Regulators.

LQDFX Is Currently Not Licensed By Any Of The Major Financial Regulators, Including But Not Limited To The UK Financial Conduct Authority (FCA), The US Commodity Futures Trading Commission (CFTC) Or The Australian Securities And Investments Commission (ASIC). This Could Raise Concerns Among Traders About The Safety And Legality Of Their Funds.

Trading Products

Trading Instruments : CFDs For Forex, Commodities, Indices, Metals, Cryptocurrencies, Stocks Specific Asset Class :

- Forex : EUR/USD, GBP/USD, Etc. Commodities : Gold, Crude Oil, Etc.

- Indices : S & P 500, Dow Jones, Etc. Cryptocurrencies : Bitcoin, Ethereum, Etc. Trading Software

- Supports 30 Languages

- Offers Over 50 Customizable Technical Indicators

- Supports 9 Timeframes

- Compatible With Multiple Trading Strategies

- Micro Account (minimum Deposit Of 20 Dollars, Maximum Leverage Of 1:500)

- Gold Account (minimum Deposit Of 500 Dollars, Maximum Leverage Of 1:300)

- ECN Account (minimum Deposit Of 500 Dollars, Maximum Leverage Of 1:300)

- VIP Account (minimum Deposit Of $25,000, Maximum Leverage Of 1:100)

- Islamic Account (minimum Deposit Of $20, Maximum Leverage Of 1:300)

- Micro Accounts: Maximum Leverage 1:500, Spreads From 1 Pip

- Gold And Islamic Accounts: Maximum Leverage 1:300, Spreads From 0.7 Pips

- ECN Accounts: Maximum Leverage 1:300, Spreads From 0.1 Pips

- VIP Accounts: Maximum Leverage 1:100, Spreads From 0.1 Pips

- Live Trading : Low Latency Trading Environment

- Multi-Platform Support : Support For Mobile Devices And Desktop

- Educational Resources : Provides Trading Calculators, Economic Calendars And Video Tutorials

- Beginner And Intermediate Traders

- Traders Seeking Low Thresholds And High Leverage

- Low Deposit Threshold (from 20 Dollars)

- Flexible Leverage Settings (up To 1:500)

- Competitive Spread (as Low As 0.1 Pip For ECN Accounts)

Trading Platform : MT4 Supported Devices : Windows, Android, IOS, WebTrader Main Features :

The Main Trading Tool Of LQDFX Is The MT4 Platform, Which Is Known For Its Rich Functionality And Intuitive Design, Suitable For All Levels Of Traders.

Deposit And Withdrawal Methods

Deposit Methods : Visa, MasterCard, Cryptocurrency, PayRedeem Withdrawal Methods : Visa, MasterCard, Cryptocurrency, PayRedeem Minimum Deposit : 20 Dollars (Micro Accounts And Islamic Accounts) Minimum Withdrawal : 10 Dollars-75, The Specific Amount Varies By Payment Method Handling Fee : Visa And MasterCard Withdrawal Fees Are 10 Dollars, Other Methods Are Free

LQDFX Provides A Variety Of Deposit And Withdrawal Methods To Meet The Diverse Needs Of Traders. However, Visa And MasterCard Withdrawal Fees Are Relatively High.

Customer Support

Support Methods : Phone, Email, Live Chat Support Hours : 24/5 Multilingual Service Support Languages : English, Chinese, Russian, Etc.

LQDFX's Customer Support Team Assists Traders Through Multiple Channels, Supports Multiple Languages, And Is Suitable For Traders Around The World.

Core Business And Services

Account Types :

LQDFX Offers A Variety Of Account Types To Meet The Capital Size And Risk Appetite Of Different Traders.

Leverage And Spreads :

LQDFX's Leverage And Spread Settings Are Competitive, But Traders Should Use Leverage Cautiously To Avoid Potentially High Risk.

Technical Infrastructure

Core System : MT4 Trading Platform Technical Advantages :

LQDFX Provides Traders With Stable Technical Support Through The MT4 Platform, While Providing Rich Educational Resources To Help Traders Improve Their Trading Skills.

Compliance And Risk Control System

Compliance Measures : Segregated Storage Of Funds Risk Management System : Provides Stop Loss And Take Profit Functions, As Well As Negative Balance Protection

LQDFX Is Committed To Protecting The Safety Of Customers' Funds And Providing Negative Balance Protection. However, Due To The Lack Of Regulatory Licenses, The Transparency And Effectiveness Of Its Risk Management System Are In Doubt.

Market Positioning And Competitive Advantage

Target Market :

Competitive Advantage :

LQDFX Attracts Through Low Thresholds And High Leverage Traders, But Their Unregulated License May Limit Their Attractiveness In Some Markets.

Social Responsibility And ESG

Social Responsibility : No Specific Information ESG Commitment : No Clear Statement

LQDFX Does Not Disclose Its Specific Commitments Or Practices In Social Responsibility And ESG.

Strategic Cooperation Ecosystem

Partners : No Public Information Industry Involvement : No Public Information

LQDFX Does Not Disclose Its Strategic Partnerships Or Involvement Within The Industry.

Financial Health

Financial Transparency : Undisclosed Capital Adequacy : Undisclosed

Due To LQDFX's Failure To Disclose Its Financial Information, Traders Cannot Evaluate Its Capital Adequacy And Financial Health.

Future Roadmap

Development Plan : Undisclosed Innovation Direction : No Specific Information

LQDFX Has Not Disclosed Its Future Development Plan Or Technological Innovation Direction.