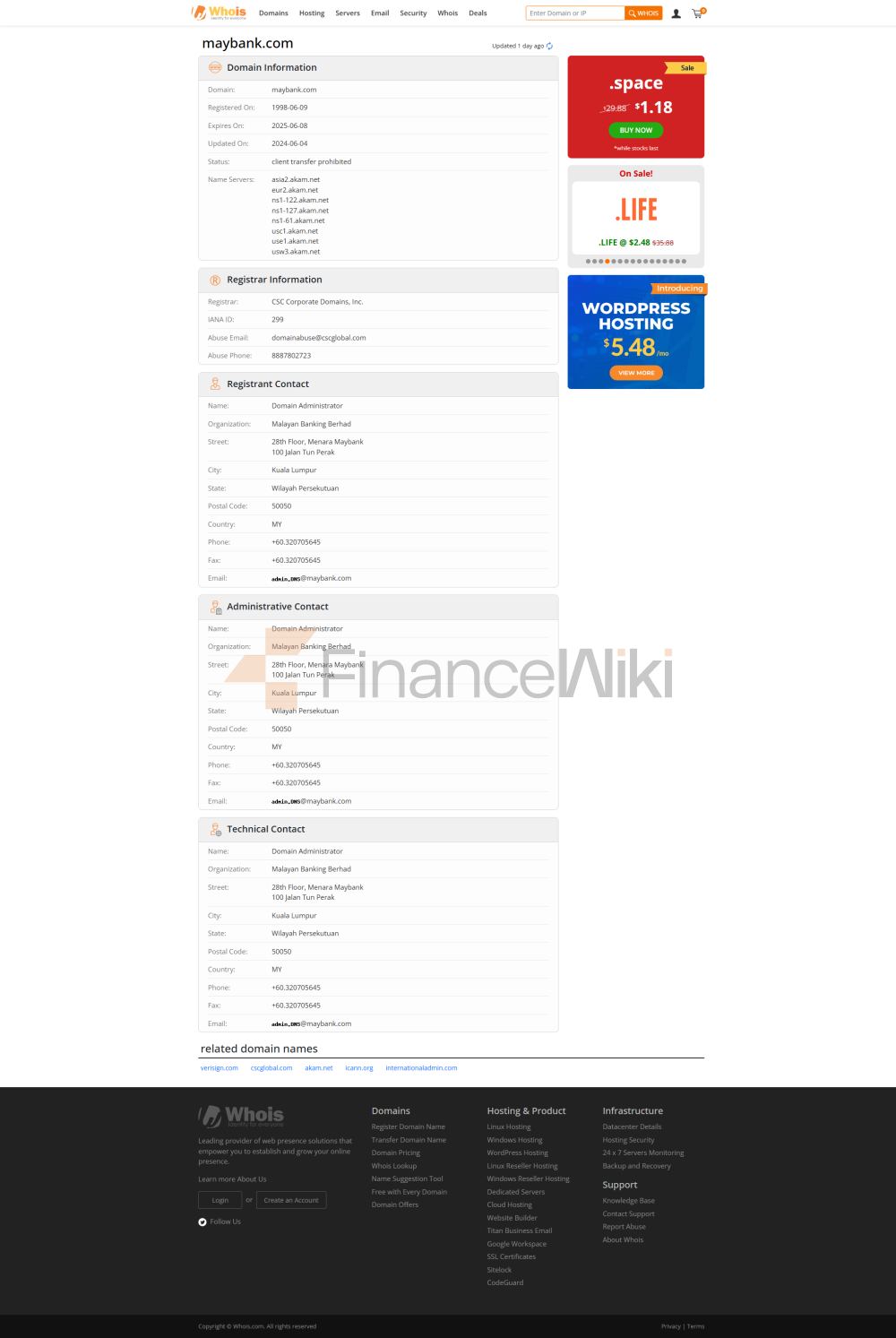

Maybank Securities Is A Global Financial Firm Headquartered In Singapore That Provides Traders With Products And Services Including Stocks, Contracts For Difference, Foreign Exchange, Exchange Traded Funds, Bonds And Fixed Income, Warrants, Real Estate Investment Trusts, Daily Leveraged Certificates, Margin Services, Multi-currency Electronic Payments, Securities Lending, Shenzhen-Hong Kong Stock Connect, Shanghai-Hong Kong Stock Connect, Special Purpose Buyout Companies, Investment Banking And Advisory, Stocks And Trading. Currently The Company Is Not Regulated By Any Recognized Financial Institution Group, Which May Cause Concerns When Trading.

Products & Services

Maybank Securities Offers A Comprehensive Suite Of Financial Products And Services To Meet The Diverse Needs Of Investors And Traders.

Clients Have Access To A Wide Range Of Investment Opportunities, Including Traditional Equities, Contracts For Difference (CFDs), And The Dynamic Foreign Exchange Market. In Addition, The Platform Offers Exchange-traded Funds (ETFs), Bonds And Fixed Income Products, As Well As Warrants, Allowing Investors To Diversify Their Portfolios.

For Those Seeking Real Estate Investments, Real Estate Investment Trusts (REITs) Are Available. Daily Leveraged Certificates Provide Leveraged Trading Options, While Margin Facilities Provide Investors With Additional Trading Capabilities. Multi-currency Electronic Payments Facilitate Seamless Cross-border Transactions, And Securities Lending Options Further Enhance Flexibility.

Through The Shenzhen-Hong Kong Stock Connect And The Shanghai-Hong Kong Stock Connect, Clients Can Participate In Cross-border Investments. Special Purpose Acquisition Companies (SPACs) Services Make It Possible To Participate In Potential Mergers And Acquisitions.

Investment Banking And Advisory Services, As Well As Prime Brokerage And Stock And Trading Services, Provide Comprehensive Support To Corporate And Individual Clients, Ensuring A Comprehensive And Comprehensive Financial Experience With Maybank Securities.

Accounts

Maybank Securities Offers Both Demo And Real Trading To Meet The Diverse Trading Needs Of Its Clients.

Demo Accounts Offer Traders An Opportunity To Practice And Become Familiar With Trading Platforms And Strategies Without Taking Real Risks.

On The Other Hand, A Live Account Offers A Range Of Options With No Minimum Amount Requirement, Ensuring That It Is Accessible To Traders Of All Levels.

Clients Can Choose From A Variety Of Different Active Account Types, Such As The Maybank Trading Cash Account For Direct Cash Trading, The Maybank Trading Advance Account For Prepayment Balances, And The Maybank Margin Financing Account For Leveraged Trading. For Those Interested In Contracts For Difference (CFD) Trading, The Maybank CFD Account Requires A Minimum Deposit Of SGD3,000, While The Maybank Forex Account Provides Access To The Dynamic Forex Exchange Market.

If Your Maybank Account Has Not Had Any Trading In The Past 4 Years, It Will Be Considered Dormant Due To Lack Of Activity. However, You Can Reactivate Dormant Accounts By Using MyInfo, A Safe And Convenient Way To Update Your Account Info And Restore Its Active Status.

Forex Spreads

Maybank Securities Offers A Trading Environment With Relatively Wide Spreads, Especially On The Popular EURUSD Currency Pair, Starting At 1.0 Pips. Spreads Represent The Difference Between The Bid And Ask Prices Of Financial Instruments, And Wider Spreads May Result In Higher Transaction Costs For Traders. Traders Should Carefully Consider The Impact Of Spreads On Their Trading Strategy And Account Performance. While Wider Spreads May Be Appropriate For Certain Trading Styles, Others May Prefer Brokers With Smaller Spreads To Optimize Their Transaction Costs. Traders Must Weigh Various Options And Choose A Broker That Matches Their Trading Objectives And Risk Tolerance.

Trading Platform

Maybank Trading Provides Clients With The Convenience And Flexibility To Access Their Trades Via A Web Platform Or Mobile App.

The Web-based Maybank Trading Platform, Maybank Trade, Enables Traders To Access Their Accounts From Any Networked Device Via A Compatible Web Browser, Providing A Seamless And User-friendly Trading Experience.

For Those Who Need It While On The Go, The Maybank Trading Mobile App Is Available On IOS And Android Devices, Ensuring Traders Can Monitor And Execute Trades Anytime, Anywhere.

Furthermore, With Maybank CFD (Contracts For Difference) And Maybank Forex Available On IOS And Android Devices, Clients Can Access A Wide Range Of Financial Instruments To Trade And Invest, Catering To Different Trading Preferences And Strategies.

Trading Tools

Maybank Securities Offers A Valuable Trading Tool, The Event Calendar, Which Provides Clients With Timely And Critical Market Information. The Event Calendar Includes A Comprehensive Schedule Of Upcoming Economic Events, Company Announcements, Central Bank Meetings, And Other Important Events That May Affect Financial Marekt. Traders Can Use This Calendar To Plan Their Trading Strategies, Understand Potential Market Impact Events, And Make Informed Decisions Based On The Expected Impact Of Each Event.

Deposits & Withdrawals

Maybank Securities Offers Its Customers A Variety Of Payment Methods That Can Be Used For Both Funds Trading Accounts And Foreign Exchange Withdrawal Accounts.

Customers Can Deposit Using Online Banking, Telegraphic Transfers, And Other Convenient Means.

For Withdrawals, Customers Can Request Funds Via Email Using Their Registered Email Address And Can Choose To Receive A Check Or Deposit Funds Directly Into Their Bank Account.

Withdrawal Requests Received Before 12:00 On Business Days Are Usually Processed Within 2 Business Days. Please Note That Maybank Securities Does Not Allow Third-party Funds Transfers To Ensure Enhanced Security For Customers' Transactions. Withdrawal Options Are Limited To The Client's Name And Bank Account, Further Enhancing The Focus On Client Security And Protection.

Maybank Securities Offers A Variety Of Client Server Options To Assist Its Clients. Clients Can Contact Maybank Securities With Their Questions And Concerns Through Various Channels As Follows:

Address: 50 North Canal Road, Singapore 059304, 9am-6pm (Mon-Fri)

Email: MSSG_Helpdesk@maybank.com.

Email: MSSG_LeveragedFXDept@maybank.com.

Email: MSSG_LeveragedFXDept@maybank.com For Investment Banking And Advice.

Email: MSSG_dpo@maybank.com For Data Protection.

Tel: + 65 6231 5888

Night Trading Desk (US Trading): + 65 6231 5554 (Business Hours: 9:30pm To 4:00am Daylight Saving Time; Standard Time US Market Trading Days: 10:30pm To 5:00am)

As Part Of Its Comprehensive Customer Support Service, Maybank Securities Offers A User-friendly Inquiry Form That Allows Customers To Conveniently Contact The Company With Their Questions, Concerns, Or Any Assistance They Need.