IFC Markets · Company Profile

Founded In 2006, IFC Markets Is A Malaysia-based Financial Trading Platform. It Operates Under The Supervision Of The LFSA And FSC, But There Are Doubts About The Authenticity Of Its FSC License. The Platform Offers Users A Wide Range Of Market Instruments To Trade, Including Currency Pairs, Precious Metals, And Cryptocurrency CFDs. New Users Can Familiarize Themselves With The Platform Through Their Available Demo Accounts. IFC Markets Offers Leverage Of Up To 1:400 With A EUR/USD Spread Of 1.8 Pips. They Have Multiple Trading Platforms For Users To Choose From, Including Nettradex, Mt4, And Mt5. For Any Assistance, Clients Can Contact Their Support Team Via Phone, Email Or Social Media (Twitter, Instagram, Linkedin). IFC Markets Is A Brand Of The IFCM Group That Focuses On The Development And Execution Of Different Projects In The Field Of Financial Technology. FC Markets Is An International Finance Company That Provides Trading Services For Currency Pairs, Precious Metals, Index CFDs, Stock CFDs, Commodity CFDs. In Addition, FC Markets Has Launched An Innovative Trading Method - GeWorko. Through This Method, Traders Can Create A Personal Portfolio Instrument (PCI) In The Trading Analysis Platform NetTradeX And Get Instant Access To Its Price History.

FC Markets' Main Goal Is To Provide Its Clients With Top-notch Services, Including: No Trade Requests Regardless Of The Volume Of Trades You Are Executing, Instant Execution Of All Kinds Of Orders, Low Spreads, Access From Anywhere In The World In Minutes And 24-hour Technical Support. FC Markets Is Currently Establishing Subsidiaries In Different Regions And Countries Around The World.

FC Markets Offers A Competitive Partner Program: Commissions Are Charged As Low As $10 To $15 Per Standard Lot.

The Most Important Difference Between IFC Markets And Other Companies Is That It Offers Its Next-generation Trading Platform NetTradeX. This Project Is The Result Of Years Of Work By A Team Of Highly Qualified Programmers At NetTradeX. NetTradeX Also Includes Advantages In The FC Markets Team

- Professional Own Trading Platform NetTradeX

- Trading With Fixed Spread Flow Quotes

- Leverage Of 1:40 For Currency Pairs And 1:40 For Stocks

- Interbank Currency Swaps

- Interest-free Borrowing Of Non-monetary Assets

- Opportunity To Create A Personal Composite Trading Instrument PCI

- AIG European Funds & Insurance Limited

IFC Markets · Company Profile

IFC Markets Founded In 2006, It Is A Financial Trading Platform Headquartered In Malaysia. It Operates Under The Supervision Of The LFSA And FSC, But There Are Doubts About The Authenticity Of Its FSC License. The Platform Offers Users A Wide Range Of Market Instruments To Trade, Including Currency Pairs, Precious Metals And Cryptocurrency CFDs. New Users Can Familiarize Themselves With The Platform Through Their Available Demo Accounts. IFC Markets Offers Leverage Of Up To 1:400 With A EUR/USD Spread Of 1.8 Pips. They Have Multiple Trading Platforms For Users To Choose From, Including Nettradex, Mt4 And Mt5. For Any Assistance, Clients Can Contact Their Support Team Via Phone, Email Or Social Media (Twitter, Instagram, Linkedin).

Pros And Cons

Pros:

• 17 Years Of Global Financial Marekt Experience: IFC Markets Has Been Operating For Almost Two Decades, Demonstrating Its Deep Understanding And Expertise In Financial Marekt.

• 650 + Trading Instruments: This Wide Range Provides Traders With Diverse Options, Helping To Diversify Portfolios And Align With Individual Trading Strategies.

• Instant Execution: Ensuring Immediate Fulfillment Of Orders, Which Is Especially Important In Volatile Markets Where Prices Change Rapidly.

• No Hidden Commissions: A Transparent Pricing Structure Helps Traders Pinpoint Their Potential Costs And Profits.

Cons:

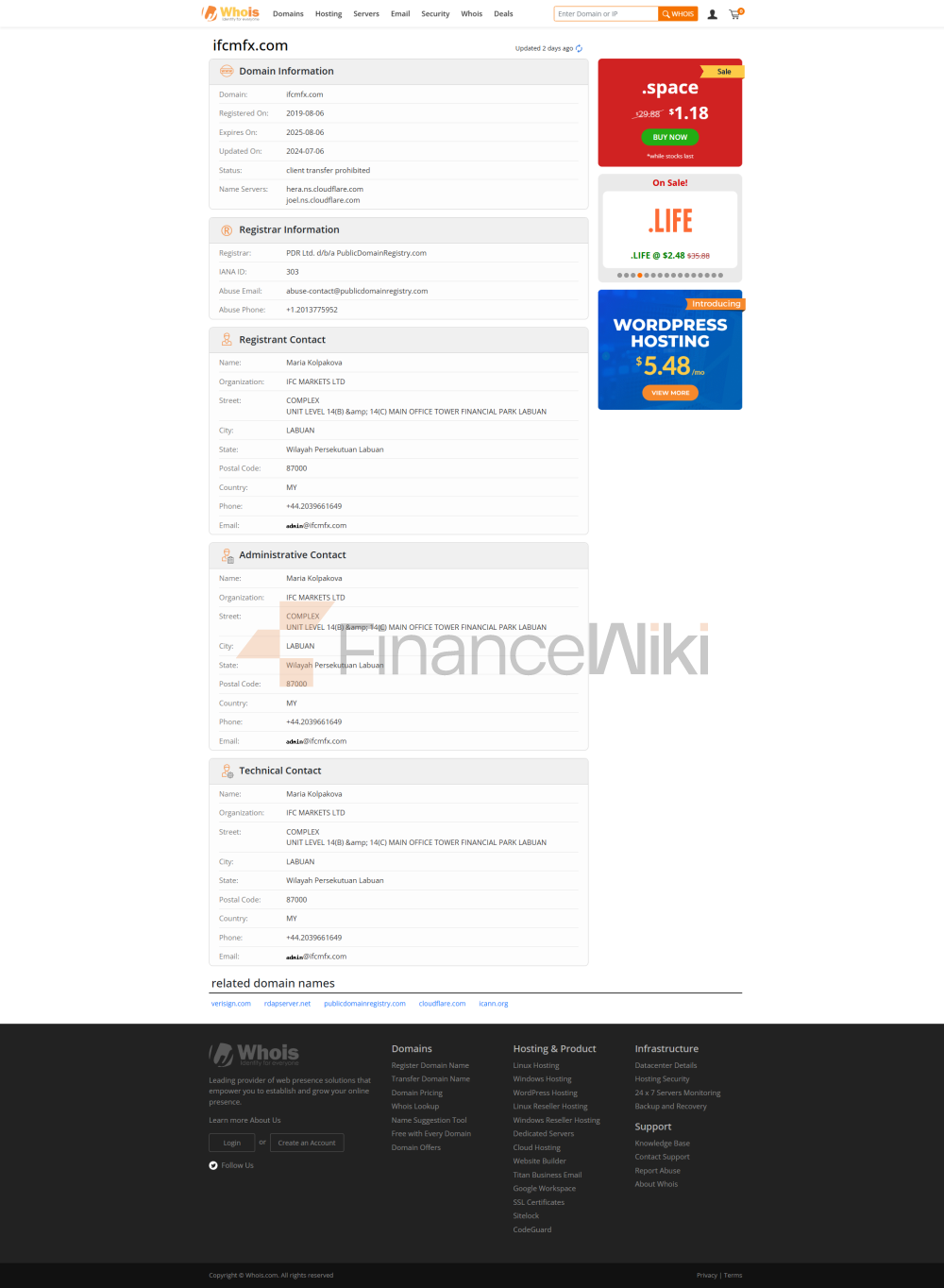

• Dubious Regulation By The FSC: Suspicions Surrounding The State Of Regulation Of The Platform Can Be Cause For Concern. Proper Regulation Guarantees That Brokers Comply With Legal And Ethical Standards, Protecting Traders From Potential Misconduct.

• Limited Influence Compared To Some Competitors: While IFC Offers Leverage Of Up To 1:400, Some Competitors May Offer Higher Leverage, Which May Appeal To Certain Risk-seeking Traders.

• Restrictions On Access In Certain Countries: IFC Markets Caters To The Needs Of Most International Traders. Traders From Japan Or Russia Will Not Be Able To Access Or Use The Platform, Limiting Its Global Reach.

FC Markets Has A Comprehensive And Diverse Range Of Market Tools To Meet The Diverse Needs Of Clients Around The World. From, Traditional Forex Trading, To Innovative Cryptocurrency CFDs, The Platform Offers Multiple Avenues For Potential Investments. Here Are Some Examples Of The Instruments Available:

Trading On Currency Pairs

The Forex Section Is Located In IFC Markets Has Traditional Instruments For This Market, Such As Currency Pairs. These Currency Pairs Represent The Value Of One Currency In Another.

CFD Trading In Precious Metals

Precious Metals, Especially Gold, Have Always Been Seen As A Reliable Asset During Times Of Market Crisis And High Volatility.

CFD Trading In World Indices

Such Instruments Allow Traders To Participate In Indices On Major Stock Exchanges. Pricing Of These Instruments Is Set In The Local Currency Of Each Particular Index.

CFD Trading In Stocks Online

This Section Includes CFDs On Highly Liquid Stocks Of Companies Listed On Major Global Stock Markets.

Online Cryptocurrency Trading - Cryptocurrency CFDs

Cryptocurrency CFDs Enable Traders To Speculate On The Value Of Cryptocurrencies Without Directly Owning The Underlying Asset. Cryptocurrencies Are Traded With Standard Currencies, Such As Ethusd For Ethereum. A Distinct Advantage Is That There Is No Need For A Cryptocurrency Trading Account Or Bitcoin Wallet. IFC Markets Takes Cryptocurrency Prices From Reputable Exchanges As Well As Futures Prices For Assets Such As Bitcoin And Ethereum.

IFC Markets Not Only Offers Preferential, Demo Accounts For Potential Traders To Familiarize Themselves With The Platform, But Also Offers A Wide Range Of Benefits When One Chooses To Open A Trading Platform, An Online Trading Account. With One Account, Traders Have Access To An Impressive Array Of Over 650 Trading Instruments Complemented By Optimal Conditions Including Instant Execution And Extremely Low Spreads Of 0.4 Pips From The Following Times. In Addition, The Platform Ensures Fast And Trustworthy Withdrawal And Deposit Options With Trading Amounts As Low As $1. In Addition, Users Can Trade With Confidence Knowing That IFC Markets Is Regulated And Licensed By The Following Authority, The British Virgin Islands FSC.

Leverage

IFC Markets Enables Traders To Maximize Their Trading Potential By Using Leverage. Leverage Is A Powerful Tool That Allows Traders To Open Positions Much Larger Than Their Initial Deposit. By Offering Up To 1:400, IFC Markets Enables Clients To Expand Their Market Exposure And Potentially Achieve Higher Investment Returns. However, It Is Important To Note That Leverage, While It Can Amplify Profits, Can Also Amplify Losses, So Traders Must Use The Tool Wisely And Understand The Risks Involved.

Spreads And Commissions

IFC Markets Builds Commissions Based On The Specific Trading Instrument And Platform Used, Making Commissions Vary Depending On The Currency Pair And Other Assets Selected. For Example, Commissions Vary From, 0.1% Of The Order Volume For A Specific Instrument. In Terms Of Stock Trading, US Stocks Attract Commissions Of, $0.02 Per Stock, While Canadian Stocks Attract Commissions Of, $0.03 Per Stock. These Commissions Apply Both At Opening And Closing Positions. In Addition, For Platforms Such As NetTradeX And MT4, The Minimum Commission For A Trade Is Set To 1 Quote Currency. However, There Are Exceptions, Such As HKD 8 For Chinese Stocks, JPY 100 For Japanese Stocks, And CAD 1.50 For Canadian Stocks. On The MT5 Platform, The Base Commission Is Defined By The Currency Of The Account Balance And Can Be USD 1, EUR 1, Or JPY 100. Only USD 1 Is Charged For US Stocks.

IFC Markets Offers A Diverse Range Of Spreads To Suit Traders' Preferences. For Those Looking For Stability, Our Fixed Spreads Range From 1.8 Pips For Currency Pairs Such As USD/EUR And EUR/JPY. These Fixed Spreads Offer The Predictability Of Trading Costs, Allowing Traders To Plan Their Strategies With Confidence. Plus, For Traders Who Value Flexibility And Potentially Narrower Spreads, They Also Offer Floating Spreads, Starting As Low As 0.4 Pips, On These Currency Pairs. This Versatility Ensures That Whether You Are A Conservative Trader Or A More Risk-tolerant Trader, IFC Markets Has The Right Spread Options To Suit Your Trading Style.

Trading Platform

IFC Markets Offers Three Versatile Trading Platforms:

Web Trade X: A User-friendly Platform With Advanced Tools Accessible On Desktop And Mobile Devices.

MetaTrader 4 (MT4): Known For Using The Stability And Automated Trading Of Expert Advisors As Well As A Wide Range Of Charting And Analytical Tools.

MetaTrader 5 (MT5): The Premium Successor To MT4, With Extended Timeframes, More Technical Indicators And Wider Asset Class Support.

Choose The Platform That Suits Your Trading Style And Access A Wide Range Of Assets With Competitive Spreads, All In A Safe Trading Environment.

Deposits And Withdrawals

IFC Markets Offers Users A Variety Of Deposit And Withdrawal Methods, Catering To The Different Preferences Of Clients Worldwide.

- International Bank Transfer: This Method Usually Takes 2 To 3 Business Days, And The Deposit Fee Is Determined By Your Bank. The Minimum Deposit Amount For This Method Is $100 Or €100, And The Corresponding Withdrawal Method Is Also Through International Bank Transfer.

- Bank Card: Deposits Are Processed Immediately Without Any Fees. The Minimum Amount Is $100, €100 Or ¥10,000, And The Upper Limit Is $5,000, €5,000 Or ¥500,000. When Withdrawing Money, The Same Bank Card As The Deposit Is Required.

- Mobile Money/M-Pesa: A Method Of Instant Processing Without Paying The Deposit Fee. Minimum Deposit Is As Low As $5 Or €5 And Maximum Limit Is $500 Or €500. Withdrawals Can Be Made Via Mobile Money/M-Pesa.

- Cryptocurrency: Instant Deposit Is Available Without Any Associated Fees. Minimum Deposit Is From $20, €20, JPY 2000 Or 800 UBTC. Withdrawals Can Be Processed Via The Corresponding Cryptocurrency.

- Perfect Money: Processing Time Is Instant And Commissions Range From 0.5% To 1.99%. Deposits Can Be As Low As $1 Or €1 And Up To $5,000 Or €5,000. Withdrawals Can Be Executed Via Perfect Money.

- Net Money: Instant Deposits Come With A 20% Fee And A Minimum Deposit Amount Of $1. The WebMoney Payment System Handles Withdrawals.

- ADVC Cash: This Method Provides Instant Deposits With No Fees, With A Minimum Amount Of $1 Or €1 And A Maximum Of $5,000 Or €5,000. ADVCash Is The Designated Method Of Withdrawal.

Users Should Note That While IFC Markets Ensures Flexibility In Deposits, Withdrawing Funds May Be Subject To Payment System Commissions. These Commissions Are Subject To Change Without Notice As Determined By The Respective Payment System.

Trading Hours

The Trading Hours Of The CFD And Forex Markets Mainly Revolve Around The Trading Hours Of Global Financial Exchanges Such As The London Stock Exchange, The New York Stock Exchange, The Hong Kong Stock Exchange, And The Tokyo Stock Exchange. Given The Fragmented Locations And Time Zones Of These Markets, Monitoring The Trading Hours Of Various Financial Instruments Can Be Complex. However, In The Case Of Currency Pairs, Their Trading Hours Are All Week Except Weekends. For Example, Forex Trading Hours Are, Monday To Thursday (00:00 - 22:00, 22:15 - 24:00), Friday (00:00 - 22:00)