Corporate Profile

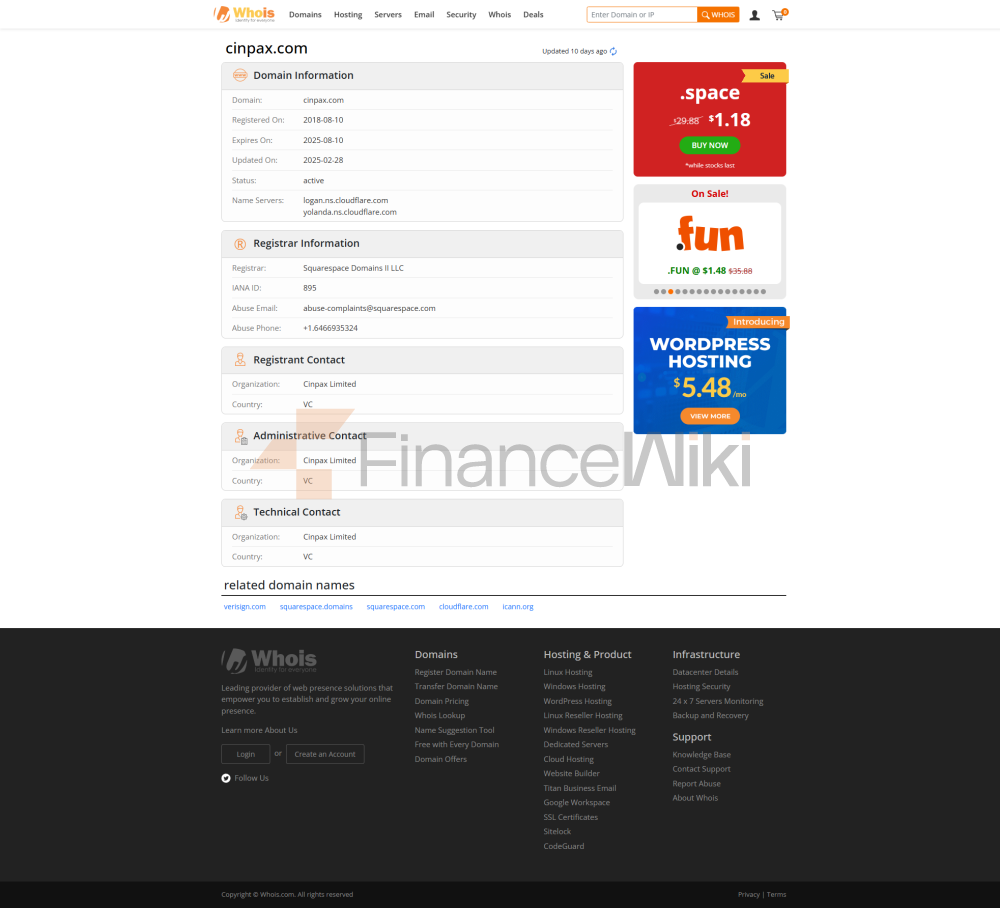

Cinpax Is An Online Trading Platform Based In Saint Vincent And The Grenadines That Provides Traders With Access To A Wide Range Of Financial Marekts. The Company Is Committed To Meeting The Needs Of Traders Of Different Experience Levels Through Its Diverse Range Of Services And Tools. Cinpax's Range Of Services Covers Asset Classes Such As Currency Pairs, Commodities, Energy, Precious Metals, Stocks And Stock Indices, Providing Investors With A Wide Range Of Investment Options. The Company Ensures Traders Can Trade Anytime, Anywhere By Providing Multi-asset Trading Platforms, Web Trading And Mobile Applications.

Regulatory Information

Cinpax Currently Lacks Effective Regulatory Oversight, A Situation That Raises Concerns About Its Safety And Legality. Regulatory Oversight Is Essential To Ensure That Financial Service Providers Comply With Industry Standards And Protect The Interests Of Investors. Traders May Face Fraud, Difficulty Withdrawing Funds And Other Latent Risks Due To The Unregulated State, So Caution Should Be Considered When Choosing This Platform.

Trading Products

Cinpax Offers A Diverse Range Of Trading Products Covering The Following Asset Classes:

- Currency Pairs: Allows Traders To Trade In Different Foreign Exchange Markets, Including Major Currency Pairs (e.g. EUR/USD, GBP/USD) And Minor Currency Pairs.

- Commodities And Energy: Includes Trading In Commodities Such As Crude Oil, Natural Gas, Gold, Etc. Precious Metals: Offers Trading Opportunities In Precious Metals Such As Gold, Silver, Platinum, And Palladium.

- Stocks And Stock Indices: Allows Traders To Participate In The Trading Of Major Global Stock Markets, Covering Multiple Industries Such As Technology, Finance, And Healthcare.

Trading Software

Cinpax Offers A Variety Of Trading Platforms To Meet The Needs Of Different Traders:

- Multi-asset Trading Platform: Supports The Trading Of Currencies, Commodities, Indices, And Stocks, Providing Advanced Charting Tools And Analytical Functions.

- Web Transactions: Accessible Through Windows, Mac, And Linux Systems, Transactions Can Be Made Without Downloading Software.

- Mobile Transactions: Includes Mobile Apps For Android And IOS Devices, Enabling Anytime, Anywhere Transactions.

Deposit And Withdrawal Methods

Cinpax Offers A Variety Of Payment Methods, Including:

- Visa And Mastercard: Supports Deposits And Withdrawals Through These Credit Card Networks.

- Other Methods: Depending On The User's Geographical Location And Payment Preferences, Cinpax May Offer Alternative Payment Methods.

Customer Support

Cinpax Provides Comprehensive Customer Support Services. Traders Can Contact The Support Team Through The Following Channels:

- Phone: + 18009851351 Email: Customer.info@cinpax.net Online Chat: Communicate Directly With The Support Team Through The Official Website

Core Business And Services

Cinpax's Core Business Focuses On Providing Traders With Convenient Online Trading Services. Its Main Services Include:

- High Leverage Trading: Offers Leverage Up To 1:400 , Allowing Traders To Control Larger Positions With Smaller Funds.

- Multiple Account Types: Includes STARTER Account (250 Dollars Minimum Deposit), BASIC Account (2500 Dollars Minimum Deposit), ADVANCED Account ($25,000 Minimum Deposit), PROFESSIONAL Account ($100,000 Minimum Deposit) And VIP Account (by Invitation Only) For Different Trading Needs.

- Customized Trading Tools: Provides Exclusive Trading Solutions And Market Analysis Tools For High Net Worth Clients And Institutional Investors.

Technical Infrastructure

Cinpax's Technical Infrastructure Is Centered On A Multi-asset Trading Platform That Supports A Wide Range Of Trading Tools And Analytical Functions. The Distinguishing Features Of Its Trading Platform Are:

- Multi-asset Support: Covers A Wide Range Of Asset Classes Including Currencies, Commodities, Stocks, And Stock Indices.

- Cross-platform Compatibility: Supports Trading Operations On Web, Mobile End And Desktop, Providing Flexibility And Convenience.

Compliance And Risk Control System

Although Cinpax Currently Lacks Effective Regulation, Its Compliance Statement States That The Company Is Committed To Complying With Anti-money Laundering (AML) And Know-your-customer (KYC) Regulations. However, Without Clear Regulatory Oversight, The Effectiveness Of Its Risk Control System And Service Transparency May Be Questionable.

Market Positioning And Competitive Advantages

Cinpax's Market Positioning Is Primarily Aimed At Traders Who Wish To Conduct High-risk, High-reward Trades. Its Competitive Advantages Include:

- High Leverage Trading: 1:400 Leverage Ratio Provides Traders With Greater Flexibility And Potential Returns.

- Multiple Account Types: Meet The Needs Of Clients With Different Trading Experiences And Fund Sizes.

- Flexible Deposit And Withdrawal Methods: Supports Major Payment Methods Such As Visa And Mastercard, Simplifying The Fund Management Process.

Customer Support And Empowerment

Cinpax Helps Traders With Account Registration, Trading Issues And Other Related Queries Through Its Multi-channel Customer Support Services. The Professionalism And Responsiveness Of Its Support Team Are Important Factors In Measuring Customer Satisfaction.

Social Responsibility And ESG

Cinpax Does Not Currently Disclose A Clear Social Responsibility Program Or Commitment To ESG (environmental, Social And Governance) Initiatives.

Strategic Cooperation Ecosystem

Cinpax's Development Strategy Has Not Been Fully Disclosed, But It Seems To Be Committed To Attracting Different Types Of Traders And Building A Diversified Trading Ecosystem By Providing Multiple Account Types And Trading Tools.

Financial Health

Cinpax's Financial Health Is Difficult To Assess Due To The Lack Of Regulation And Transparent Financial Information. Investors Should Carefully Consider Its Latent Risk When Choosing The Platform.

Future Roadmap

Cinpax Does Not Currently Disclose A Detailed Future Roadmap, But It Demonstrates Its Commitment To Attracting Traders Interested In High-risk Investments By Offering High Leverage And Diverse Trading Tools.

Risk Warning

Online Trading Involves Significant Risks And Traders May Lose Their Entire Invested Capital. High Leverage Trading Amplifies Potential Gains And Risks And Is Not Suitable For All Traders. Investors Should Pay Particular Attention To Regulatory Status, Compliance Statements And Customer Support Services When Choosing A Trading Platform.