Corporate Profile

FBK Markets Is A Forex And CFD Broker Based In South Africa, Established In 2018. The Company Offers Trading Services On A Wide Range Of Financial Instruments, Including Forex, Stocks, Indices And Commodities. The Target Client Group Of FBK Markets Is Retail Traders, Especially Those Looking For A High Leverage And Low Spread Trading Environment.

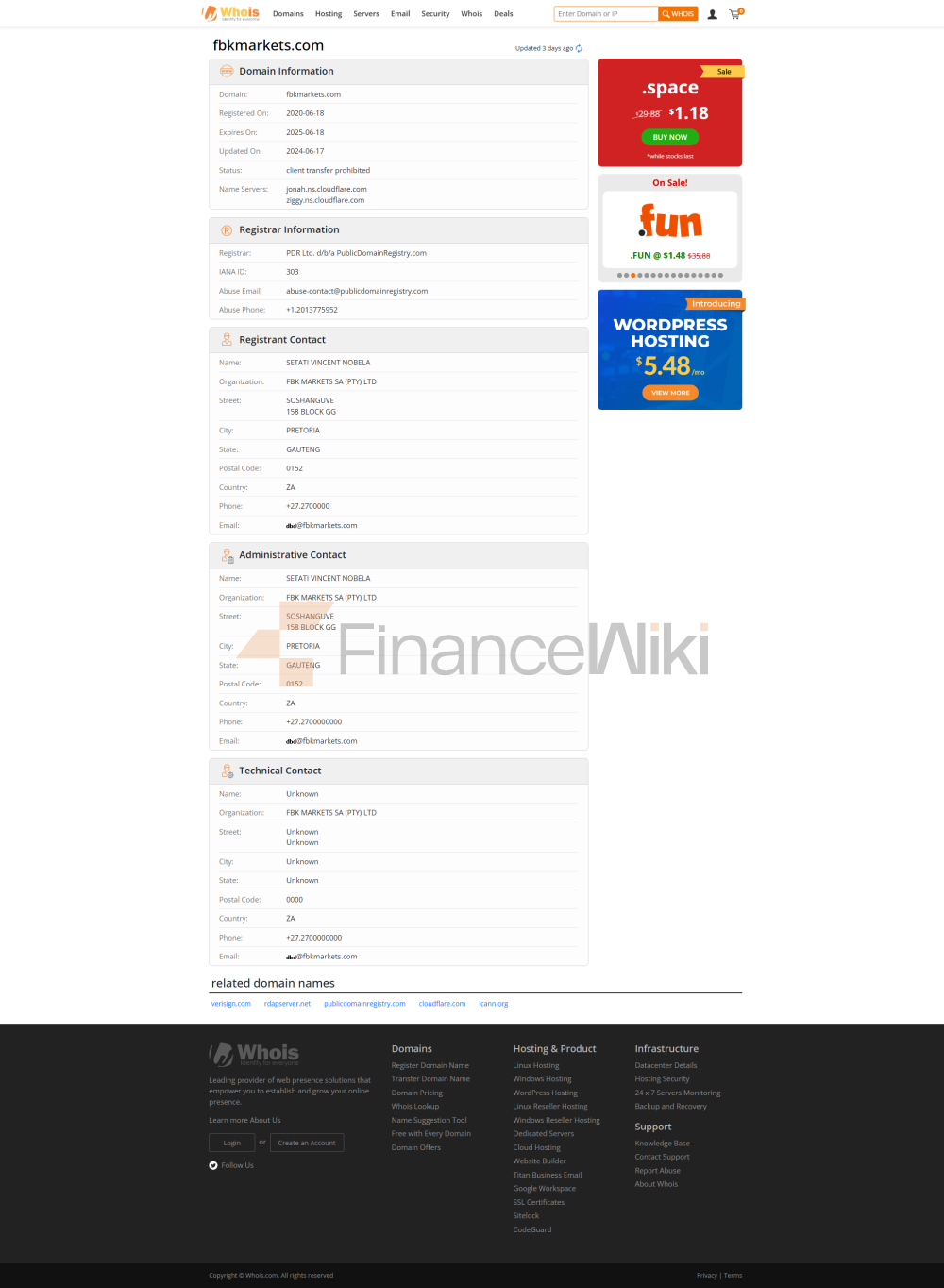

Regulatory Information As Of The Third Quarter Of 2023, FBK Markets Has Not Obtained Any Valid Regulatory License. Although The Company Claims To Be Regulated By The South African FSCA (Regulation No: 49769), This Statement Has Not Been Officially Confirmed. Therefore, Traders Should Fully Understand The Latent Risk Before Choosing The Platform.

Trading Products FBK Markets Offers A Range Of Trading Tools, Including Forex, Commodities, Indices And Bonds. However, Its Range Of Trading Tools Is More Limited Compared To Other Brokers Within The Industry, Which May Not Meet The Needs Of All Traders.

Trading Software FBK Markets Primarily Uses The MetaTrader 4 (MT4) Trading Platform, Which Supports Desktop, Mobile And Web End Points. MT4 Is Popular With Traders For Its Technical Analysis Tools And Highly Customized Features, But The MT4 Platform Is Limited To A Single Trading Platform Option And May Not Be Suitable For Users Who Prefer Other Trading Platforms.

Deposit And Withdrawal Methods FBK Markets Offers A Variety Of Deposit And Withdrawal Methods Including Bank Telegraphic Transfer, Ozow, Virtual Pay And Skrill. The Minimum Deposit And Withdrawal Amount Is R100 And There Are No Deposit Fees. However, Its Payment Options Are More Limited Compared To The Industry's Leading Payment Methods.

Customer Support FBK Markets Offers 24/7 Customer Support Services Including Live Chat, Email, WhatsApp As Well As Social Media Platforms Such As Facebook And Twitter. In Addition, Customers Can Also Access The Physical Address Provided By The Company. However, All Support Channels Are Only Available In English, Which May Pose A Barrier For Non-English Speaking Traders.

CORE BUSINESS AND SERVICES The Core Business Of FBK Markets Is To Provide Traders With A Diverse Range Of Account Types And Competitive Trading Conditions. The Company Offers A Wide Range Of Account Types Including Standard, Zero Spread, Bonus 100, ECN And Micro Accounts To Meet Different Trading Needs.

TECHNOLOGY INSTITUTIONS The Technical Infrastructure Of FBK Markets Relies Primarily On The MetaTrader 4 (MT4) Platform, Which Is Widely Recognized For Its Stability And Rich Functionality. However, Its Single Choice Of Trading Platform May Limit The Experience Of Some Traders.

Compliance And Risk Control System FBK Markets As A Market Maker (Market Maker), Its Trading Model May Lead To Potential Conflicts Of Interest. While The Company Offers Negative Balance Protection, Ensuring That Traders Do Not Lose More Than Their Account Balance, Its Lack Of Effective Regulatory Compliance May Have An Impact On The Safety Of Traders' Funds.

Market Positioning And Competitive Advantage FBK Markets Has A Certain Competitive Advantage In The Market With Its High Leverage (up To 1:1000), Low Spreads And Wide Selection Of Account Types. However, Its Market Maker Model And Limited Regulatory Compliance May Limit Its Positioning In The Wider Market.

Client Support & Empowering FBK Markets Provides 24/7 Support To Clients Through Multiple Channels And Provides Educational Resources To Help Traders Improve Their Trading Skills. However, The Depth And Breadth Of Educational Resources Is Limited And May Not Meet The Needs Of Experienced Traders.

Social Responsibility & ESGFBK Markets Does Not Mention Explicit Social Responsibility And ESG Practices On Its Official Website. As Such, Its Information In This Area Is More Limited And May Require Further Investigation.

Strategic Collaboration Eco FBK Markets Has Established Partnerships With Its Payment Service Providers Such As Ozow And Skrill To Provide A Diverse Range Of Deposit And Withdrawal Methods. However, Its Strategic Cooperation Ecology Is More Limited Compared To The Industry Leaders.

Financial Health FBK Markets' Financial Health Is Difficult To Assess Due To The Lack Of Effective Regulatory Compliance Information. However, High Leverage And Trading Patterns Of Market Makers May Have Some Impact On Its Financial Stability.

Future Roadmap As Of The Third Quarter Of 2023, FBK Markets Has Not Yet Announced Detailed Future Development Plans. Therefore, Potential Clients Should Contact The Company Directly For The Latest Information.

Please Note That The Above Information Is Based On Data Up To The Third Quarter Of 2023. It Is Recommended To Directly Verify The Latest Information Before Making A Decision.

Corporate Introduction: FBK Markets

FBK Markets Is A South African-based Forex And CFD Broker Established In 2018. The Company Offers Trading Services On A Wide Range Of Financial Instruments, Including Forex, Stocks, Indices And Commodities. The Target Client Group Of FBK Markets Is Retail Traders, Especially Those Seeking A High Leverage And Low Spread Trading Environment.

Regulatory Information As Of The Third Quarter Of 2023, FBK Markets Has Not Obtained Any Valid Regulatory License. Although The Company Claims To Be Regulated By The South African FSCA (regulatory Number: 49769), This Statement Has Not Been Officially Confirmed. Therefore, Traders Should Fully Understand The Latent Risk Before Choosing This Platform.

Trading Products FBK Markets Offers A Range Of Trading Tools Including Forex, Commodities, Indices And Bonds. However, Its Range Of Trading Tools Is More Limited Compared To Other Brokers In The Industry, Which May Not Meet The Needs Of All Traders.

Trading Software FBK Markets Primarily Uses The MetaTrader 4 (MT4) Trading Platform, Which Supports Desktop, Mobile And Web End Points. MT4 Is Popular With Traders For Its Technical Analysis Tools And Highly Customised Features, But The MT4 Platform Is Limited To The Choice Of A Single Trading Platform And May Not Be Suitable For Those Users Who Prefer Other Trading Platforms.

Deposit And Withdrawal Methods FBK Markets Offers A Variety Of Deposit And Withdrawal Methods, Including Bank Telegraphic Transfer, Ozow, Virtual Pay And Skrill. The Minimum Deposit And Withdrawal Amount Is R100 And There Are No Deposit Fees. However, Its Payment Options Are More Limited Compared To The Industry's Leading Payment Methods.

CUSTOMER SUPPORT FBK Markets Offers 24/7 Customer Support Services Including Live Chat, Email, WhatsApp As Well As Social Media Platforms Such As Facebook And Twitter. In Addition, Customers Can Also Access The Physical Address Provided By The Company. However, All Support Channels Are Only Available In English, Which May Pose A Barrier For Non-English Speaking Traders.

CORE BUSINESS AND SERVICES The Core Business Of FBK Markets Is To Provide Traders With A Diverse Range Of Account Types And Competitive Trading Conditions. The Company Offers Multiple Account Types Including Standard, Zero Spread, Bonus 100, ECN And Micro Accounts To Meet Different Trading Needs.

Technical Infrastructure FBK Markets' Technical Infrastructure Relies Primarily On The MetaTrader 4 (MT4) Platform, Which Is Widely Recognized For Its Stability And Rich Functionality. However, Its Single Choice Of Trading Platform May Limit The Experience Of Some Traders.

Compliance And Risk Control System FBK Markets As A Market Maker (Market Maker), Its Trading Model May Lead To Potential Conflicts Of Interest. While The Company Provides Negative Balance Protection, Ensuring That Traders Do Not Lose More Than Their Account Balance, Its Lack Of Effective Regulatory Compliance May Have An Impact On The Safety Of Traders' Funds.

Market Positioning And Competitive Advantage FBK Markets Has A Certain Competitive Advantage In The Market With Its High Leverage (up To 1:1000), Low Spreads And Wide Selection Of Account Types. However, Its Market Maker Model And Limited Regulatory Compliance May Limit Its Positioning In The Wider Market.

Customer Support And Empowerment FBK Markets Provides 24/7 Support To Its Clients Through Multiple Channels And Provides Educational Resources To Help Traders Improve Their Trading Skills. However, The Depth And Breadth Of Educational Resources Are Limited And May Not Meet The Needs Of Experienced Traders.

Social Responsibility And ESG FBK Markets Does Not Mention Explicit Social Responsibility And ESG Practices On Its Official Website. Therefore, Its Information In This Area Is Limited And May Require Further Investigation.

Strategic Partnership Ecology FBK Markets Has Established Partnerships With Its Payment Service Providers Such As Ozow And Skrill To Provide A Diverse Range Of Deposit And Withdrawal Methods. However, Its Strategic Partnership Ecosystem Is Limited Compared To Industry Leaders.

Financial Health The Financial Health Of FBK Markets Is Difficult To Assess Due To The Lack Of Effective Regulatory Compliance Information. However, High Leverage And The Trading Patterns Of Market Makers May Have Some Impact On Its Financial Stability.

Future Roadmap As Of The Third Quarter Of 2023, FBK Markets Has Not Announced Detailed Future Development Plans. Therefore, Potential Clients Should Contact The Company Directly For The Latest Information.

Please Note That The Above Information Is Based On Data As Of The Third Quarter Of 2023. It Is Recommended To Directly Verify The Latest Information Before Making A Decision.