Corporate Profile

Rallyville Markets (hereinafter Referred To As "Rallyville Markets") Is An Australia-based Foreign Exchange Broker Established In 2015 With Branches In Vanuatu And Vancouver. The Company Provides Traders With Foreign Exchange, Commodities (e.g. Gold, Silver, Crude Oil) And Index Trading Services Globally. The Registered Entity Of Rallyville Markets Is RALLYVILLE FINANCIAL GROUP PTY LTD With A Registered Address In Sydney And Registration Number 76 139 110 295. The Broker Provides Services In Multiple Jurisdictions Worldwide, But Does Not Include Countries Such As The United States, Australia, Canada, Etc.

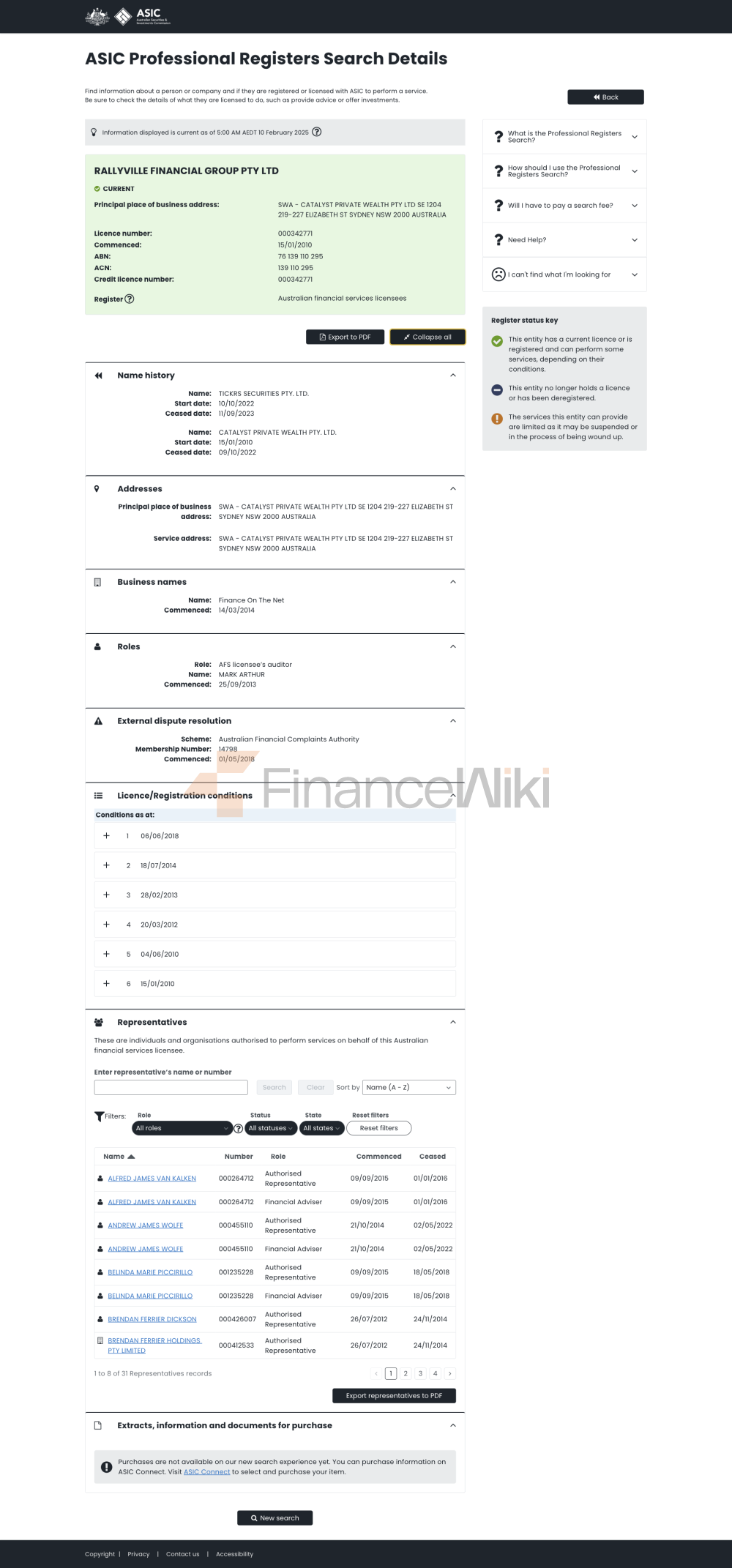

Regulatory Information

Rallyville Markets Is Highly Regulated Worldwide. Its Key Regulators Include:

- Australian Securities And Investments Commission (ASIC) : The Broker's Australian Entity, RALLYVILLE FINANCIAL GROUP PTY LTD, Holds A Straight-through Processing (STP) License Issued By ASIC With License Number 342771.

- Financial Transactions And Reports Analysis Centre Of Canada (FINTRAC) : The Broker's Canadian Entity, RALLYVILLE MARKETS SDN. BHD., Holds A Currency Exchange License With License Number M23092517.

- Vanuatu Financial Services Commission (VFSC) : The Broker's Vanuatu Entity, RALLYVILLE MARKETS LIMITED, Holds A Retail Foreign Exchange License With License Number 41698.

Trading Products

Rallyville Markets Offers The Following Types Of Trading Products:

- Forex Pairs : Including Major Currency Pairs, Cross Currency Pairs, And Exotic Currency Pairs.

- Commodities : Offers Trading In Gold, Silver, And Crude Oil.

- Indices : Offers Trading On Major Global Stock Market Indices.

Although Rallyville Markets Has A Relatively Limited Range Of Trading Products, It Covers Most Of The Popular Trading Instruments In The Market.

Trading Software

Rallyville Markets Offers Traders The Following Trading Platform:

- MetaTrader 4 (MT4) : This Is A Popular Trading Platform That Supports Multiple Order Types, Technical Indicators And Automated Trading Functions.

- Rallyville Markets Platform : This Broker Also Offers A Proprietary Platform To Meet The Diverse Needs Of Traders.

Deposit And Withdrawal Methods

Rallyville Markets Supports A Variety Of Deposit And Withdrawal Methods, Including:

- Bank Telegraphic Transfer : This Is The Most Commonly Used Deposit Method And Is Usually Completed Within 1-3 Business Days.

- International Bank Transfer : Supports Instant Transfers In Multiple Currencies.

- Credit/Debit Cards : Such As Visa And Mastercard.

- Blockchain Payments : Including Cryptocurrency Payment Methods.

Customer Support

Rallyville Markets Provides 24/5 Customer Support Services For Traders, Supported Languages Include Chinese, English, Etc. Clients Can Contact Customer Support At:

- Telephone : + 61 2 9261 2979 (Sydney)/+ 1 604-439-4853 (Vancouver)

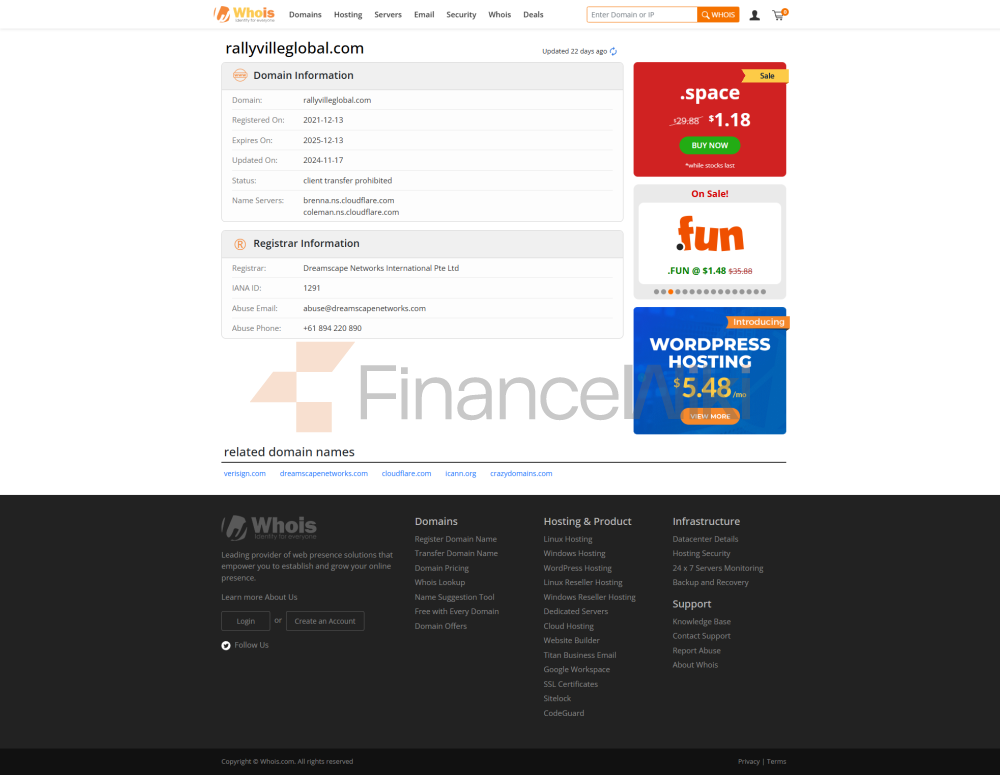

- Email : Support@rallyvilleglobal.com

- Online Contact Form : Submit Questions Through The Official Website.

Core Business & Services

Rallyville Markets' Core Business Includes:

- Forex Trading : Offers Highly Leveraged Trading Up To 1:400.

- Commodity Trading : Offers Trading In Gold, Silver And Crude Oil.

- Index Trading : Offers Trading In Major Global Stock Indices.

The Broker Also Offers The Following Services:

- Demo Account : Allows Traders To Test Trading Strategies In A Risk-free Environment.

- Islamic Account : A Trading Account That Complies With The Rules Of Islamic Finance.

Technical Infrastructure

Rallyville Markets' Technical Infrastructure Is Based On Industry Standard Trading Platforms (such As MT4) And Supports Multi-device Trading, Including Desktop, Mobile End And Web. Its Servers Are Distributed In Multiple Locations Around The World To Ensure Stability Of Trade Execution.

Compliance And Risk Control System

Rallyville Markets Complies With The Strict Regulatory Requirements Of Its Jurisdictions And Has Implemented The Following Risk Management Measures:

- Leverage Control : Provides Fixed Leverage Ratios Depending On Asset Classes, Such As 1:400 For Forex Trading.

- Stop Loss Mechanism : Supports Multiple Stop Loss Order Types To Control Potential Trading Losses.

- Fund Segregation : Separation Of Client Funds From Company Operating Funds To Ensure The Safety Of Funds.

Market Positioning And Competitive Advantage

Rallyville Markets' Market Positioning Is To Provide A Multi-asset Trading Platform For Global Traders. Its Competitive Advantages Include:

- Multiple Regulation : Licensed In Multiple Jurisdictions Worldwide To Ensure Transparency And Client Protection.

- High Leverage Trading : Provides Competitive Leverage In The Industry To Help Traders Amplify Their Gains.

- Diversified Trading Tools : Covers Major Trading Instruments Such As Forex, Commodities And Indices.

Customer Support And Empowerment

Rallyville Markets Empowers Its Traders By:

- Educational Resources : Provides A Guide To Using The MT4 Platform To Help Traders Get Started Quickly.

- Simulated Trading : Provides A Risk-free Trading Environment For Traders To Practice And Test Strategies.

Social Responsibility And ESG

Rallyville Markets Focuses On Social Responsibility In Its Operations, Actively Participates In Public Welfare Projects, And Is Committed To Sustainable Development.

Strategic Cooperation Ecology

Rallyville Markets Has Established Strategic Partnerships With Several Of The World's Leading Fintech Companies To Enhance Their Technology And Product Capabilities.

Financial Health

Rallyville Markets' Financial Position Is Sound And Its Capital Adequacy Ratio Meets Regulatory Requirements, Ensuring That It Can Handle Market Volatility.

Future Roadmap

Rallyville Markets Plans To Continue To Expand Its Products And Services, Add More Trading Instruments (such As Cryptocurrencies And Stocks), And Enhance Its Technical Infrastructure And Customer Support Capabilities.

Through The Above Introduction, Rallyville Markets Has Demonstrated Its Professionalism And Competitiveness As A Multi-regulated Global Foreign Exchange Broker.