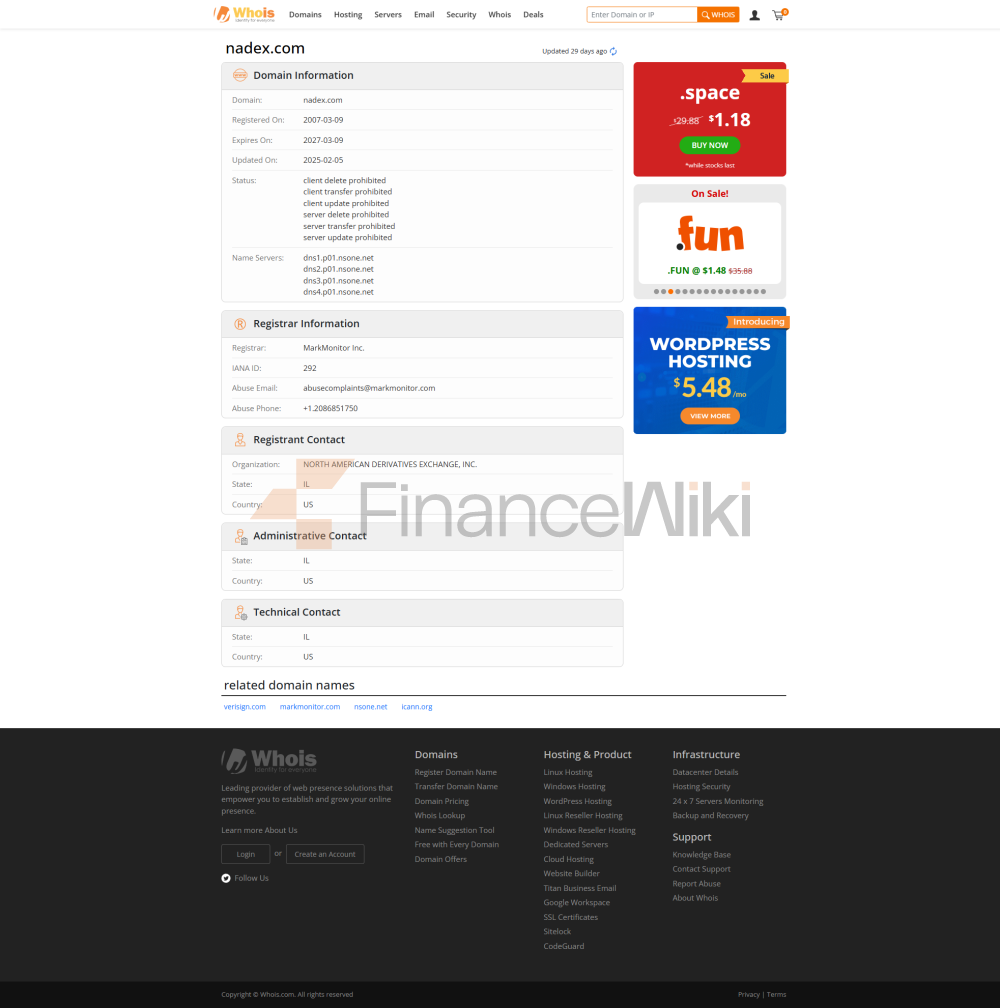

OverviewNadex (North American Derivatives Exchange) is a derivatives exchange headquartered in Chicago, Illinois, USA, focusing on providing traders with financial derivatives trading services such as binary options elimination ™ and call option spreads. Nadex was officially established in 2009 and was acquired and renamed by IG Group Holdings Limited as the "hedgestreet" exchange, which was launched in 2004. Nadex's core positioning is to provide traders of all experience levels with powerful trading tools and advanced features that enable them to trade efficiently in the commodities, forex and stock index futures markets.

Nadex's operating model is different from traditional brokerage firms, as a regulated exchange, it directly provides a transparent and open market environment for traders. As of 2023Q3, the average daily trading volume of Nadex has exceeded 1 million, covering traders in more than 40 countries around the world. Nadex's trading platform supports a variety of trading products, including stock index futures, forex currency pairs, and commodities, providing traders with a variety of investment options.

Regulatory

InformationNadex is strictly regulated by the U.S. Commodity Futures Trading Commission (CFTC) and holds a trading facility license issued by the CFTC with license number 40145。 The CFTC's regulation ensures that Nadex meets international standards in terms of transaction transparency, fund security and risk management. In addition, Nadex also follows the specifications of the Futures Industry Association (NFA) to further enhance its compliance and transparency.

trading

productsNadex's trading products cover a wide range of market sectors, including:

stock index futures: Covers the US 500 Index (S&P 500), Wall Street 30 Index (DOW), NASDAQ Index, Russell 2000 Small Cap Index, as well as FTSE 100 Index, German DAX Index, Nikkei 225 Index, etc.

Forex currency pairs: including major currency pairs such as EUR/USD, USD/JPY, GBP/USD, AUD/USD, etc.

Commodities: Covers commodities such as crude oil, gold, silver, copper, natural gas, soybeans and corn.

trading software

Nadex offers a variety of trading platforms to meet the needs of different traders. These include:

MT4 (MetaTrader 4): a powerful trading platform that allows traders to conduct technical analysis, execute trades, and view real-time market data.

Nadex WebTrader: Intuitive web-based trading platform for both novice and experienced traders.

deposit and withdrawal

methodsNadex provides traders with a variety of convenient deposit and withdrawal methods, including:

Wire Transfer: Fast money transfer for international traders.

ACH Transfer: Available only to U.S. residents, supports fast funds transfers between banks.

Paper Checks: Available only to U.S. residents, with traditional check deposit available.

Debit cards: Mainstream debit cards such as VISA and MasterCard are supported.

customer

supportNadex places a high value on customer support and provides a variety of channels to help traders solve problems:

Live chat support: Help traders answer questions in real time and provide efficient service.

Email support: Traders can contact Nadex's customer service team directly via email.

core business and

servicesNadex's core business includes:

binary options eliminated ™: A simple and easy-to-use financial derivative where traders can trade within a preset price range.

Call Spread: A unique trading tool that allows traders to trade within a fixed price range, reducing the risk of market volatility.

technical

infrastructureNadex's trading infrastructure has been optimized to ensure efficient and stable trading. Its trading platform supports real-time data updates and provides a variety of technical analysis tools to help traders conduct accurate market analysis.

compliance and risk control

systemNadex's compliance and risk management system is supervised by the CFTC and NFA to ensure the transparency of transactions and the safety of funds. Nadex also adopts an AIoT risk control system, which combines artificial intelligence and Internet of Things technology to monitor market dynamics in real time and prevent potential risks.

market positioning and competitive

advantageNadex occupies an important position in the derivatives trading market with its efficient trading tools, diversified products and transparent market environment. As a regulated exchange, Nadex offers traders greater transparency and lower transaction costs than traditional brokerage firms.

Customer Support &

EmpowermentNadex provides traders with a wealth of educational resources, including trading guides, market analysis, and demo account operations. These resources help traders improve their skills and trade more efficiently.

Social Responsibility and ESG

Nadex is committed to fulfilling its social responsibilities and contributing to the sustainable development of society by supporting financial education and community development projects. In addition, Nadex also cares about environmental protection, adopting green energy in its operations and reducing its carbon footprint.

strategic cooperation

ecosystemNadex has established strategic partnerships with a number of financial institutions and technology companies to further optimize its trading infrastructure and services. These collaborations cover areas such as trading technology, data analytics and marketing, enhancing Nadex's competitiveness in the market.

Financial HealthAs

of 2023Q3, Nadex's annual revenue has reached $120 million and its capital adequacy ratio is 15%, showing its healthy financial position and stable profitability.

future roadmap

Nadex plans to further expand its trading products and services in the coming years, including the introduction of more cryptocurrencies and ESG-related financial instruments to meet the changing market demand. Nadex also plans to invest heavily in upgrades in technology infrastructure and customer support to enhance the user experience.

Through the above, Nadex has established a strong reputation as a highly regulated derivatives exchange around the world, providing traders with an efficient, secure and transparent trading environment.