Corporate Overview

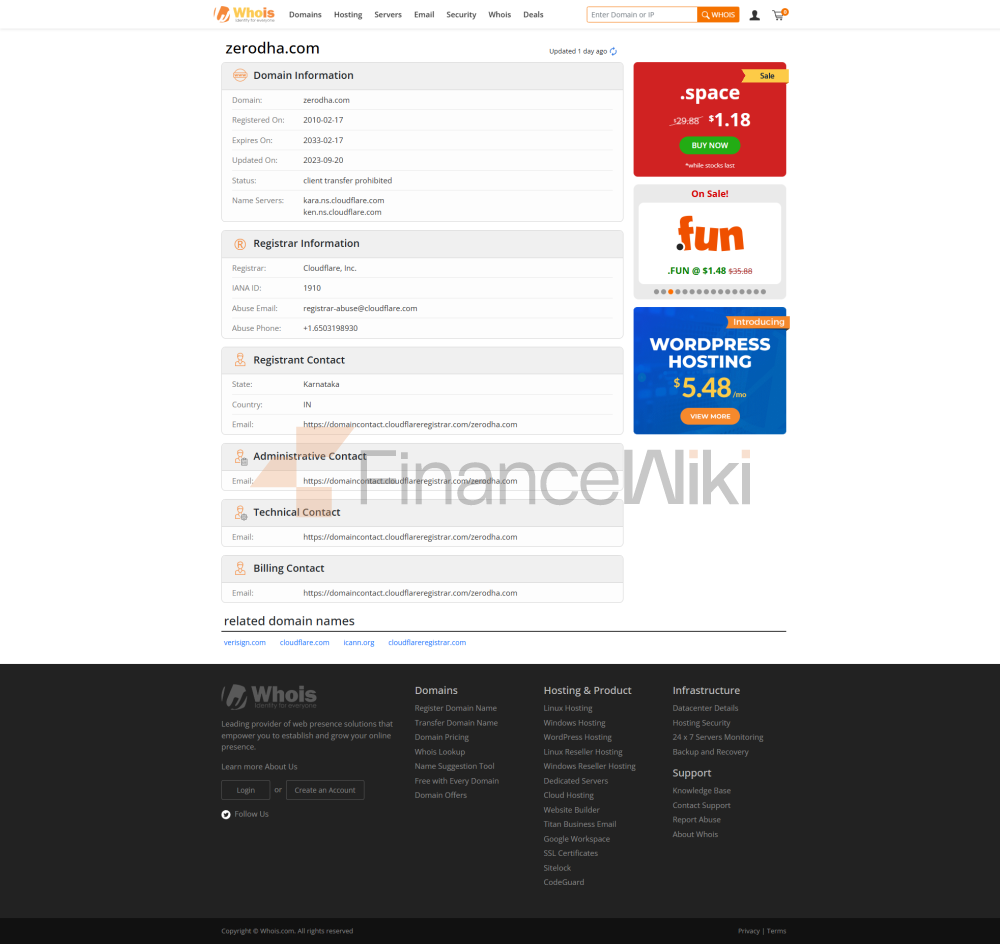

Zerodha Was Established In 2010 And Is A High-tech Stock Brokerage Company Headquartered In Mumbai, India . The Company Is Committed To Providing Investors With Efficient And Transparent Trading Services. As Of 2023Q1 , Its Platform Has 1.50 Million Active Accounts . Zerodha's Vision Is To Become The Trading Platform Of Choice For Investors In India And Globally Through Technological Innovation And Customer-oriented Services.

Regulatory Information

Zerodha's Operations Are Regulated By Securities And Exchange Board Of India (SEBI) , Which Is The Primary Regulator Of Financial Marekt In India. Zerodha Strictly Adheres To The Regulations And Compliance Requirements Laid Down By The SEBI, Ensuring The Legitimacy And Transparency Of Trading Activities. In Addition, The Company Also Conducts Regular Internal Audits To Ensure The Safety Of Its Compliance Statements And Client Funds.

Trading Products

Zerodha Offers Investors A Diverse Range Of Trading Products, Mainly Including:

- Stocks : Including Stock Trading In The Domestic Market Of India.

- ETF (Exchange Traded Fund) : Offers A Variety Of Index ETFs And Thematic ETFs.

- Forex : Allows Investors To Trade In Foreign Exchange.

- Bonds : Offers Trading Services For Government Bonds And Corporate Bonds.

- Options And Futures : Supports Derivatives Trading To Help Investors Hedge Risk.

Trading Software

Zerodha's Trading Platform Is Known For Being User-friendly And Efficient. Its Main Features Include:

- User Interface : Simple And Intuitive, Suitable For Both Novice And Professional Investors.

- Fee Reporting : Clear Display Of Transaction Costs And Other Fees.

- Search Function : Powerful Search Tool To Help Investors Quickly Find Target Assets.

However, The Platform's Two-step Login And Limited Customization Options Are Its Main Drawbacks.

Deposit And Withdrawal Methods

Zerodha Currently Supports Bank Transfer As The Main Method Of Funding Accounts, And Does Not Support Credit Or Debit Card Direct Deposit. In Addition, Zerodha Provides Investors With Free Withdrawal Services , Further Reducing Transaction Costs.

Customer Support

Zerodha's Customer Support Team Provides Assistance To Investors Through Multiple Channels, Including Phone , Email , And Online Chat . In Addition, The Company Has Established Customer Community , Which Allows Investors To Share Experiences And Receive Real-time Advice. However, Zerodha Currently Does Not Offer Demo Accounts , Which May Be An Inconvenience For Novice Investors.

Core Business And Services

Zerodha's Core Business Includes Stock Trading , Foreign Exchange Trading And Option Futures Trading . The Company Provides Customized Trading Solutions For Individual And Institutional Investors Through Its High-tech Trading Platform.

Technical Infrastructure

Zerodha's Technical Infrastructure Is Characterized By Low Latency And High Stability . The Company Uses Cloud Technology And Distributed System To Ensure Fast Execution Of Transactions And System Reliability. In Addition, Zerodha Has Developed AIoT Risk Control System , Which Monitors Transaction Risks In Real Time Through Artificial Intelligence And Internet Of Things Technology To Ensure The Safety Of Customer Funds.

Compliance And Risk Control System

Zerodha's Compliance And Risk Control System Is The Cornerstone Of Its Business Operations. The Company Has Implemented A Multi-level Risk Management System , Including Real-time Market Monitoring, Pre-trade Threat And Risk Assessment And Post-trade Risk Management. In Addition, Zerodha Also Regularly Submits Compliance Reports To Regulators To Ensure That Its Business Activities Comply With Relevant Regulatory Requirements.

Market Positioning And Competitive Advantage

Zerodha Has A Significant Market Position In The Indian Stock Brokerage Market. Its Competitive Advantage Is Mainly Reflected In The Following Aspects:

- Technical Support : With Its High-tech Trading Platform, Zerodha Is Able To Provide Investors With A Fast And Stable Trading Experience.

- Cost Efficiency : The Company Provides Investors With No Minimum Deposit Limit Services Through An Efficient Operating Model.

- Customer-centric : Zerodha Focuses On Customer Experience And Offers Diverse Trading Products And Flexible Trading Options.

Customer Support And Empowerment

Zerodha Is Committed To Providing Investors With Educational Resources And Tool Support Through Its Platform And Community. The Company Regularly Holds Online Seminars And Trading Strategy Sharing Sessions To Help Investors Improve Their Trading Skills. At The Same Time, Zerodha Also Provides Full-time Client Server Team To Ensure That Investors Can Receive Timely Support During The Transaction Process.

Social Responsibility And ESG

Zerodha Is Actively Involved In Social Welfare Activities, Supporting The Development Of Education, Medical Care And Environmental Protection. The Company Is Also Committed To Promoting Environmental, Social And Corporate Governance (ESG) Standards, Contributing To Sustainable Development Through Responsible Investment Practices.

Strategic Cooperation Ecology

Zerodha Has Established Strategic Partnerships With Several Financial Institution Groups And Technology Companies, Covering Payment Solutions, Data Analytics And Technology Development. These Collaborations Further Enhance Zerodha's Technical Strength And Service Capabilities, Providing Solid Support For Its Business Expansion.

Financial Health

As Of 2023Q1 , Zerodha's Management Scale Has Exceeded $10 Billion . The Company Has Achieved Solid Financial Growth By Optimizing Operating Costs And Improving Transaction Efficiency. In Addition, Zerodha Has Also Received Multiple Rounds Of Financing Support , Providing Sufficient Funding For Its Business Expansion.

Future Roadmap

Zerodha's Future Roadmap Includes The Following Aspects:

- Technology Upgrade : Further Optimize The Trading Platform And Enhance The User Experience.

- Market Expansion : Plan To Enter The International Market To Provide Services To Global Investors.

- Product Innovation : Develop More Types Of Financial Products To Meet The Diverse Needs Of Investors.

Zerodha Will Continue Its Technological Innovation And Customer-centric Business Philosophy To Drive The Continued Development Of Financial Marekt In India And Globally.