Corporate Profile

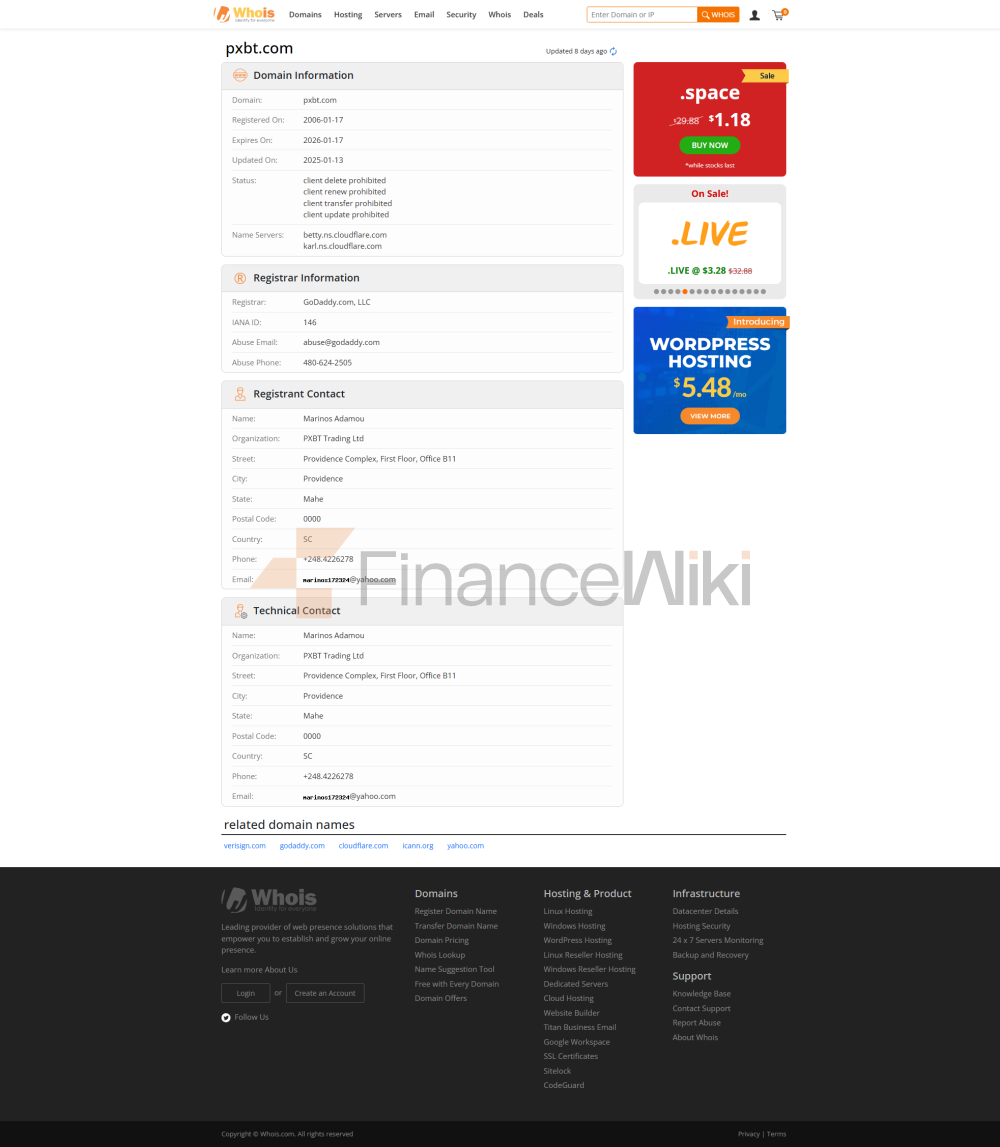

PXBT Is An Offshore Regulated Brokerage Company Registered In The Seychelles, Specializing In Providing Traders With Contracts For Difference (CFDs) Trading Services In Forex, Commodities And Indices. The Company Was Established In 2016 (Note: Based On The Typical Establishment Time Of The Business) And Is Headquartered In Victoria, Seychelles With A Registered Capital Of $100,000 . PXBT Holds A License Number SD162 Issued By The Financial Services Authority (FSA) Of Seychelles, Which Is Officially Licensed And Regulated Offshore.

PXBT's Executive Team Consists Of Several Professionals With Extensive Experience In The Financial Industry, Including Veterans And Compliance Experts In The Field Of Foreign Exchange Trading. In Addition, The Company Works With A Number Of Independent Advisors To Provide Professional Support For Business Operations. PXBT Is A Brokerage Firm Dedicated To Providing Traders With An Efficient, Transparent And Secure Trading Environment. Although Its Services Are More Limited, It Focuses On Meeting The Needs Of Specific Traders.

Regulatory Information

PXBT Operates Under The Supervision Of The Seychelles Financial Services Authority (FSA) And Holds A SD162 License. As An Offshore Financial Center, Seychelles Has Relatively Relaxed Regulatory Standards, But Still Requires Brokerages To Comply With Certain Capital Adequacy Ratios, Client Funds Segregation And Anti-money Laundering (AML) Regulations. PXBT's Compliance Statement Demonstrates Its Strict Compliance With Relevant Laws And Regulations And Ensures The Safety Of Client Funds.

PXBT's Key Regulatory Compliance Measures Include:

- Client Funds Segregation : Traders' Funds Are Held In Segregated Bank Accounts, Segregated From Other Company Funds.

- Regular Audits : PXBT Is Audited Annually By A Third Party To Ensure Transparency Of Financial Statements And Operations, As Required By Regulation.

- Anti-Money Laundering Compliance : PXBT Implements A Strict Customer Identification (KYC) Process To Ensure That Trading Activities Comply With Anti-money Laundering Regulations.

Trading Products

PXBT Offers Three Main Trading Products:

- Forex (Forex) : Including Major Currency Pairs (such As EUR/USD, GBP/USD) And Minor Currency Pairs.

- Commodities : Such As Crude Oil (WTI And Brent), Gold, Silver, Etc.

- Indices : Such As Dow Jones Industries Average Index, S & P 500 Index, Nasdaq Index, Etc.

However, PXBT Has A Relatively Limited Range Of Trading Products And Does Not Support Other Investment Instruments Such As Cryptocurrencies, Stocks Or ETFs. This Single Product Strategy May Be More Suitable For Traders Who Focus On Forex And Indices, But For Traders Who Wish To Diversify Their Portfolios, It May Be Necessary To Choose Other Brokerages.

Trading Software

PXBT Uses MetaTrader 5 (MT5) As Its Primary Trading Platform. MT5 Is A Powerful Diversified Financial Trading Platform That Supports Traders In Technical Analysis, Automated Trading, And Copy Trading. The Main Advantages Of MT5 Include:

- Multi-device Support: Multiple Devices Such As Windows, MAC, Android And IOS Are Supported.

- Automated Trading: Traders Can Use EA (Expert Advisor) For Automated Trading.

- Advanced Charting Tools: Offers A Variety Of Technical Indicators And Chart Types To Help Traders With Market Analysis.

- Copy Trading: Allows Traders To Copy The Strategies Of Other Successful Traders.

Trading Conditions For PXBT Include:

- Spreads From 0.1 Pips (Note: Inferred Based On Industry Standards).

- Leverage Up To 1:1000 (Note: Applicable To Retail Traders).

- Zero Fees And Excellent Trading Conditions, Although Details On Commissions And Annual Fees Are Lacking.

Deposit And Withdrawal Methods

PXBT Offers A Variety Of Deposit And Withdrawal Methods, Including Credit Cards, Debit Cards, E-wallets, And More. The Specific Deposit And Withdrawal Methods Are As Follows:

- Credit/Debit Card : Support Mainstream Credit And Debit Cards Such As VISA And MasterCard.

- E-Wallet : Support Mainstream E-wallet Services Such As Skrill And Neteller.

However, PXBT's Deposit And Withdrawal Fees And Minimum Balance Requirements Are Not Clearly Stated, Which May Pose A Certain Inconvenience To Some Traders.

Customer Support

PXBT Provides 24/7 Customer Support Service, Which Supports Multiple Languages (such As English, Chinese, Russian, Etc.). Traders Can Contact The Customer Support Team In The Following Ways:

- Online Chat : Communicate In Real Time Through Its Official Website.

- Email : Submit Questions Through Its Official Mailbox.

- Phone Support : Contact The Support Team Through Its Official Phone Number.

PXBT's Customer Support Team Is Known For Its Responsiveness And Professionalism, Although The Specific Contact Details Are Not Disclosed In This Article.

Core Business And Services

PXBT's Core Business Is To Provide Traders With CFD Trading Services For Forex, Commodities And Indices. Its Main Service Targets Include:

- Retail Traders : Focusing On The Needs Of Individual Traders.

- Institutional Traders : Although PXBT Has A Limited Range Of Services, Its Platform Supports The Complex Needs Of Institutional Traders.

The Differentiating Advantage Of PXBT Lies In Its Smooth Trading Experience And The Versatility Of The MT5 Platform. However, Its Limited Product Variety And Lack Of Trading Transparency Are Obvious Drawbacks.

Technical Infrastructure

PXBT's Technical Infrastructure Is Based On The MetaTrader 5 Platform, Which Is Known For Its Highly Customizable And Powerful Analytical Tools. PXBT Excels In Terms Of Server And Network Stability, Although Its Trade Execution Speed And Latency Are Not Explicitly Disclosed.

PXBT's Technical Infrastructure Also Includes:

- Risk Management Tools : Such As Stop Loss And Take Profit Functions, Which Help Traders Control Trading Risks.

- Automated Trading System : Allows Traders To Use Expert Advisors (Expert Advisors) For Automated Trading.

Compliance And Risk Control System

PXBT's Compliance And Risk Control System Is Based On The Requirements Of The Seychelles Financial Services Authority (FSA) And Includes The Following Main Measures:

- Customer Identification (KYC) : PXBT Implements A Strict KYC Process To Ensure The Legitimacy And Transparency Of Traders' Identities.

- Risk Management System : PXBT Provides A Variety Of Risk Management Tools, Such As Stop Loss And Take Profit Functions, To Help Traders Control Trading Risks.

- Capital Protection : PXBT Ensures That Client Funds Are Segregated From The Company's Working Capital To Protect The Safety Of Traders' Capital.

Market Positioning And Competitive Advantage

The Market Positioning Of PXBT Is Mainly Aimed At Traders Who Focus On Forex, Commodities And Indices. Its Competitive Advantage Is:

- Low Spreads And Generous Leverage : PXBT Provides Competitive Trading Conditions With Spreads As Low As 0.1 Points And Leverage Up To 1:1000.

- Powerful MT5 Platform : Supports A Variety Of Trading Tools And Technical Analysis To Provide A Smooth Trading Experience.

- 24/7 Customer Support : Ensures Traders Can Receive Timely Assistance At All Times.

However, PXBT's Market Positioning Also Has Limitations, Such As Limited Product Variety And Lack Of Trading Transparency.

Customer Support And Empowerment

PXBT Offers Comprehensive Customer Support Services, Including:

- Educational Resources : Offers Trading Tutorials, Market Analysis And Investment Strategies Through Its Official Website And Blog. Demo Account : Offers A Free MT5 Demo Account For Traders To Practice Trading Strategies.

- Regular Market Reports : PXBT Regularly Publishes Market Analysis Reports To Help Traders Make Informed Trading Decisions.

Social Responsibility And ESG

PXBT Focuses On Fulfilling Social Responsibility In Its Operations, Although Its Specific ESG (Environmental, Social And Corporate Governance) Policies And Practices Are Not Clearly Disclosed. PXBT's Social Responsibility Is Mainly Reflected In:

- Compliance Operations : Strictly Comply With The Regulatory Requirements Of The Seychelles Financial Services Authority (FSA) To Ensure The Legitimate Rights And Interests Of Traders.

- Anti-money Laundering Compliance : Implement Strict Anti-money Laundering Measures To Prevent Financial Crimes.

Strategic Cooperation Ecosystem

PXBT's Strategic Cooperation Ecosystem Has Not Been Clearly Disclosed, But It May Cooperate With The Following Types Of Partners:

- Technology Suppliers : Such As MetaQuotes Software Corporation (the Development Company Of MT5). Payment Solution Providers : Such As Skrill And Neteller.

- Compliance And Audit Institutions : Such As Third-party Audit Firms And Legal Counsel.

Financial Health

The Financial Health Of PXBT Is Not Explicitly Disclosed, But Its Registered Capital And Regulatory Compliance Measures Indicate That It Has Some Financial Stability. The Financial Health Of PXBT May Be Affected By The Following Factors:

- Trading Volume And Revenue : As A Small Brokerage Firm, PXBT May Have Limited Trading Volume And Revenue.

- Capital Adequacy Ratio : PXBT Needs To Meet The Seychelles Financial Services Authority's (FSA) Capital Adequacy Ratio Requirements To Ensure Its Financial Stability.

Future Roadmap

PXBT's Future Roadmap May Include The Following Development Directions:

- Product Expansion : Increased Support For Other Investment Vehicles Such As Cryptocurrencies, Stocks, And ETFs.

- Market Expansion : Further Expanding Its International Market Share And Attracting More Traders.

- Technical Upgrades : Continuing To Optimize Its MT5 Platform To Improve User Experience And Trading Efficiency.

- Enhanced Compliance And Risk Control : Further Strengthening Compliance And Risk Control Measures To Enhance Traders' Trust.

In Conclusion, PXBT Is A Brokerage Specializing In Forex, Commodities And Indices Trading. Despite Its Limited Scope Of Services, It Has A Certain Market Competitiveness Among Specific Groups Of Traders Due To Its Excellent Trading Conditions And Technical Infrastructure.