Corporate Profile

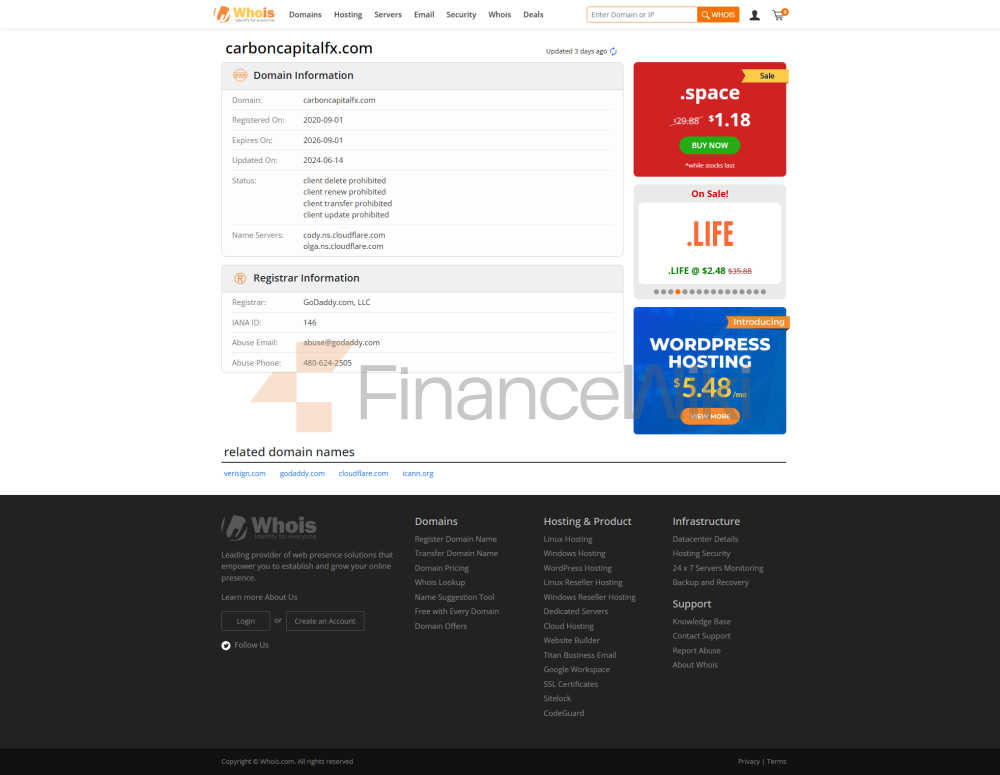

CARBON CAPITAL Is A Financial Broker Established In 2021 And Registered In Saint Vincent And The Grenadines . The Company Focuses On Providing Global Traders With A Wide Range Of Financial Instrument Trading Services, Including Foreign Exchange, Cryptocurrencies, Etc. The Company Is Headquartered In Beachmont Business Centre, 151 Beachmont, Kingstown, Saint Vincent And The Grenadines And Has An Efficient Client Server Team That Supports 24/7 Multilingual Services.

Although The Company Offers A Range Of Trading Tools And Resources, It Is Important To Note That CARBON CAPITAL Currently Does Not Have A License From Any Financial Regulator . This Lack Of Regulation Could Raise Concerns About Its Transparency And Reliability, Especially When It Comes To Handling Client Funds And Trade Execution.

Regulatory Information

CARBON CAPITAL Currently Has No Regulatory License . This Means That The Company Is Not Supervised By Any Authoritative Financial Regulator, Such As FCA (UK Financial Conduct Authority) Or NFA (US National Futures Association) . This Situation May Make It Impossible For Traders To Rely On The Protective Measures Of Regulators To Safeguard Their Rights And Interests. Therefore, Traders Should Be Extra Cautious When Choosing CARBON CAPITAL , And It Is Recommended To Choose A Regulated Broker First.

Trading Products

CARBON CAPITAL Offers More Than 200 Financial Instruments , Covering The Following Categories:

- Currency Pairs : Mainstream Currencies Such As EUR/USD, GBP/USD , Etc. Cryptocurrencies : Including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) , Etc.

These Tools Are Designed To Meet The Needs Of Different Traders, Especially When It Comes To Cryptocurrency Trading, Attracting Traders Interested In Emerging Assets.

Trading Software

CARBON CAPITAL Provides Two Main Sets Of Trading Platforms:

- MetaTrader 5 (MT5) :

- Supports Desktop, Mobile IOS, Mobile Android And WebTrader .

- Offers Advanced Charting Tools, A Customizable Interface And Multi-asset Trading Capabilities For Professional Traders.

- CarbonTrader :

- Designed To Simplify Operation, For Users Who Prefer An Intuitive Trading Experience.

- Equipped With Trading Signals, Technical Indicators And A Comprehensive Trading Dashboard To Enhance Trading Efficiency.

Deposit And Withdrawal Methods

CARBON CAPITAL Only Deposits And Withdrawals Via Cryptocurrency Are Supported. This Payment Method Can Raise Transparency Concerns, As Cryptocurrency Deposits Typically Do Not Have The Consumer Protection Features Of Traditional Payment Methods, Such As Refunds Or Chargebacks. This Can Be A Potential Disadvantage For Traders Who Value Payment Security And Transparency.

CUSTOMER SUPPORT

CARBON CAPITAL 's Customer Support Team Provides 24/7 Multilingual Services, And Traders Can Contact Them By:

- Email : Support@carboncapitalfx.com

- Social Media : Including Facebook, Instagram And YouTube .

However, The Company Does Not Offer Live Chat Or Phone Support, Which May Affect The Trader's Experience In Certain Emergencies.

Core Business And Services

CARBON CAPITAL Core Services Include:

- High Leverage Trading : Provides Leverage Up To 1:500 For Traders Seeking High Risk And High Reward.

- Educational Resources : Provides Over 100 Educational Videos, Three E-books, Quizzes And Analysis Videos To Help Traders Improve Their Skills.

- Demo Account : Not Provided, Traders Can Only Trade Through A Real Account.

In Addition, The Company Offers Two Account Types:

- Platinum Account :

- Minimum Deposit Requirement Is $100 .

- Spread Is 0.00 Pips And Commissions Are Charged.

- Carbon Account :

- The Minimum Deposit Requirement Is $500,000 .

- The Spread Is 1.5 Pips And No Commission Is Charged.

There Are Significant Differences In The Target Customer Groups Of These Two Account Types, Which May Limit The Options For Traders Seeking A Middle Ground.

Technical Infrastructure

CARBON CAPITAL 's Technical Infrastructure Is Based On MetaTrader 5 (MT5) And CarbonTrader And Supports Efficient Trade Execution And Multi-asset Trading. However, Due To The Lack Of Supervision And Transparency, Traders Cannot Fully Confirm The Technical Stability And Service Quality Of The Platform.

Compliance And Risk Control System

Although CARBON CAPITAL Provides A Range Of Trading Tools And Educational Resources, Its Lack Of Regulatory Clearance And Transparency May Raise Questions About Its Compliance And Risk Control Capabilities. Highly Leveraged Trading, While Offering The Potential For High Returns, Also Significantly Increases The Risk Of Loss. Traders Should Exercise Caution When Using Leverage And Ensure That Appropriate Risk Management Strategies Are In Place.

Market Positioning And Competitive Advantage

CARBON CAPITAL Key Competitive Advantages Include:

- Wide Range Of Trading Tools : Offers More Than 200 Financial Instruments, Including Mainstream Currency Pairs And Cryptocurrencies.

- MT5 Platform Support : Provides Traders With Powerful And Flexible Trading Tools.

- Educational Resources : Provides Rich Online Educational Resources To Help Traders Improve Their Skills.

However, Its Lack Of Regulatory Clearance And Transparency Is A Clear Disadvantage, Especially When It Comes To Handling Client Funds And Trade Execution.

CUSTOMER SUPPORT AND EMPOWER

CARBON CAPITAL The Customer Support Provided Mainly Includes 24/7 Emails And Services , As Well As Interaction With Clients Via Social Media Platforms. However, The Lack Of Live Chat Or Phone Support May Affect The Trader's Experience In Some Cases.

Social Responsibility And ESG

Currently, CARBON CAPITAL Does Not Disclose Its Specific Practices And Commitments In Terms Of Social Responsibility And ESG (environmental, Social, Governance). This May Be Related To The Company's Relatively New And Lack Of Regulatory Background. In The Future, If It Can Strengthen Its Disclosure And Practices In These Areas, It Will Help To Enhance Its Market Image.

Strategic Cooperation Ecology

CARBON CAPITAL Does Not Disclose Its Details In Terms Of Strategic Cooperation. This May Be Related To Its Relatively New Market Positioning And Lack Of Regulatory Background. In The Future, Through Strategic Cooperation With Other Financial Institution Groups Or Technology Platforms, The Company May Further Enhance Its Market Competitiveness.

Financial Health

The Financial Health Of CARBON CAPITAL No Specific Data Is Disclosed, Which May Be Related To Its Lack Of Regulatory Background And Transparency. Traders Should Consider This Latent Risk When Choosing The Company.

Future Roadmap

Although CARBON CAPITAL Offers A Range Of Trading Tools And Educational Resources, Its Future Success Will Depend On:

- Regulatory Compliance : Obtaining Licenses From Authoritative Regulators To Enhance Customer Trust And Protection.

- Transparency Improvement : Further Disclosure Of The Company's Ownership Structure And Management Team Information To Reduce Customer Concerns.

- Diversification Of Payment Methods : Increasing Support For Traditional Payment Methods To Improve The Convenience And Security Of Customer Funds.

SUMMARY

CARBON CAPITAL Is A Broker That Offers A Wide Range Of Trading Tools And Educational Resources, Especially In Cryptocurrency Trading. However, Its Lack Of Regulatory License And Transparency May Become A Latent Risk For Traders. In The Future, If Progress Can Be Made In Regulatory Compliance And Transparency, CARBON CAPITAL Is Expected To Further Enhance Its Market Competitiveness.