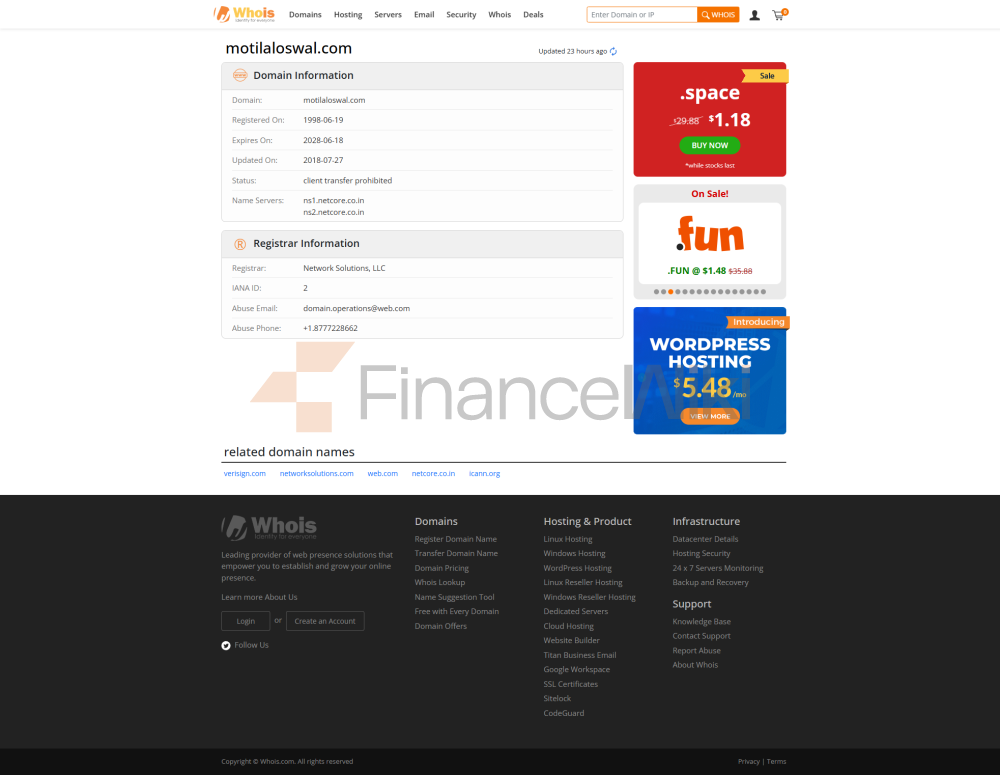

Brand History And Reputation:

Founded In 2010, Motilal Oswal Financial Services Ltd Is A Well-known Financial Services Company In India. Headquartered In Mumbai, The Company Has Been Dedicated To Providing Comprehensive Financial Services And Investment Solutions To Its Clients For Many Years. Its Brand Enjoys A Good Reputation In The Financial Industry And Is Known For Professionalism, Reliability And Innovation.

Regulatory Compliance:

Motilal Oswal Financial Services Ltd Is Regulated By The Securities And Exchange Board Of India (SEBI) With Registration Number: INZ000158836. It Complies With The Relevant Regulations And Regulations Of Financial Marekt In India. The Company Is Committed To Maintaining The Safety Of Client Funds And Transaction Transparency, And Safeguarding The Rights And Interests Of Investors.

Products And Services:

Motilal Oswal Financial Services Ltd Provides A Variety Of Financial Products And Services, Including:

- Stock Trading And Derivatives Trading: The Company Provides Stock Trading And Derivatives Trading Services To Help Clients Invest And Trade In The Indian Stock Market.

- Wealth Management: Motilal Oswal Financial Services Ltd Provides Wealth Management Services To Help Clients Manage And Add Value To Their Wealth Portfolios.

- Research Reports And Investment Advice: The Company Provides Professional Research Reports And Investment Advice To Help Clients Understand Market Dynamics And Make Informed Investment Decisions.

- Pension Planning: Provides Pension Planning Services To Help Clients Plan Their Retirement And Future Financial Goals.

- Insurance Products: Motilal Oswal Financial Services Ltd Also Offers A Variety Of Insurance Products To Help Clients Protect Their Property And Manage Risks.

Through These Products And Services, The Company Is Committed To Providing Its Clients With Comprehensive Financial Solutions That Help Them Achieve Their Financial Goals And Manage Their Risks

Trading Platform:

Motilal Oswal Financial Services Ltd Provides An Advanced Online Trading Platform That Facilitates Customers To Trade Stocks, Futures And Options, Etc. The Trading Platform Is Powerful And User-friendly, Providing Real-time Market Data And Analytical Tools.

Here Are Some Of The Major Trading Platforms Offered By The Company:

- MO Investor App: This Is A Mobile Trading App Offered By Motilal Oswal. Users Can Conveniently Trade Stocks, Futures Options, And More Through Their Mobile Phones Or Tablets. The App Has A Friendly Interface And Real-time Market Data.

- MO Trader: This Is A Professional-grade Trading Platform Offered By Motilal Oswal, Suitable For Experienced Traders And Investors. MO Trader Offers Advanced Chart Analysis Tools, Technical Indicators, And Customized Trading Functions.

- MO Trader Web: This Is The Web-based Trading Platform Of Motilal Oswal. Users Can Access And Trade Stocks, Futures And Options Through A Total Page Browser. The Platform Provides Real-time Market Data And Analysis Tools.

- MO Trader Desktop: This Is The Desktop Version Of The Trading Platform Provided By Motilal Oswal. It Provides Traders With More Customization Features And A Larger Trading Interface, Suitable For Clients Who Require More Complex Trading Operations.

These Trading Platforms Cover Mobile End, Web End And Desktop End, Providing Clients With Diverse Options So That They Can Trade Stocks And Futures Options According To Their Needs And Preferences.

Education & Resources:

- Provide Investment Education Courses And Seminars To Help Clients Improve Their Investment Knowledge And Skills.

- Provide Market Research Reports, Industry Analysis And Other Resources To Keep Clients Informed About Market Dynamics And Investment Opportunities.

Account Types And Offers:

- Offers A Variety Of Account Types Such As Ordinary Stock Trading Accounts, Derivatives Trading Accounts, Wealth Management Accounts, Etc.

- Offers Such As Commission Offers And Referral Reward Programs Are Regularly Launched To Provide Customers With More Investment Opportunities And Benefits.

Here Are Some Common Account Types And The Promotions That May Be Offered:

Account Types:

- Ordinary Stock Trading Accounts: This Kind Of Account Is Suitable For Customers To Conduct Basic Trading Operations Such As Stock Trading, Buying And Selling Stocks.

- Derivatives Trading Accounts: Derivatives Trading Accounts Allow Clients To Trade Derivatives Such As Futures, Options, Etc. These Trading Forms Can Be Used To Hedge Risks Or Conduct More Complex Investment Strategies.

- Wealth Management Accounts: Wealth Management Accounts Typically Offer More Professional Investment Management Services To Help Clients Manage Their Portfolios And Develop Investment Strategies Based On Their Risk Preferences And Goals.

Promotions:

- Commission Offers: Commission Promotions Are Introduced Regularly, Which May Include Reduced Trading Commissions, Free Number Of Trades, Etc., To Save Clients On Trading Costs.

- Referral Rewards Program: Referral Rewards Program Is Offered To Encourage Existing Clients To Refer New Clients To Open An Account. Benefits Such As Rewards Or Discounts May Be Obtained.

These Account Types And Promotions Provide Clients With More Investment Options And Benefits, Helping Them To Better Manage Their Investments And Gain Access To More Investment Opportunities.

Leverage Introduction And Fees:

Leveraged Trading Is An Investment Strategy That Increases The Latent Risk And Return Of Profit Or Loss By Borrowing To Scale Up An Investment. When Making Leveraged Trades, Clients Need To Consider The Following Fees:

Fees:

- Interest Fees: When Clients Borrow Money To Make Leveraged Trades, They Are Usually Required To Pay Interest Fees. These Interest Fees May Vary Depending On The Amount Borrowed, The Interest Rate, And The Duration Of The Loan.

- Commissions: When Making Trades, Clients Are Usually Required To Pay Trading Commissions To The Brokerage Firm. These Commissions May Be Fixed Or Calculated As A Percentage Of The Trading Amount.

- Trading Taxes: Depending On Local Regulations, Clients May Be Required To Pay Trading Taxes. These Taxes And Fees May Be Calculated Based On The Trading Amount Or Trading Profit.

Investment Decisions:

When Entering Into Leveraged Trading, Clients Need To Carefully Consider The Cost Factors And Make Decisions Based On Their Own Risk Tolerance And Investment Objectives. It Is Important To Comprehensively Evaluate The Potential Risks And Returns And Ensure That There Are Sufficient Funds To Deal With Possible Losses.

Before Entering Into Leveraged Trading, Clients Should Understand All Relevant Fees And Formulate Trading Strategies Based On Their Financial Situation And Risk Appetite. At The Same Time, Clients Should Also Pay Close Attention To Market Fluctuations And Adjust Trading Strategies In A Timely Manner To Reduce Risks And Maximize Investment Returns.

Motilal Oswal Financial Services Ltd Is Dedicated To Providing Clients With A Full Range Of Financial Services And Investment Support. Through A Professional Team And Advanced Technology, It Helps Clients Achieve Their Financial Goals And Achieve Investment Success.