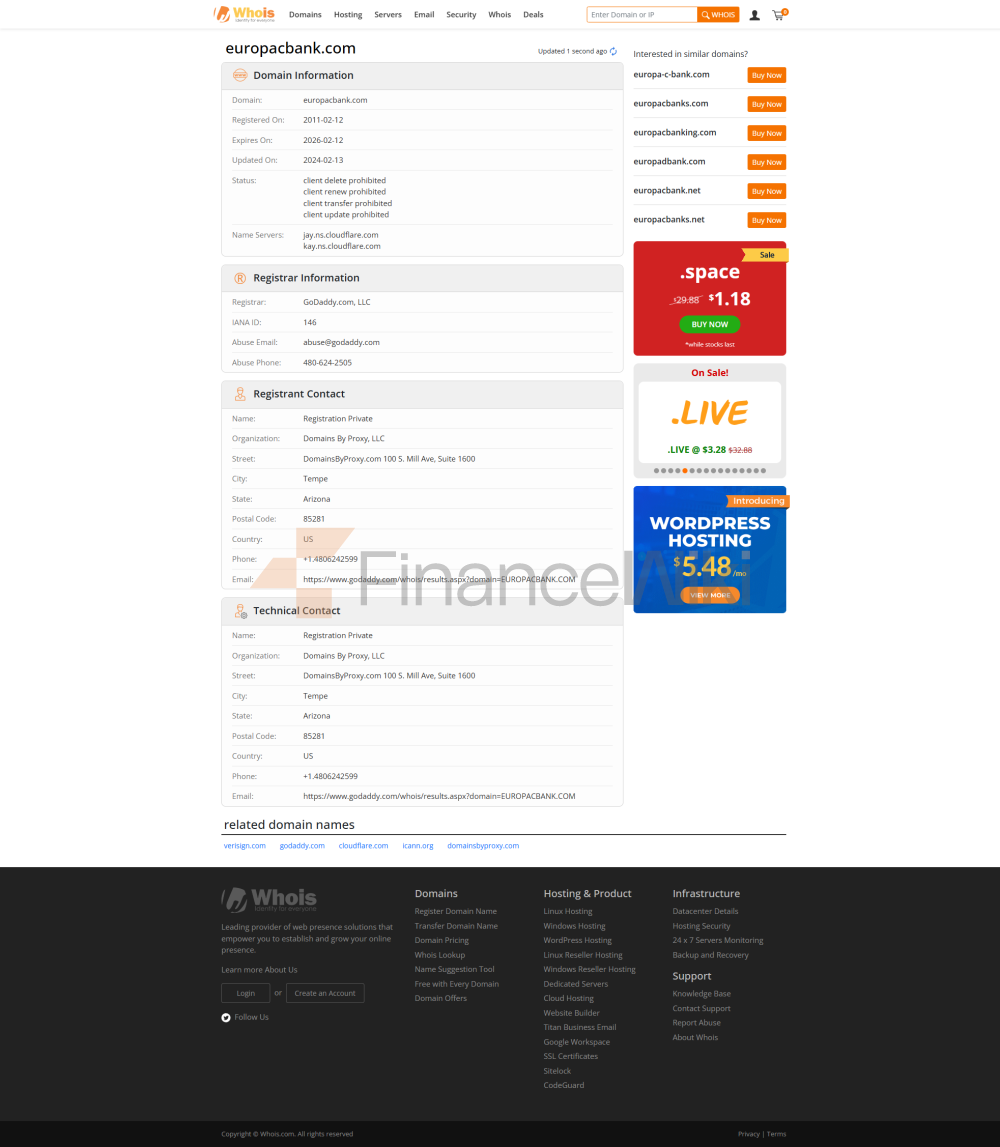

Verified: Euro Pacific Bank, Inc. Domain Name Was Registered In 2011 And Is A Financial Company Located In Puerto Rico. The Company Is Currently Unregulated. Please Be Aware Of The Risks In Case Your Funds Are Damaged.

Note: Euro Pacific Bank As A, Unregulated Broker, This Means That The Client's Investment May Not Be Adequately Protected. Due To The Lack Of A Regulator To Hold The Company Accountable, The Lack Of Regulation Increases The Risk Of Potential Financial Losses.

If You Invest In An Unregulated Broker, There Is A Good Chance That They Will Run Away With Your Hard-earned Money Without Any Recourse. Therefore, Investors Must Be Extremely Cautious And Remind Everyone To Stay Away From These Unregulated As Much As Possible When Choosing A Dealer.

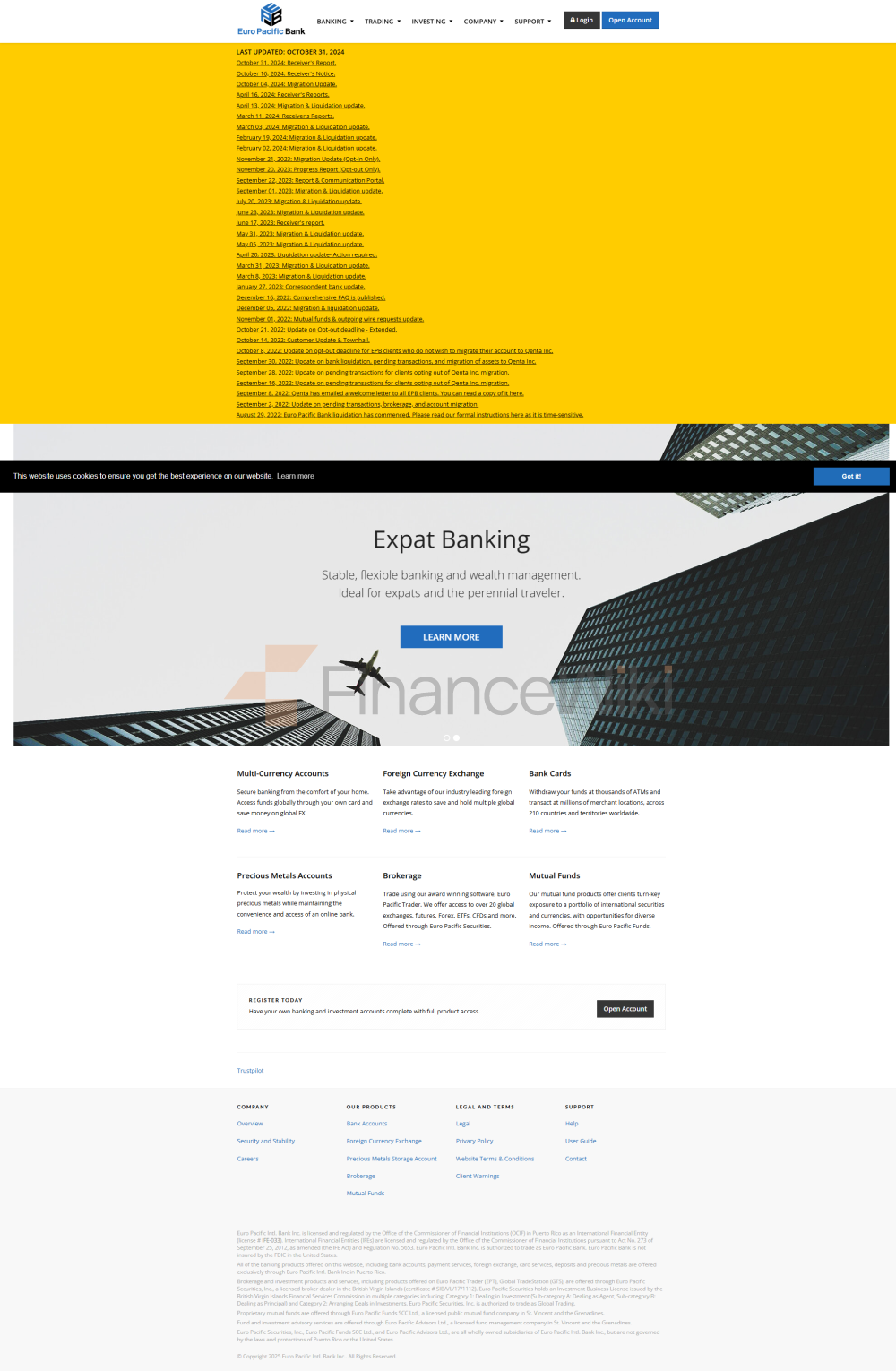

According To The Company's Official Website:

Euro Pacific Bank Was Launched In 2011 With The Goal Of Making The Banking Industry Safe, Digital And Globalized. Euro Pacific Specializes In Trading Banking, Brokerage And Investment Services. In Fact, 100% Of Its Profits Come Only From Transaction Fees, Service Fees And Commissions, Not From Borrowing Or Proprietary Trading.

Banking

Euro Pacific Bank Offers Both Personal And Corporate Accounts. Accounts Are Denominated In Your Choice Of EUR, GBP, CAD, CHF, JPY And PLN. Minimum Initial Deposit Starts At $500 For Both Personal And Corporate Accounts, With A Monthly Maintenance Fee Of $5 For Personal Accounts And $40 For Corporate Accounts. Freeze Amount (The Frozen Amount Will Be Deducted From Your Available Balance Upon Your Arrival And Will Be Used To Cover Monthly Maintenance For The First Year) $60 For Personal Accounts And $40 For Corporate Accounts.

Euro Pacific Bank Claims To Be Authorized And Regulated By The OCIF, But After Verification, There Is No Relevant Regulatory Information Of The Company, And According To The Supervision Number Provided On The Company's Official Website, This Supervision Is A Deck And Belongs To Offshore Supervision.

Trading Products

Tradable Financial Products Include Stocks, ETFs, Warrants, Structured Products, Options, Fixed Income, Foreign Exchange, Contracts For Difference, Futures, Futures Options. Stock Futures/exchanges For Physical Spreads, Spot Metals, Indices And Mutual Funds.

Account Types

Three Trading Accounts Are Available: Standard (Deposit $1000- $25000), Premium (Deposit $25000- $100000) And Prime (Deposit Over $100,000).

Forex Spreads

Spreads Vary According To Different Trading Accounts. The More Funds Deposited, The Narrower The Spread Offered. The Spread For The EUR/USD Currency Pair Is 1.8 Pips In The Standard Account, 1.4 Pips In The Premium Account And 0.8 Pips In The Premium Account Respectively.

Leverage

Maximum Trading Leverage Offered By Euro Pacific Bank For Forex Trading Up To 1:200. As Leverage Can Amplify Gains And Losses, Excessive Leverage Is Not Recommended For Inexperienced Traders.

Trading Platform

Euro Pacific Securities Inc. Launches Its Premier Multi-asset Brokerage Account, Euro Pacific Trader, TraderPro, Mobile Trader, As Well As The MT4 Trading Platform.

Precious Metals Accounts

Precious Metals Accounts Offer Investors The Opportunity To Access The Precious Metals Market And Diversify Their Portfolios. On 29 October 2020, The Company Ended Its Relationship With Perth Mint And Began Transferring All Of Its Precious Metals Assets To Our New Custodian In Singapore, A Global Leader In High-security Vault Storage. Precious Metals Accounts Continue To Function Normally, Allowing You To Buy, Sell And Hold Gold And Silver 24/7.

Storage Fee

Annual Storage Fee Is Accrued Daily And Deducted Semi-annually. On January 1, 2021, Storage Fees Will Be Changed From 0.00% For Gold And 0.95% For Silver To 0.25% And 0.45% Respectively.

Customer Support

The Customer Support Team Can Be Contacted Via Email, Phone.

Address: 53 Palmeras St, 10th Floor, San Juan, 00901, Puerto Rico.