What Is FXPN?

FXPN, Regulated By The NBRB, Offers A Comprehensive Range Of Market Tools. Traders Can Benefit From A Diverse Selection Of Platforms And Regulatory Oversight, Ensuring A Safe And Transparent Trading Environment. FXPN Offers Leverage Up To 1:100. Traders Can Access Financial Marekt Through Industry-leading Trading Platforms Such As MT4 And Sirix. FXPN Supports Phone Calls, WhatsApp, Email And Online Messaging.

Pros And Cons

Pros Of FXPN:

- Regulatory Oversight: FXPN Is Regulated By The National Bank Of Belarus (NBRB), Providing Traders With Security And Transparency In Their Trading Activities.

- Diversified Market Tools: FXPN Offers A Comprehensive Range Of Market Tools Including Forex, Stocks, Precious Metals, Commodities, Cryptocurrencies And Indices, Enabling Traders To Diversify Their Portfolios And Explore Various Trading Opportunities.

- Multiple Account Tiers: FXPN Offers Three Different Account Tiers (Silver, Gold And Platinum), Each Adjusted To The Trader's Experience Level And Risk Appetite. This Ensures That Traders Can Choose The Type Of Account That Matches Their Personal Preferences And Trading Objectives.

- User-Friendly Trading Platforms: FXPN Offers Industry-leading Trading Platforms, Such As MT4 And Sirix, Available On Both Mobile And Web Interfaces. These Platforms Are Equipped With Advanced Charting Tools And Seamless Execution Features That Enable Traders To Execute Their Strategies Efficiently.

Disadvantages Of FXPN:

- Higher Minimum Deposit And Commissions Charges: FXPN Has A Higher Minimum Deposit Requirement Of $200 And Charges Commission Fees From 0.35% To 0.5%, Which May Deter Smaller Traders Or Those Looking To Keep Trading Costs To A Minimum.

- Long Withdrawal Processing Times: Some Users Have Reported Processing Times That Exceed Expectations When Using FXPN For Withdrawals, Which May Cause Concern For Traders Who Prioritize Quick Access To Their Funds.

Is FXPN Safe?

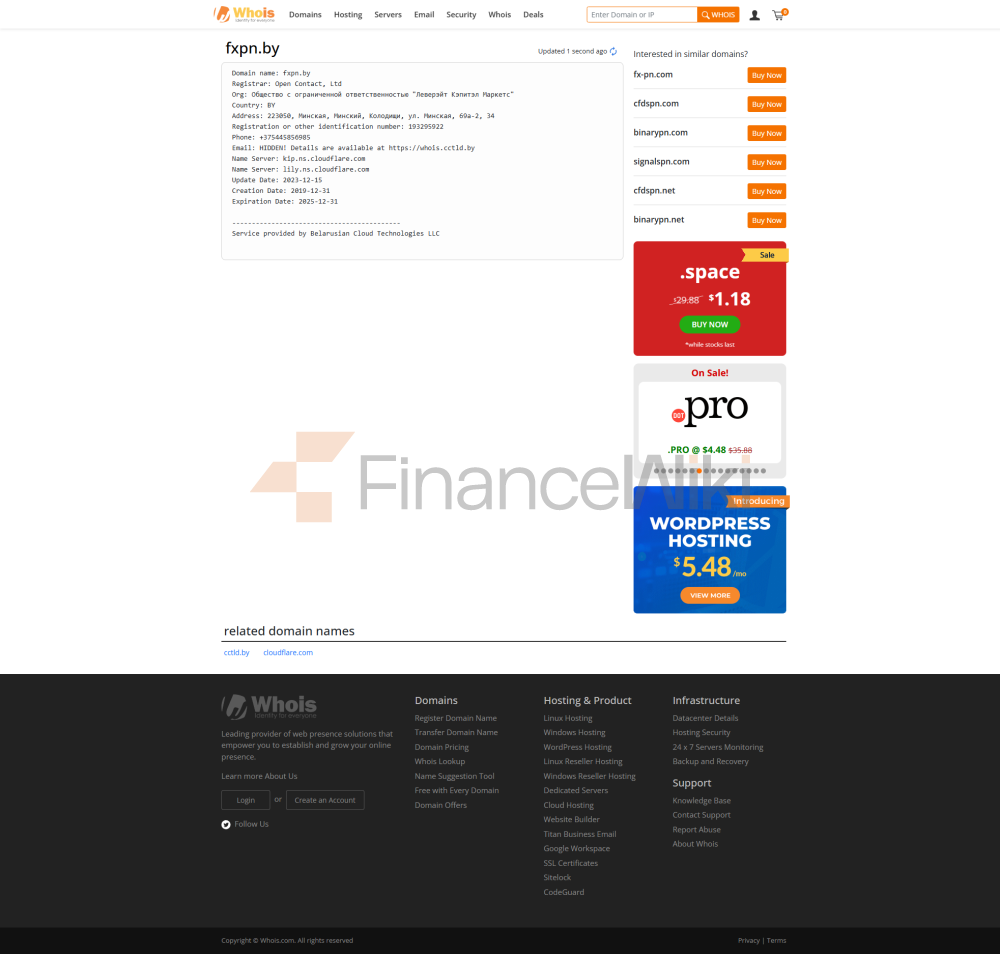

FXPN Operates Under The Supervision Of The National Bank Of Belarus (NBRB) And Holds A Retail Forex License With License Number 193295922. This License Indicates That FXPN Complies With The Regulatory Framework Established By The NBRB, The Central Bank Of Belarus, Headquartered In The Capital, Minsk. Although Regulation Provides A Degree Of Oversight And Accountability, Traders Should Recognize That All Investments Carry Inherent Risks.

Market Tools

FXPN Offers A Number Of Trading Tools For Different Asset Classes, Providing Traders With The Opportunity To Participate In Different Markets.

- Forex: FXPN Allows Traders To Trade In The Forex Market, Providing Access To Major, Minor And Exotic Currency Pairs. Forex Trading Enables Investors To Speculate On Exchange Rate Fluctuations Between Different Currencies.

- Stocks: Traders Can Invest In Individual Stocks Of Listed Companies Through FXPN's Platform. This Allows Them To Take Positions On The Price Movement Of A Particular Stock, With The Potential To Profit From Rising And Falling Price Trends.

- Precious Metals: FXPN Offers Trading In Precious Metals Such As Gold, Silver, Platinum, And Palladium. Often Used As A Safe Haven Asset, Precious Metals Are A Popular Choice For Portfolio Diversification And Combating Economic Uncertainty.

- Commodities: Traders Can Access A Variety Of Commodity Markets Through FXPN, Including Energy Commodities (such As Crude Oil And Natural Gas), Agricultural Commodities (such As Wheat, Corn, And Soybeans), And Metals (in Addition To Precious Metals).

- Cryptocurrencies: FXPN Enables Traders To Participate In The Cryptocurrency Market, Allowing Them To Buy And Sell Digital Currencies Like Bitcoin, Ether, Ripple, Litecoin, And Others. Cryptocurrency Trading Offers Profit Opportunities Through Price Speculation And Volatility.

- Indices: FXPN Provides A Way To Trade Indices That Represent Baskets Of Stocks Or Other Assets And Serve As Benchmarks For Specific Financial Marekt Areas. Traders Can Speculate On The Overall Performance Of These Indices, Such As The S & P 500, Dow Industries Jones Average Index, FTSE 100, Nikkei 225 And Others.

Account Types

FXPN Offers Three Different Account Types To Meet The Different Needs And Preferences Of Traders.

- Silver Account:

- Minimum Deposit: 200 Dollars

- This Account Type Is Designed For Beginner Traders Or Those Who Prefer To Start With Smaller Investments.

- Gold Account:

- Platinum Account:

- MT4

- Minimum Deposit Amount: $10,000

- Gold Account Is Tailored For More Experienced Traders With Larger Trading Capital.

- This Account Type Also Offers Personalized Account Manager Assistance And Access To Exclusive Trading Events Or Workshops.

- Minimum Deposit: $50,000 - Platinum Account Is A Premium Account Offered By FXPN For High Net Worth Individual And Institutional Traders.

FXPN Also Offers Demo Accounts For Traders Who Wish To Practice And Familiarize Themselves With The Platform Before Trading With Real Money. Demo Accounts Simulate Real Market Conditions And Allow Traders To Trade Using Virtual Money.

How Do I Open An Account?

To Open An FXPN Account, Follow These Steps:

Leverage

FXPN Offers Its Traders A Maximum Leverage Ratio Of 1:100.

Leverage In Trading Allows Investors To Control Larger Positions With Relatively Little Capital. With A Leverage Ratio Of 1:100, A Trader Can Magnify Their Gains Or Losses By A Factor Of 100. For Example, With $1,000 In Capital, A Trader Can Control A Position Worth $100,000 In The Market.

While Leverage Can Amplify Profits, It Also Increases The Level Of Risk. Trading With High Leverage Means That Even Small Price Swings Can Lead To Large Profits Or Losses.

Spreads And Commissions

FXPN Offers Competitive Spreads And Commissions Across Its Account Tier To Meet The Diverse Trading Needs Of Its Clients. Spreads Start At 1.8 Pips For Silver Accounts, 1.3 Pips For Gold Accounts, And 0.7 Pips For Platinum Accounts, Reflecting The Different Levels Of Trading Advantage Associated With Each Tier. Lower Spreads Often Mean Tighter Pricing, And Can Reduce Trading Costs, Especially For Traders Who Execute High-frequency Or High-volume Trades.

In Addition To The Spread, FXPN Charges Commissions On Stock Trades, 0.5% For Silver Accounts, 0.4% For Gold Accounts, And 0.35% For Platinum Accounts. These Commissions Are Calculated Based On The Value Of Trades And Contribute To The Total Cost Of Executing Stock Trades On The Platform.

Trading Platform

FXPN Offers Its Clients A Range Of Advanced Trading Platforms To Meet Different Preferences And Needs.

One Of The Main Platforms Offered Is MetaTrader 4 (MT4), An Acclaimed Platform Known For Its Powerful Features And User-friendly Interface. MT4 Offers A Comprehensive Set Of Technical Analysis Tools, Automated Trading Through Expert Advisors (EAs), Customizable Charting Options, And Real-time Market Data. Traders Can Access MT4 On Their Desktop, Allowing For Precise Trade Execution And In-depth Market Analysis.