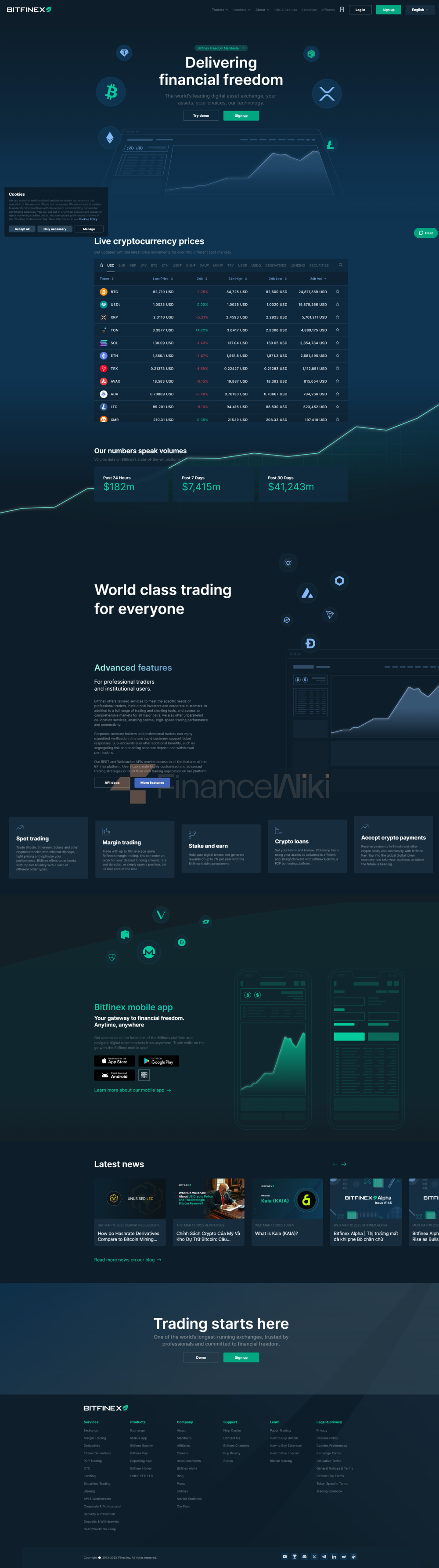

Bitfinex Is A Long-established Cryptocurrency Exchange. It Was Launched In 2012 And Is Operated By Hong Kong-based IFinex Inc. The Largest Stablecoin By Market Capitalization, Tether (USDT), Is Also Operated By IFinex Inc. This Centralized Exchange (CEX) Platform Is Designed For Professional Traders And Institutions, And Supports Both Fiat And Cryptocurrencies. The Exchange Is Considered One Of The Most Liquid For BTC Pairs And Other Major Counterfeit Products Such As ETH And XMR. To Protect User Assets, The Platform Provides Both Two-factor Authentication And IP Address Monitoring.

The Exchange Focuses On Professional Traders And Experienced Investors, And Provides Platform Users With Services Such As Margin Lending, Margin Financing, Pair Trading, Over The Counter (OTC), Etc. In Addition To Spot And Margin Trading, Bitfinex Also Offers Other Products, Such As Bitfinex Borrow, Bitfinex Pay, Bitfinex Pulse, Affiliate Marketing Programs, APIs And Its Native Utility Token, UNUS SED LEO, Etc.

Bitfinex Was Co-founded In 2012 By Raphael Nicolle And Giancarlo Devasini.

Nicolle Started Out As An IT Technician, Working As A System Admin At Gutenberg Networks. After That, He Focused On The Bitcoin Ecosystem And Started Developing Bitfinex Based On The Bitconica Trading Platform Program Code.

Devasini Currently Serves As Chief Financial Officer. He Graduated From The University Of Milan With A Medical Doctorate. However, He Became Interested In Technology And Subsequently Entered The Computer Hardware Industry. He Founded Point-G Srl And Solo SpA. In 2012, Devesini Met Raphael Nicolle And Joined Bitfinex, Where He Was Responsible For Trading And Risk Management.

The Company Is Registered In The British Virgin Islands And Is Headquartered In Hong Kong.

Bitfinex Is Restricted To People In Iran, North Korea, Cuba, Syria, Crimea, Donetsk People's Republic, And The Self-proclaimed Lugansk People's Republic. The Exchange Is Also Not Available To Citizens Of The United States, Citizens Or Residents Of Canada, The British Virgin Islands, The Government Of Venezuela, And Residents Of Austria And Italy.

For Cryptocurrency-to-cryptocurrency/stablecoin/fiat Transactions, The Pending Order Fee Is 0.10%, While The Order Fee Is 0.20%. The Pending Order Fee For Cryptocurrency Derivatives Is 0.020%, And The Order Fee Is 0.065%. Users Can Hold UNUS SED LEO Tokens To Enjoy Preferential Discounts Of 15% - 25% On Transaction Fees.

Cryptocurrency, Stablecoin And Securities Deposits Are Free Of Fees, While Telegraphic Transfer Fees Are 0.10%. Withdrawal Fees Depend On The Cryptocurrency Currency.

Eligible Users Of The Platform (basic Plus Verification Level And Above) Can Use 10x Leverage And Access Funds Through Its Peer-to-peer (P2P) Margin Financing Platform.