Corporate Profile

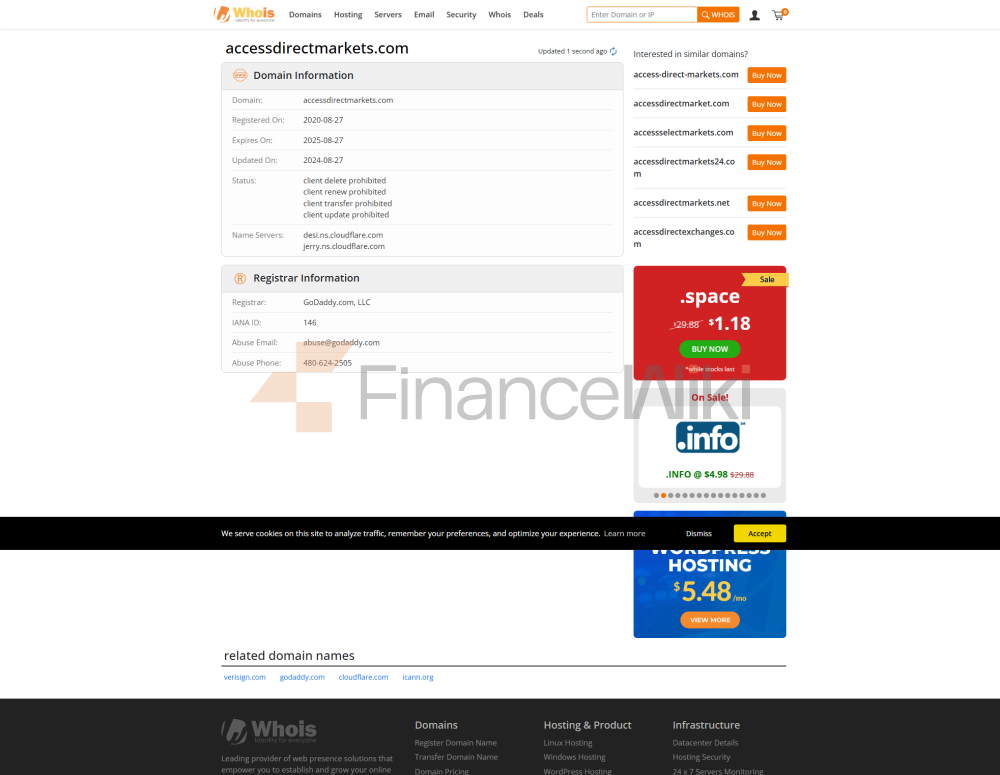

Access Direct Markets Ltd. Was Established In 2020 And Is Headquartered In Australia. It Is A Broker That Offers Trading In A Wide Range Of Financial Instruments. The Company Is Regulated By The Australian Securities And Investments Commission (ASIC), But Is Currently In A "Exceeded" Status , Indicating That It Operates Beyond The Scope Of Its Mandate. Access Direct Offers A Wide Range Of Trading Products Including Futures, Foreign Exchange, Contracts For Difference (CFDs), Commodities, Equities And Exchange Traded Funds (ETFs) .

The Company Offers Four Account Types For Different Traders' Needs, Namely Classic Account, Professional Account, Classic ECN Account And Professional ECN Account With Leverage Up To 1:500 . Traders Can Trade Through Platforms Such As WebTrader, Access Desktop (CQG), Access Mobile And MetaTrader 5 (MT5) .

Regulatory Information

Access Direct Markets Ltd. Regulated By The Australian Securities And Investments Commission (ASIC), The License Number Is ASIC License Number (to Be Clearly Stated) . However, The Company Is Currently In The "beyond" Status , Meaning That Its Operating Activities Are Beyond The Scope Of The Authorization. This Status May Have An Impact On The Safety And Equity Of Clients' Funds, And Traders Should Exercise Extreme Caution When Choosing Such Brokers.

Trading Products

Access Direct Offers The Following Main Trading Instruments:

- Futures : Exchange-based Derivative Contracts That Allow Traders To Deliver Commodities Or Assets At A Fixed Price In The Future. Futures Market Participants Are Generally Divided Into Hedgers And Speculators.

- Forex (Forex) And Contracts For Difference (CFDs) : Trade Multiple Currency Pairs In The Highly Liquid And Transparent Forex Market. CFD Trading Allows Traders To Trade On Price Fluctuations In Underlying Assets Without Actually Holding The Asset.

- Commodities : Includes Hard Commodities (e.g. Gold, Silver, Crude Oil) And Soft Commodities (e.g. Cotton, Coffee, Corn, Livestock). Commodity Trading Offers Investors The Opportunity To Diversify Their Investments And Make Quick Profits.

- Stocks : Trade Stocks To Accumulate Savings, Protect Against Inflation And Taxes, And Maximize Investment Income. Stock Traders Enjoy The Company's Assets And Returns Proportionally By Holding Stocks.

- Exchange Traded Funds (ETFs) : Financial Instruments That Track Specific Indices And Contain Multiple Asset Classes Such As Stocks, Bonds, And Commodities, Providing Flexible Trading And Diversified Investment Opportunities.

Trading Software

Access Direct Supports Multiple Trading Platforms To Meet The Needs Of Different Traders. Mainly Includes The Following:

- WebTrader : Designed For Advanced Users, The Platform Offers ECN Pricing, Fast Execution, And Tight Spreads, Which Can Be Accessed From Any Web Browser.

- Access Desktop (CQG) : Provided By CQG, Supports More Than 3000 Financial Instruments, Provides Real-time News, Economic Calendar, And Advanced Charting Tools For Desktop And Mobile Devices.

- Access Mobile : Designed For Mobile Users, It Offers A Clean, User-friendly Interface And Fast Response Time, Suitable For Trading Anytime, Anywhere.

- MetaTrader 5 (MT5) : Full Support For Stock, Futures And Foreign Exchange Trading, Providing Algorithmic Trading, Copy Trading And A Wide Range Of Analytical Tools For Windows, Mac, IOS And Android Devices.

Deposit And Withdrawal Methods

Access Direct Provides A Variety Of Deposit And Withdrawal Methods, As Follows:

- Deposit Methods : Support VISA, MasterCard, Telegraphic Transfer, China UnionPay (CUP), Neteller, Skrill, USDT And Thailand QR And Other Payment Methods, With Fast Processing Time (fastest 10 Minutes, Slowest 24 Hours).

- Withdrawal Fee : Different Withdrawal Methods Have Different Fees:

- VISA And MasterCard: 5.5% Fee

- Bank Transfer: Fixed $30 Or €30 Fee

- China UnionPay: 0.5% Fee

- Neteller: 2.0% Fee

- Skrill: 1.0% Fee

- USDT: 0.5% Fee

Withdrawal Processing Time Is Usually 24 Hours, But May Be Extended Due To Third-party Delays, Bank Transfers Take 3-5 Business Days, Credit Card Withdrawals It Takes 10 To 14 Working Days.

Customer Support

Access Direct Offers The Following Customer Support Channels:

- Email : Support@accessdirectmarkets.com Phone : + 230 529-70998

- Contact Form : Submissions Can Be Made Through The Company Website

- Social Media : Facebook, LinkedIn, Instagram And Twitter

Although The Company Offers Multiple Support Channels, Lacks Live Chat Support , Which May Affect Traders The Ability To Obtain Immediate Assistance.

Core Business And Services

Access Direct's Core Business Includes Providing Multiple Types Of Accounts, Trading Products And Trading Platforms, As Well As Enhancing Traders' Skills Through Its Educational Resources. The Company Provides Differentiated Services For Different Groups Of Traders (from Beginners To Professional Traders), Such As:

- Classic Account : Suitable For Beginners, Minimum Deposit Is 100 Dollars , Spreads Start From 1.5 Pips .

- Professional Account : Suitable For Dedicated Traders With A Minimum Deposit Of 500 Dollars And Spreads Starting From 1pip .

- Classic ECN Account : Suitable For Traders Looking For Tighter Spreads With A Minimum Deposit Of 500 Dollars And Spreads Starting From 0pip .

- Professional ECN Account : Suitable For Professional Traders With A Minimum Deposit Of $2,500 And Spreads Starting From 0pip .

Technical Infrastructure

Access Direct's Technical Infrastructure Covers Its Trading Platform And Trade Execution System. For Example:

- WebTrader : Supports ECN Pricing And Fast Execution.

- Access Desktop (CQG) : Provides Real-time News And An Economic Calendar.

- MetaTrader 5 (MT5) : Supports Advanced Analytical Tools And Algorithmic Trading.

These Platforms Provide Traders With A Diverse Trading Experience And Tools.

Compliance And Risk Control System

Access Direct's Compliance And Risk Control System Needs To Be Further Clarified As It Is Currently In An "out Of" Regulatory State. Traders Should Carefully Assess Latent Risk When Choosing Such Brokers.

Market Positioning And Competitive Advantage

Access Direct's Market Positioning Is Mainly To Provide A Variety Of Trading Tools And Platforms, As Well As Flexible Account Options. Its Competitive Advantages Include:

- Offering Multiple Account Types And Flexible Leverage Options.

- Supports Multiple Deposit And Withdrawal Methods.

- Uses Well-known Trading Platforms Such As MT5.

However, Its "out Of" Regulatory Status And Higher Withdrawal Fees May Erode Its Competitive Advantage.

Customer Support & Empowerment

Access Direct Provides Educational Resources Including:

- Glossary : Explains Basic Trading Terminology.

- Trading Central : Provides Artificial Intelligence Analysis And Expert Insights.

- Economic Calendar : Provides Information On Important Global Market Events And Economic Data Releases.

These Resources Help Traders Improve Their Trading Skills And Decision-making Abilities.

Social Responsibility And ESG

Access Direct's Social Responsibility And ESG-related Information Is Not Explicitly Mentioned And Needs To Be Further Supplemented.

Strategic Cooperation Ecosystem

Access Direct's Strategic Cooperation Ecosystem Information Is Not Explicitly Mentioned And Needs To Be Further Supplemented.

Financial Health

Access Direct's Financial Health Information Is Not Explicitly Mentioned And Needs To Be Further Added.

Future Roadmap Information

Access Direct's Future Roadmap Information Is Not Explicitly Mentioned And Needs To Be Further Added.