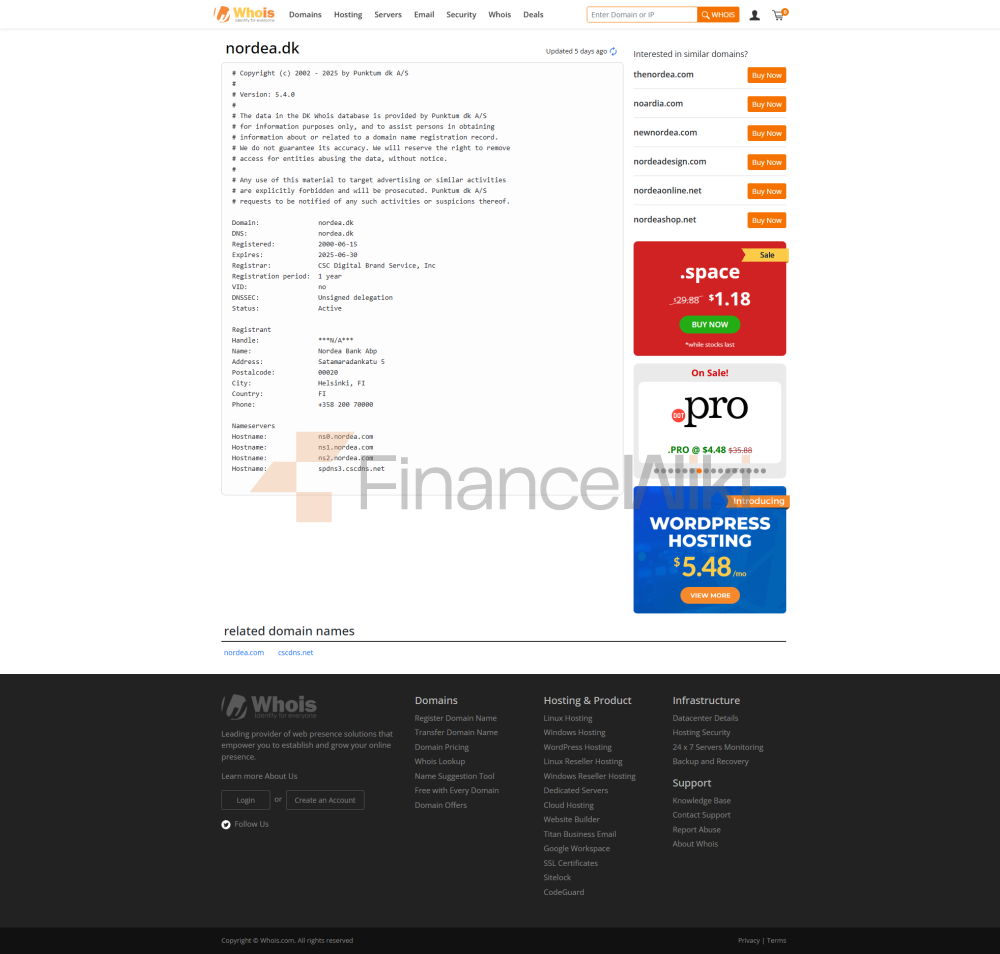

Nordea is a commercial bank, known as Nordea Bank Abp, which was established in 1998 through a series of mergers, including Nordbanken in Sweden, Kansallis-Osake-Pankki in Finland, Christiania Bank og Kreditkasse in Norway and Unidanmark in Denmark. Headquartered in Aleksanterinkatu 36 B in Helsinki, Finland, Nordea is one of the largest banks in the Nordic region, with services in Denmark, Finland, Sweden and Norway, with around 800 branches and an extensive network of ATMs to facilitate deposits, withdrawals and transactions. Nordea also has representative offices in Asia, Europe and North America to serve international clients.

Nordea is a publicly traded company whose shares are listed on the Nordic Stock Exchange (Nasdaq Helsinki, Nasdaq Copenhagen, Nasdaq Stockholm) under the ticker symbol NDA. Shareholders include institutional investors (such as pension funds and insurance companies) and individual investors, with a stable shareholding structure that supports their long-term strategic development. At the end of 2024, Nordea has a market capitalization of around €36.8 billion and more than 600,000 shareholders.

Nordea is strictly regulated by financial regulators in the Nordic countries, including the Finnish Financial Supervisory Authority (FIN-FSA), the Danish Financial Supervisory Authority (DFSA), the Swedish Financial Supervisory Authority (SFSA) and the Norwegian Financial Supervisory Authority (FSA). Banks participate in the EU Deposit Insurance Scheme, which covers a maximum of €100,000 per person per bank, to ensure the safety of customer funds. In terms of compliance records, Nordea was investigated for anti-money laundering issues involving Russian customers between 2007 and 2015, and in 2024 Danish authorities filed a lawsuit against it for allowing $3.7 billion in suspicious transactions. Nordea has taken steps to enhance its Anti-Money Laundering (AML) and Customer Due Diligence (KYC) processes and has not reported any new significant compliance issues in the near future.

Financial

healthNordea's financial health is a key reflection of its position as a leading bank in the Nordics. Here are the key financial metrics for 2024:

- Capital adequacy ratio: The core Tier 1 capital adequacy ratio (CET1) was 15.8%, above regulatory requirements, showing a strong capital base.

- Non-Performing Loan Ratio: The non-executive loan ratio (NPL) was 0.91%, up slightly from 0.87% in 2023, but still below the industry average, reflecting good credit quality.

- Liquidity Coverage Ratio: The average liquidity coverage ratio (LCR) is 133%, which is higher than the regulatory requirement of 100%, and the high quality liquid assets (HQLA) are sufficient, indicating that banks are able to cope with short-term liquidity pressures.

In 2024, Nordea's total assets will be around €551.4 billion, with net interest income of €9 billion and net profit of €3 billion. The bank strengthened its capital position through continuous dividend payments (€0.94 per share in 2024, up 2% year-on-year) and a share buyback program (completed until February 28, 2025). In 2024, Nordea's shareholder return (ROE) reached 16.7%, down slightly from 16.9% in 2023, but still showing strong profitability.

Quick Take: Nordea's solid financial position, capital adequacy and liquidity coverage ratios above regulatory requirements, and low non-performing loan ratios indicate that it is resilient to market volatility. However, historical AML issues may have an impact on investor confidence, and it is advisable to consult the latest financial reports for more detailed data.

Deposit & Loan

ProductsNordea offers a wide range of deposit and loan products to meet the financial needs of individual and corporate customers.

Deposits:

- Demand deposits, such as CurrentAccount, are suitable for daily transactions and have a lower interest rate (about 0.25%, for example, in Finland).

- Fixed Deposits: FlexiDeposit, for example, offers a fixed interest rate of up to 3.90% p.a. with tenors ranging from 1 month to 12 months, with the option of early withdrawal (fees may apply).

- High-yield savings accounts: PerkAccount, for example, has an interest rate linked to the Nordea Premier Interest Rate, which is 2.15% in April 2025 and is suitable for short-term savings.

- Large Certificates of Deposit (CDs): Savings options with fixed interest rates and tenors, depending on the bank.

- ASP Account: Designed for customers aged 15-44 to encourage first-time home savings, a 10% deposit of the home price.

Loans:

- Mortgages: Fixed and variable rate mortgages are available with a minimum annual interest rate of 2.73% (April 2025, based on a 12-month Euribor plus 0.6% spread). Support flexible repayment options, such as early repayment or adjustment of repayment schedule.

- Personal Line of Credit: e.g. FlexiCredit, APR 15.5% (based on 3-month Euribor plus 8.9% spread, March 2025) for consumer demand.

List of common

feesNordea's fee structure includes the following common fees:

- Account management fee: such as the Mobile Plus or Basic account package, and no monthly/annual fee for some accounts (such as student accounts).

- Transfer fee: Domestic transfers are usually free of charge, international transfers cost €20 (sent in euros via online banking).

- Overdraft Fees: Overdraft accounts are subject to a daily fee and interest, the exact amount of which is subject to the terms and conditions.

- ATM interbank withdrawal fee: €2.50 per trip using non-Nordea ATMs and 3% foreign exchange transaction fee for overseas withdrawals.

- Hidden Fee Alert: This may include a minimum balance requirement (below which may be charged €5/month) or an account inactivity fee.

Digital Service

ExperienceNordea's digital services are based on the Nordea Mobile app, available for iOS and Android platforms, with a rating of 4.7 stars (based on 1,200 reviews) on the App Store and 3.9 stars (based on 1,300 reviews) on Google Play. For the second year in a row, Nordea Mobile has been named the "Best Banking App in Northern Europe" by Forrester Digital Experience Review.

Core Features:

- Pay bills and transfer money in real-time

- View account balances and transaction history

- Manage cards (report loss, unregister, set limits)

- Apply for products and sign agreements online

- Investment management (stocks, funds)

- Budget and expenditure analysis

Technological innovations:

- Artificial intelligence: Provide personalized budget recommendations with AI-driven insight tools.

- Open Banking API: Supports third-party service integrations that allow customers to access other bank accounts.

- Biometric login: Supports face recognition and fingerprint login to improve security and convenience.

- Apple Pay/Google Pay: Provides a fast and secure payment method.

Nordea has also developed the Nordea ID app for authentication and secure logins, enhancing the customer experience.

Customer Service Quality

Nordea provides customer service through multiple channels, ensuring that customers receive support at all times:

- 24/7 telephone support: 0200 70 000 for Finnish customers and 0771-22 44 88 for Swedish customers, with round-the-clock response for emergencies such as lost cards.

- Live chat: Live support via Nordea Mobile and online banking.

- Social Media Responsiveness: Respond quickly to customer inquiries through the X platform.

- Branch services: Approximately 800 branches provide face-to-face support.

Complaint Handling: Nordea has a customer feedback mechanism where customers can submit a complaint through an online form and contact their local financial grievance authority if they are not satisfied. In 2024, customer satisfaction with digital services is high.

Multilingual support: Services are available in Danish, Finnish, Swedish, Norwegian, and English for cross-border customers.

Security

MeasuresNordea has taken a number of measures to protect client funds and data:

- Security of funds: participation in the EU deposit insurance scheme up to €100,000. Real-time transaction monitoring and Nordea ID two-factor authentication prevent fraud.

- Data security: GDPR compliant, data encryption and access controls in place, no major data breaches reported.

Featured Services & DifferentiationNordea

meets the needs of market segments with the following services:

- Student account: Nordea Gold card is free of charge, offers travel insurance and product safety insurance.

- Senior-only service: Seniorservice offers dedicated telephone support for customers aged 67 and above.

- Green financial products: Support green loans and ESG investments, such as green housing loans.

Market Position & Accolades

Nordea is one of the largest banks in Northern Europe, with a market share of around 24% (loans) and 27% (deposits) in 2024. Globally, Nordea ranks 53rd in the "Top 1000 Global Banks" and is a constituent of the OMX Nordic 40 index. The bank has won several awards:

- "Best Banking App in Northern Europe" (Forrester, 2023-2024).

- "Best Sustainable Bank" (Global Finance, 2025).

- "Best Responsible Investment Bank" (Euromoney).