Corporate Profile

EXMA TRADING (Full Name: EXMA TRADING LLC) Is A Forex Broker Registered In Saint Vincent And The Grenadines. The Company Claims To Provide Clients With A Diverse Range Of Trading Services In Financial Instruments, Including Forex, Metals, Indices, Cryptocurrencies, Stocks And Commodities, Etc. Through MT4 And MT5 Trading Platforms. The Company Offers Three Real Trading Account Types (Gold, Diamond, Ruby) And Supports Multiple Deposit And Withdrawal Methods, Including Credit Cards, Bank Transfers And Cryptocurrencies. As Of 2023, The Minimum Initial Deposit Requirement For EXMA TRADING Is $250 And A 1% Trading Fee Is Charged On All Deposits And Withdrawals .

REGULATIONAL INFORMATION

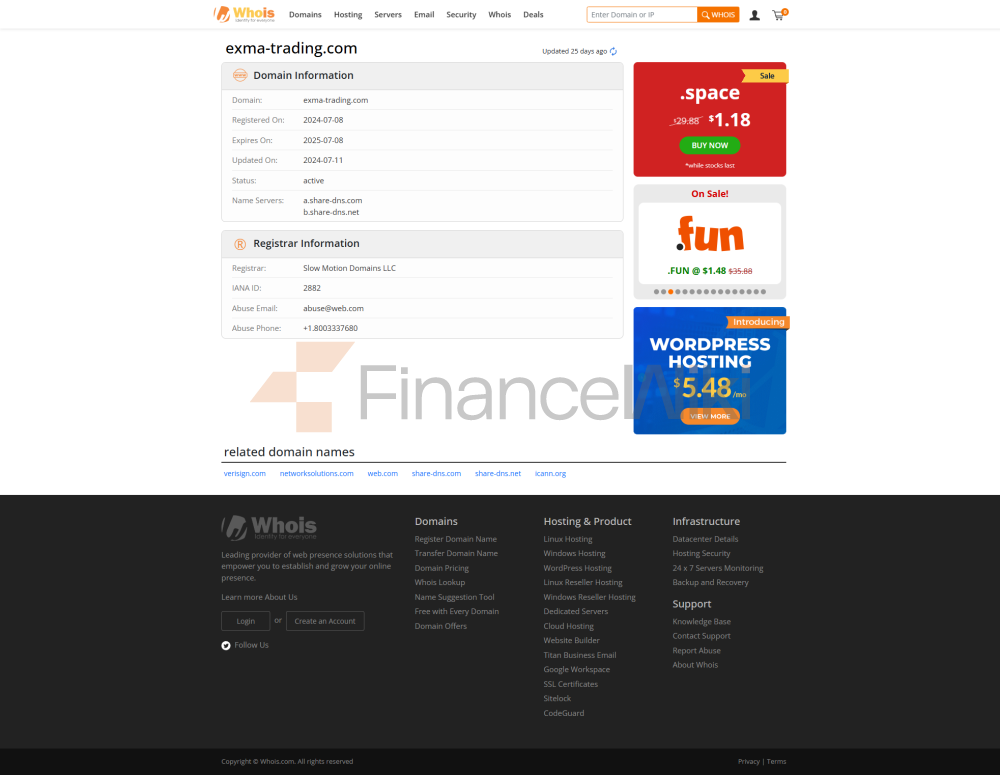

EXMA TRADING Is Currently Not Subject To Any Valid Regulatory Authority, And Its Regulatory Status Is Marked As "unlicensed" On The Wikifx Platform, With A Score Of 1.82/10 . This Means That Customers Need To Be Especially Careful When Choosing The Platform To Avoid Latent Risk.

Trading Products

EXMA TRADING Offers More Than 1,250 Tradable Financial Instruments , Covering The Following Categories:

- Forex : Including Major Currency Pairs (such As EUR/USD, USD/JPY, Etc.) And Emerging Market Currency Pairs.

- Metals : Such As Gold (XAU/USD), Silver (XAG/USD), Palladium And Platinum, Etc.

- Indices : Such As Dow Jones, S & P 500, FTSE 100, Etc.

- Cryptocurrencies : Including Bitcoin (BTC/USD), Ethereum (ETH/USD), Etc.

- Stocks : Stocks Such As Apple (AAPL), Google (GOOGL), Etc.

- Commodities : Energy Commodities Such As Crude Oil, Natural Gas, Etc.

Trading Software

EXMA TRADING's Trading Tools Are Based On The Market-leading MetaTrader 4 (MT4) And MetaTrader 5 (MT5) Platforms. These Two Platforms Not Only Support Desktop Trading, But Also Provide Mobile Applications And Web Version Trading Capabilities. MT4 And MT5 Are Widely Praised By Traders And Brokers For Their Ease Of Use, Powerful Charting Capabilities, And Customization Options. In Addition, These Two Platforms Support Automated Trading Robots (Expert Advisors) , Providing More Flexibility For Advanced Traders.

Deposit And Withdrawal Methods

EXMA TRADING Supports The Following Deposit And Withdrawal Methods:

- Credit Card : Including Major Credit Card Brands Such As VISA And MasterCard.

- Bank Transfer : Customers Can Complete The Deposit And Withdrawal Of Funds Through International Bank Transfer.

- Cryptocurrency : Supports Deposits And Withdrawals Of Mainstream Cryptocurrencies Such As Bitcoin (BTC) And Ethereum (ETH).

- Deposit And Withdrawal Time : All Operations Can Be Processed Immediately After Submission .

Customer Support

EXMA TRADING Provides 24/7 Customer Support Services, And Customers Can Be Contacted By:

- Phone : + 44 2045252031

- Email : Support@exma-trading.com

- Live Chat : Real-time Communication Through The Official Website The Company's Headquarters Is Located In Kingston, St. Vincent And The Grenadines (First Floor, First St. Vincent Bank Building, James Street, Kingstown) .

Core Business And Services

EXMA TRADING's Main Business Focuses On Providing Multi-asset Class Trading Services To Retail And Institutional Clients. The Company Offers A Diverse Range Of Trading Tools And Flexible Trading Conditions Through Its Supported MT4 And MT5 Platforms. Here Are The Highlights Of Its Core Services:

- High Leverage Trading : Gold Accounts Offer 1:100 Leverage , Diamond And Ruby Accounts Offer 1:500 Leverage .

- Floating Spreads : Gold Accounts Have A Minimum Spread Of 1.7 Points , Diamond And Ruby Accounts Have A Minimum Spread Of 0.0 Points .

- Commission Structure : Gold Accounts Do Not Charge Commissions For Forex And Metals Trading, Diamond Accounts Charge $5 Per Side Commission, Ruby Accounts Charge $3.50 Per Side Commission.

TECHNOLOGY INSTITUTE

EXMA TRADING's Technical Infrastructure Is Based On The MT4 And MT5 Trading Platforms, Which Are Known For Their Stability And Security . In Addition, The Company Supports Cryptocurrency Trading, Demonstrating Its Ability To Lay Out In The Emerging Technology Field.

Compliance And Risk Control System

Although EXMA TRADING Is Currently Unregulated, Its Official Website Claims To Follow Strict Compliance Statements To Ensure Transparency And Security Of Transactions. However, The Lack Of Regulatory Coverage May Increase The Security Risk Of Client Funds And Transactions.

Market Positioning And Competitive Advantage

EXMA TRADING's Main Competitive Advantage Lies In Its Offering Of High Leverage Trading Conditions And Diverse Trading Tools . In Addition, The Company Supports Cryptocurrency Trading, Which Is Not Common Among Traditional Forex Brokers. However, The Fact That It Is Not Regulated Can Become A Disadvantage Of Market Positioning.

Customer Support And Empowerment

EXMA TRADING Provides Comprehensive Trading Support And Problem Solving Services To Its Clients Through Its 24/7 Customer Support Team. In Addition, The Advanced Features Of Its MT4 And MT5 Platforms, Such As Expert Advisors, Provide Its Clients With More Trading-empowering Possibilities.

Social Responsibility Vs. ESG

Currently, EXMA TRADING Does Not Mention Anything Related To Social Responsibility Or ESG (Environmental, Social And Corporate Governance) On Its Official Website.

Strategic Collaboration Ecology

As Of 2023, EXMA TRADING Does Not Disclose Any Major Strategic Collaborations Or Industry Awards.

Financial Health

EXMA TRADING's Financial Health Is Not Publicly Disclosed, So Clients Cannot Directly Assess Its Financial Stability.

Future Roadmap

EXMA TRADING's Future Roadmap Has Not Been Made Public, But Its Official Website Hints That It Will Continue To Expand Its Trading Tools And Platform Capabilities To Meet Client Needs.

Summary

EXMA TRADING, As A Forex Broker Registered In Saint Vincent And The Grenadines, Offers Its Clients A Diverse Range Of Trading Tools And Flexible Trading Conditions. However, The Fact That It Is Unregulated May Increase The Risk Exposure Of Its Clients. When Selecting This Platform, Customers Need To Consider The Diversity Of Its Market Instruments, The Stability Of The Trading Platform, The Convenience Of Deposit And Withdrawal And The Potential Risks .