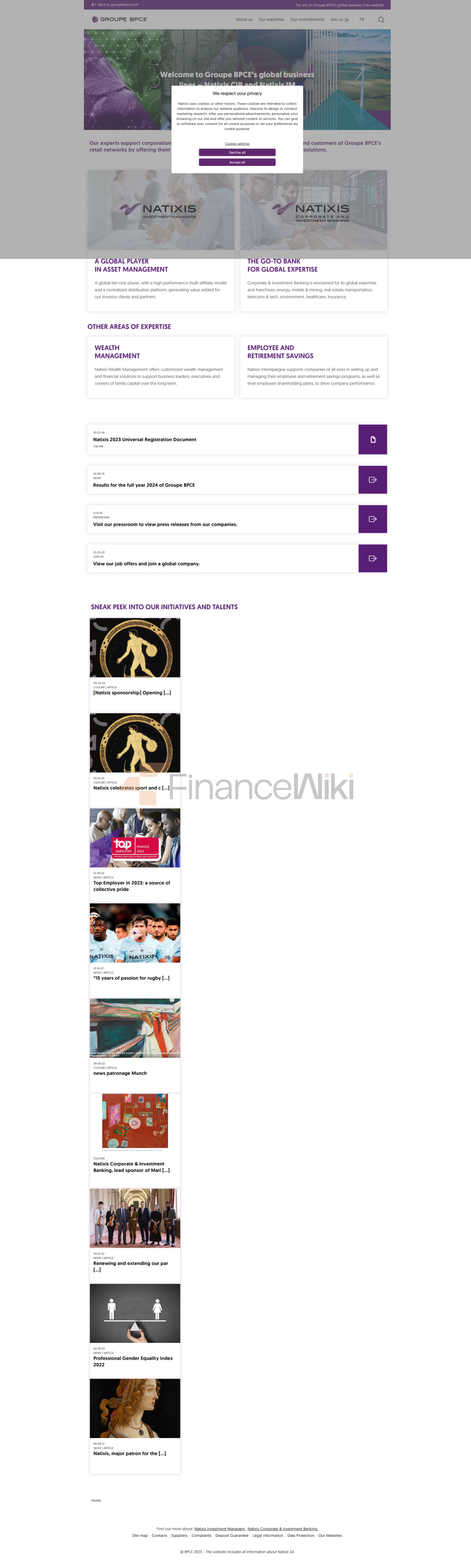

Banco Natixis, Or Banco Natixis, Is An Investment Bank Of The French BPCE Group, Formed By The Merger Of The Asset Management And Investment Divisions Of The People's Bank Of France And The Savings Bank. The Combined Funds Of The Two Banks Exceed 70% Of The Capital Of The New Bank, And The Rest Of The Funds Are Publicly Raised By Paris Bourse.

Historical Events

In 1818, The First French Savings Bank Was Established In Paris To Promote, Absorb And Manage Public Deposits, And To Launch Savings Accounts.

In 1837, The Management Of Savings Accounts Was Handed Over To The French Development Bank. Savings Banks Expanded: From 284 In 1839 To 364 In 1847.

In 1878, The First Public Bank Opened Its Doors In Angers. The Public Bank Was Founded By And For Individual Entrepreneurs, Providing Easier Financing For The Development Of Their Projects.

In 1919, In Order To Facilitate The Reconstruction Of France After World War I, The National Credit Bank Was Established.

In 1921, The Central Savings Department Of The Public Bank Was Established.

In 1946, The French Foreign Trade Bank Was Established To Promote The Development Of International Trade Transactions.

In 1996, The National Credit Bank Merged With The French Foreign Trade Bank To Form Natexis S.A. Limited. This Was The First Bank Merger In France In Nearly 30 Years.

In 1998, The Central Savings Department Of Volkswagen Bank Acquired Natexis S.A., Which Became The Listed Shell Company Of The Volkswagen Bank Group.

In 1999, The Central Savings Department Of Volkswagen Bank Transferred Its Operations To Natexis S.A. The Central Savings Department Of Volkswagen Bank Was Renamed Volkswagen Federal Bank

In 1999, The National Savings Department Of The Savings Bank Was Created

In 2001, The CDC IXIS Bank Was Founded, Mainly Engaged In Investment Banking, And Was Spun Off From The Competitive Financial Business Of The French Development Bank.

In 2004, The National Savings Department Of The Savings Bank Annexed The CDC IXIS Bank. The Savings Bank Group Thus Became A Full-service Banking Institution, Creating Two Business-oriented Banks, IXIS CIB And IXIS AM, Respectively.

In 2006, Natixis Bank Was Restructured By IXIS Bank And Volkswagen Natexis Bank.

In 2009, BPCE Group, The Second Largest Banking Group In France, Was Established. The Group Was Formed By The Merger Of The National Savings Department Of Savings Bank And Volkswagen Federal Bank. BPCE Group Became The Parent Company Of French Natixis Bank.

In 2013, GF Futures (Hong Kong), A Wholly-owned Company Of GF Securities, Completed The Acquisition Of Its Wholly-owned British NCM Futures Company From Natixis Bank Of France, Thus Enabling GF Futures To Have Membership In The Main Futures Exchange In The United Kingdom. The Initial Transaction Amount Is US $36.14 Million (approximately HK $282 Million).

Ranking By Business

Corporate & Investment Banking:

- European Project Finance (Europe Bank Of The Year 2010)

- Real Estate Finance (France)

- Major Corporate Bonds (France)

- CDO Issuance (Europe)

- Eurobond Primary Market

- Trade Finance (Africa & Middle East)

- Global Aviation Finance

Asset Management:

- Asset Management Bank (France)

- Asset Management Bank (Europe)

- Asset Management Bank (Global)

Private Equity And Private Banking:

- One Of The Leading Players In Asset Investment For SMEs In France

Services:

- Employee Savings Management (France)

- Insurance Deposits (France)

- Global Custodian

- Retail Custodian (France)

- Electronic Payment Operator (France)

- Bank Insurance IARD (France) UL >

- Accounts Receivable Management (France)

- Factoring (France)

- Factoring (Global)

- Credit Insurance (Global)

- Accounts Receivable Management (Global)

- Corporate Information Provider (Global)

Accounts Receivable Management: