Basic Information & Regulators

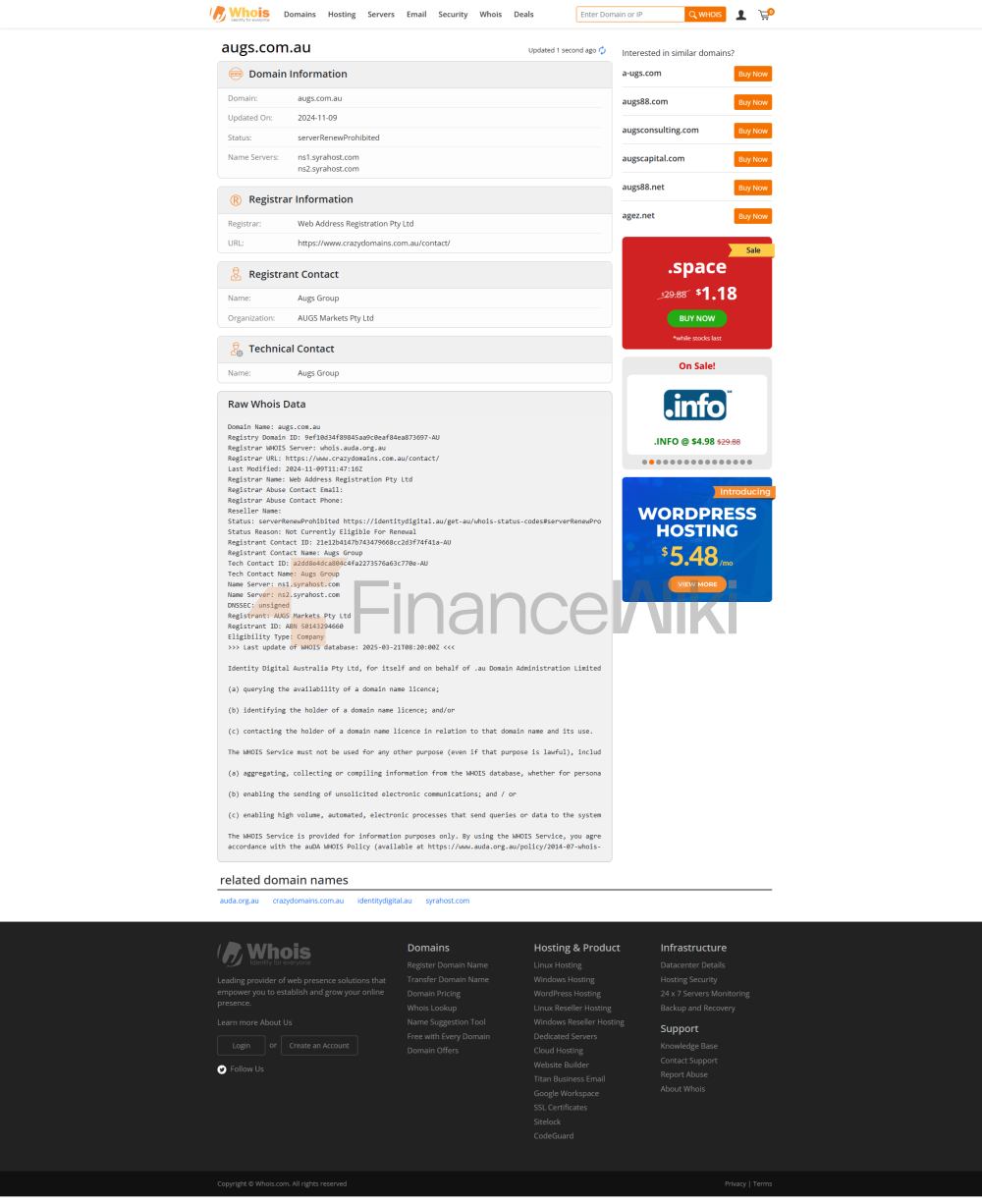

AUGS Was Established In 2011 And Is Headquartered In Sydney, Australia. After Years Of Development, AUGS Is Not Only Committed To Providing Customers With Rich Products, Safe Funds And Superior Trading Experience, But Also Constantly Improving The Financial Professional Qualifications. Currently, It Has The Australian Securities And Investments Commission (ASIC) STP Straight-through License And The Vanuatu Financial Services Commission (VFSC) Retail Foreign Exchange License.

Security Analysis

All AUGS Customers' Funds Are Completely Segregated From The Company's Own Funds And Deposited Separately In Top Banks Around The World. At The Same Time, We Also Establish Trust Guarantees With Banks To Ensure That Customer Funds Are Segregated From Bank Assets And Are Not Used By Banks For Investment Operations. Unlike General Traders, We Can Provide Relevant Vouchers For Our Clients. At The Same Time, In Order To Minimize The Opportunity Of Using Foreign Exchange Trading For Money Laundering, We Do Not Accept Deposit And Withdrawal Requirements From Third Parties. The Source Of Funds Must Always Be The Same As The Name Of The Account Owner.

Main Business

AUGS Provides Mainstream As Well As Popular Trading Products On Global Financial Marekt For Investors To Choose From, Mainly Including Foreign Exchange (major Currency Pairs And Minor Currency Pairs), Precious Metals (gold, Silver), Energy, Indices And CFDs And Other Products.

Leverage & Account

The Maximum Leverage Set By AUGS Is 1:400. There Are Two Types Of Accounts: Standard Account And ECN Account.

Spreads & Handling Fees

The Main Spreads For Standard Accounts Are EUR USD 1.5, USD JPY 1.6, GBP USD 2.0, AUD USD 1.6, Gold 2.4, Silver 2.1, US Crude Oil 3. The Main Spreads For ECN Accounts Are EUR 0.3, US Japan 0.4, GBP USD 1.0, AUD 0.6, Gold 1.4, Silver 1.1, US Crude Oil 3.

Trading Platform

AUGS MT4 Provides Traders With Trading Functions And Technical Analysis Functions In Real-time Mode, A Large Number Of Technical Indicators And Curves, Self-determined Western Indicators And Scripts. The Platform Supports Trading Of A Variety Of CFD Products, And The Variety Of Products Is Constantly Increasing To Meet The Multi-faceted Needs Of Customers. The Platform Currently Has Web Version, Desktop Version, Apple And Android Mobile End Applications.

Deposit And Withdrawal Policy

Minimum Deposit Is $500. Select Bank Telegraphic Transfer Withdrawal, The Bank Will Charge A Processing Fee Ranging From $15-50, And The Bank Will Deduct It From The Withdrawal Amount. Select RMB Withdrawal, And The Exchange Rate Of RMB Will Be Calculated According To The Exchange Rate Of The Payment Gateway Company.