Corporate Profile

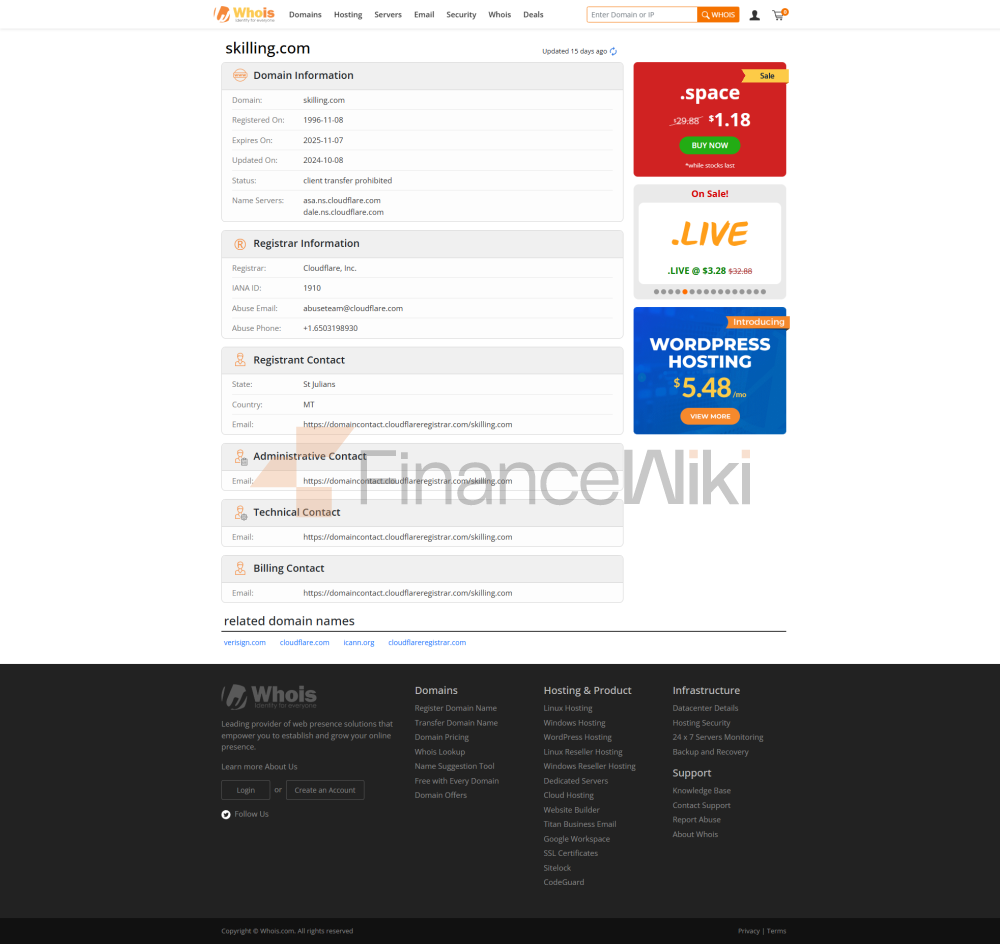

Skilling Is A Short-established But Fast-growing Fintech Company Headquartered In Nicosia, Cyprus, With Branches In The Seychelles, Spain And Malta. Founded In 2016 , The Company Aims To Provide Traders With A Rich Variety Of Trading Products And Services. It Is Committed To Providing Customers With Innovative Trading Platforms And Professional Trading Conditions To Meet The Needs Of Different Types Of Investors.

Regulatory Information

Skilling Is Regulated By The Following Regulators:

- Cyprus Securities And Exchange Commission (CySEC) : Regulation Number 357/18 .

- Seychelles Financial Services Authority (FSA) : Regulation Number SD042 .

These Regulators Ensure That Skilling Complies With Relevant Laws And Regulations In The Course Of Its Operations, Protecting The Safety Of Its Clients' Funds And Trading Interests.

Trading Products

Skilling Offers A Variety Of Trading Products, Covering The Following Categories:

- Currency Pairs : Including Major Currency Pairs (e.g. EUR/USD, GBP/USD) And Minor Currency Pairs.

- Indices : For Example, S & P 500 Index, Dow Jones Index, Etc.

- Stocks : Covers Stocks Of Globally Renowned Companies, Such As Apple, Google, Microsoft, Etc.

- Commodities : Including Gold, Silver, Crude Oil, Natural Gas, Etc.

- Cryptocurrencies : Such As Bitcoin, Ethereum, Etc.

As Of The Third Quarter Of 2023 (2023Q3) , Skilling Offers More Than 800 Financial Products , Including Currency Pairs 73 , Cryptocurrencies 50 , Indices 50 , Commodities 6 , Stocks 760 .

Trading Software

Skilling Provides The Following Trading Platforms:

- SkillingTrader : An Intuitive Trading Platform Designed For Beginners.

- CTrader : A Powerful Advanced Trading Platform For Experienced Traders.

- MetaTrader4 (MT4) : An Industry-leading Trading Platform Offering Advanced Charts And Trading Tools.

Deposit And Withdrawal Methods

Skilling Supports A Variety Of Deposit And Withdrawal Methods, Including:

- Bank Transfer : Transfer Directly From The Bank Account.

- Trustly : Fast Direct Banking.

- Electronic Wallets : Such As Skrill, Neteller, Etc.

There Is No Handling Fee For The Deposit And Withdrawal Process, And The Specific Processing Time Varies Depending On The Payment Method.

Customer Support

Skilling Provides Multi-channel Customer Support Services, Including:

- Phone Support : Dial + 357 22 276710 Or + 44 208 080 6555 .

- Email Support : Send An Email To Support@skilling.com .

- Online Chat : Visit The Official Website For Real-time Consultation.

Customer Support Service Hours Are Monday To Friday, 04:00 To 22:00 CET .

Core Business And Services

-

Account Type :

- Standard Account : Minimum Deposit $100 With Spreads As Low As 0.7 Pips .

- Premium Account : Minimum Deposit $5000 , Spread As Low As 0.1 Pip , Commission On Some Trades.

- MT4 Account : Minimum Deposit $100 , Spread As Low As 0.7 Pip .

-

Leverage Settings :

- Retail Client: Maximum Leverage 1:30 .

- Professional Clients: Maximum Leverage 1:200 .

- Premium Accounts And MT4 Premium Accounts Charge $35/million Commission On Forex And Spot Metals.

Fee Structure :

Technical Infrastructure

Skilling Using Advanced Technical Infrastructure, Including:

- High Liquidity And Low Latency Trading Platform To Ensure Fast And Stable Trade Execution.

- Powerful Risk Management Tools To Help Clients Control Trading Risks.

Compliance And Risk Control System

Skilling Strictly Comply With The Regulatory Requirements Of CySEC And FSA , Establish A Sound Risk Management System , Including:

- Fund Isolation : Separation Of Client Funds From Company Operating Funds.

- Daily Audit : Ensure Transaction Transparency And Fund Safety.

Market Positioning And Competitive Advantage

The Main Competitive Advantages Of Skilling Include:

- Diversified Product Portfolio : Covers A Variety Of Financial Instruments To Meet Different Investor Needs.

- Flexible Account Selection : Offers A Variety Of Account Types To Suit Different Trader Preferences.

- Strong Technical Support : Adopts Industry-leading Trading Platforms And Technologies.

As Of Q3 2023 , Skilling Has Established A Good Reputation In The Field Of Foreign Exchange Trading, Becoming One Of The Fast-growing Fintech Companies.

Customer Support And Empowerment

Skilling Provides Multilingual Customer Support, Covering English, Spanish, German, Chinese, French, Etc. Through The Official Website, Phone, Mail And Online Chat, Customers Can Get Professional Help At Any Time.

Social Responsibility And ESG

Although Skilling Has Not Disclosed Its ESG Policy In Detail, Its Transparent Trading Environment And Compliant Operations Reflect The Importance Of Social Responsibility.

Strategic Cooperation Ecosystem

Skilling By Providing A Variety Of Payment Methods And Trading Platforms, It Has Established Partnerships With Multiple Technology Providers And Payment Platforms To Ensure The Diversity And Reliability Of Services.

Financial Health

As A Regulated Fintech Company, Skilling Has A Stable Financial Position And Its Registered And Working Capital Meets Regulatory Requirements.

Future Roadmap

Skilling Future Plans Include Further Expansion Of Its Product Portfolio, Optimization Of Trading Platform Capabilities, And Enhanced Client Education And Community Building.

Overall, Skilling Has Emerged As An Emerging Leader In Forex Trading With Its Diverse Offerings, Strong Technical Support, And Premium Client Server.