SMC Overview

SMC Is A Financial Services Company Operating In India Since 1990. It Provides Brokerage Services For Asset Classes Such As Equities (cash And Derivatives), Commodities And Currencies, Investment Banking, Wealth Management, Distribution Of Third-party Financial Products, Research, Financing, Depository Services, Insurance Brokerage (life And Non-life), Clearing Services, Mortgage Advisory And Real Estate Advisory Services For Corporate, Institutional, High Net Worth Individuals And Other Retail Clients. The Company Emphasizes Customer Support, Offers Multiple Contact Details And Various Educational Resources That Are Beneficial To Individuals.

Regulatory Status

SMC Is Regulated By The Securities And Exchange Board Of India With Registration Number: INZ000199438. Strict Compliance With The Regulations And Laws And Regulations Of The Indian Financial Regulator Ensures Business Compliance And Safety Of Client Funds.

Advantages And Disadvantages

SMC Has Several Advantages, Including The Provision Of Comprehensive Services, Diversified Tradable Assets, Professional Customer Support And Extensive Educational Resources. The Broker Offers Multiple Trading Platforms And Download Methods, Enabling Clients To Access Them On Desktop And Android Devices. In Addition, The Company Offers Demo Trading, Making It Convenient For Clients To Strategize In A Risk-free Environment.

SERVICES

SMC Offers A Comprehensive Range Of Services For All Your Investment Needs, Including Brokerage, Distribution, Insurance Brokerage, Advisory, And Financing.

Brokerage: SMC Offers Trading Services In Equities And Derivatives, Commodities, Currencies, Storage, Clearing, Institutional Brokerage, NRI Business, And FPI Investments.

Distribution: Traders Can Access A Diverse Portfolio Selection Of Liquidity And Transparency In Mutual Funds And IPOs Through SMC's Expertise. Clients Can Also Trade A Variety Of Commodities, Including Agricultural Commodities, Precious Metals, Metals, Petroleum, Oilseeds, And Energy Products.

Insurance Brokerage: SMC Offers Life Insurance And Non-life Insurance Services.

Consulting: SMC Provides Advisory Services For Real Estate, Mortgages, Wealth Management, Portfolio Management, Investment Banking, And Foreign Exchange. They Provide Investors, Corporations, And Property Owners Of Well-known Developers With Comprehensive Real Estate Solutions, Including Residential And Commercial Properties For Investment Or Personal Use. Their Mortgage Advisory Team Assists In Financing Buy-to-let Investments And Provides Valuable Insights To Make Informed Decisions. In Addition, SMC Provides Professional Advice On Property Planning, Corporate Succession, Stock Option Planning, And Hedging Derivatives.

Financing: SMC Offers A Diverse Range Of Financial Solutions, Including Securities Loans, Agricultural Immediate Financing, Multi-purpose Loans, Margin Funding For IPOs/FPOs And NCDs, Supporting Corporate Growth, Medical Device Loans To Physicians, And Personal Loans For Salaried Individuals.

Tradable Assets

SMC Offers Three Types Of Trading Accounts: Equities (cash And Derivatives), Commodities, And Currencies.

For Those Interested In Equities And Derivatives, The SMC Team Offers Professional Guidance And Advice On Equity And Derivatives Investing, Including Futures And Options Trading And Low-risk Arbitrage Opportunities Across A Range Of Sectors.

Commodity Trading Involves Trading Various Types Of Commodities, Including Agricultural Products, Precious Metals, Metals, Petroleum, Oilseeds And Energy Products, Leveraging SMC's Expertise.

Currency Trading Is Conducted Through A Broker Or Dealer And Involves The Execution Of Trades In Currency Pairs. Currency Enthusiasts Can Simultaneously Buy One Currency And Sell Another For A Profit.

Trading Platform

SMC's Online Trading Platform Offers The Convenience Of Trading Using Any Device, Including Mobile Phones, Tablets Or Desktop Computers.

SMC Easy Trade - Is An Easy-to-use Online Trading Platform For Desktop, Mobile And Tablet Computers, Helping Investors And Traders To Buy And Sell Stocks And View Back Office Reports Seamlessly.

SMC Easy Go Is A Mobile Application Where You Can View Back Office Reports And Market Information With A Few Clicks.

SMC Also Provides A Powerful Desktop App-based Trading Platform, Calling Ed SMC Privilege, For Clients Who Are Actively Involved In The Stock Market And Do A Lot Of Day Trading.

Customer Support

SMC Provides A Variety Of Contact Methods To Meet The Needs Of Different Customers:

Telephone Consultation: You Can Call + 91-11-6607 5200

Office Address: SMC Global Securities Ltd, 11/6B, Shanti Chamber, Pusa Road, Delhi-110005.

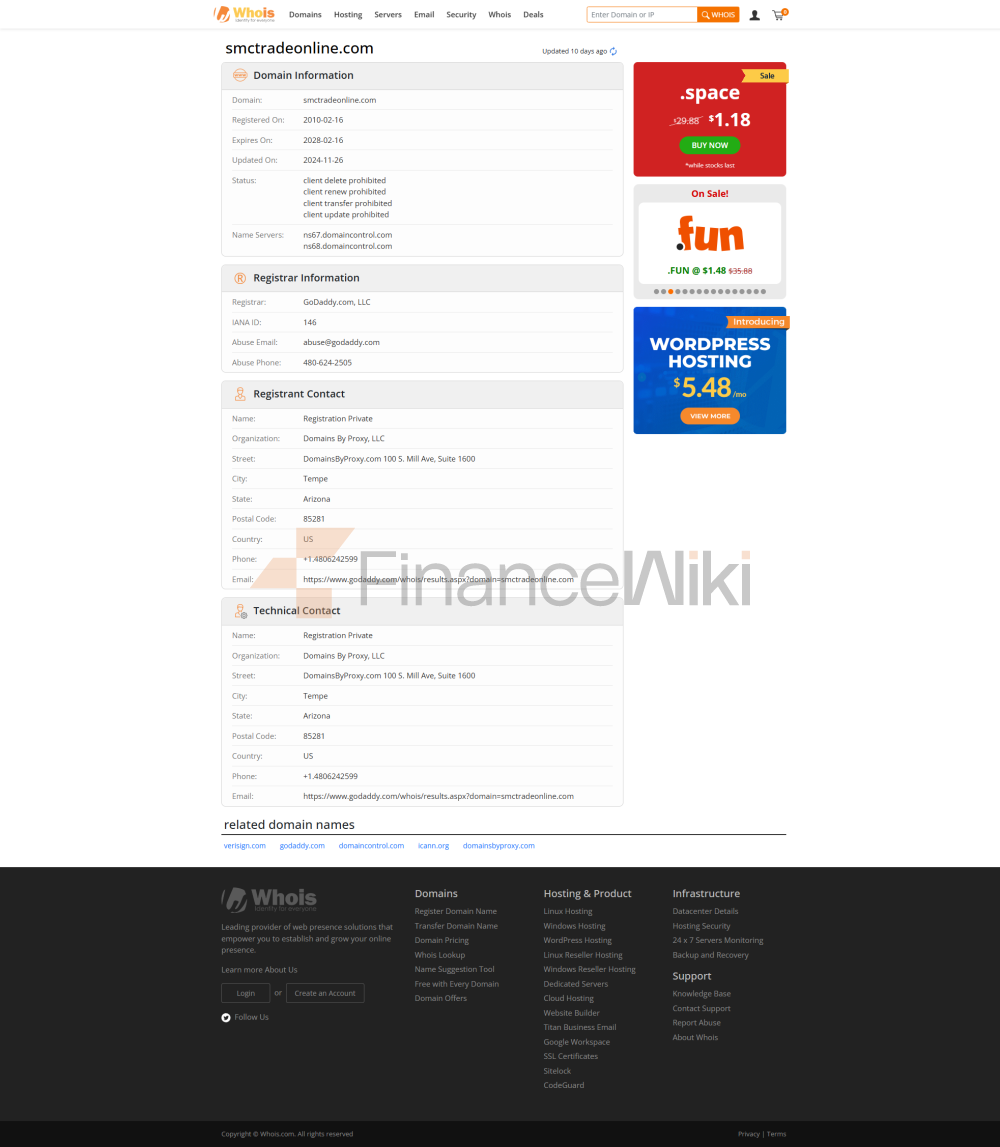

Email: Customers Can Contact SMC Via Email At Smc.care@smctradeonline.com.

Frequently Asked Questions: If You Have Questions And Are Looking For Quick Answers, SMC's Website Provides A Comprehensive List Of Frequently Asked Questions (FAQs) Where You Can Find A Lot Of Useful Information.

FAX: You Can Also Contact The Company By Fax At + 91-11-2575 4365.

SMS: You Can Contact SMC By Sending SMS "SMC HELP" To 56677.

SOCIAL MEDIA: You Are Welcome To Follow SMC On Social Media Platforms Such As Facebook, Twitter And Instagram.

EDUCATION RESOURCES

SMC Offers Traders A Wealth Of Educational Resources Including Webinars, News Updates, Research & Analysis, And Blogs.

Webinars: Hosted By Experts, These Live Sessions Cover Trading Tips, Market Trends, Financial Product Selection, And Long-term Investment Strategies.

News: SMC Provides The Latest Updates On The Economy, Corporations, Stocks, Commodities, Currencies, IPOs, And Insurance To Help Traders Make Informed Decisions.

Research & Analysis: SMC's Research Team Uses The EIC Methodology To Provide Comprehensive Fundamental Research Reports For Over 100 Stocks, Including Investment Summaries, Valuations, And Buy/sell Recommendations.

Blog: Traders Can Access Educational Content In The Form Of A Blog That Provides Basic Information In A Lively And Interesting Way

In Summary, SMC Offers Comprehensive Financial Services, Diverse Assets, Professional Customer Support, Extensive Educational Resources, Multiple Trading Platforms, And Simulated Trading.

However, This Broker Lacks Regulation And Has Limited Detailed Information On Leverage, Minimum Deposits, And Deposit And Withdrawal Methods. Traders Should Carefully Consider These Factors When Deciding To Trade With SMC To Ensure A Safe And Informed Trading Experience.