Corporate Profile

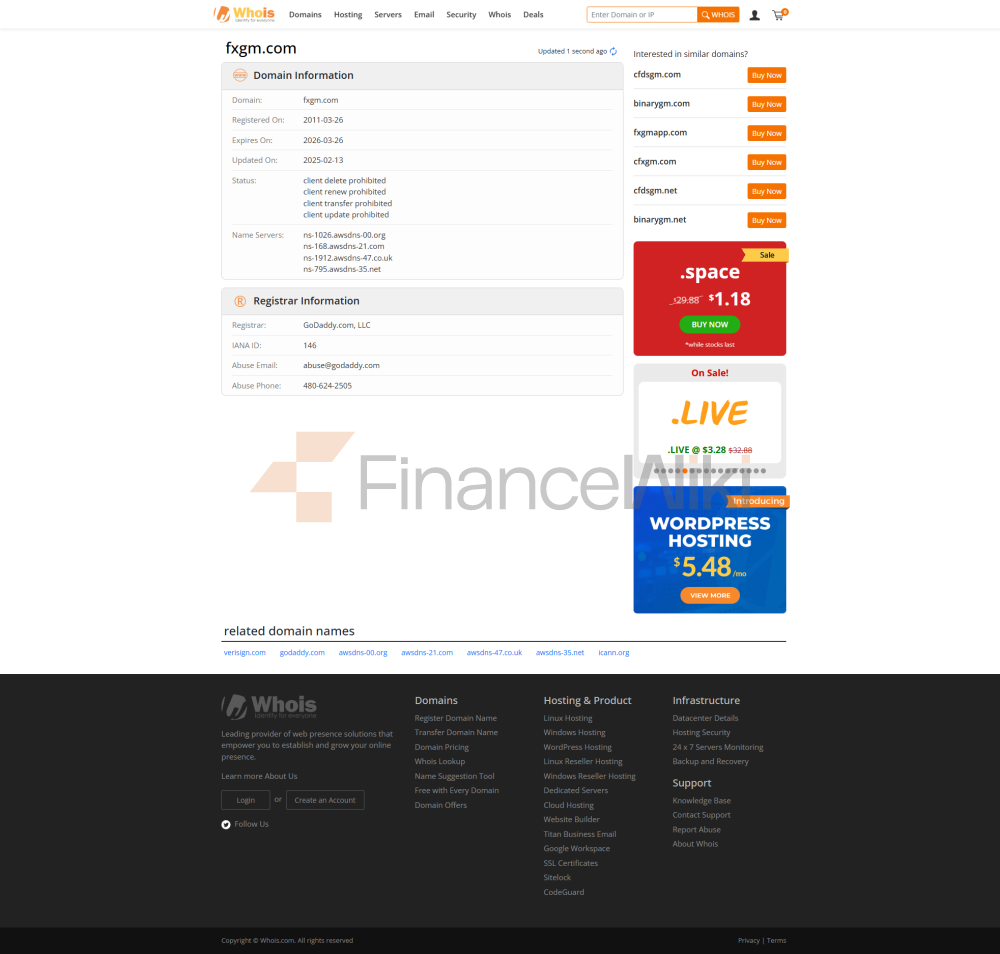

FXGM (Depaho Ltd) Is A Global Online Financial Services Provider That Specializes In Providing Retail And Professional Clients With Contracts For Difference (CFDs) Trading Services For Financial Products Such As Foreign Exchange, Commodities, Stocks, Etc. The Company Was Established In 2011 And Is Headquartered In Limassol, Cyprus With Registered Capital Of 5 Million EUR . FXGM Ensures That Its Business Meets The Highest Industry Standards And Compliance Requirements Through The Licenses It Holds From A Range Of Global Regulators.

Regulatory Information

FXGM Is Authorized And Supervised By A Number Of International Authorities, Including:

- Cyprus Securities And Exchange Commission (CySEC) : Full License (License Number: 161/11)

- German Federal Financial Supervisory Authority (BaFin) : Retail Foreign Exchange License (License Number: 130520)

- French Prudential Regulation Authority (BDF) : Retail Foreign Exchange License

- UK Financial Conduct Authority (FCA) : European Union Authorized License (License Number) : 593528)

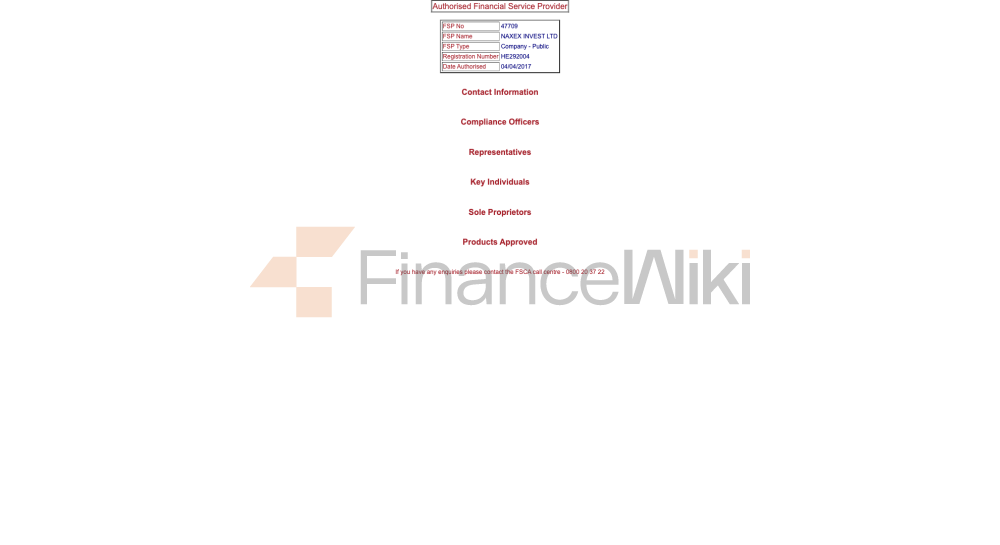

- South African Financial Supervisory Authority (FSCA) : Financial Services Enterprise License (License Number: 47709) Spanish National Securities Market Commission (CNMV) : Retail Forex License (License Number: 3321)

- Italian Securities And Exchange Commission (CONSOB) : Retail Forex License (License Number: 3567)

These Licenses Ensure That FXGM's Trading Activities And Client Funds Are Legally Protected.

Trading Products

FXGM Offers A Wide Range Of Trading Assets Covering A Wide Range Of Market Categories:

- Forex Currency Pairs (Forex) : Including Major Currency Pairs (e.g. EUR/USD, GBP/USD) And Emerging Market Currencies Commodities : Such As Gold, Silver, Crude Oil (WTI And Brent), Natural Gas, Etc. Precious Metals : Gold, Silver

- Indices : Such As S & P 500, Dow Jones, NASDAQ, FTSE 100, German DAX, Etc.

- Exchange Traded Funds (ETFs) : Such As SPY, QQQ, Etc.

- Cryptocurrencies : Bitcoin (BTC/USD), Ethereum (ETH/USD), Etc.

- Stocks : Such As Apple, Amazon, Google, Meta, Etc.

Trading Software

FXGM Provides The Following Trading Software:

- WebProfit : A Web-based Trading Platform That Is Compatible With All Major Browsers (e.g. Chrome, Firefox, IE, Etc.), Supports Forex, Commodities And CFDs Trading Without Downloading.

- MobileProfit : Designed For Mobile Devices, It Supports Access To The WebProfit Platform Through Mobile Phones And Tablets, Making It Easy For Traders To Trade Anytime, Anywhere.

Deposit And Withdrawal Methods

FXGM Supports Multiple Deposit And Withdrawal Methods, Ensuring That Traders' Funds Can Enter And Exit Their Accounts Quickly And Securely:

- Payment Cards: VISA, MasterCard, Maestro

- Electronic Wallets: Skrill, Neteller, PayPal

- Bank Transfers: Telegraphic Transfer, RAPID Transfer, MyBank

Customer Support

FXGM Provides Customers With Multi-language Support, Including English, Chinese, Arabic, And More. Clients Can Get Help In The Following Ways:

- Live Chat : Communicate With The Customer Support Team In Real Time

- Email : Submit Questions Via Designated Email

- Telephone Support : 24/7 Telephone Support In Some Regions

Core Business And Services

FXGM's Core Business Is To Provide Highly Liquid CFD Trading Services, Covering Foreign Exchange, Commodities, Stocks And Other Markets. Its Differentiating Advantages Are:

- Rich Trading Varieties : Supports More Than 100 Trading Assets

- Flexible Leverage Options : Depending On The Account Type (retail Account Or Professional Account), Different Leverage Ratios From 1:5 To 1:200

- Multilingual Support : Meet The Needs Of Customers In Different Regions

Technical Infrastructure

FXGM's Technical Infrastructure Is Developed And Maintained By Its Parent Company Depaho Ltd, Using Advanced Server And Network Technology To Ensure The Stability And Low Performance Of The Trading Platform Delay. The Performance And User Experience Of Its Trading Platform Is Leading The Way In Congeneric Products.

Compliance And Risk Control System

FXGM Strictly Follows International Financial Regulatory Requirements And Implements A Comprehensive Risk Management System:

- Customer Funds Isolation : Customer Funds Are Stored In Separate Bank Accounts, Separate From Company Working Funds

- Risk Management Tools : Provide Tools Such As Stop Loss, Take Profit, Limit Orders, Etc., To Help Customers Control Trading Risks

- Market Monitoring : Monitor Market Fluctuations In Real Time To Ensure Transparency And Fairness Of Trading Activities

Market Positioning And Competitive Advantage

FXGM's Market Positioning Is To Provide A Safe, Transparent And Efficient Trading Environment For Global Retail And Professional Customers. Its Competitive Advantage Is:

- Multi-regulatory Authorization : Supervised By Major Global Financial Regulators To Ensure Compliance And Safety Of Funds

- Innovative Trading Platform : Provides User-friendly WebProfit And MobileProfit Platforms

- Rich Trading Varieties : Covering Multiple Market Categories To Meet The Investment Needs Of Different Clients

Customer Support And Empowerment

FXGM Is Committed To Providing Customers With A High-quality Trading Experience. In Addition To Basic Trading Support, It Also Provides The Following Services:

- Educational Resources : Free Trading Education And Market Analysis Through Website And Social Media

- Market Analysis Tools : Includes Real-time Charts, Technical Indicators And Market News

Social Responsibility And ESG

FXGM Is Actively Involved In Social Causes And Supports Education, Environmental Protection And Community Development Projects. Its Corporate Social Responsibility (CSR) Programs Include:

- Educational Support : Educational Resources For Children In Underdeveloped Regions

- Environmental Protection : Support Sustainable Development Projects To Reduce Carbon Emissions

Strategic Cooperation Ecology

FXGM Has Established Strategic Partnerships With Several International Financial Institution Groups And Technology Companies To Further Enhance Its Technological And Market Competitiveness. These Areas Of Collaboration Include:

- Payment Solutions : Collaborating With Leading Global Payment Platforms To Optimize Deposit And Withdrawal Processes

- Data Analytics : Introducing AI And Big Data Technologies To Enhance Market Forecasting

Financial Health

As Of Q3 2023 , FXGM's Financial Position Is Solid, With A Capital Adequacy Ratio Higher Than The Industry Average. The Financial Report Of Its Parent Company Depaho Ltd Also Shows Healthy Profitability And Growth Potential.

Future Roadmap

FXGM's Future Development Plans Include:

- Product Innovation : Launch More Emerging Market Products, Such As Digital Assets And Green Energy Related CFD

- Technology Upgrade : Further Optimize The Performance And User Experience Of The Trading Platform

- Market Expansion : Expand Business In Asia, Middle East And Africa To Attract More Global Customers