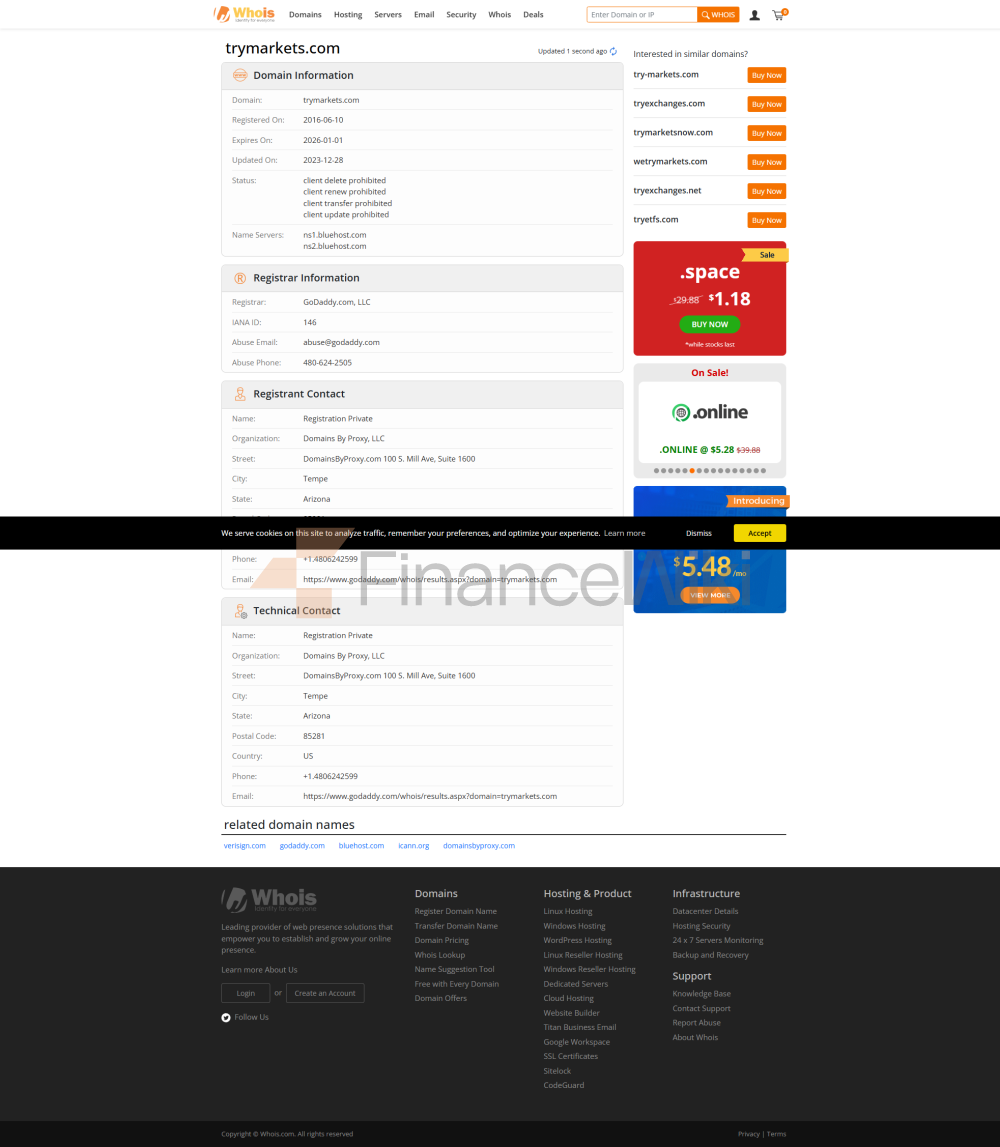

The Official Website Of TryMarkets Is Temporarily Unavailable For Unknown Reasons, So We Can Only Gather Some Relevant Information For Reference Only.

RyMarkets Is The Brand Name Of Capital Market Solutions Inc., Which Was Established In 2005. The Brokerage Is Registered And Regulated In Belize, But All Payments Are Processed By CMS Global Ltd, Which Is Registered And Regulated In Cyprus. At First Glance, TryMarkets Promises A Lot After Their Website's Slow Loading Times. The First Thing That Bothers Us In This TryMarkets Review Is That Anyone Who Takes A Moment To Delve Into The Site Will Be Confused. For Example, On The Home Page, The Broker Claims To Offer Leverage Up To 1:500 And Spreads Starting From 0.1 Pips, True ECN Pricing, No Trading Desks And STP Execution, And Deep Liquidity. On Closer Inspection, TryMarkets Appears To Be A Market Maker That Only Offers An MT4 Trading Platform, With An Average Spread Of 0.9 Pips For EUR/USD And Leverage Of 1:100.

Account Types

TryMarkets Offers Three Different Account Types. The Minimum Deposit For A Standard Account Is $500 And The Maximum Leverage Is 1:500. Professional Accounts Have A Minimum Deposit Of $5,000 And A Maximum Leverage Of 1:400, While Prime Accounts Require A Minimum Deposit Of $20,000 And A Maximum Leverage Of 1:100. All Accounts Make Margin Calls At 100%, With Mandatory Position Squaring At 30%.

Prime Accounts Are Listed As The Only Accounts To Which Swap Rates Apply, And TryMarkets Also Charges Commissions. This Commission Structure Is Still Unknown And Is Not Listed Under Their Spreads And Conditions Page, Where All Spreads Appear To Apply To Prime Accounts, As The Leverage Listed Is 1:100, But Spreads On Their Standard Accounts Start At 0.9 Pips, Corresponding To Those Listed Under EUR/USD. The Contradiction Is Not The Transparency TryMarkets Claims, But The Misinformation Campaigns Or False Advertising Expected By Unregulated, Unlicensed Brokers.

What Can Be Traded

TryMarkets Offers A Choice Of Multiple Currency Pairs, With Only CFDs On Gold And Silver And Oil, Gas And Copper. The Broker Was Unable To Diversify Its Assets And The Spread Was Much Lower Than The 0.9 Pip Advertised For EUR/USD Starting At 0.0 Pips. TryMarkets Claims That The Swap Rate Is Only Available For Prime Accounts With A Starting Deposit Of $20,000. This Is Another Red Flag And Very Unusual Market Practice, Given That Other Red Flags Indicate That This Broker Is Not Allowed To Trade; Clients Are Exposed To A Closed Virtual Trading Environment. This Also Explains The High Minimum Deposit Amount For Prime Accounts.

Forex, Gold And Silver Contract Specifications

Fees

TryMarkets Appears To Have Three Sources Of Income: Spreads, Swaps, And Losses For Traders Acting As Counterparties. After All The Inconsistencies We Found, We Wouldn't Be Surprised If This Broker Made Traders Deposits As Their Income. The MT4 Trading Platform May Show The Value Of Deposits And Clients Can Make Trades, But That Could Be The End Of It. Given The High Failure Rate Of Retail Traders, It's Easy To Gloss Over This Practice And Look Like A Functioning Forex Broker. No Other Information About Fees Can Be Found On Their Website, The FAQ Section Is Empty, And The Live Chat Is Always Offline. The Red Flags Continue.

Trading Platform

TryMarkets Offers A Full Range Of MT4 Trading Platforms, Including Desktop, Android, IPad And IPhone, Web, And The MT4 Multi-end Point Commonly Used By PAMM Managers. MT4 Is The Most Popular Trading Platform, Offering Brokers A Low-cost Way To Connect Traders With The Market.