Corporate Profile

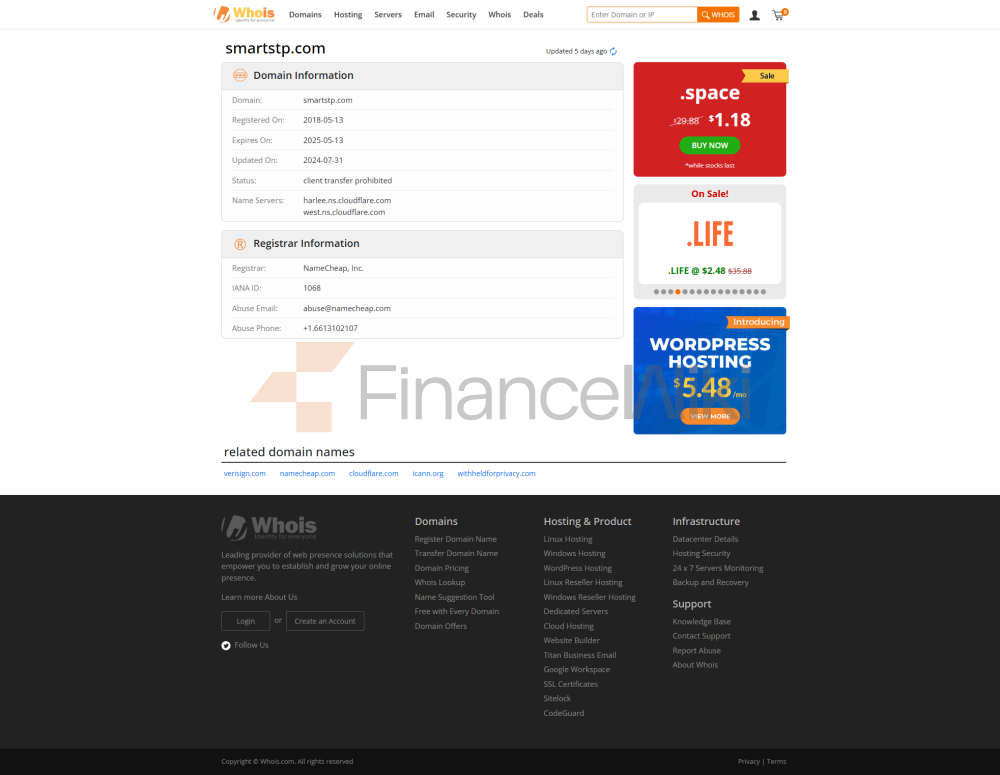

SmartSTP Is A Brokerage Firm Established In 2018 And Currently Operating In 15 Countries. The Company Is Committed To Providing Clients With A Comprehensive Range Of Trading Products Including Commodities, Forex, Indices, Stocks, Metals And Cryptocurrencies. SmartSTP Has A Minimum Deposit Requirement Of 250 Dollars And Offers Three Tiered Accounts (Silver, Gold And Platinum), Each With An Islamic Account Option. In Addition, The Company Uses The "SmartSTP WebTrader" Platform, Which Provides Clients With Basic Web Trading Functions.

Regulatory Information SmartSTP Is Currently In A State Of No Effective Regulation, Which Means That Its Activities Are Not Overseen By The Government Or The Financial Institution Group. This Situation May Have An Impact On The Security Of Client Funds And The Transparency Of Trading.

Trading Product SmartSTP Offers A Variety Of Trading Instruments, Including Commodity Contracts For Difference (CFDs), Forex, Indices, Stocks, Metals And Cryptocurrencies. Among Them, A CFD Is A Financial Instrument That Allows Traders To Trade Without Actually Holding The Underlying Asset.

Trading Software SmartSTP Uses The "SmartSTP WebTrader" Platform, Which Supports Browser Access On PC And Mobile Devices. The Platform Is Suitable For Investors Of Different Experience Levels.

Methods Of Deposit And Withdrawal SmartSTP Accepts A Variety Of Payment Methods, Including Credit Cards, Debit Cards, SEPA Telegraphic Transfer And S Wallet Import Grid T Telegraphic Transfer. The Minimum Deposit Amount Is 250 Dollars. There Is No Minimum Withdrawal Amount Requirement Except For Telegraphic Transfer. The Minimum Withdrawal Amount For Telegraphic Transfer Is 50 Dollars.

Customer Support Customers Can Contact SmartSTP's Customer Support Team By Email. The Specific Contact Details Are Not Mentioned In The Information Provided.

Core Business & Services SmartSTP's Core Business Includes The Provision Of Diversified Trading Products, Tiered Account Structures (silver, Gold, Platinum Accounts), And Islamic Account Options. In Addition, The Company Caters To The Needs Of Different Traders With Differentiated Leverage Ratios (up To 1:200) And Spread Discounts (25% Or 50%).

Technical Infrastructure SmartSTP's Trading Platform, "SmartSTP WebTrader", Relies On Web Browser Access And Makes No Mention Of Its Specific Technical Support, Server Security Or Other Infrastructure Details.

Compliance And Risk Control System Although SmartSTP Is Not Regulated, The Company Emphasizes Its Adherence To Internal Compliance Statements And Segregation Of Funds To Ensure The Safety Of Client Assets. No Mention Of Specific Risk Management System.

Market Positioning And Competitive Advantage SmartSTP Addresses The Needs Of Specific Customer Groups By Providing Tiered Accounts, Islamic Accounts And Segregation Of Funds. However, Lack Of Regulation May Be Seen As Its Major Disadvantage.

Customer Support And Empowerment SmartSTP Does Not Explicitly Provide Additional Customer Support Resources Such As Educational Materials Or Training, But Empowers Traders At Different Levels Through Differentiated Account Structures And Trading Tools.

Social Responsibility And ESG Does Not Mention Specific Actions Or Statements By SmartSTP Regarding Social Responsibility Or ESG (Environmental, Social And Corporate Governance).

Strategic Cooperation Ecosystem Does Not Mention SmartSTP's Strategic Partners Or Ecosystems. It May Expand Its Service Scope And Market Influence Through Cooperation In The Future.

Financial Health Does Not Provide SmartSTP's Financial Health Data Such As Capital Adequacy Or Profitability. It May Enhance Its Transparency Through Financial Disclosures In The Future.

Future Roadmap SmartSTP May Plan To Expand Its Product Line, Enhance Trading Platform Functionality, Or Seek Regulatory Cooperation In The Future To Enhance Its Market Competitiveness And Customer Trust.