Corporate Profile

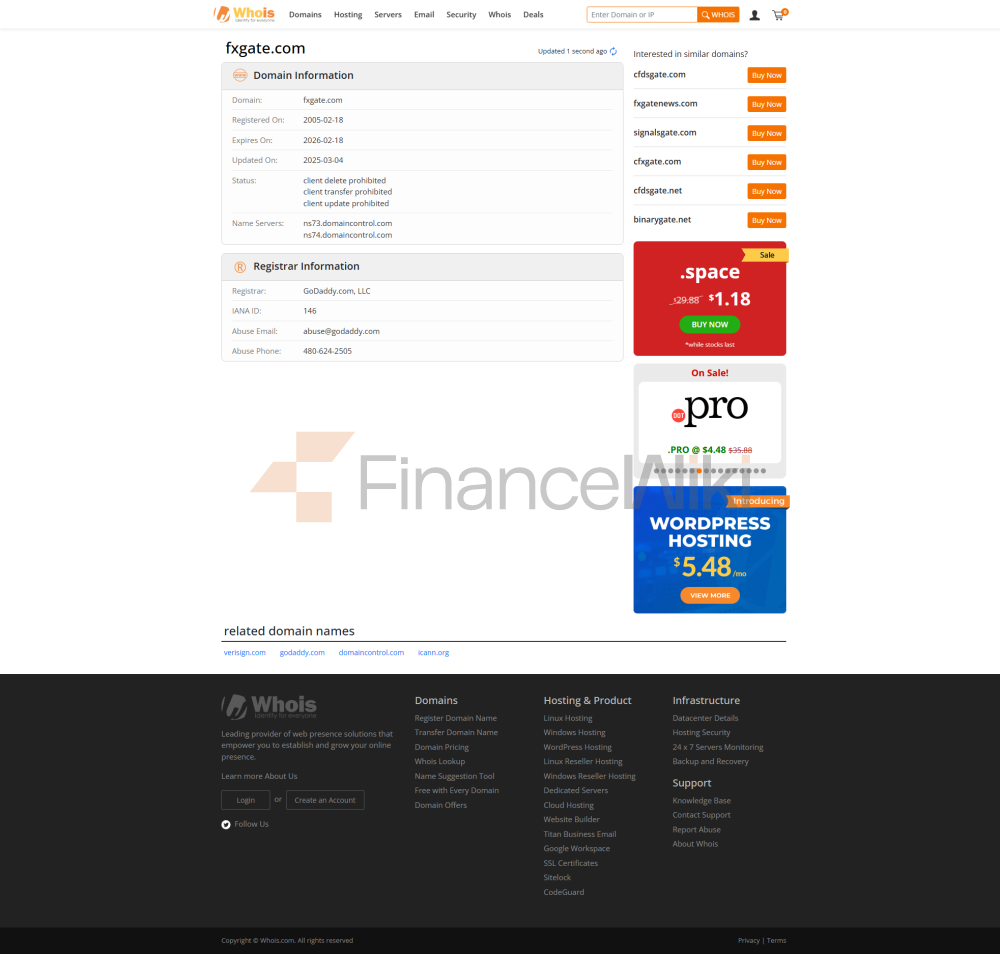

FXGate, Full Name FXGate Ltd., Was Established In 2005 And Is Headquartered In Labuan Financial Centre, Malaysia. As A Regulated Forex Broker, FXGate Offers Clients A Diverse Range Of Financial Products And Services, Including Forex, Commodities, Metals And Energy, Among Others. Its Registered Capital Is 5 Million MYR And Holds A Straight-through Processing (STP) License (License No.: MB/19/0031) Issued By Labuan Financial Services Authority (LFSA).

The Company's Executive Team Consists Of Experienced Industry Experts Covering Areas Such As Trading, Technology, Compliance And Risk Management. FXGate Ensures That Its Operations Comply With International Financial Regulatory Standards Through A Rigorous Corporate Structure And Compliance Statement.

Regulatory Information

FXGate Is Regulated By The Labuan Financial Services Authority (LFSA) In Malaysia, One Of The World's Leading Financial Regulators To Protect Investor Interests And Ensure The Transparency And Stability Of Financial Marekts.

- License Type : Straight-Through Processing (STP)

- License Number : MB/19/0031 Regulatory Advantages : The Regulation Of The LFSA Ensures That FXGate Operates In Transparency, Compliance, And Provides High Security Of Funds.

FXGate Directly Connects Traders With Liquidity Providers Through The STP Model, Reducing Human Intervention And Thus Increasing The Speed And Accuracy Of Trade Execution.

Trading Products

FXGate Offers A Diverse Range Of Financial Products To Meet The Needs Of Different Traders:

- Forex : Offers More Than 50 Foreign Exchange Pairs , Covering Major Currency Pairs (e.g. EUR/USD, GBP/USD) And Minor Currency Pairs (e.g. USD/JPY, AUD/USD).

- Commodities : Including Gold (XAU/USD), Silver (XAG/USD), Crude Oil (Crude Oil) And Natural Gas, Etc.

- Metals : Offers Trading On Gold And Silver.

All Trading Products Are Conducted Through The MetaTrader 4 (MT4) Platform, Which Supports Real-time Market Data And Efficient Trade Execution.

Trading Software

FXGate Primarily Uses MetaTrader 4 (MT4) As Its Core Trading Platform. MT4 Is Known For Its Powerful Technical Analysis Tools, Diverse Chart Types And Automated Trading Capabilities.

- Features :

- Supports Multiple Timeframes (from 1 Minute To 1 Month)

- Provides Over 50 Technical Indicators And Charting Tools

- Allows Users To Customize Strategies And Automate Trading (via Expert Advisor EAs)

- Supports Order Types (e.g. Market Order, Limit Order, Stop Loss Order)

In Addition, FXGate Also Offers A Mobile Trading Platform That Allows Traders To Trade Anytime, Anywhere.

Deposit And Withdrawal Methods

FXGate Offers Traders A Variety Of Flexible Deposit And Withdrawal Methods:

- Deposit Methods : Accept Bank Transfers, Credit/debit Cards And E-wallets (e.g. Skrill, Neteller).

- Minimum Deposit : $100 , Relatively Low, Suitable For Beginners And Small-scale Investors.

- Withdrawal : Traders Can Withdraw Funds Via Bank Transfer Or E-wallet, And The Withdrawal Time Is Usually 1-2 Business Days.

All Transactions Are Subject To Strict Anti-Money Laundering (AML) And Counter-Terrorism Financing (CTF) Policies.

Customer Support

FXGate Places A High Value On Customer Experience And Offers Multiple Customer Support Channels:

- Phone Support : + 852 + 971 4 430 6868

- Email Support : Support@fxgate.com

- Multilingual Online Chat : Support 24/5 Customer Support In Multiple Languages Such As English And Chinese.

The Customer Support Team Is Able To Respond Quickly And Solve Problems Encountered By Traders During The Trading Process.

Core Business And Services

FXGate's Core Business Includes Foreign Exchange Brokerage, Commodity Trading And Related Financial Services. Its Differentiating Advantages Are:

- High Leverage : Provides Leverage Up To 1:100 To Help Traders Scale Up Their Trades.

- Low Spreads : Spreads Start From 1.8 Pips For Standard Accounts And Lower For ECN Accounts (from 1.2 Pips).

- Flexible Account Types : Standard, Premium And Platinum Accounts Are Available To Meet The Funding And Risk Management Needs Of Different Traders.

Technical Infrastructure

FXGate's Trading System Is Based On The MT4 Platform And Uses The STP Model To Ensure That Traders Are Directly Connected To Liquidity Providers And Avoid Trading Intervention. In Addition, FXGate Ensures The Stability And Security Of The Trading System Through Redundant Servers And A Highly Available Network.

Compliance And Risk Control System

FXGate Ensures Its Compliance And Risk Management Capabilities Through The Following Measures:

- Compliance Statement : Strict Compliance With LFSA Regulatory Requirements To Ensure Transparent And Fair Operations.

- Risk Management : Provides Multiple Risk Management Tools (e.g. Stop Loss Orders, Position Limits) To Help Traders Control Risk.

- Anti-Money Laundering (AML) : Adopts A Strict Customer Identity Verification (KYC) Process To Ensure The Legitimacy Of All Trading Activities.

Market Positioning And Competitive Advantage

FXGate Stands Out In The Forex Market With The Following Characteristics:

- High Transparency : Ensures A Fair Trading Environment For Traders Through STP Mode And Real-time Market Data. Low Threshold : The Minimum Deposit Of $100 Makes It Ideal For Beginners.

- Diversified Products : Covering Multiple Types Of Financial Products Such As Forex, Commodities And Metals, To Meet The Needs Of Different Traders.

Customer Support And Empower

FXGate Not Only Provides Basic Trading Services, But Also Empowers Traders In The Following Ways:

- Demo Account : Offers Demo Trading Accounts To Help Beginners Practice Their Trading Skills In A Virtual Environment.

- Educational Resources : Provides Basic Trading And Market Analysis Educational Resources To Help Traders Improve Their Skills.

Social Responsibility And ESG

FXGate Fulfills Its Social Responsibility By Supporting Financial Education And Combating Financial Crime. In Addition, The Company Actively Participates In ESG (environmental, Social And Governance) Initiatives To Promote Sustainable Development.

Strategic Cooperation Ecology

FXGate Has Established Strategic Partnerships With Several Well-known Financial Institution Groups And Payment Service Providers To Optimize Its Trading Systems And Customer Support Services.

Financial Health

As Of 2023, FXGate Has A Sound Financial Position With A Capital Adequacy Ratio Of 12.5% , Which Is Well Above The Industry Average. This Indicates Its Strong Risk Resistance And Potential For Continued Growth.

Future Roadmap

FXGate Plans To Further Expand Its Financial Product Line And Enhance Its Technology Infrastructure In The Coming Years To Meet The Needs Of Global Traders. The Company Also Plans To Strengthen Its Presence In The Asia Pacific Market By Launching Localized Services And Language Support To Attract More Traders.

Through The Above Introduction, You Can Fully Understand The Core Advantages And Operating Model Of FXGate. As A Regulated Professional Broker, FXGate Provides A Safe, Transparent And Efficient Trading Environment For Global Traders.