Corporate Profile

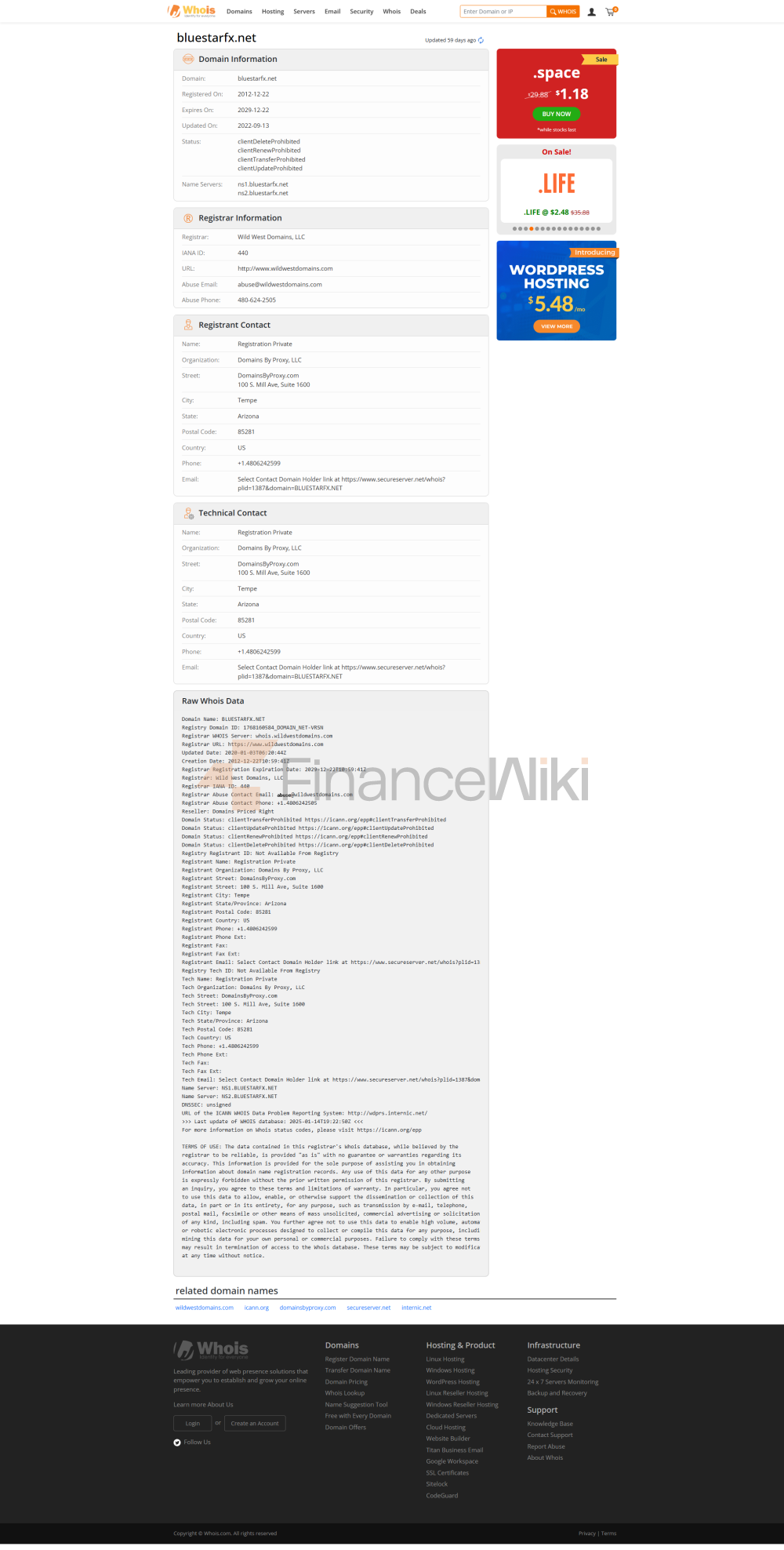

BlueStarFX (full Name: BLUESTAR EQUITY GROUP LIMITED ) Was Established In 2013 And Is Headquartered In USA . The Broker Primarily Serves The Forex And Contracts For Difference (CFD) Markets, Targeting Retail Traders, Institutional Traders, And Expert Advisors (EAs) Users . BlueStarFX Offers Three Account Types: Floating Spread Account, ECN Professional Account, And Demo Account To Meet The Needs Of Different Traders.

Regulatory Information

BlueStarFX Is Not Formally Regulated In The Forex And CFD Brokerage Markets . This Situation May Have An Impact On Traders' Funds Security And Dispute Resolution Mechanisms. The Unregulated Status Means That BlueStarFX Is Not Required To Follow Strict Financial Regulations In Certain Countries, But It May Also Lead To Potential Risks Such As Inadequate Funds Protection And Lack Of Transparency.

Trading Products

BlueStarFX's Core Trading Products Are Forex And CFD. The Foreign Exchange Market It Provides Mainly Covers Major Currency Pairs (such As EUR/USD, GBP/USD, Etc.) And Minor Currency Pairs (such As USD/JPY, AUD/USD, Etc.) . CFD Trading Includes Indices, Commodities And Stocks . However, Detailed Information On Specific Trading Instruments Is Limited In Public Information.

Trading Software

BlueStarFX Supports Two Trading Platforms, MetaTrader 4 (MT4) And MetaTrader 5 (MT5) . These Two Software Are Widely Popular With Traders For Their Powerful, User-friendly And Automated Trading Capabilities. MT4 And MT5 Are Cross-platform And Support Windows, IOS And Android Devices To Meet Diverse Trading Needs.

Deposit And Withdrawal Methods

BlueStarFX Offers A Variety Of Deposit And Withdrawal Methods, Including:

- Bank Transfer : Supports International And Local Bank Transfers.

- Electronic Payments : Such As PayPal And Skrill .

- Telegraphic Transfer : Suitable For Large-amount Funds Transactions.

Broker Emphasizes Its Efficient Withdrawal Process And Claims That There Are No Withdrawal Amount Limits Or Time Limits. However, The Specific Withdrawal Time And Arrival Speed Are Not Clearly Stated In The Public Information.

Customer Support

BlueStarFX's Customer Support Team Provides The Following Contact Details:

- Email : Customerservice@bluestarfx.net Telephone : + 678 25965

- Office Address : Kumur Road Legal Partners Building, Port Vila, Vanuatu, Ephat Island Village/Island.

Client Server Hours Are Monday To Friday 9:00am - 5:00pm (PST) And 24/7 Support Is Not Available. While The Team Is Dedicated During Working Hours, The Lack Of 24/7 Service Can Be Inconvenient For Some Traders.

Core Business And Services

BlueStarFX's Core Business Is Focused On Its Three Account Types:

-

Floating Spread Account :

- Minimum Deposit : 500 Dollars

- Leverage : Up To 1:500

- Spread : Minimum 0.1 Pip

- Suitable For Traders Seeking Flexibility And Competitive Conditions.

-

ECN Professional Account :

- Minimum Deposit : 1000 Dollars

- Leverage : Up To 1:1000

- Spread : Starting At 0.02 Pips

- Commission : 10 Dollars Per Lot

- Suitable For Experienced Traders And Institutional Clients, Especially Expert Advisor Users.

-

Demo Account :

- Provides A Real Trading Environment With Support For ECNs And Variable Spreads.

- Suitable For Beginners To Test Strategies Without Financial Exposure.

Technical Infrastructure

BlueStarFX's Technical Infrastructure Is Based On The MetaTrader Platform , Which Is Known For Its Power And Flexibility. MT4 And MT5 Support Advanced Charting Functions, Technical Indicators And Automated Trading To Meet The Individual Needs Of Different Traders. However, Specific Information On BlueStarFX's Technical Support And Server Stability Is Limited In Public Filings.

Compliance And Risk Control System

Although BlueStarFX Is Not Formally Regulated, Its Compliance And Risk Control System Still Needs Attention. According To Broker, Its ECN Pro Account Offers Ultra-low Spreads And High Leverage, But The Lack Of Transparency In Swap Rates And Fees May Have An Impact On Transaction Costs. In Addition, The Absence Of A Regulatory Status May Lead To The Absence Of A Dispute Resolution Mechanism, And Traders Need To Carefully Evaluate Latent Risk.

Market Positioning And Competitive Advantage

BlueStarFX's Main Advantage In The Market Is Its Diverse Account Selection And High Leverage (up To 1:1000 For ECN Pro Accounts). The Extensive Use Of The MT4 And MT5 Platforms Has Also Attracted A Large Number Of Traders For It. However, Its Unregulated Status And Lack Of Educational Materials Pose Challenges To The Attractiveness Of Novice And Institutional Traders.

Customer Support And Empowerment

BlueStarFX's Customer Support Is Provided Via Email And Phone, And While Dedicated During Working Hours, It Lacks 24/7 Service. In Addition, Broker Does Not Provide Educational Materials Or Training Resources, Which May Adversely Affect The Growth Of Novice Traders.

Social Responsibility And ESG

Regarding BlueStarFX's Social Responsibility And ESG Practices, No Relevant Details Are Provided In The Public Materials. To Evaluate Its Performance In Environmental Protection, Social Responsibility And Corporate Governance, Further Inquiries Are Required.

Strategic Cooperation Ecology

BlueStarFX Has Not Clearly Announced Its Significant Strategic Partnerships. However, The Payment Methods It Supports (such As PayPal And Skrill) Indicate That It Has Established Connections With Technology Partners.

Financial Health

The Financial Health Of BlueStarFX Has Not Been Clearly Demonstrated In The Public Information. As An Unregulated Broker, Its Financial Condition May Have An Impact On Its Long-term Operational Ability And The Safety Of Client Funds.

Future Roadmap

The Future Roadmap Of BlueStarFX Has Not Been Clearly Announced. However, Its Commitment To Providing Diverse Account Options And Technical Support Indicates That It May Plan To Further Expand The Scope Of Services And Optimize Existing Products.

Conclusion : BlueStarFX, As An Unregulated Forex And CFD Broker, Offers A Diverse Range Of Trading Accounts And Popular Trading Platforms. However, Its Unregulated Status And Lack Of Transparency In Its Fee Structure Pose Latent Risks That Traders Need To Evaluate Carefully.

Note: The Above Is For Informational Purposes Only And Does Not Constitute Investment Advice. Traders Should Evaluate Their Own Risks And Choose The Appropriate Broker.