Corporate Profile

Since Its Inception In 2017, Emporium Capital Has Rapidly Grown Into A Trusted Online Trading Platform, Recognized For Its Operation Under The Supervision Of The Cyprus Securities And Exchange Commission (CySEC). Headquartered In Cyprus, The Company Focuses On Providing A Diverse Range Of Financial Services And Instruments To Traders Around The World. Emporium Capital's Core Strength Lies In Its Wide Range Of Trading Products, Advanced Trading Platform (MetaTrader 5), And Flexible Account Type Selection, Able To Meet The Diverse Needs Of Traders From Novice To Veteran. As Of 2023Q3, Emporium Capital Has Provided An Exceptional Trading Experience To Tens Of Thousands Of Traders.

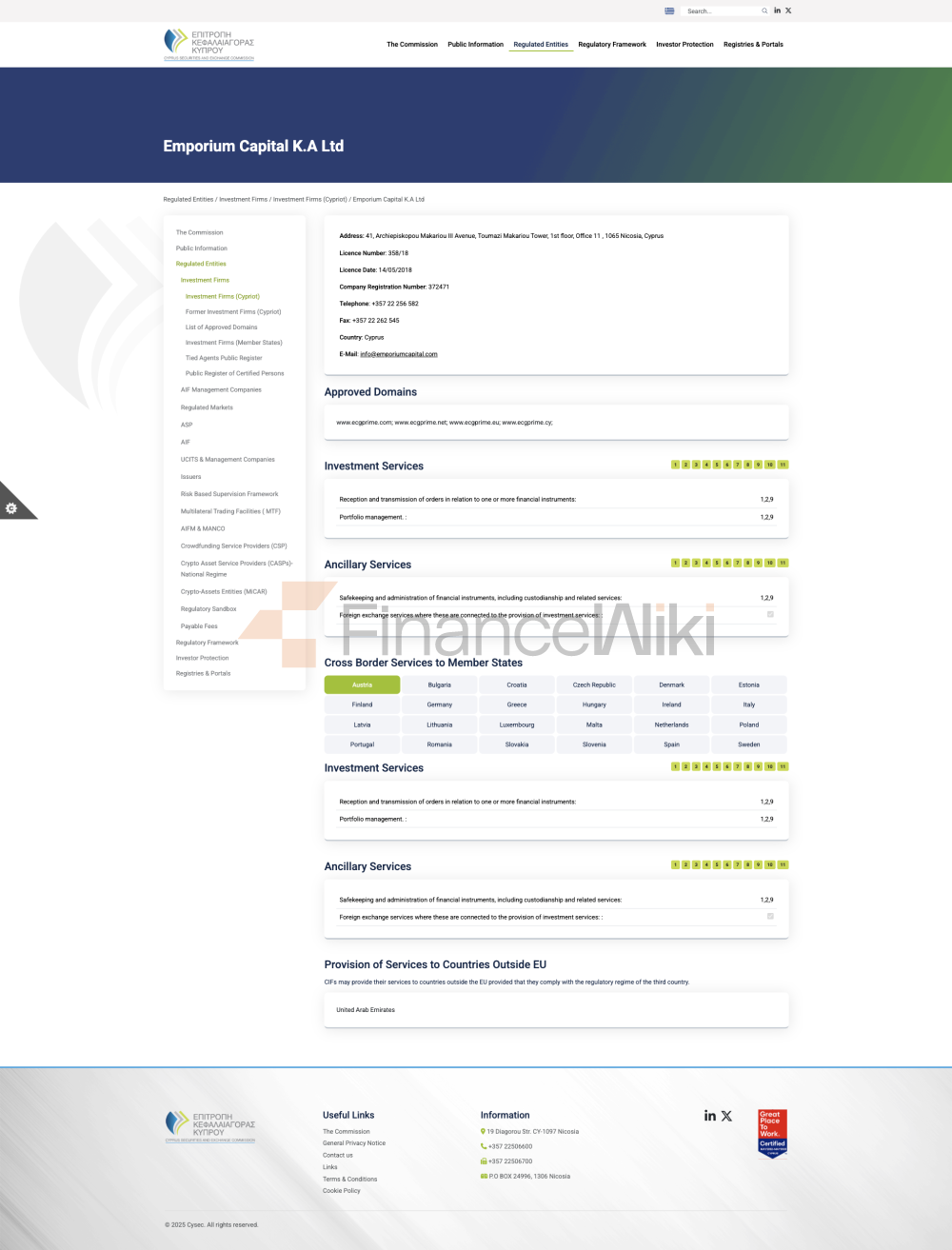

Regulatory Information

Emporium Capital Is Regulated By The Cyprus Securities And Exchange Commission (CySEC) As A Designated Representative (AR) With License Number 358/18 . CySEC's Regulatory Framework Ensures That Emporium Capital Strictly Complies With The Operational Standards And Consumer Protection Regulations Of The European Union Financial Marekt. In Addition, Emporium Capital Ensures That Its Operations Are Transparent, Secure And Provide A Reliable Investment Environment For Its Clients Through Regular Audits And Compliance Reviews.

Compliance Statement : Emporium Capital Strictly Complies With The Regulatory Requirements Of CySEC, Including The Segregation Of Client Funds, Risk Management Measures And Technical Infrastructure Safeguards. The Company Is Committed To Protecting The Safety Of Clients' Funds And Privacy Information.

Trading Products

Emporium Capital Offers A Rich And Diverse Range Of Trading Products Covering The Following Asset Classes:

- Forex : More Than 30 Major And Emerging Currency Pairs, Including EUR/USD, GBP/USD, USD/JPY, Etc.

- Contracts For Difference (CFDs) : Covering Stocks, Indices (e.g. NASDAQ, S & P 500), Commodities (e.g. Gold, Oil), Etc.

- Commodities : Traders Can Trade Precious Metals And Energy Products Such As Gold, Silver, And Crude Oil.

These Trading Tools Offer Traders A Wide Range Of Portfolio Diversification Opportunities.

Trading Software

Emporium Capital Has Adopted MetaTrader 5 (MT5) As Its Core Trading Platform, Providing The Following Features:

- Advanced Technical Analysis Tools : Includes Charts, Indicators, And Technical Analysis Functions.

- Automated Trading : Support For Trading Robots (EAs) And Signal Trading, Enabling Traders To Automate Operations.

- Mobile Trading : MT5 Supports IOS And Android Platforms, Making It Easy For Traders To Trade Anytime, Anywhere.

Deposit And Withdrawal Methods

Emporium Capital Offers Flexible Deposit And Withdrawal Methods To Suit The Needs Of Different Traders:

- Deposit Methods : Bank Telegraphic Transfer (bank Transfer/SWIFT), VISA, MasterCard, Neteller, PayPal, PerfectMoney, Skrill.

- Withdrawal Methods : Supports Multiple Payment Methods Consistent With Deposit Methods And Ensures That Funds Arrive Quickly.

Customer Support

Emporium Capital Places A High Value On Customer Support And Offers Assistance Through Multiple Channels:

- Email : Submit Questions At Any Time Via A Designated Email Address.

- Phone Support : Offers Multilingual Support Services To Ensure A Quick Response.

Core Business And Services

Emporium Capital's Core Business Revolves Around The Following Aspects:

- Diversified Trading Tools : Support Forex, CFDs, Commodities And Other Transactions To Meet Different Investment Needs.

- Customized Account Options : Standard, Premium And VIP Accounts Are Available To Cover Different Traders' Capital Sizes And Trading Needs.

- Educational Resources : Although Educational Resources Are Currently Relatively Limited, The Company Is Planning To Launch More Educational Content To Help Novice Traders Improve Their Skills.

Technical Infrastructure

Emporium Capital Relies On A Strong Technical Infrastructure To Ensure The Stability And Fluidity Of Transactions:

- Low-latency Trading Environment : Adopts An Advanced Server Network To Ensure Fast Response To Transaction Execution.

- Security Guarantee : Secure Customer Data Through SSL Encryption Technology.

Compliance And Risk Control System

Emporium Capital's Compliance And Risk Control System Includes The Following Core Elements:

- Client Funds Isolation : Client Funds Are Completely Separated From The Company's Working Funds To Ensure The Safety Of Funds.

- Risk Management Tools : Provide Stop Loss, Take Profit, Limit Orders And Other Tools To Help Traders Control Risk.

Market Positioning And Competitive Advantage

Emporium Capital Has The Following Significant Competitive Advantages In The Online Trading Market:

- Regulated Platform : CySEC's Regulation Provides Traders With Trust And Security.

- Advanced Trading Platform : MT5 Offers Rich Functionality And Flexibility.

- Flexible Account Selection : Adapt To Different Traders' Funding And Risk Preferences.

Customer Support And Empowerment

Emporium Capital Is Committed To Empowering Clients In The Following Ways:

- Personalized Support : Premium And VIP Accounts Offer Dedicated Account Manager Services To Help Traders Optimize Their Trading Strategies.

- Educational Resources : Although Educational Resources Are Currently Limited, The Company Plans To Launch More Free Educational Resources In The Future.

Social Responsibility And ESG

Emporium Capital Attaches Great Importance To Social Responsibility And Environmental, Social And Governance (ESG) Issues And Is Actively Involved In The Following Activities:

- Public Welfare Activities : Support Education And Environmental Protection Projects To Give Back To Society.

- Sustainability : The Company Is Exploring The Integration Of ESG Factors Into Its Operations And Investment Decisions.

Strategic Cooperation Ecology

Emporium Capital Has Established Strategic Partnerships With Several Well-known Financial Institution Groups And Technology Companies To Enhance The Competitiveness Of Its Products And Services. These Collaborations Include Technology Solution Providers And Liquidity Providers.

Financial Health

Emporium Capital Has Maintained A Solid Financial Position Since Its Establishment. As Of 2023Q3, The Company's Capital Adequacy Ratio Meets The Requirements Of CySEC, Ensuring That It Can Maintain Operational Stability In The Face Of Market Fluctuations.

Future Roadmap

Emporium Capital Is Committed To Achieving The Following Goals In The Future:

- Expanding Trading Products : Plans To Add More Cryptocurrencies And Exchange-traded Funds (ETFs). Enhancing Educational Resources : Launching More Free And Paid Educational Content To Help Traders Improve Their Skills.

- Optimizing User Experience : Further Enhancing The Ease Of Use And Functionality Of The Trading Platform.

FAQ

Q: Is Emporium Capital Regulated? A: Yes, Emporium Capital Is Regulated By The Cyprus Securities And Exchange Commission (CySEC) Under License Number 358/18.

Q: What Trading Platforms Does Emporium Capital Offer? A: Emporium Capital Uses MetaTrader 5 (MT5) As Its Core Trading Platform.

Q: What Types Of Accounts Are Available At Emporium Capital? A: Emporium Capital Offers Standard, Premium, And VIP Accounts For Clients With Different Trading Experiences And Fund Sizes, Respectively.

Q: What Is The Minimum Deposit Required At Emporium Capital? A: The Minimum Deposit Is $1,000 For A Standard Account, $5,000 For A Premium Account, And $10,000 For A VIP Account.

Q: How Do I Contact Emporium Capital Customer Support? A: Clients Can Reach The Customer Support Team Through Designated Email And Phone Channels.

Risk Warning

Online Trading Involves Significant Risks And May Not Be Suitable For All Investors. Please Ensure That You Fully Understand The Relevant Risks And Carefully Evaluate Your Financial Position And Risk Tolerance Before Making Any Trading Decisions. This Content Is For Informational Purposes Only And Does Not Constitute Investment Advice.