It Is Important To Note That The Information Provided In This Review Is Subject To Change Due To Constant Updates To The Company's Services And Policies. In Addition, The Date This Review Was Generated May Also Be An Important Factor To Consider As The Information May Have Changed Since Then. Therefore, Readers Are Advised To Always Check With The Company Directly For Updated Information Before Making Any Decision Or Taking Any Action. Responsibility For Using The Information Provided In This Review Rests Solely With The Reader.

InvesaCapital General Information

InvesaCapital Is An Online Trading Platform That Provides Access To A Wide Range Of Financial Instruments Including Forex, Stocks, Indices, Commodities And Cryptocurrencies. The Company Offers Multiple Account Types With Different Minimum Deposits And Spreads, As Well As Leverage Of Up To 1:500. InvesaCapital Also Offers Educational Resources And Customer Support Services To Its Clients. The Platform Can Be Accessed Through Its Own Web-based Platform.

Pros And ConsPros:

- Multiple Account Types With Different Minimum Deposit Requirements.

- Educational Resources Available To All Account Holders.

- 24/5 Customer Support Available Via Phone And Email.

- Maximum Leverage Of Up To 1:500 For All Account Types.

- There Are No Deposit Fees, And Withdrawal Fees Vary By Account Type.

Cons:

- Limited Information On Commissions Charged On Trades.

- An Inactivity Fee Is Charged On Accounts That Have Not Traded For At Least One Month.

- Payment Options For Deposits And Withdrawals Are Limited.

- MT4 Or MT5 Are Not Available.

- Demo Accounts With Virtual Funds Are Only Available For A Limited Time.

- There Are No Regulations In Force.

What Type Of Broker Is InvesaCapital

InvesaCapital Is A Market Maker (mm) Broker, Which Means That It Acts As A Counterparty To Its Clients In Trading Operations. That Is, Instead Of Directly Connecting To The Market, InvesaCapital Acts As An Intermediary And Is In The Opposite Position To Its Clients. As A Result, It Can Offer Faster Order Execution, Smaller Spreads, And Greater Leverage Flexibility. However, It Also Means That InvesaCapital Has A Certain Conflict Of Interest With Their Clients, As Their Profits Come From The Difference Between The Buy And Sell Prices Of An Asset, Which Can Lead Them To Make Decisions That Are Not Necessarily In The Best Interests Of Their Clients. Traders Are In Contact With InvesaCapital Or Any Other Mm Broker.

Regulatory Information

Imermarket (PTY) Ltd And OBR Investments Limited Belong To The Same Group Of Companies. OBR Investments Limited, Located At 161 Makarios III Avenue, 3027, 6th Floor, Akapnitis Court, Limassol, Cyprus, Regulated By The Cyprus Securities And Exchange Commission, CIF License Number 217/13.

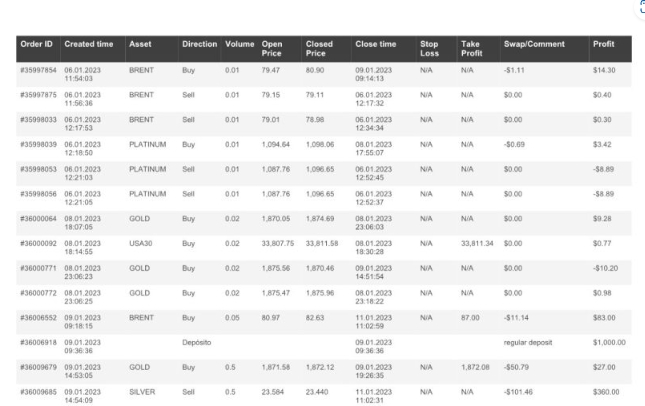

Spreads And Commissions On Trades

InvesaCapital Offers Competitive Variable Spreads On A Variety Of Trading Instruments, Ranging From 1.6 To 3.0 Depending On The Account Type. However, No Information Is Provided Regarding Any Commissions Charged. Traders Should Also Note That An Inactivity Fee Is Charged If Their Trading Account Has Not Been Traded For At Least A Month. Although InvesaCapital Offers A Wide Range Of Trading Instruments, The Lack Of Transparency In The Add-on Fees May Be A Concern For Some Traders.

Available Trading Accounts

InvesaCapital Offers Four Different Account Types, Each With A Different Minimum Deposit Amount And Average Spreads For Different Currency Pairs. The Minimum Deposit For The Basic Account Is $250, With Spreads Starting From 3.0 Pips For EUR/USD, While The VIP Account Has A Minimum Deposit Of $250,000 And Offers The Most Competitive EUR/USD Spreads Starting From 1.6 Pips. Traders Can Choose The Account Type That Best Suits Their Trading Needs And Experience Level. However, The High Minimum Deposit Amount For The Top VIP Accounts May Deter Some Traders From Investing At InvesaCapital. Nonetheless, The Availability Of Demo Accounts Allows Traders To Test The Platform Before Submitting A Live Account.

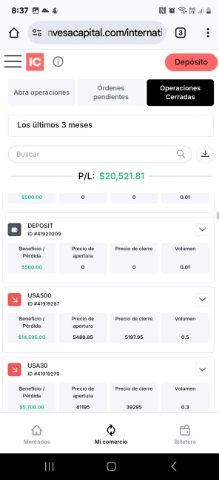

The Trading Platform Offered By InvesaCapital

NvesaCapital Offers Its Own Web-based Platform, Which Is User-friendly And Accessible Over The Web. The Platform Is Customized, Allowing Traders To Browse Easily. However, The Lack Of Compatibility With Popular Platforms Such As Mt4 And Mt5 Can Be A Drawback For Some Traders Who Prefer To Use These Platforms. Additionally, The Platform Has Limited Third-party Integration Compared To Other Platforms On The Market And Lacks Advanced Trading Tools And Features. Overall, The Platform Is Suitable For Beginners And Intermediate Traders Looking For A Simple And Intuitive Trading Experience.

Maximum Leverage

InvesaCapital Offers Its Clients A Maximum Leverage Of 1:500. This High Leverage Allows Traders To Open Larger Positions With Less Capital, Which Can Increase Their Potential Profits. It Also Allows For Greater Flexibility In Trading Strategies And The Ability To Access Multiple Markets. However, It Is Important To Note That High Leverage Also Means Higher Risk, Which Can Lead To Significant Losses. Therefore, Traders Must Adopt A Rigorous Risk Management Approach And Avoid Excessive Leverage To Mitigate These Risks. Overall, The High Leverage Offered By InvesaCapital Can Be A Powerful Tool For Experienced Traders With A Deep Understanding Of Risk Management.

Deposits And Withdrawals

InvesaCapital Offers A Number Of Convenient Deposit And Withdrawal Options, Including Credit/debit Cards, E-wallets And Telegraphic Transfers. Deposits Are Free And Withdrawal Requests Are Processed Within 24 Business Hours. However, Withdrawal Fees Vary Depending On The Type Of Account You Have, And There Is A Minimum Limit For Withdrawals Via Telegraphic Transfer. In Addition, Withdrawals Are Capped At The Amount Of Funds Available In Your Account, Excluding Any Funds Currently Invested In Non-position Squaring Transactions. VIP Account Holders Can Withdraw Unlimited Free Withdrawals, And The Number Of Free Withdrawals Decreases As The Number Of Account Types Decreases. Comprehensive, InvesaCapital Offers A Range Of Deposit And Withdrawal Options To Meet Different Needs, But It Is Important To Understand The Fees And Limitations Associated With Each Account Type.

Client Server

InvesaCapital Offers 24/5 Customer Support Through Multiple Communication Channels Such As Phone, Chat And Email. The Site Also Has An FAQ Section That Answers Frequently Asked Questions. However, Customer Support Is Not Available 24/7 And There Is No Live Chat Support. Additionally, Response Times To Inquiries Are Not Mentioned On The Site. On A Positive Note, Platinum And VIP Account Holders Can Contact A Dedicated Account Manager To Assist With Their Inquiries.

Conclusion

To Sum Up, InvesaCapital Is A Forex And CFD Broker That Offers Traders A Range Of Trading Tools, Account Types, And Its Own Platform. Its Offerings Include A Variety Of Educational Resources And A Responsive Customer Support Team That Can Be Reached Via Email And Phone. The Broker Offers Traders Competitive Spreads And Leverage Up To 1:500. However, It Has Some Limitations, Such As High Withdrawal Fees For Certain Account Types, Limited Customer Support Channels, And A Lack Of Regulation By Major Financial Authorities. Despite These Drawbacks, InvesaCapital May Be A Suitable Choice For Traders Seeking An Accessible And User-friendly Trading Experience.

Inducement Fraud

Inducement Fraud