Corporate Overview

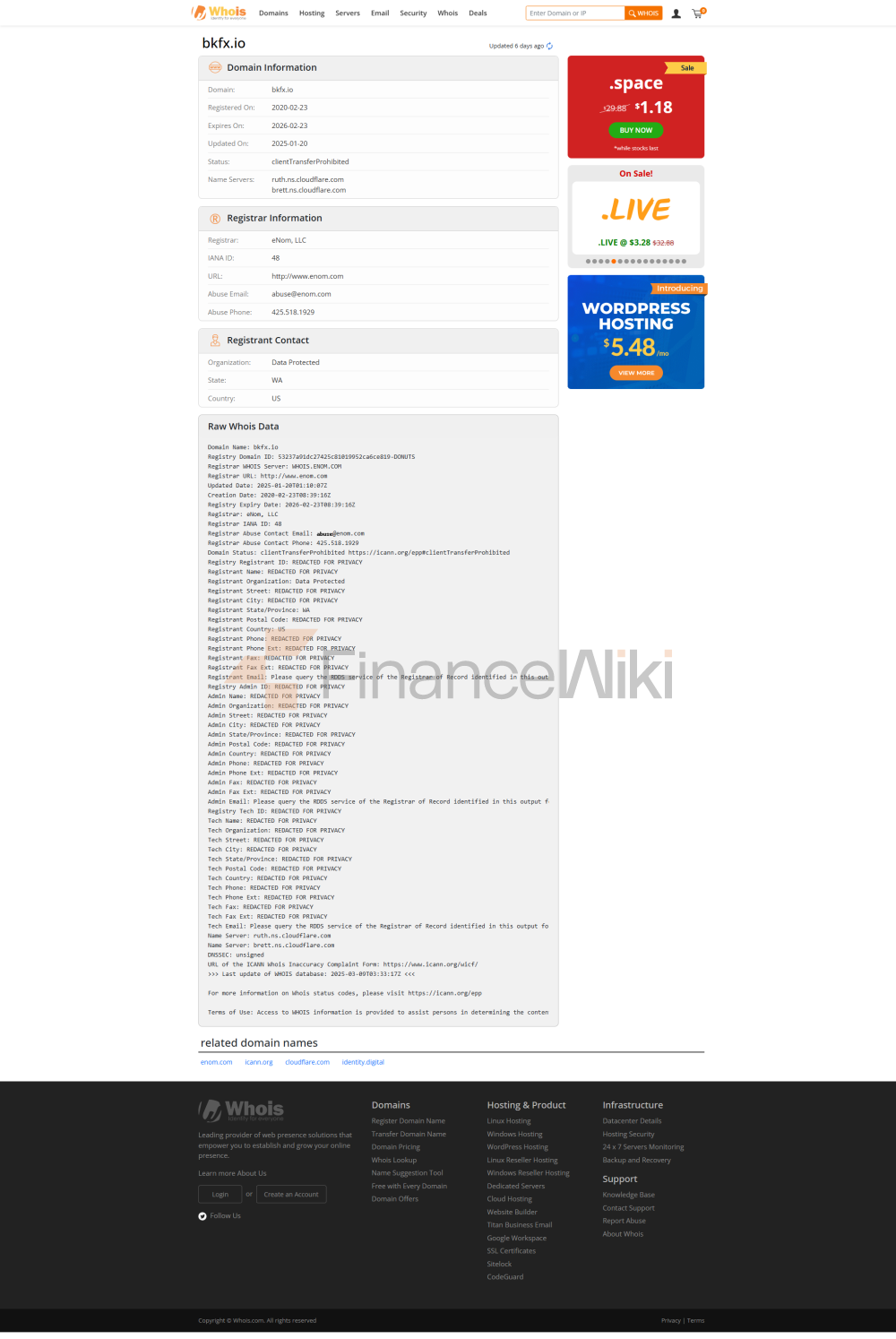

BKFX ( BKFX Limited ) Is An Online Forex And CFD Broker Registered In Saint Vincent And The Grenadines, Established In 2020 . Headquartered In The Country's Capital With A Registered Capital Of 5 Million USD , The Company Is An Internet Finance Enterprise Dedicated To Providing Customized Trading Brokerage Services To Institutional Clients, Fund Managers And Professional Traders Around The World. BKFX Holds A Financial Services License Issued By The Financial Conduct Authority Of South Africa ( FSCA ) With License Number 49288 . As Of 2023, BKFX Has Developed Into An Institution With A Significant Presence In The Global Capital Markets.

Regulatory Information

BKFX Is Regulated By The Financial Conduct Authority Of South Africa (FSCA) With License Number 49288 . The FSCA Is The Body Responsible For Regulating The Financial Services Industry In South Africa, Ensuring The Transparency And Fairness Of Financial Marekts. BKFX Strictly Complies With All The Regulatory Requirements Of The FSCA, Including Capital Adequacy Ratio, Segregation Of Client Funds, Anti-money Laundering And Counter-terrorism Financing, Etc., To Ensure The Legitimacy And Transparency Of Its Operations. Although The License Of BKFX Has Been Rated As A "suspicious Clone" By Certain Third Parties, It Is Still Committed To Compliance Operations And Protecting The Rights And Interests Of Its Customers.

Trading Products

BKFX Provides Customers With A Diverse Range Of Trading Products Covering The Following Areas:

- Forex Currencies : Offers Trading Of Major Global Foreign Exchange Currency Pairs, Including USD/EUR, USD/JPY, Etc.

- Commodities : Trading Commodities Such As Gold, Silver, Crude Oil, Etc.

- Stock Index : Provides Trading In Stock Indices Such As Dow Jones Industrial Average And S & P 500 Index.

- Stocks : Trades In Stocks Of World-renowned Companies Such As Apple, Microsoft, Etc.

- Cryptocurrency : Provides Trading In Mainstream Cryptocurrencies Such As Bitcoin And Ethereum.

These Products Cover Major Global Markets And Can Meet The Trading Needs Of Different Customers.

Trading Software

BKFX Mainly Uses MetaTrader 4 (MT4) As Its Trading Platform And Supports The Following Versions:

- Desktop : Dedicated Client Side For Windows And Mac Operating Systems.

- Mobile End : Supports Mobile Trading Applications For IOS And Android Devices.

- Web End : Solution For Trading Via Total Page Browser.

MT4 Is Popular For Its Powerful Features And User-friendly Interface, Supporting Advanced Features Such As Technical Analysis, Charting Tools, Automated Trading, Etc.

Deposit And Withdrawal Methods

BKFX Provides A Variety Of Deposit And Withdrawal Methods, Supporting The Following Payment Methods:

- Electronic Wallet : Neteller, Skrill, SticPay, LetKnow Pay.

- Cryptocurrencies : A Variety Of Mainstream Cryptocurrencies.

- Virtual Payments : Dragonpay, Payguru, Etc.

The Minimum Deposit Amount For BKFX Is 5 USD/EUR (for Cent Accounts). Customers Can Withdraw Funds Via Online Payment Or Bank Transfer, Which Is Faster. When Withdrawing Funds, Customers Need To Submit A Request Through A Trading Account, And Funds Will Be Released Upon Confirmation By Customer Service.

Customer Support

BKFX Provides 24/7 Customer Support Services, Including:

- Live Chat : Support 24/7 Live Live Live Chat.

- Phone Support : Local And International Phone Numbers Are Available.

- Local: + 27 10 44 64 500

- International: + 44 20 80 97 62 00

Additionally, BKFX Is Active On Social Media Platforms Including Facebook, Instagram, Twitter, LinkedIn, YouTube, Engaging With Customers And Providing Support In A Timely Manner.

Core Business And Services

BKFX's Core Business Is To Provide Customized Trading Brokerage Services For Institutional Clients And Professional Traders, Covering The Following:

- Trading Accounts : BKFX Offers Four Account Types, Including Cent Account, Standard Account, Premium Account, And Custom Account.

- Leverage : Supports Leverage Ratios Up To 1:500 To Meet The Needs Of High-risk Preference Clients.

- Spread Pricing : Different Spread Pricing Is Available For Cent Accounts, Standard Accounts, Premium Accounts And Custom Accounts.

- Cent Accounts: Spreads Are Approximately 1.8 Pips.

- Standard Accounts: Spreads Are Approximately 1.5 Pips.

- Premium Accounts: Spreads Are Approximately 1 Pip.

- Custom Accounts: Original Spread Pricing Is Available.

BKFX Serves Primarily Institutional Clients, Fund Managers And Professional Traders, Providing Personalized Trading Solutions.

Technical Infrastructure

BKFX's Technical Infrastructure Is Based On The MetaTrader 4 (MT4) Platform, Which Is Known For Its Stability And Functionality. BKFX Is Also Equipped With High-performance Servers That Ensure Low Latency And High Stability Of Trading. BKFX's Technical Team Continuously Optimizes The Trading Platform And Back-end Systems To Provide Clients With A Smooth Trading Experience.

Compliance And Risk Control System

BKFX Strictly Complies With The Regulatory Requirements Of The FSCA And Has Established A Complete Compliance And Risk Control System, Including:

- Customer Funds Isolation : Customer Funds Are Strictly Separated From The Company's Operating Funds To Ensure The Safety Of Customer Funds.

- Anti-Money Laundering (AML) And Counter-Terrorism Financing (CTF) : BKFX Implements Strict Customer Identity Verification (KYC) Procedures To Prevent Illegal Financial Flows.

- Risk Management : Monitor And Manage Clients' Trading Risks Through Technical Means And Manual Review.

- Transparency : Regularly Report Operations To Regulators To Ensure Transparency Of Information.

BKFX Compliance Statement: BKFX Limited Complies With All Applicable Financial Regulatory Laws And Regulations And Is Committed To Providing Clients With Safe, Transparent And Professional Trading Services.

Market Positioning And Competitive Advantage

BKFX's Market Positioning Is To Provide Customized Trading Brokerage Services For Institutional Clients And Professional Traders. Its Competitive Advantages Include:

- Trading Product Diversity : Offers A Wide Range Of Trading Products Such As Forex, Stocks, Commodities, Stock Indices, And Cryptocurrencies. High Leverage : Offers Leverage Ratios Up To 1:500 To Meet The Needs Of Clients With High Risk Appetite.

- Transparent Operations : Strict Compliance With Regulatory Requirements To Ensure Transparency And Security Of Transactions.

- Globalization Services : Serving Global Customers, With Support For Multiple Payment Methods And Languages.

Although BKFX's License Issues May Have Taken A Toll On Its Reputation, It Has Significant Advantages In Terms Of The Diversity Of Products And Technical Support For This Transaction.

Customer Support And Empowerment

BKFX Provides Support To Customers Through Multiple Channels, Including 24/7 Live Chat, Phone Support, And Social Media Interactions. In Addition, BKFX Empowers Clients Through Its Educational Resources (e.g. Trading Guides, Market Analysis Reports) To Help Them Improve Their Trading Skills And Market Understanding.

Social Responsibility And ESG

BKFX Is Committed To Fulfilling Social Responsibility And Promoting Sustainable Development. This Includes:

- Environmental Protection : Reducing E-waste And Supporting Resource Conservation And Recycling.

- Social Equity : Supporting Multiculturalism And Social Inclusion, Promoting Financial Education And Financial Inclusion.

- Corporate Governance : Establishing Transparent Management And Disclosure Mechanisms To Ensure Openness And Fairness In Company Decisions.

Although BKFX's Specific Actions On ESG Have Not Been Made Public, Its Commitment To Compliance And Transparent Operations Demonstrates Its Emphasis On Social Responsibility.

Strategic Cooperation Ecology

BKFX Has Established Strategic Partnerships With Several Well-known Financial And Technology Companies, Covering The Following Areas:

- Payment Services : Working With E-wallet Providers Such As Neteller, Skrill, Etc.

- Technology Platform : Uses MetaTrader 4 (MT4) As Its Core Trading Platform.

- Data Analytics : Cooperates With Several Globally Renowned Data Analytics Companies To Provide Clients With Real-time Market Data And Analytical Tools.

In Addition, BKFX Also Participates In Several Industry Associations And Cross-border Financial Forums To Promote Industry Communication And Development.

Financial Health

BKFX Is In Good Financial Health As Follows:

- Capital Adequacy Ratio : Meets FSCA's Capital Adequacy Ratio Requirements.

- Profitability : BKFX Has Strong Profitability Due To Its Diverse Trading Products And High Leverage Ratio.

- Risk Management : Ensures Financial Exposure Is Manageable Through A Rigorous Risk Control System.

Although Its Specific Financial Data Has Not Been Made Public, Its Capital Scale And Regulatory Compliance Indicate That Its Financial Position Is Healthy And Sound.

Future Roadmap

The Future Development Directions Of BKFX Include:

- Product Innovation : Expand More Trading Products, Such As More Cryptocurrencies And Emerging Market Stocks.

- Technology Research And Development : Continuously Optimize The Trading Platform And Back-end System To Improve The Trading Experience.

- Globalization Layout : Expand More Markets And Attract More International Clients.

- Compliance And Supervision : Continuously Strengthen The Compliance System Construction, Enhance The Company's Reputation And Customer Trust.

In Conclusion, BKFX, As An Online Forex And CFD Broker Registered In Saint Vincent And The Grenadines, Occupies An Important Position In The Global Financial Marekt With Its Diverse Trading Products, Strong Technical Support And Professional Client Server. Although Its License Issue May Have Had A Certain Impact On Its Reputation, Its Performance In Terms Of Service Quality And Technological Innovation In This Transaction Is Worthy Of Recognition.