Business

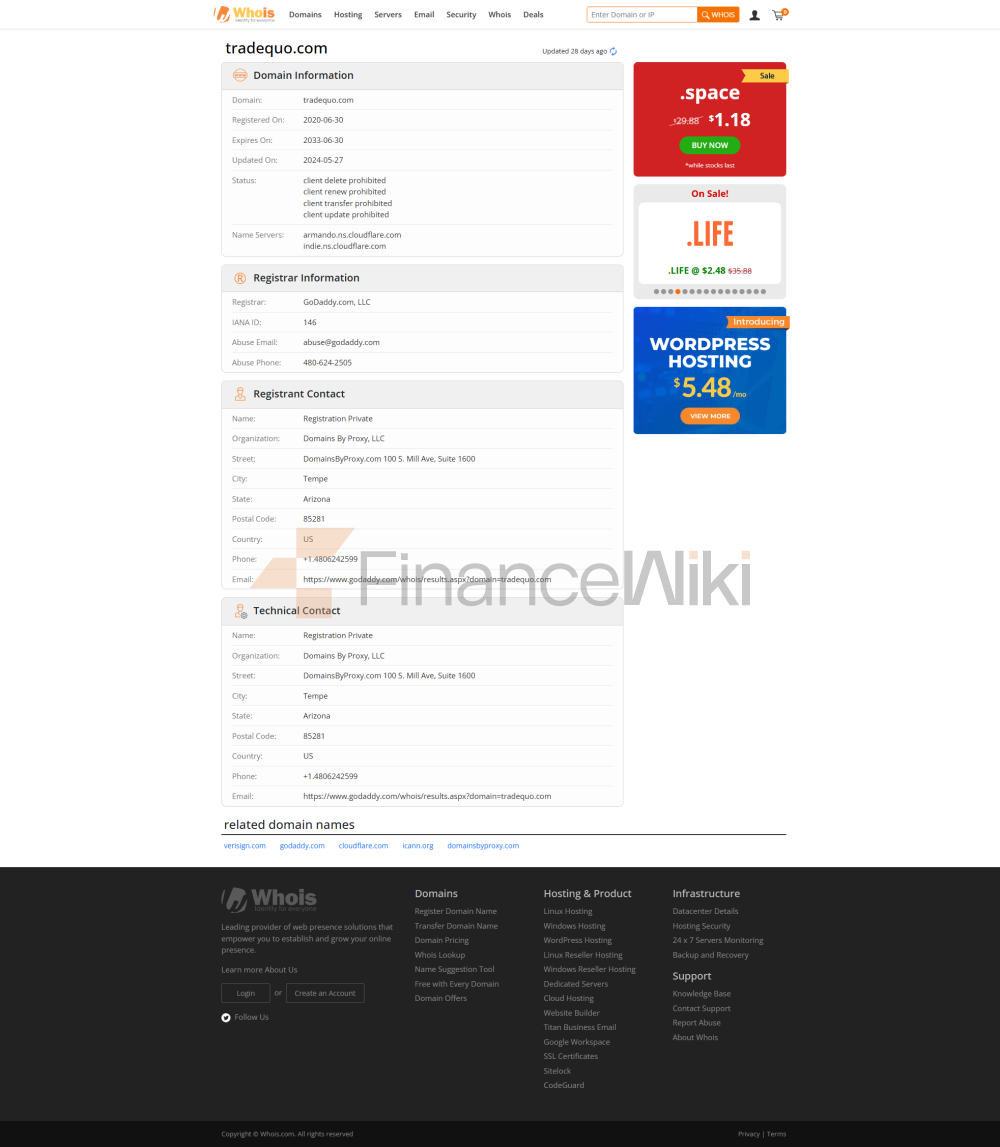

Overview Trade Quo is an offshore broker regulated by the Financial Services Authority (FSA) in the United Kingdom and headquartered in the Seychelles. The company was established on June 30, 2020, with an undisclosed registered capital, but its business operations strictly follow the regulatory requirements of the Seychelles Financial Services Authority (SFSA). Trade Quo holds a retail forex trading license with license number SD140.

The company's senior management team has rich industry experience, and the advisory team is composed of a number of senior experts in the financial field. Trade Quo is also a member of several industry associations, including the Seychelles Financial Services Association (SFSA Affiliates).

Trade Quo's core business is to provide diversified financial trading services to clients around the world, including asset classes such as forex, precious metals, indices, energies, cryptocurrencies and stocks. The company uses MetaTrader 5 (MT5) and MetaTrader 4 (MT4) as its main trading tools and supports a variety of deposit and withdrawal methods.

Regulatory Information

Trade Quo is registered in Seychelles and regulated by the Seychelles Financial Services Authority (SFSA) with license number SD140. Despite its regulatory status of "offshore", the license indicates that the company must comply with relevant laws and regulations in the course of its operations.

As of Q3 2023, Trade Quo's regulatory information is as follows:

- Regulator: Seychelles Financial Services Authority (SFSA)

- License Number: SD140

- Type of Regulation: Offshore Regulated

Trading ProductsTrade

Quo offers a wide range of trading products, covering the world's major financial asset classes, as follows:

Forex

- Major currency pairs (such as EUR/USD, GBP/USD, USD/JPY, etc.)

- Other currency pairs

Precious Metals

- Gold ,

- silver ,

- platinum ,

- palladium

Indices

:- S&P 500 ,

- Dow Jones Industrial Average (DJIA),

- NASDAQ ,

- FTSE 100

, Energy

- Crude Oil Natural

- Gas

Cryptocurrencies

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

Stocks

- Stocks of major listed companies around the world

As of the third quarter of 2023, Trade Quo has a wide range of trading products that are able to meet the needs of different traders.

Thetrading software

Trade Quo offers two trading platforms, MetaTrader 5 (MT5) and MetaTrader 4 (MT4), which can be operated on both desktop and mobile terminals.

Platform Details:

MetaTrader 5 (MT5)

- Supported Devices: Windows, Mac, Android, iOS

- Suitable for: Professional Traders

- Key features: Advanced charts, technical indicators, EA (automated trading) support

MetaTrader 4 (MT4)

- Supported devices: Mobile devices (Android, iOS)

- Suitable for: Novice traders

- Key features: Easy-to-use interface, basic technical analysis tools

In addition, Trade Quo also offers Supercharts and Windows versions of MT5 to meet the needs of different traders.

Deposit and withdrawal

methodsTrade Quo supports a variety of deposit and withdrawal methods, as follows:

Deposit methods:

- Visa and MasterCard credit cards

- Bank transfer

- E-wallets (e.g. NETELLER, Skrill).

- Cryptocurrencies (e.g. Bitcoin, Ethereum)

Withdrawal Methods:

- Bank Transfer

- E-Wallets

- Cryptocurrencies

The deposit and withdrawal process for Trade Quo is usually within 5 business days Completion, depending on the payment method. The minimum deposit amount is $1.

Customer SupportTrade

Quo offers multi-channel customer support services, including:

- Email: support@tradequo.com

- Phone: +35725123894

- Social Media: Twitter, LinkedIn, Instagram, Facebook, TikTok, YouTube, Line

Customers can get help with account opening, trading, deposits and withdrawals, etc. through the above channels. Trade Quo also specializes in providing educational tools for its traders to help clients better understand the markets and trading strategies.

Core Business & Services

Trade Quo's core business is to provide financial trading services to customers around the world, and its main services include:

- High leverage trading (up to 1:1000)

- Low spread trading (standard account average EUR/USD spread is 0.8 pips)

- Diversified trading products (covering foreign exchange, precious metals, indices, etc.).

- Advanced trading platforms (MT5 and MT4)

- Diversified deposit and withdrawal methods

Technical InfrastructureTrade

Quo's technical infrastructure is centered on the MetaTrader platform, combined with its strong network of liquidity providers, to ensure that traders' orders can be executed quickly. Here are the technical advantages:

- Liquidity providers: Cooperate with a number of world-class liquidity providers to ensure market depth and order execution speed

- Server nodes: Deploy server nodes in multiple regions around the world to reduce latency

- Trading Platforms: MT5 and MT4 Powerful and user-friendly

Compliance & Risk

Control SystemTrade Quo complies with the regulatory requirements of the Seychelles Financial Services Authority and implements the following compliance and risk control measures:

- Segregation of client funds: Client funds are kept segregated from the company's operating funds to ensure the safety of client funds

- Risk management system : Provide a variety of risk control tools (such as stop loss, take profit) to help traders manage risk

- Anti-Money Laundering (AML) Policy: Strictly comply with anti-money laundering regulations and verify customer identity

- Compliance Statement: Trade Quo is committed to transparent operations to ensure that all trading activities are legal and compliant

Market Positioning & Competitive Advantage

Trade Quo's market positioning is to provide diversified financial trading services to traders around the world. Its competitive advantages include:

- High leverage: Provides up to 1:1000 leverage to meet the needs of traders with a high risk appetite

- Low spreads: The average EUR/USD spread on the standard account is 0.8 pips, which is competitive in the industry

- Diversified trading products: covering foreign exchange, Major asset classes such as precious metals, indices

- Advanced trading platform: MT5 and MT4 platforms are powerful and support a variety of trading strategies

Customer Support & EnablementTrade

Quo values customer education and support, providing the following resources:

- Education Center: Free trading strategies, Education on market analysis and fundamentals

- Market Reports: Publish regular market analysis and forecast reports

- Customer support: Multi-channel support to help customers solve problems in trading

Responsibility & ESG

Trade Quo Limited disclosure of information on social responsibility, But its compliance operations and transparency reflect a sense of responsibility to its customers. In the future, its performance in ESG is worth looking forward to.

Strategic Cooperation Ecology

Trade Quo has established cooperative relations with a number of internationally renowned liquidity providers and financial institutions to ensure the stability and market competitiveness of its business.

Financial health:

Trade Quo's financial health has not been publicly disclosed, but as a regulated broker, its operating funds are segregated from client funds and have a high level of security.

Roadmap for the future

:

- Expand into more trading instruments and markets

- Enhance customer education and marketing Continuous

- optimization of trading platforms and trading experience

As of the third quarter of 2023, the future development plans of Trade Quo have not yet been clarified, However, its performance in its existing business lays the foundation for its future growth.