Corporate Profile

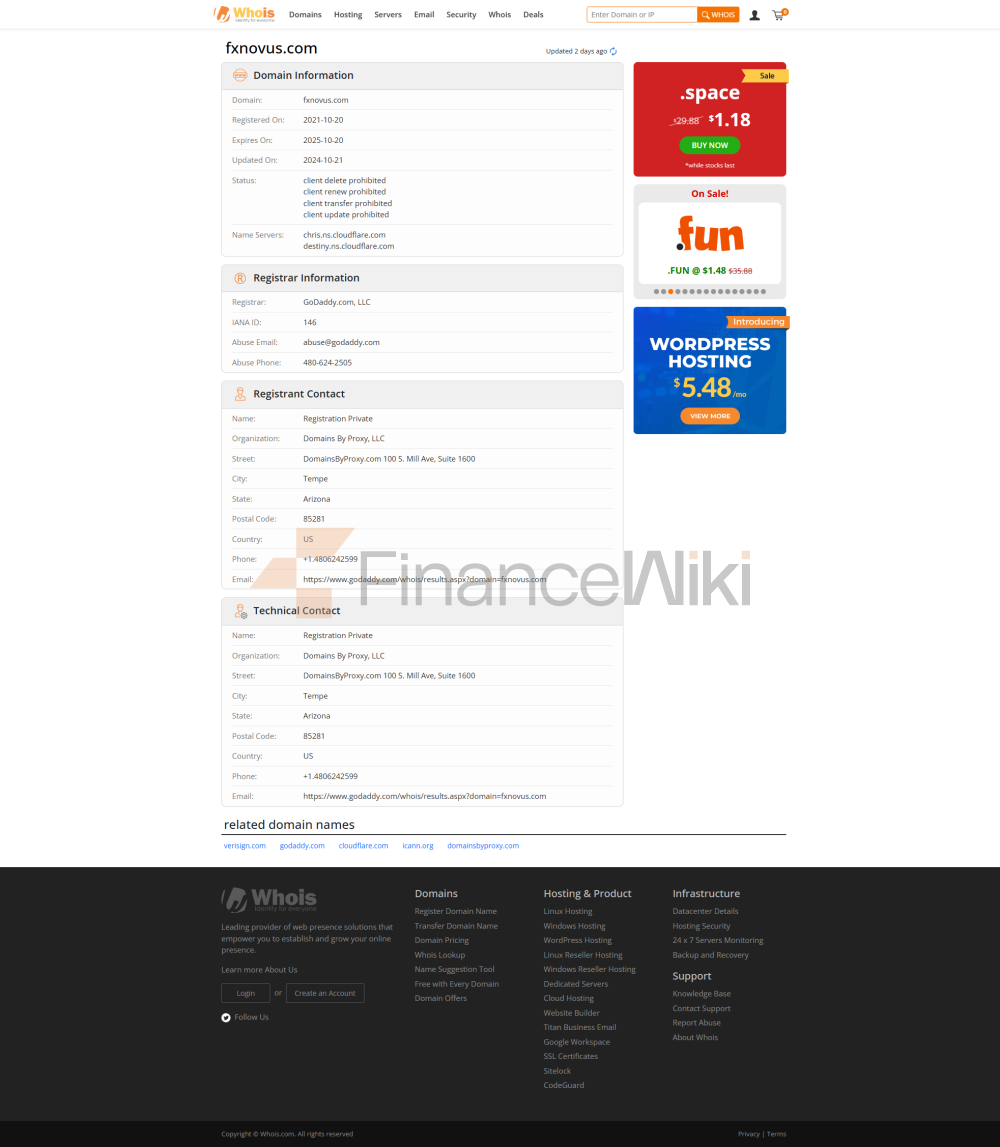

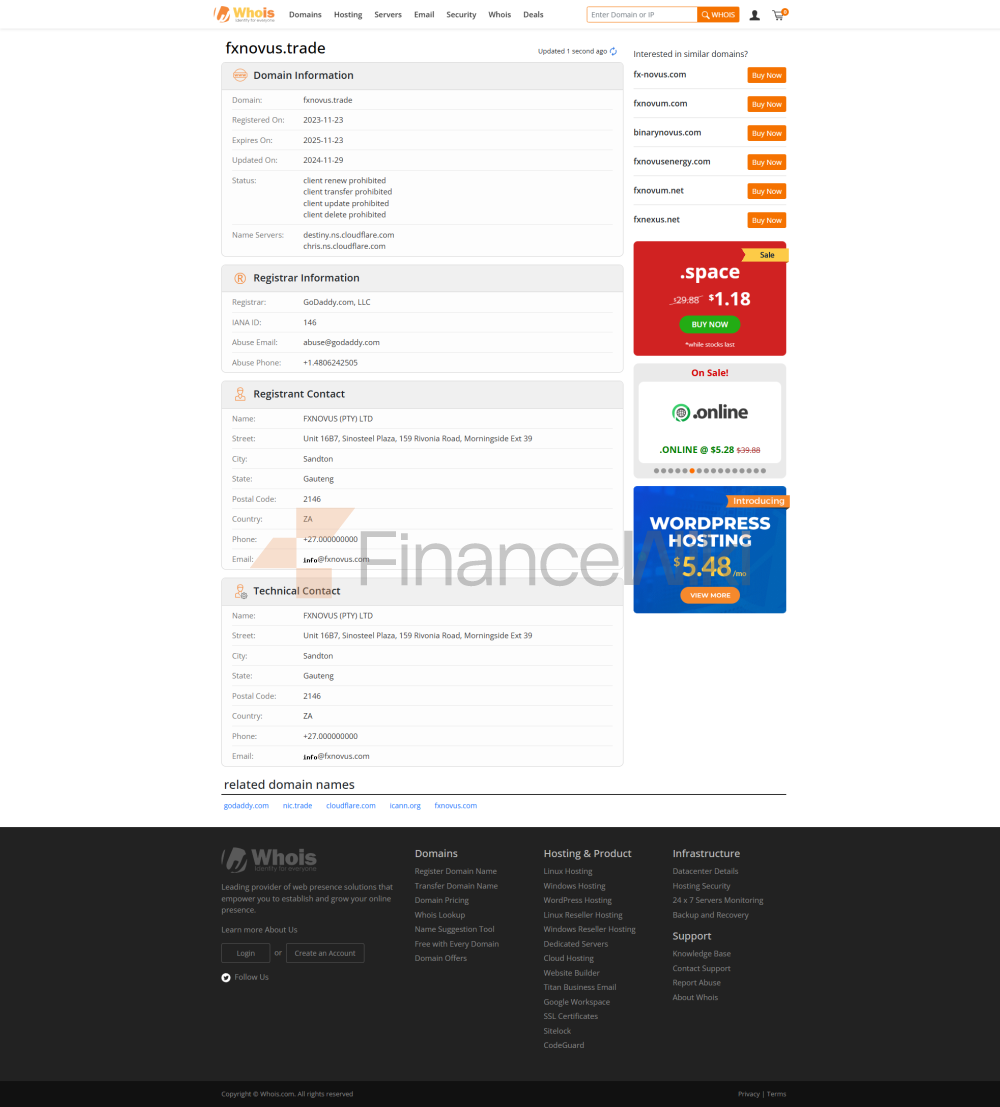

FXNovus Is A Brokerage Company Registered In South Africa And Established On October 20, 2021. The Company Claims To Be Regulated By The Financial Sector Conduct Authority (FSCA) Of South Africa, But Its Regulatory License (license Number: 50963) Has Been Verified As A Suspect Clone. FXNovus Offers Clients Trading Services On A Wide Range Of Financial Instruments, Including Forex, Commodities, Indices, Stocks, Cryptocurrencies And Precious Metals. The Company Appeals To Traders Of Different Experience Levels By Offering Differentiated Account Types, High Leverage And Low Spreads.

Regulatory Information

FXNovus Claims To Be Regulated By The Financial Sector Conduct Authority (FSCA) Of South Africa And Holds License Number: 50963. However, The Legality Of This License Has Been Called Into Question And Has Been Flagged As A "suspicious Clone". Therefore, Customers Should Exercise Their Discretion And Be Aware Of The Associated Risks When Choosing FXNovus For Trading.

Trading Products

FXNovus Offers A Wide Range Of Trading Products Covering The Following Categories:

- Forex Currency Pairs : More Than 45 Currency Pairs, Including Major Currency Pairs (e.g. EUR/USD, GBP/USD) And Minor And Exotic Currency Pairs. Cryptocurrency Contracts For Difference (CFDs) : Includes Bitcoin, Ethereum And Other Emerging Cryptocurrencies.

- Indices : Covers Important Global Indices Such As S & P 500, Dow Jones Industries Average Index, FTSE 100 And Nikkei 225.

- Precious Metals : Offers Trading In Gold, Silver, Platinum And Palladium.

- Commodities : Includes Crude Oil, Natural Gas, Agricultural Products, Etc.

- Stocks : Offers Investment Opportunities In Tech Giants Such As Apple, Amazon And Other Industry Companies Through Contracts For Difference (CFDs).

Trading Software

FXNovus Provides An Own Proprietary Trading Platform That Supports The Following Devices And Operating Systems:

- WebTrader : Accessed Via Web Browser, Works On Any Device.

- Mobile App : Covers IOS And Android Platforms And Supports Anytime, Anywhere Trading.

- Desktop App : Works On Windows And Mac Users.

The Platform Provides Real-time Market Data, Charting Tools, And Technical Analysis Capabilities, But Does Not Integrate Advanced Analysis Tools And EA Intelligence Systems From Mature Platforms Such As MT4/MT5.

Deposit And Withdrawal Methods

FXNovus Offers A Variety Of Deposit And Withdrawal Methods:

- Deposit Methods : Supports Credit/debit Cards, Telegraphic Transfers, And Alternative Payment Methods (APMs) With No Deposit Fees.

- Withdrawal Method : The Minimum Withdrawal Amount Is 10 EUR/USD/CHF (credit Card/e-wallet), And The Minimum Withdrawal Amount For Telegraphic Transfer Is 100 EUR/USD/CHF. Withdrawal Processing Time Is Usually 8 To 10 Business Days.

Fee Description :

- Inactive Fee : If The Account Has No Transactions For 30 Days Or More, An Inactive Fee Starting From $100 Per Month Will Be Charged.

- Maintenance Fee : A Monthly Account Maintenance Fee Of $10 Will Be Charged.

- Withdrawal Fee : There Is A Flat Fee Of $30 For Telegraphic Transfer Withdrawals.

Customer Support

FXNovus Offers Multiple Customer Support Channels:

- Online Chat : Instant Support To Solve Common Problems.

- Phone Support : Traders Can Contact The Support Team At + 27 010 157 1900 Or + 44 0151 265 5514.

- Email : Questions Can Be Submitted Through Support@fxnovus.com.

The Customer Support Team Promises To Respond To Most Inquiries Within 24 Hours, But Does Not Provide A Specific Service Time Guarantee.

Core Business And Services

FXNovus Mainly Provides Contract For Difference (CFD) Trading Services For Financial Derivatives To Retail Traders. Its Service Target Includes Individual Traders And Institutional Investors, Especially For Users Who Wish To Trade With Low Spreads And High Leverage.

Technical Infrastructure

FXNovus Uses Its Own Electronic Trading Platform To Support Multi-device Trading. However, Its Technical Infrastructure Is Not Yet Mature Compared To Industry Standard Platforms Such As MT4/MT5. The Platform's Strength Lies In Its Simplicity, But Lacks Advanced Analytical Tools And Automated Trading Capabilities.

Compliance And Risk Control System

Despite FXNovus' Claim To Be Regulated By The FSCA, There Are Questions About The Legality Of Its License. The Company Offers A Range Of Security Measures, Including Liability Protection And Margin Calls, To Protect Client Funds. However, The Use Of The MT4/MT5-free Platform Limits The Maturity Of Its Risk Management System.

Market Positioning And Competitive Advantage

FXNovus Appeals To Clients Who Wish To Conduct High-frequency Trading At Low Cost By Offering High Leverage (up To 1:400), Tight Spreads (as Low As 0.9 Pips), And Commission-free Trading. However, Its License Free Of Suspicious Clones And Non-use Of The MT4/MT5 Platform May Have A Negative Impact On Its Market Positioning.

Customer Support And Empowerment

FXNovus Provides Basic Trading Education Resources, But Does Not Have A Demo Account. Clients Can Access Support Via Online Chat, Phone, And Email, But Lack The Empowering Services Of A Community Or Educational Platform.

Social Responsibility And ESG

FXNovus Does Not Disclose Its Social Responsibility And ESG Practices And Cannot Evaluate Its Performance In Sustainable Finance.

Strategic Partnership Ecology

Currently, FXNovus Does Not Disclose Its Significant Strategic Partnerships Or Industry Awards.

Financial Health

FXNovus' Financial Health Is Not Disclosed, But The Various Types Of Fees It Charges, Such As Inactivity Fees And Maintenance Fees, May Have An Impact On The Long-term Profitability Of Customer Accounts.

Future Roadmap

FXNovus Does Not Disclose A Clear Future Development Strategy. Its Current Core Competitiveness Depends On Transaction Costs And Leverage Levels, Rather Than Technology Or Market Expansion.

Please Note That There Is Considerable Uncertainty About The Regulatory Status And License Legality Of FXNovus, And Customers Should Carefully Evaluate Risks When Selecting Its Services.