FIC Info

Founded In 2018, FIC Offers A Diversified Range Of Trading Assets Including Forex, Contracts For Difference, ETFs, Stocks, Bonds And Derivatives. The Platform Operates Under The Supervision Of The Cyprus Securities And Exchange Commission (CYSEC) With Flexible Commissions. However, The Complex Cost Structure And Limited Customer Support Are Not Suitable For Beginners.

Advantages And Disadvantages

Advantages

Regulated By CYSEC, Complex Fee Structure

Multiple Financial Instruments

Advanced Trading Platform: MT4 And Multi-Product Platform

Clear And Consistent Commission Rates For Various Securities And Markets

Payments In Different Currencies Through Multiple Foreign Banks

Disadvantages

Complex Fee Structure

Limited Educational Resources

For Missing IBAN Information And Payments Investigation Fees.

Regulatory Information

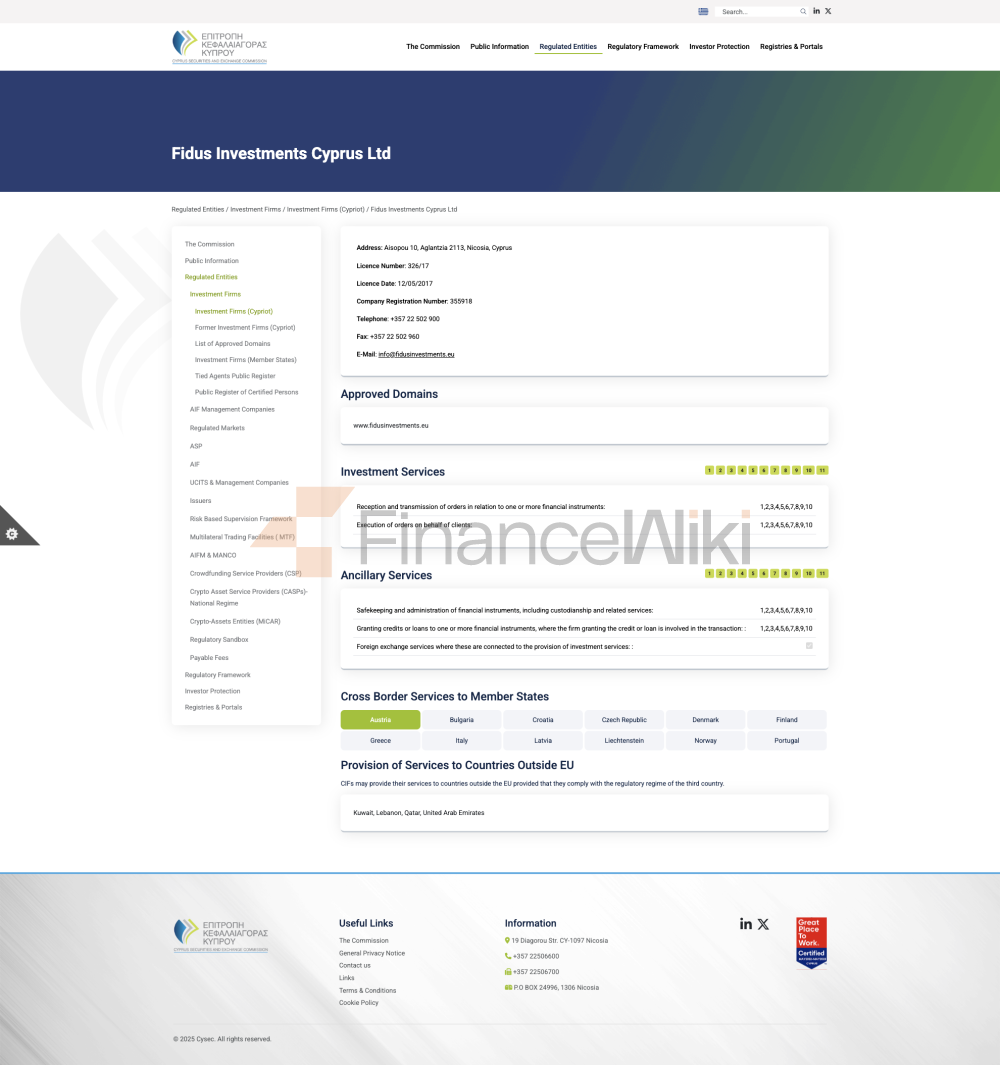

FIC Is Regulated By CYSEC With License Number 326/17.

Trading Products

FIC Offers Clients A Wide Range Of Investment Products And Services, Such As Forex, Contracts For Difference, Exchange Traded Funds, Stocks, Bonds And Derivatives.

FIC Fees

The Structure Of FIC Fees

Compared To Other Trading Institutions, FIC Is More Flexible, But Relatively Complex.

Trading Fees

FIC Offers A Complete Commission Structure That Varies Depending On The Financial Instrument And Market. While The FIC's Commission Structure Is Flexible, It May Be More Suitable For Experienced Traders Or Those With Specific Market Preferences Due To The Complexity Involved.

Trading Platform

- MT4: Support For MT4 Is Suitable For Experienced Traders Looking For Advanced Charting Tools And Fast Trading Features.

- Multi-Product Platform: Available Devices Windows, Android, Linux, Apple Is Suitable For Traders Looking For A Comprehensive Platform With Fully Customized Options And Advanced Charting Features.

Deposit And Withdrawal

Deposit OptionsBank Transfer, Fee For Missing Or Wrong IBAN Is EUR 30

Withdrawal Options

Bank Transfer, Investigation Fee 50 EUR; 15 EUR Per Message