Corporate Profile

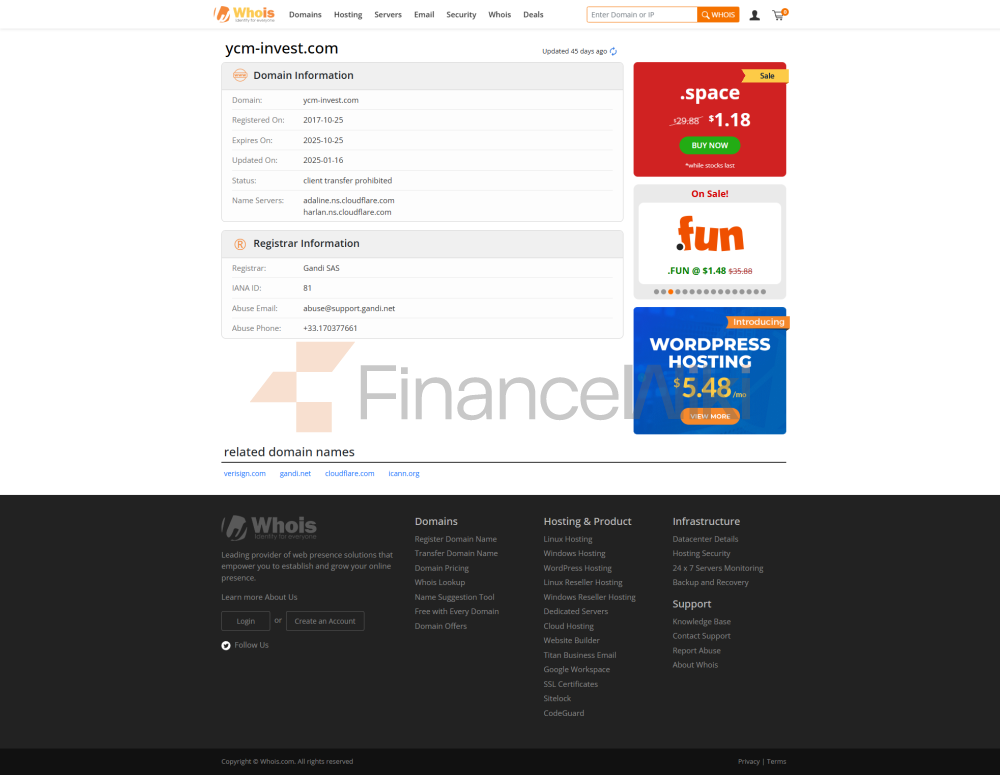

YCM Invest Was Established In 2018 And Is An Asset Management Company Headquartered In The United Kingdom. The Company Focuses On Providing Financial Marekt Traders With A Diverse Range Of Trading Services And Tools, Covering Forex, Precious Metals, Indices, Energy, Individual Stocks And Cryptocurrency Contracts For Difference (CFDs), Etc.

The Core Mission Of YCM Invest Is To Help Traders Achieve Their Investment Goals Through Leading Trading Platforms, Compliance Operating Models, And Quality Services. The Company Always Adheres To The Principles Of Transparency, Safety, And Efficiency To Provide Reliable Financial Services To Traders Around The World.

Regulatory Information

YCM Invest Is Regulated By The Financial Conduct Authority (FCA) In The UK With Regulatory License Number 470392 . As A Regulated Financial Institution Group, YCM Invest Must Comply With Strict Industry Standards And Regulatory Requirements To Ensure The Safety Of Traders' Funds And The Transparency Of Its Operations.

The FCA's Supervision Not Only Provides Protection For Traders, But Also Adds Credit Endorsement To The Operations Of YCM Invest. The Company Always Strictly Follows Regulatory Regulations To Ensure That It Can Provide Customers With A Reliable Trading Environment In A Volatile And Complex Market Environment.

Trading Products

YCM Invest Provides Traders With A Wide Range Of Market Tools Covering Multiple Asset Classes:

- Forex : Supports Major Currency Pairs (e.g. EUR/USD, GBP/USD, Etc.) And Minor Currency Pairs.

- Precious Metals : Provides Trading Services For Precious Metals Such As Gold And Silver.

- Index : Covers Major Global Stock Indices (e.g. S & P 500, Dow Jones, Etc.).

- Energy : Supports The Trading Of Energy Products Such As Oil And Gas.

- Individual Stocks : Allows Traders To Directly Invest In The Stocks Of Specific Listed Companies.

- Cryptocurrency CFD : Offers CFD Trading On Multiple Cryptocurrencies Such As Bitcoin And Ethereum.

Through These Diverse Trading Products, YCM Invest Helps Traders To Diversify Their Portfolios And Meet The Needs Of Different Risk Preferences And Market Sentiment.

Trading Software

YCM Invest Provides Traders With A Range Of Powerful Trading Platforms And Tools To Support The Execution Of Their Trading Strategies:

- Metatrader 4 (MT4) : An Industry-standard Trading Platform That Supports Advanced Charting Capabilities, Technical Analysis Tools, And Trading Robots (EAs).

- Metatrader 5 (MT5) : An Advanced Trading Platform Designed For Complex Trading Strategies, With Support For Multiple Markets And Portfolio Management.

- Currenex Platform : Aggregates Quotes From Major Liquidity Providers And Anonymous Liquidity Pools, Making It Particularly Suitable For Traders Seeking High Liquidity.

- FIX Application Programming Interface : Supports Institutional-level Trading Automation, Suitable For High-frequency Trading And Algorithmic Trading.

- Web Trade : A Web-based Trading Platform That Offers Flexible Layouts And Real-time Position Tracking Capabilities.

In Addition, YCM Invest Supports Mobile Trading, Allowing Traders To Trade Anytime, Anywhere Via IPhone And Android Devices.

Deposit And Withdrawal Methods

YCM Invest Offers Traders A Variety Of Deposit And Withdrawal Methods, Including:

- Credit/Debit Card : Supports Mainstream Credit And Debit Cards (e.g. Visa, MasterCard).

- Electronic Wallet : Including Popular Electronic Payment Methods Such As Skrill, Neteller, Etc.

- Bank Transfer : Supports Direct Telegraphic Transfer And SWIFT Transfer.

Customers Can Quickly Complete The Deposit And Withdrawal Of Funds Through The Above Methods. The Specific Fee And Processing Time Vary Depending On The Payment Method.

Customer Support

YCM Invest Attaches Great Importance To Customer Support And Provides Traders With Multi-channel Services:

- Telephone Support : + 44 (0) 20 351 45555 (online 24/7 On Weekdays).

- Online Chat : Real-time Communication Through The Official Website To Solve Trading-related Problems.

- Chinese Support : Some Services Support Chinese To Meet The Communication Needs Of Non-English Speaking Traders.

In Addition, YCM Invest Also Provides A Wealth Of Educational Resources, Including Market Analysis, Trading Tutorials, And Risk Management Guides To Help Traders Improve Their Investment Skills And Market Understanding.

Core Business And Services

The Core Business Of YCM Invest Includes:

- Brokerage Services : Provides A Wide Range Of Trading Tools And Execution Services For Individual And Institutional Traders.

- Fund Allocation : Provides Funds Allocation Services To Successful Traders To Help Them Scale Their Investments.

- Krypfin Cryptocurrency Portfolio : Provides Predefined Long-term And Short-term Cryptocurrency CFD Portfolios.

- Introducing Broker Services : Works With Third-party Introducing Brokers To Provide Them With Compliance Trading Solutions.

Through These Services, YCM Invest Not Only Meets The Basic Needs Of Traders, But Also Helps Them Achieve Their More Advanced Investment Goals.

Technical Infrastructure

The Technical Infrastructure Of YCM Invest Is Based On High Availability, Low Latency And High Security:

- Server Network : Deploy Servers In Major Financial Centers Around The World To Ensure Traders Get The Best Possible Order Execution Speed.

- Cyber Security : Protect Customer Data And Transaction Security With Multi-layer Security Protocols (e.g. SSL Encryption, Firewalls, Etc.).

- Backup System : Have Comprehensive Disaster Recovery And Backup Mechanisms To Ensure Business Continuity In Extreme Situations.

A Strong Technical Infrastructure Supports YCM Invest's Efficient Operations And Customer Satisfaction.

Compliance And Risk Control System

YCM Invest's Compliance And Risk Control System Includes The Following Key Elements:

- Straight-through Processing (STP) Model : All Orders Are Passed Directly To Liquidity Providers, Ensuring Transparent And Fair Execution.

- Risk Management System : Provides A Variety Of Risk Control Tools, Including Stop-loss Orders, Limit Orders, And Leverage Limits, To Help Traders Manage Market Risk.

- Compliance Statement : The Company Is Committed To Complying With All Relevant Laws And Regulations And Is Regularly Audited And Supervised By The FCA.

Through These Measures, YCM Invest Ensures A Fair And Transparent Trading Environment While Maximizing The Protection Of Client Interests.

Market Positioning And Competitive Advantage

YCM Invest Has The Following Competitive Advantages On Financial Marekt:

- Extensive Product Portfolio : Supports Trading Across Multiple Asset Classes To Meet The Diverse Needs Of Different Traders.

- Strong Technical Support : Provides Leading Trading Platforms And Tools To Support The Execution Of Complex Trading Strategies.

- Regulated Operating Model : FCA Regulation Provides Traders With Higher Levels Of Trust And Security.

- Globalized Service Network : Supports Multilingual And Multi-currency Trading, Providing A Convenient Trading Experience For Global Clients.

These Advantages Make YCM Invest Stand Out In The Highly Competitive Financial Marekt And Become The Broker Of Choice For Many Traders.

Customer Support And Empowerment

YCM Invest Not Only Provides Trading Services, But Also Strives To Help Traders Improve Their Skills Through Educational Resources And Tools:

- Market Analysis Reports : Regular Release Of Market Trend Analysis To Help Traders Seize Investment Opportunities.

- Trading Tutorials : Provides Detailed Tutorials For Different Trading Tools And Strategies.

- Risk Management Guide : Helps Traders Develop Scientific Risk Management Plans.

Through These Empowering Services, YCM Invest Helps Traders Make More Efficient Investments In Complex And Changing Markets.

Social Responsibility And ESG

Although YCM Invest's Specific Practices In The Field Of Social Responsibility And ESG Have Not Been Disclosed In Detail, As A Regulated Financial Institution Group, The Company Always Follows The Highest Ethical And Compliance Standards In The Industry And Is Committed To Supporting Customers And Creating Value For Society.

Strategic Cooperation Ecosystem

YCM Invest Has Established Strategic Partnerships With Several Institutions To Further Enhance Its Service Capabilities And Market Influence:

- Liquidity Providers : Collaborate With Several Top Liquidity Providers To Ensure Traders' Quote Depth And Execution Efficiency.

- Technology Partners : Collaborate With Leading Trading Platforms And Technology Suppliers To Provide Clients With The Best Trading Experience.

- Industry Association : Actively Participate In The Development And Promotion Of Industry Standards As A Member Of Several Financial Industry Associations.

Financial Health

The Financial Health Of YCM Invest Can Be Assessed By The Following Key Indicators:

- Registered Capital : The Company's Registered Capital Is £2.30 Million (as Of 2023).

- Management Size : The Company's Asset Management Size Is Approximately £250 Million As Of 2023.

These Data Indicate That YCM Invest Is A Financially Sound And Sustainable Financial Institution Group.

Future Roadmap

The Future Development Directions Of YCM Invest Include:

- Product Expansion : Plans To Launch More Innovative Trading Tools And Investment Products In The Future To Meet Changing Market Demands.

- Technology Upgrade : Continuously Optimize The Trading Platform And Infrastructure To Improve The Trading Experience And Execution Efficiency.

- Globalization Strategy : Further Expand The Global Market Presence, Especially In Asia And The Middle East.

- Client Education : Increase Investment In Educational Resources To Help More Traders Improve Their Investment Skills And Market Understanding.

Through These Programs, YCM Invest Will Continue To Strengthen Its Leading Position In Financial Marekt And Provide Better Service To Its Clients.