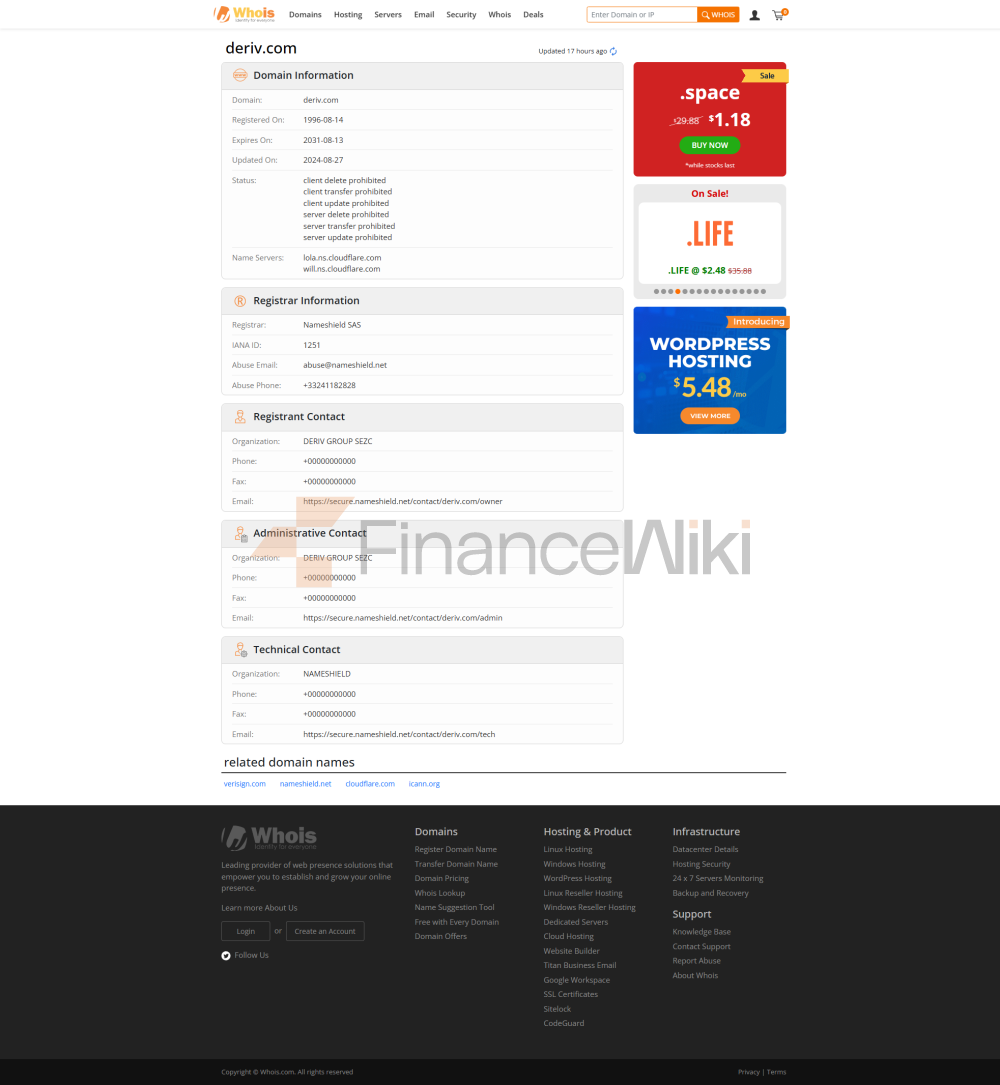

ProfileDeriv is an online trading broker founded in 1999 and developed from Regent Markets. The company is known as Deriv Group and is headquartered in Malta. As a long-established trading platform, Deriv's predecessors included brands such as BetOnMarkets.com and Binary.com, and the evolution and integration of these brands have made Deriv an important player in the current market.

Deriv offers a wide range of trading products and services, including Forex, Cryptocurrencies, Commodities, Stock Indices and Contracts for Difference (CFDs). The platform is designed to meet the needs of different traders, from novice to professional traders, to find the right tool for them in Deriv.

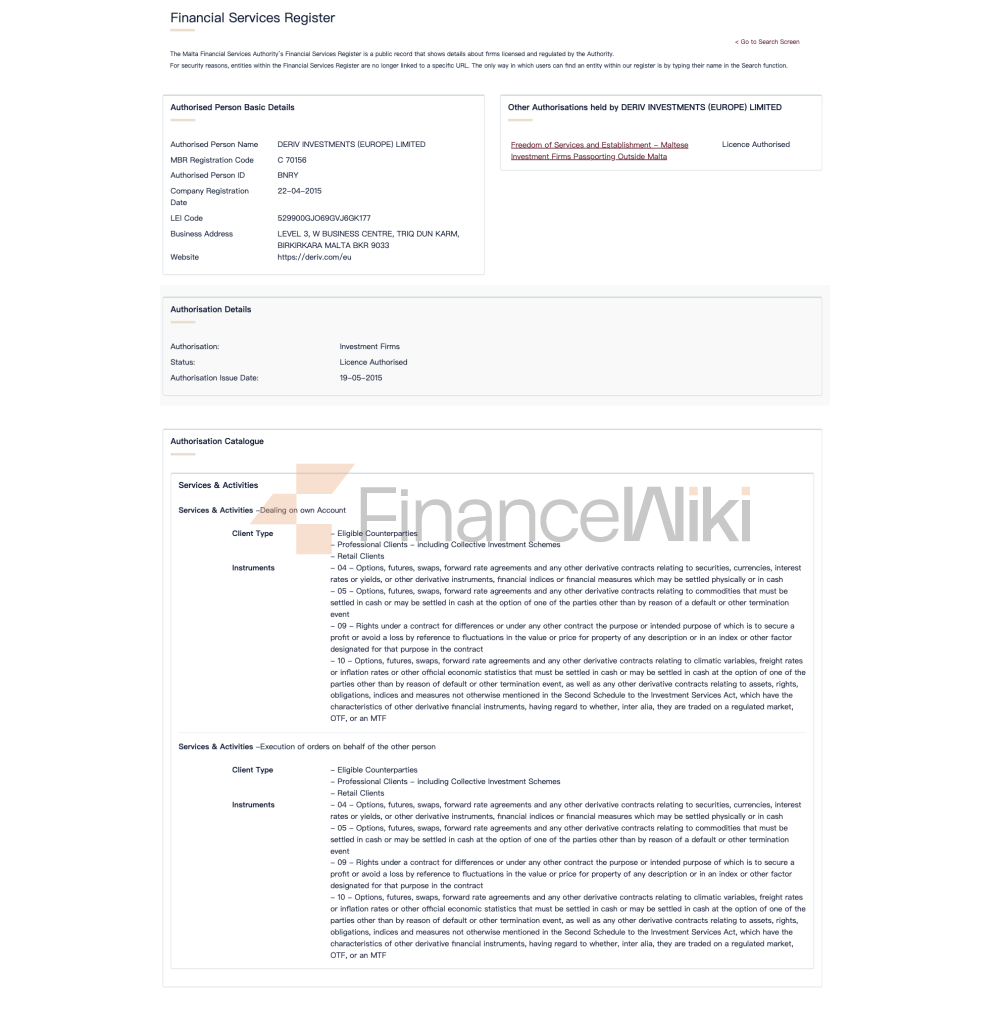

regulatory

informationDeriv is not currently supervised by financial regulators in any country or region. While its parent company Binary.com licensed with the Malta Financial Services Authority (MFSA) in Malta, Deriv itself is not officially authorized by any regulatory body. This is an important consideration when choosing Deriv for trading, as the safety of investors' funds and transactions may not be fully guaranteed without regulatory oversight.

trading

productsDeriv offers a wide range of trading products, covering multiple financial asset classes:

forex currency pairs: This includes major currency pairs (such as EUR/USD) and minor currency pairs.

Cryptocurrencies: Offer trading in digital currencies such as Bitcoin and Ethereum.

Commodities: including gold, silver, crude oil, etc.

Stock indexes: Covers the world's major stock indices, such as the Dow Jones index, NASDAQ index, etc.

Derived Indices: This is a virtual index unique to Deriv that simulates the volatility of the real market and provides traders with additional trading opportunities.

Contract for Difference (CFD): Allows traders to trade based on the price fluctuations of the underlying asset.

Digital Options and Multiplier Options: A variety of options trading types are available, including options for high leverage and limited risk.

Deriv's trading products cover both traditional financial markets and emerging digital assets, providing traders with a wide range of options.

trading software

Deriv offers a variety of trading platforms to meet the preferences of different traders:

DerivTrader: Web-based platform with intuitive charting tools and real-time data.

DerivGo: Designed for mobile trading, it supports both iOS and Android devices.

DerivBot: An automated trading platform that allows traders to set up and execute automated trading strategies.

DerivMT5: A platform integrated with MetaTrader 5 (MT5) that supports advanced analytics and algorithmic trading.

DerivX: A versatile trading platform that offers a variety of order types and charting tools.

SmartTrader: A platform focused on technical analysis, suitable for traders with complex strategies.

Designed with the user experience in mind, Deriv's trading platform offers a variety of tools and features to help traders execute their trading strategies more efficiently.

deposit and withdrawal

methodsDeriv supports a variety of payment methods to ensure easy access to traders' funds:

credit/debit cards: including Visa , MasterCard, Maestro, etc.

E-wallets: Advcash, Neteller, Skrill, etc.

Cryptocurrencies: Bitcoin, Ethereum, USDT, etc.

Bank Transfers: Local and international bank transfers are supported.

Mobile payments: including M-Pesa, MTN, Vodafone, etc.

For the minimum and maximum amounts for deposits and withdrawals, Deriv varies depending on the payment method and currency type. For example, Visa and MasterCard typically offer deposit amounts ranging from $10 to $5,000, while e-wallets and cryptocurrencies are more flexible in deposit and withdrawal amounts.

customer

supportDeriv offers a variety of customer support channels to meet the needs of traders around the world:

Live chat: Ideal for urgent questions and real-time consultations.

Help Center: Contains frequently asked questions (FAQs), instructional videos, and how-to guides.

Community forums: Allow traders to exchange experiences, share strategies, and seek community support.

Physical Offices:D ERIV has offices in many countries and regions around the world, including Malta, Singapore, Dubai, Rwanda, etc.

Deriv's customer support team is known for being multilingual, providing clear and timely assistance to traders in different countries and regions.

core business and

servicesDeriv's core business is to provide online financial derivatives trading services to retail and institutional investors. Its services cover multiple financial markets, including forex, cryptocurrencies, commodities, and stock indices. Deriv helps traders participate in the market in different ways through its diverse platforms and tools:

Margin Trading: Allows traders to control larger positions with a small amount of capital.

Options Trading: Digital options and multiplier options are available to help traders achieve high returns with limited risk.

CFD Trading: Trading based on the price fluctuations of the underlying asset without holding the actual asset.

Deriv's business model emphasizes flexibility and versatility, making it suitable for traders with different trading styles and investment goals.

technical

infrastructureDeriv's technical infrastructure is based on high-performance servers and an advanced trading engine to ensure fast and stable trade execution. Its platform supports multi-device transactions, including PCs, mobile devices, and web terminals. In addition, Deriv offers API interfaces that allow traders to integrate with third-party tools and trading platforms.

Compliance & Risk Control SystemAlthough Deriv is not currently regulated, it has taken a series of measures in terms of risk management:

high leverage control: For different trading products, Deriv has set different leverage caps, up to 1:1000.

Risk Segregation: Through a separate account structure, it is ensured that the client's funds are segregated from the company's operating funds.

Market monitoring: Monitor market fluctuations through technical means to prevent abnormal trading behaviors.

Deriv's risk management measures are designed to minimise trading risk, but its lack of regulation may limit the effectiveness of these measures.

Market Positioning &

Competitive AdvantageDeriv's market positioning is to provide a variety of trading tools and flexible trading platforms to meet the needs of different traders. Its competitive advantages include:

product diversity: covering a variety of asset classes to meet the preferences of different traders.

User experience: Provide a variety of trading platforms to adapt to different trading styles and needs.

Low initial deposit requirements: Some accounts require a minimum deposit of only $5, making them suitable for novice traders with limited funds.

Multilingual support: Covering traders around the world, customer support and educational resources are available in multiple languages.

Despite being unregulated, Deriv has attracted a large number of traders around the globe through the flexibility of its technology and platform.

Customer Support &

EnablementDeriv helps traders upskill through its educational resources, including:

- Help

Center: FAQs and how-to guides are available.

Community Forum: A place where traders can share their experiences and discuss strategies.

Blog: Provides market analysis, trading tips, and industry updates.

Deriv's educational resources are hands-on and help traders quickly master trading skills and increase profitability.

Social Responsibility and ESG

Deriv has limited information disclosure on social responsibility, but as a global fintech company, it may assume certain social responsibilities in the following aspects:

financial education: help more people understand financial markets and trading tools through educational resources.

Technology empowerment: Support financial technology innovation and promote the development of financial markets.

Deriv has not yet explicitly published its ESG (Environmental, Social, Governance) report, but could make a difference in this area in the future as global attention to sustainability increases.

Strategic Partnership

EcosystemDeriv has established partnerships with partners in the fintech sector, including payment platforms, technology solution providers, and data analytics companies. These partnerships are designed to enhance Deriv's platform performance, trading experience, and customer service capabilities.