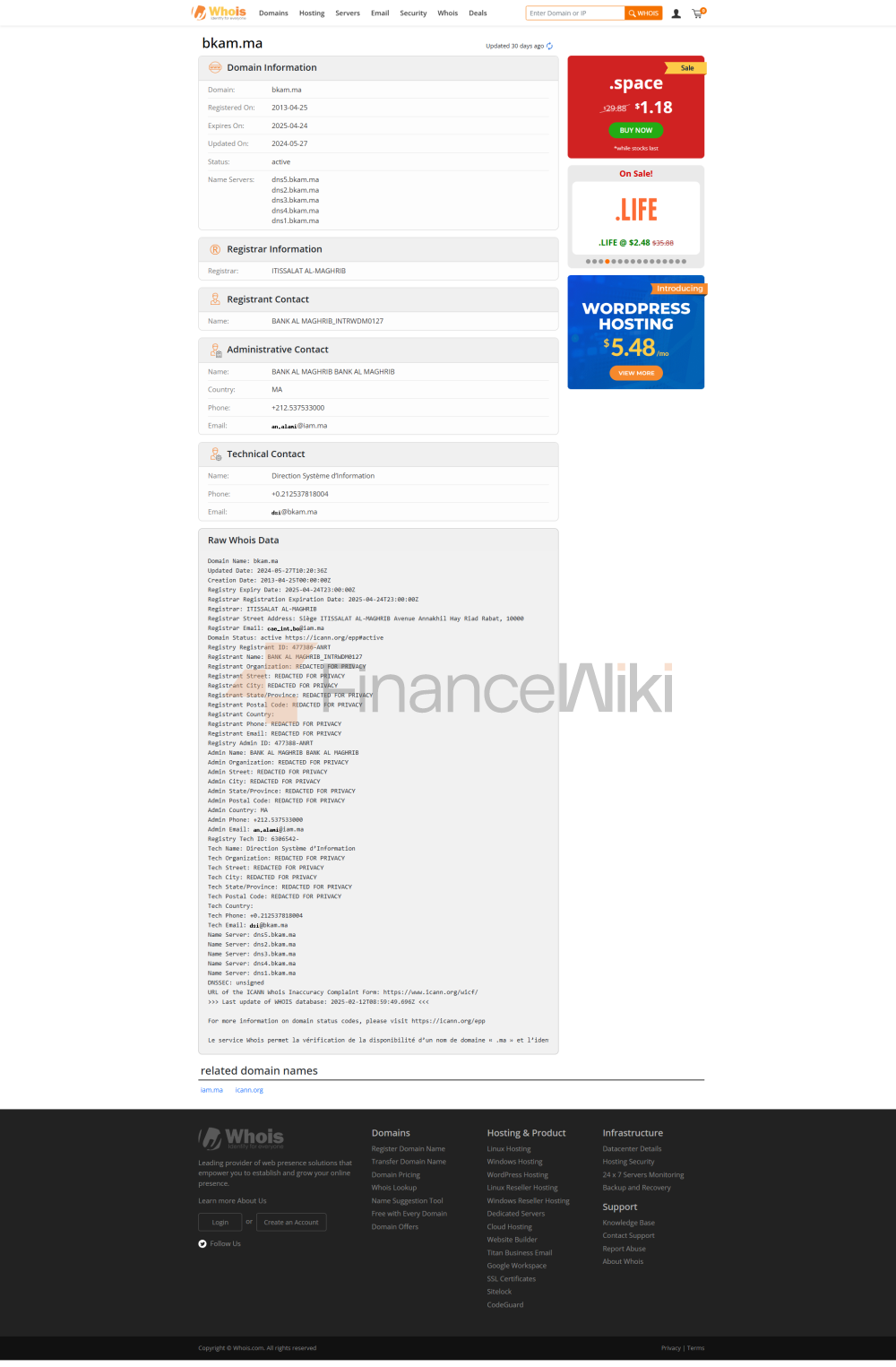

Bank Al-Maghrib Basic InformationBank

Al-Maghrib (Bank of Morocco) is the central bank of Morocco, founded in 1959 and headquartered in Rabat, the capital of Morocco. As the nation's central bank, Bank Al-Maghrib plays a crucial role in Morocco's monetary policy, financial stability, and banking supervision. The Bank of Morocco is not a commercial bank in the traditional sense, but a state-owned institution that is directly subordinate to the Moroccan government. It is not listed and is completely controlled by the state.

Scope of ServicesBank

Al-Maghrib's main clients are the Moroccan financial system, including banks, insurance companies, investment companies, etc. Its functions involve financial stability, monetary policy, exchange rate management, financial market supervision, etc. Although it does not have offline outlets and ATM facilities, as a central bank, it does not provide retail banking services directly to the public, but rather ensures that financial services can be reached nationwide through partnerships with commercial banks.

Regulation & ComplianceAs

the central bank of Morocco, Bank Al-Maghrib is regulated by the Moroccan government. Its functions are to ensure the healthy functioning of the financial system, implement financial policies, and supervise other financial institutions, including commercial banks. Bank Al-Maghrib itself does not participate in the deposit insurance program, but it is the core regulator of the Moroccan financial system, responsible for developing and supervising the compliance practices of financial institutions and ensuring the stability and transparency of financial markets.

Financial HealthAs

a central bank, Bank Al-Maghrib relies primarily on state fiscal support and does not directly rely on traditional profit models. Its financial health is directly determined by the policies it implements and the state of the country's economy. Although the Bank of Morocco does not disclose its financial indicators that are common to commercial banks, such as its capital adequacy ratio, non-performing loan ratio and liquidity coverage ratio, one of its main functions is to ensure the country's economic stability and the effectiveness of monetary policy.

Deposits & LoansBank

Al-Maghrib does not offer direct-to-person or business-oriented deposit and loan products like commercial banks. Its main task is to manage Morocco's money supply and develop the corresponding monetary policy. The functions of a bank include:

deposit management: As a central bank, it influences market liquidity by regulating measures such as the reserve ratio of commercial banks.

Lending operations: It regulates the flow of funds in the financial markets by providing refinancing support to commercial banks in Morocco.

Digital Service ExperienceBank

Al-Maghrib also maintains high standards when it comes to digital services. It promotes digital finance in Morocco by providing financial regulation, foreign exchange trading platforms, and monetary policy transparency. Its website and associated digital platforms provide real-time data and policy updates to the public and financial institutions. The core functions of the Bank of Morocco include real-time exchange rate information, monetary policy statements, and updates to the regulatory and regulatory framework for financial institutions.

Technological InnovationAs

a central bank, Bank Al-Maghrib plays a leading role in driving fintech innovation. It drives the development of the Moroccan fintech ecosystem by partnering with fintech companies. For example, banks have played an important role in promoting cashless payments, electronic payment systems, and the use of blockchain technology in the financial sector.

Quality of Customer ServiceWhile

Bank Al-Maghrib does not provide retail banking services per se, it provides multi-channel support to commercial banks and other financial institutions, including through its website, telephone hotline, and collaboration with government departments to ensure the smooth operation of the financial services system. The Bank of Morocco also regularly organizes public discussions on financial policy and the economic situation to enhance public understanding of financial regulation and monetary policy.

Security MeasuresAs

a central bank, Bank Al-Maghrib has strict safeguards in place in terms of data and fund security. It ensures the stability and security of Morocco's financial markets through high standards of encryption and system security safeguards. In addition, the Bank of Morocco has implemented strict anti-fraud technology and monitoring systems to ensure the legitimacy and transparency of financial transactions.

SummaryBank

Al-Maghrib As the central bank of Morocco, Bank Al-Maghrib is responsible for maintaining the country's financial stability, formulating monetary policy, and supervising financial institutions. It does not provide retail banking services directly, but its regulatory framework ensures the healthy functioning of the Moroccan banking system and promotes the development of the Moroccan financial ecosystem through digital technologies. Although its functions differ from those of commercial banks, Bank Al-Maghrib's central role in Morocco's economy and financial markets makes it an important player in the global financial system.