Corporate Profile

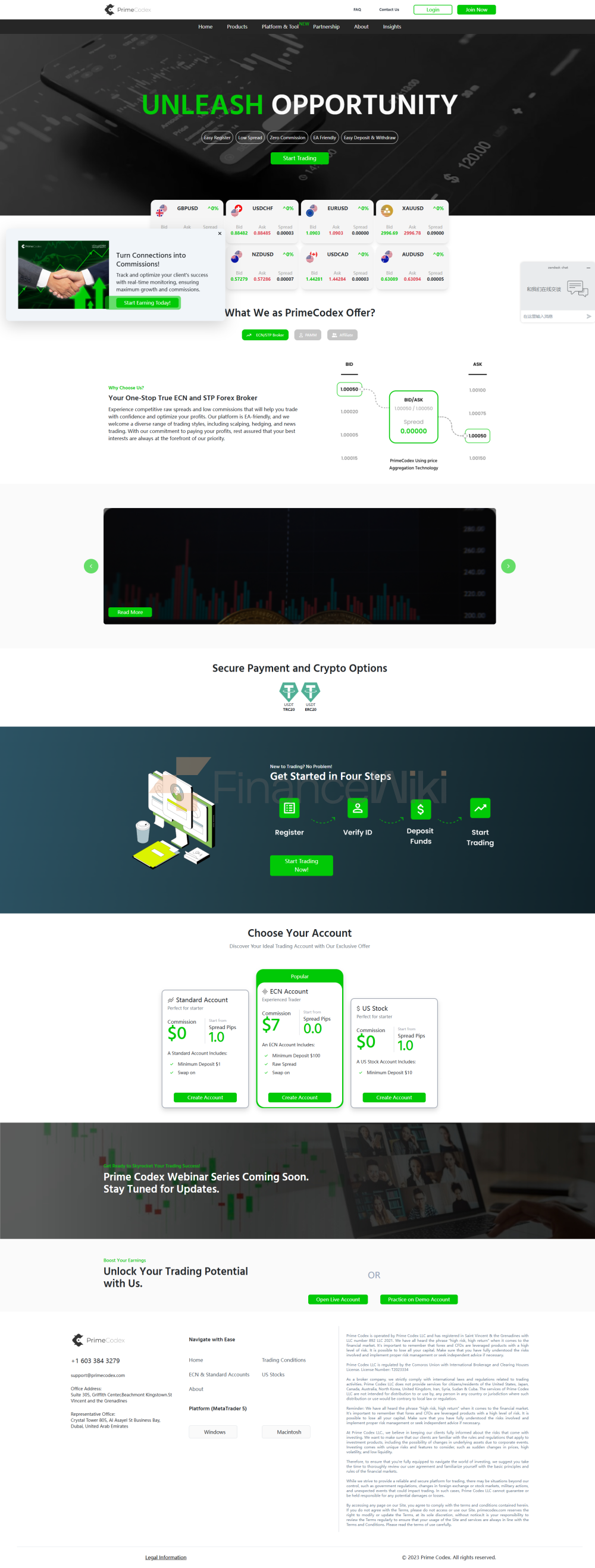

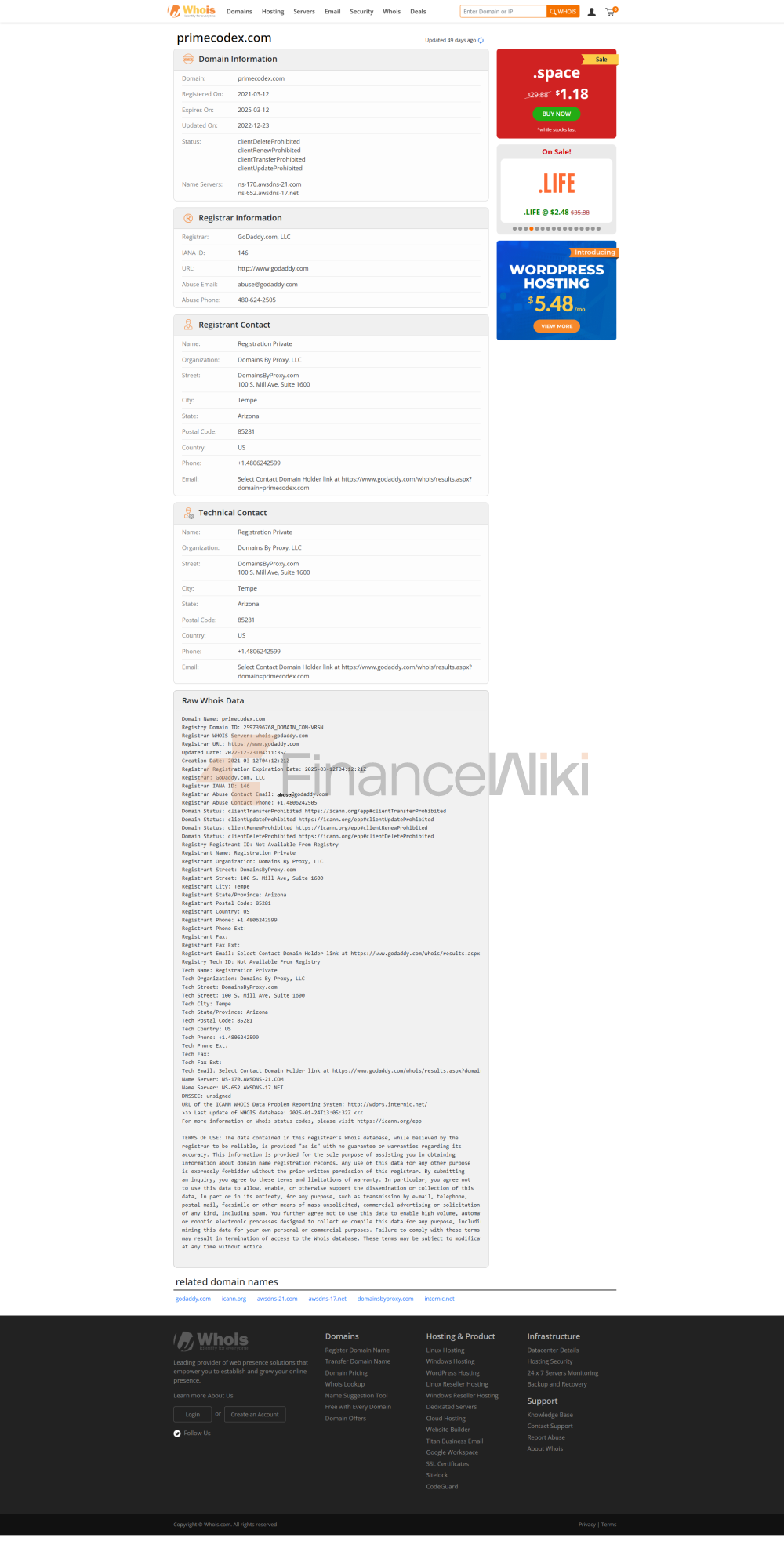

Prime Codex LLC, Established In 2021, Is Headquartered In Saint Vincent And The Grenadines And Has A Representative Office In Dubai. The Company Offers A Variety Of Financial Products And Services, Including Foreign Exchange, Precious Metals, And US Equity Trading. Although Prime Codex Is Registered In Saint Vincent And The Grenadines, It Does Not Have A Valid Regulatory Mandate And Its Regulatory Status With The National Futures Association (NFA) In The United States Has Not Been Approved.

Prime Codex Attracts Clients With Its Trading Conditions Of Low Spreads, High Leverage, And Zero Commissions. The Company Offers Multiple Account Types Including Standard Account, ECN Account, US Stock Account, And Demo Account With Minimum Deposit Requirements Of 1 Dollar, 100 Dollars, 10 Dollars, And None, Respectively. Customers Can Make Deposits And Withdrawals Using A Variety Of Payment Methods Including Cryptocurrencies, Credit Cards, And Bank Transfers.

Regulatory Information

Prime Codex Currently Has No Effective Regulation. Although It Is Registered With The National Futures Association (NFA), Its Regulatory Status Has Not Been Approved. Lack Of Effective Regulation May Increase Risk Exposure For Traders, So Caution Should Be Considered When Choosing Prime Codex As A Trading Partner.

Prime Codex Is Headquartered In Saint Vincent And The Grenadines And Has A Representative Office In Dubai. Due To The Lack Of Effective Regulation, Prime Codex May Not Be Able To Operate Legally In Certain Countries And Regions, Such As The United States, Japan, Canada, Australia, North Korea, The United Kingdom, Iran, Syria, Sudan, And Cuba.

Trading Products

Prime Codex Offers Three Main Trading Products:

- Forex Market: The Forex Market Is The Largest Financial Marekt In The World, Offering High Liquidity And 24-hour Trading. Prime Codex Allows Traders To Trade Taking Advantage Of Currency Fluctuations.

- Precious Metals: Gold And Silver Are Inherently Valuable And Attractive As Safe-haven Assets In Times Of Economic Uncertainty.

- US Stocks: Prime Codex Allows Traders To Invest In US-listed Companies And Participate In The Growth Of The World's Largest Economy.

Trading Software

Prime Codex Offers Multiple Trading Platforms, Including MetaTrader 5 (MT5) And PAMM (Percent Allocation Management Module). MT5 Is A Comprehensive Trading Platform That Offers Advanced Charting Tools, Customizable Indicators, And Algorithmic Trading Capabilities. PAMM Allows Traders To Allocate Funds To Professional Traders To Participate In Financial Marekt Through Passive Investing.

Prime Codex Also Offers Demo Accounts That Allow Traders To Practice And Optimize Their Trading Strategies In A Risk-free Environment.

Deposit And Withdrawal Methods

Prime Codex Supports A Variety Of Deposit And Withdrawal Methods, Including Cryptocurrencies, Credit Cards, And Bank Transfers. The Minimum Requirements For Deposits And Withdrawals Are:

- Standard Account: Minimum Deposit Of 1 Dollar, No Maximum Limit

- ECN Account: Minimum Deposit Of 100 Dollars, No Maximum Limit

- US Stock Account: Minimum Deposit Of 10 Dollars, No Maximum Limit

Prime Codex Accepts Cryptocurrencies As The Primary Method Of Withdrawal, Providing Fast And Secure Transactions. Credit Card Deposits Are Subject To A Maximum Transaction Limit Of 3,200 Dollars To Comply With Regulatory Standards. Customers Who Choose To Deposit With A Credit Card Are Subject To Additional Verification Procedures.

Customer Support

Prime Codex Offers Multiple Channels Of Customer Support, Including Email, Phone, And Office Addresses. Clients Can Contact Prime Codex At:

- Email: Support@primecodex.com

- Phone: + 1 603 384 3279

- Office Address: Griffith Center, Beachmont Kingstown, St. Vincent And The Grenadines, Suite 305

- Representative Office Address: Crystal Tower 805, Al Asayel St, Business Bay, Dubai, United Arab Emirates

Core Business And Services

Prime Codex's Core Business Includes Foreign Exchange, Precious Metals And US Equity Trading. The Company Offers A Variety Of Account Types, Including Standard Accounts, ECN Accounts, US Stock Accounts, And Demo Accounts. Prime Codex Also Offers EA (Expert Advisor) Support That Allows Traders To Automate The Trading Process Using Algorithmic Trading Strategies.

Prime Codex's Low Spreads, High Leverage, And Zero Commission Trading Conditions Make It A Popular Choice For Traders. The Company Also Offers Educational Resources To Help Traders Improve Their Trading Skills And Knowledge.

Technical Infrastructure

The Technical Infrastructure Of Prime Codex Includes The MetaTrader 5 (MT5) And PAMM Platforms.

- MetaTrader 5: MT5 Is A Powerful Trading Platform That Provides Advanced Charting Tools, Customizable Indicators, And Algorithmic Trading Capabilities. It Supports Multiple Trading Strategies, Including Manual And Automated Trading.

- PAMM: PAMM Allows Traders To Allocate Funds To Professional Traders To Participate In Financial Marekt Through Passive Investing. The PAMM System Provides Transparent Management Fees And Profit Distribution, Enabling Traders To Easily Participate In The Trading Market.

Prime Codex Also Offers Demo Accounts That Enable Traders To Practice And Optimize Their Trading Strategies In A Risk-free Environment.

Compliance And Risk Control System

Prime Codex Currently Has No Effective Regulation And Its Regulatory Status Has Not Been Approved Despite Being Registered With The National Futures Association (NFA) In The United States. Lack Of Effective Regulation May Increase Traders' Risk Exposure, So Caution Should Be Considered When Choosing Prime Codex As A Trading Partner.

Prime Codex Is Headquartered In Saint Vincent And The Grenadines And Has A Representative Office In Dubai. Due To Lack Of Effective Regulation, Prime Codex May Not Be Able To Operate Legally In Certain Countries And Territories, Such As The United States, Japan, Canada, Australia, North Korea, The United Kingdom, Iran, Syria, Sudan And Cuba.

Market Positioning And Competitive Advantage

Prime Codex's Market Positioning Is Primarily Focused On Offering Trading Conditions With Low Spreads, High Leverage, And Zero Commissions. The Company's Competitive Advantages Include:

- Low Spreads: Prime Codex's Spreads Start From 0 Pips, With Low Transaction Costs And Maximum Potential Profits.

- High Leverage: Prime Codex Offers Leverage Of Up To 1:500, Allowing Traders To Control Larger Positions With Relatively Little Capital.

- Zero Commissions: Prime Codex's Standard And US Stock Accounts Have No Commissions, Enabling Traders To Execute Trades Without Incurring Additional Fees.

- Support For EAs: Prime Codex Supports EAs (Expert Advisors), Allowing Traders To Automate The Trading Process Using Algorithmic Trading Strategies.

- Account Diversity: Prime Codex Offers Multiple Account Types, Including Standard Accounts, ECN Accounts, US Stock Accounts, And Demo Accounts, To Meet The Diverse Needs Of Traders.

Customer Support And Empowerment

Prime Codex Offers Multiple Customer Support Channels, Including Email, Phone, And Office Addresses. Customers Can Contact Prime Codex At:

- Email: Support@primecodex.com

- Phone: + 1 603 384 3279

- Office Address: Griffith Center, Beachmont Kingstown, St. Vincent And The Grenadines, Suite 305

- Representative Office Address: Crystal Tower 805, Al Asayel St, Business Bay, Dubai, United Arab Emirates

Prime Codex Also Provides Educational Resources To Help Traders Improve Their Trading Skills And Knowledge. Educational Content Includes:

- Academy: Various Courses Covering Different Aspects Of Forex Trading.

- Interactive Quiz: Traders Can Assess Their Skills And Get Advice Through An Interactive Quiz.

- Popular Courses: Covers A Wide Range Of Topics, Including Beginner, Intermediate And Advanced Courses.

- Latest News: Prime Codex Provides Information To Traders Through The Latest Market News And Updates.

Social Responsibility And ESG

Prime Codex Currently Has No Explicit Information On Social Responsibility And Environmental, Social And Governance (ESG) Aspects. The Company Mainly Focuses On Providing Effective Financial Transaction Services, But Does Not Disclose Its Specific Policies And Measures In Terms Of Social Responsibility And ESG.

Strategic Cooperation Ecology

Prime Codex Currently Has No Publicly Available Information On Strategic Partners. The Company Mainly Relies On Its Own Technology Infrastructure And Client Server To Attract And Retain Customers.

Financial Health

There Are Currently No Publicly Available Details On The Financial Health Of Prime Codex. Due To The Lack Of Effective Supervision Of The Company, Its Financial Transparency And Stability May Be Affected.

Future Roadmap

Future Roadmap Of Prime Codex Currently Has No Publicly Available Details. The Company May Plan To Continue To Expand Its Trading Products And Services, Optimize Its Technical Infrastructure, And Improve The Quality Of Its Customer Support And Educational Resources In Order To Attract More Traders And Investors.

Prime Codex May Also Plan To Acquire More Regulatory Licenses In Order To Enhance Its Legitimacy And Credibility. In Addition, The Company May Plan To Expand Its Regional Services In Order To Attract More International Clients.

Overall, Prime Codex Attracts The Attention Of Traders By Offering Low Spreads, High Leverage, Zero Commissions, And A Variety Of Account Types. However, The Lack Of Effective Regulatory And Regional Restrictions May Have An Impact On Its Appeal To Traders In Certain Regions. Clients Should Carefully Consider The Risks And Advantages Of Prime Codex When Choosing It As A Trading Partner.