EXCO Is A Trading Platform Established In 2019 And Registered In Saint Vincent And The Grenadines. It Is Important To Note That EXCO Is Not Regulated By Any Financial Institution Group. The Platform Offers Trading In Indices, Commodities And Cryptocurrencies And Is Available In Two Account Types: EXCO ECN And EXCO STP. The Minimum Deposit Amount To Open An Account Is $50 And The Maximum Leverage Provided Is 1:1000. Spreads Start From 0.5 Pips For Both Account Types.

EXCO Utilizes The MetaTrader 4 (MT4) Platform For Trading And Users Can Explore The Platform Using Demo Accounts Before Committing To Using Real Money. Customer Support Is Available Via Email, Phone And Social Media Channels. Deposit And Withdrawal Options Include Online Banking, Bank Transfers, Cryptocurrencies, And Payment Wallets. EXCO Also Offers A Range Of Educational Resources Such As Live Trading Sessions, Webinars, Tutorials, Articles, And Trading Courses.

Pros And Cons

Pros: Diverse Market Instruments, Account Types Configured By Two Different Traders, Competitive Spreads Starting At 0.5 Pips, Demo Accounts Available, Comprehensive Customer Support Via Email, Phone And Social Media, Educational Resources (live Trading Sessions, Webinars, Tutorials, Articles And Trading Courses)

Cons: Lack Of Regulatory Oversight, Withdrawal Processing Limited To Business Hours, Possible Withdrawal Fees, Variable Maximum Leverage For Currency Pairs

Pros:

Diversified Market Tools: EXCO Offers A Wide Range Of Trading Options, Including Popular Indices, Commodities, And Cryptocurrencies. This Allows Traders To Diversify Their Portfolio And Explore Different Market Opportunities.

Two Account Types With Different Needs: EXCO Offers Two Account Types, ECN And STP, Catering To Both Experienced And Beginner Traders. ECN Accounts Offer Tighter Spreads And Direct Market Access, While STP Accounts Have Looser Spreads But No Commissions.

Competitive Spreads: Starting From 0.5 Spreads, EXCO's Spreads Are Competitive And May Improve Traders' Profitability.

Availability Of Demo Accounts: Demo Accounts Allow Traders To Explore The Platform And Test Their Strategies Using Virtual Funds Before Committing Real Money. This Is An Invaluable Tool For Both Beginners And Experienced Traders.

Comprehensive Customer Support: EXCO Offers Multiple Channels Of Customer Support, Including Email, Phone, And Social Media. This Ensures That Traders Can Easily Ask For Help When They Need It.

Educational Resources: EXCO Offers A Variety Of Educational Resources, Including Live Trading Sessions, Webinars, Mentorship Programs, Articles, And Trading Courses. This Can Help Traders At All Levels Improve Their Skills And Knowledge.

Cons:

Lack Of Regulatory Oversight: An Important Issue Is The Lack Of Regulation Of EXCO. This Means That Traders May Not Have The Same Level Of Protection As Regulated Brokers. For Example, If EXCO Goes Bankrupt, There Is No Guarantee That Traders Will Be Able To Recover Their Funds.

Withdrawal Processing Is During Business Hours Only: While There Are Convenient Options For Deposits Such As Cryptocurrencies, Withdrawals At EXCO Are Processed Only During Business Hours, Monday Through Friday. This May Be Less Convenient For Traders Who Need Access To Their Funds Outside Of Normal Business Hours.

Possible Fees Incurred For Withdrawals: Although Specific Processing Fees Are Not Readily Available, Some Withdrawal Methods At EXCO May Incur Additional Fees. This May Reduce Potential Profits, Especially For Smaller Withdrawal Amounts.

Variable Maximum Leverage: The Maximum Leverage Offered By EXCO Varies Depending On The Instrument And Account Type. For Example, Currency Pairs Can Have Leverage Up To 1:1000, But Other Instruments Have Leverage Capped At 1:100. This Can Be Confusing For Traders And Is Not For Everyone.

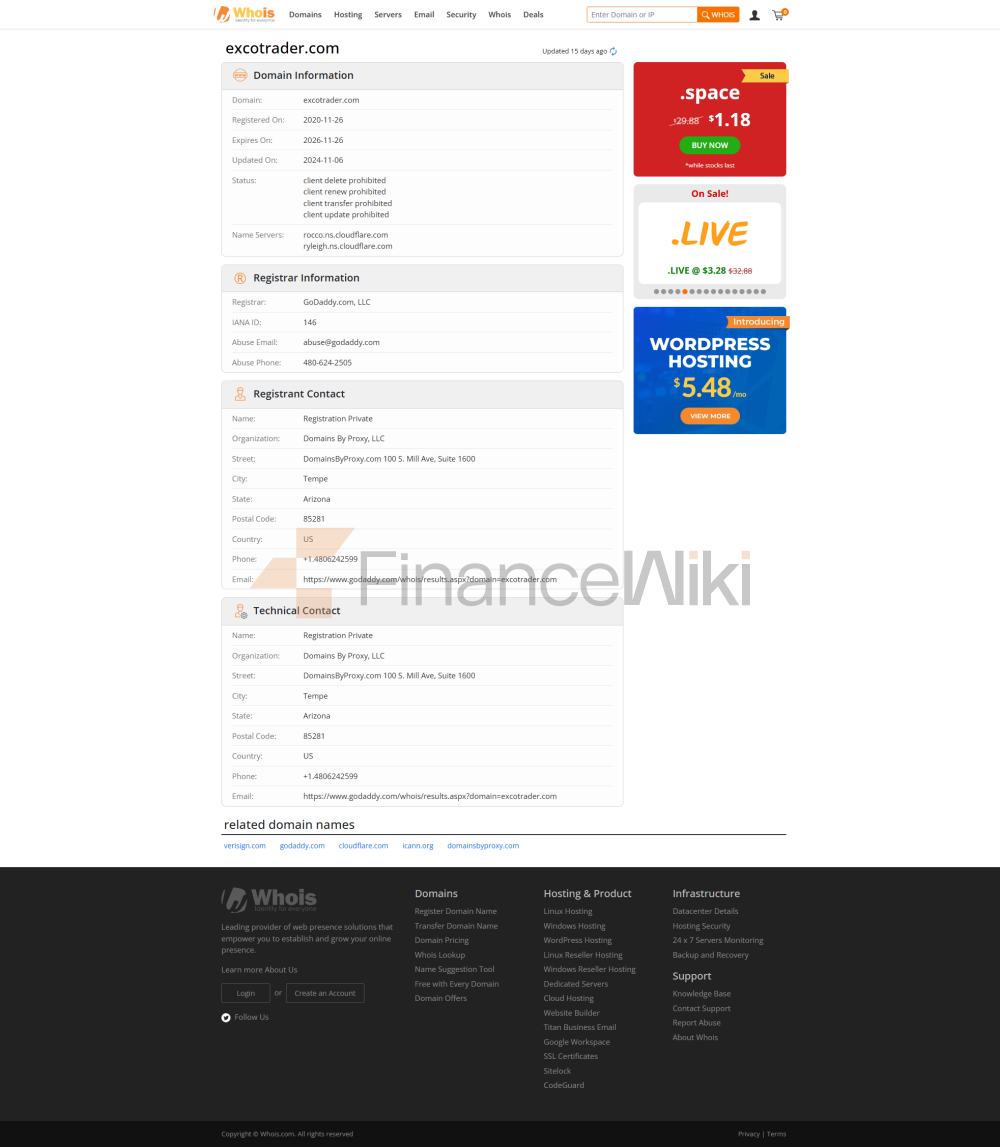

Regulatory Status

EXCO Does Not Have Any Regulated Licenses. It Is Important To Note That Operations Without Regulatory Oversight May Pose A Risk To Traders, As Regulators Are Responsible For Ensuring That Financial Institution Groups Comply With Established Standards And Protect The Interests Of Investors.

Before Trading With Any Trading Platform, It Is Necessary For Investors To Thoroughly Research And Verify The Regulatory Status Of The Broker. A Reputable And Regulated Broker Is Usually Licensed By An Accredited Financial Institutions Group, Providing Transparency And Accountability.

Market Instruments

EXCO Is A Platform That Caters To A Wide Variety Of Investment Needs By Trading In Three Main Categories: Indices, Commodities And Cryptocurrencies. Here Are The Specifics Of What You Can Trade On EXCO:

Account Types

EXCO Offers Two Different Account Types To Suit Different Trading Styles And Needs: EXCO ECN And EXCO STP.

EXCO ECN Account:

EXCO ECN Account Is Designed For Experienced Traders Who Are Willing To Take High Risks In Their Trading Activities. Designed For Currency Pair Trading, This Account Offers Leverage Of Up To 1:500, Enabling Traders To Control Positions That Are 500 Times Larger Than Their Account Balance. It Is Worth Noting That The Maximum Leverage Is Different For Other Instruments, With A Maximum Leverage Of 1:100 For Indices And Commodities. The Account Structure Features A Commission-based Fee Model With A $2 Fee Per Side, Indicating That Traders Are Required To Pay A Fee When Opening And Closing Positions. To Use The Account, A Minimum Deposit Of $100 Is Required. Overall, The EXCO ECN Account Is Designed For Experienced Traders Who Are Looking For Enhanced Leverage And Are Willing To Take On The Associated Risks And Costs.

EXCO STP Account:

The EXCO STP Account Is A More Appropriate Option Designed For Beginners And Risk-averse Traders. Focused On Minimizing Risk Exposure, The Account Offers Lower Leverage With A Maximum Of 1:500 For Currency Pairs And 1:100 For Other Instruments. This Conservative Leverage Structure Provides Security, Reducing The Likelihood Of A Trader Losing Their Entire Investment In The Event Of An Adverse Trade. Unlike ECN Accounts, EXCO STP Accounts Operate On A Commission-free Model In Favor Of A Slightly Looser Spread. The Absence Of Commissions Simplifies The User's Fee Structure. To Open An EXCO STP Account, Traders Need To Make A Minimum Deposit Of $50, Making It A More Approachable Option For Novice Traders Or Those Who Prefer A Low-risk Environment.

The Account That Best Suits You Will Depend On Your Personal Trading Goals And Risk Tolerance. If You Are An Experienced Trader Who Is Comfortable Taking On High Risks, Then An EXCO STP Account May Be A Good Choice. However, If You Are A Beginner Or Risk-averse Trader, Then An EXCO STP Account Is A Better Option.

Spreads And Commissions

EXCO Offers Competitive Spreads And Commission Accounts On Its Trading Platform. Both EXCO's ECN And EXCO's STP Accounts Start With A Minimum Spread Of 0.5 Pips On Currency Pairs, Offering A Competitive Rate, Specific Instruments And Market Conditions May Vary. However, Spread Details On Commodities, Indices And Cryptocurrencies Are Not Available.

In Terms Of Commissions, EXCO ECN Charges A Fee Of $2 Per Side, Meaning That Traders Only Pay One Commission When Opening And Closing Positions. EXCO STP, On The Other Hand, Does Not Charge Any Commission. Instead, To Make Up For The Lack Of Direct Market Access, It May Offer Slightly Looser Spreads. Traders Can Choose One Of Two Account Types Based On Their Preference For Commission Or Commission-free, Combined With Relevant Spreads And Trading Conditions.

Leverage

EXCO Offers Different Maximum Leverage Options Depending On The Instrument Being Traded And The Trader's Account Equity. For Currency Pairs On EXCO's ECN And STP Accounts, Users Can Leverage Up To 1:500, Enabling Them To Control Positions 500 Times Larger Than Their Account Balance. However, For Other Instruments Such As Indices, Commodities And Bonds, The Maximum Leverage Is More Conservative And Limited To 1:100. It Is Important To Note That EXCO Employs Dynamic Leverage And Reserves The Right To Adjust The Maximum Leverage Based On The Trader's Account Equity. For Example, If The Equity Is Less Than $500, EXCO May Reduce The Leverage To 1:1000 In Response To The Risk Management Measures Taken In Response To Changes In Account Conditions.

Trading Platform

EXCO's Trading Platform Is Built On The World's Leading MetaTrader 4 (MT4). The Platform Offers Advanced Technology That Provides A User-friendly Interface That Puts Powerful Tools Close At Hand. With Real-time Price Streams And One-click Trading, Users Can Execute Trades Quickly And Efficiently. The Platform Is Capable Of In-depth Market Analysis, With The Ability To Analyze Data In Nine Different Time Frames, Ensuring A Comprehensive Understanding Of Market Trends.

Traders Using EXCO's MT4 Trading Platform Can Access Online Financial Marekt News For Easy Decision-making. The Platform Supports Automated Trading, Allowing Users To Implement Strategies Through Expert Advisors And Other Tools. With Advanced Measures Such As 128-bit Coding, EXCO Ensures The Protection Of User Data And Trades.

In Addition, The MetaTrader 4 Platform Provided By EXCO Is Equipped With Various Trading Tools, Indicators And Advisors To Enhance The Trading Experience. It Allows Users To Monitor, Maintain And Manage Their Trading Accounts Seamlessly. The Versatility Of The Platform Also Includes The Creation Of Custom Tools, Giving Traders The Option To Develop And Share Trading Tools With Others. Overall, EXCO's MetaTrader 4 Platform Provides A Consistent And User-friendly Interface For Trading CFDs, Combining Advanced Technology With A Suite Of Analytical Tools To Meet The Diverse Needs Of Traders.

Deposits & Withdrawals

EXCO's Deposit Process Provides A Flexible And Convenient Way For Traders To Top Up Their Accounts Through Online Banking, Bank Transfers, Cryptocurrencies, And Payment Wallets Such As DuusuPay And PaymentAsia. Minimum Deposit Requirements Vary Depending On EXCO ECN Requirements Of $100 And EXCO STP Requirements Of $50. While Processing Time Depends On The Method Chosen, Certain Options Such As Cryptocurrencies And Payment Wallets May Offer Instant Deposits. The Platform Emphasizes Ease Of Use And Emphasizes Security Measures To Protect Financial Information.

Regarding Withdrawals, EXCO Provides A Simple Process Where Users Can Choose Their Preferred Method, Enter The Withdrawal Amount, And Confirm The Transaction. Withdrawals Will Be Processed During Working Hours From Monday To Friday, With Specific Policies Including The Provision Of Additional Document Verification If Necessary. The Platform Reserves The Right To Recover Processing Fees When There Is No Trading Activity And Provides Transparency About Potential Delays Caused By Disruptions In The Payment Processing System. Overall, EXCO's Deposit And Withdrawal Systems Are Designed To Provide Traders With A Seamless And Secure Financial Experience.

Customer Support

EXCO Has Demonstrated A Comprehensive Approach To Customer Support Through Various Channels, Ensuring Accessibility And Responsiveness For Users. For Direct Communication, Users Can Contact The Support Team Via Email Support@excotrader.com Or By Phone At + 234 912 698 8988. This Gives Users The Option To Choose The Method That Best Suits Their Needs.

Additionally, EXCO Maintains An Active And Engaging Presence On Social Media Platforms Including Facebook (https://www.facebook.com/EXC Open Deal RADERCOM), Instagram (https://www.instagram.com/excotrader/) And LinkedIn (https://www.linkedin.com/company/exco-trader/). These Social Media Channels Not Only Serve As Channels Of Communication But Also Provide Users With A Platform For Updates, Announcements And Interaction With The Community.

By Providing Multiple Channels Of Communication, EXCO Ensures That Users Can Reach Out For Help The Way They Prefer, Whether It's Traditional Email And Phone Support Or Interacting With The Platform Via Popular Social Media Channels. This Multi-faceted Approach To Customer Support Improves Accessibility And Responsiveness, Providing A Positive Overall Experience For Users.

Educational Resources

EXCO Offers A Comprehensive Set Of Educational Resources To Meet The Needs Of Traders Of All Levels Of Experience:

Live Trading: Conducted By Market Experts On Mondays And Thursdays At 3pm (GMT + 1) And 2pm (GMT + 1), Including Live Orders, Individual Market Strategies, Technical And Fundamental Analysis, Live Q & A Sessions, And Community Interaction.

Webinars: Covering A Variety Of Topics Such As Live Trading, Market Analysis, Price Action, And Foreign Exchange Basics, The Seminars Are Scheduled To Take Place Every Wednesday And Thursday At 11am (London/Nigeria Time). Some Sessions Require Advance Registration To Attend.

Mentoring: The Strategy And Mentorship Program Takes Place Monday To Thursday At 2pm (London/Nigeria Time). It Covers Expert Advisors, Technical Analysis, Indicators And Risk Management. Registration Is Required To Attend These Educational Courses.

Articles: EXCO Offers A Library Of Free Trading Articles On Its Website Covering All Aspects Of Trading To Enhance Traders' Knowledge And Skills.

Trading Courses: An Online Professional Trading Course That Can Be Purchased On The EXCO Website Is Designed To Help Traders Grasp Market Opportunities. Offered By Trading Experts, The Course Offers Flexible Online Learning And Includes A Certificate Of Completion.