Corporate Profile

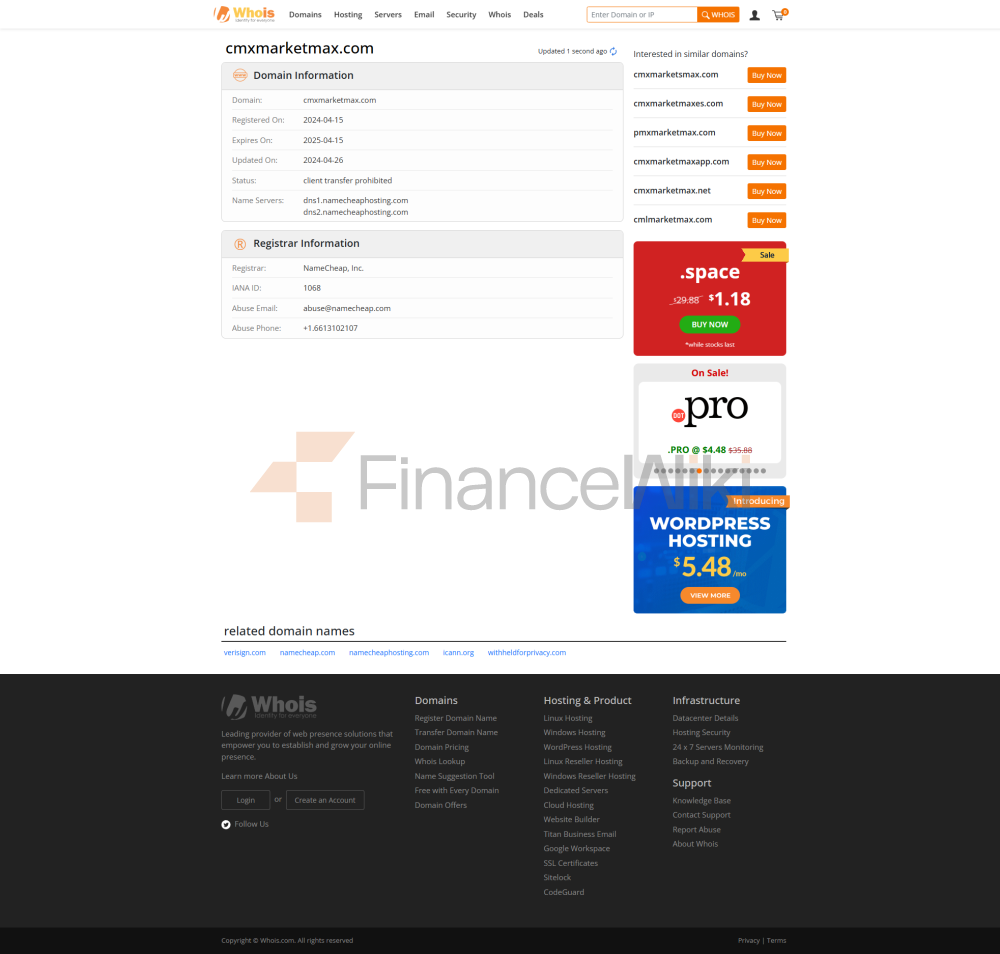

CMX Markets Ltd (Cmx Markets) Is A Foreign Exchange Brokerage Headquartered In Saint Vincent And The Grenadines , Established In 2015 . As An Unregulated Financial Services Provider, CMX Primarily Provides Traders With Foreign Exchange, Futures And Contracts For Difference (CFD) Trading Services. Although The Company Has Demonstrated Certain Advantages In Terms Of Technical Infrastructure And Trading Tools, Its Services Need To Be Carefully Evaluated By Potential Clients Due To The Lack Of Regulatory Coverage.

Regulatory Information

CMX Brokers Operate Outside The Regulatory Framework, I.e. Without Authorization From The Financial Regulatory Authority Of Any Country Or Region. This Lack Of Supervision May Increase The Latent Risk For Clients, As There Is No Supervisory Authority To Provide Protection Or Resolve Disputes. Investors Should Conduct Adequate Due Diligence Before Choosing Such Services To Ensure A Comprehensive Understanding Of The Company's Qualifications And Services.

Trading Products

The Trading Assets Offered By CMX Mainly Include Foreign Exchange Pairs, Covering Major Currency Pairs Such As EUR/USD, GBP/USD, Etc. Through Its Trading Platform, Traders Can Access These Highly Liquid Assets To Trade Taking Advantage Of Market Fluctuations. However, The Detailed Product Range And The Number Of Instruments That Can Be Traded Are Not Clearly Stated In The Information Provided By The User.

Trading Software

The Core Trading Platform Of CMX Is Based On MetaTrader 4 (MT4) , Which Is One Of The Tools Widely Used By Traders Worldwide. MT4 Offers A Wealth Of Features, Including Multi-asset Trading, Chart Analysis, Technical Indicators, As Well As Automated Trading (EA). With MT4, Traders Have Access To Real-time Market Data, Practice On Demo Accounts, And Multi-platform Operation (including Desktop And Mobile Devices).

Deposit And Withdrawal Methods

CMX Supports A Variety Of Deposit And Withdrawal Methods, Including:

- VISA

- MasterCard (MASTER)

- Neteller

- Skrill

The Minimum Amount Required For Deposit And Withdrawal Is 50 Dollars (depending On Account Type), And The Deposit And Withdrawal Operation Is Usually Completed Immediately. However, Specific Information Regarding Handling Fees, Processing Times And Withdrawal Limits Is Not Detailed In The Data Provided By The User.

Customer Support

CMX Provides A Multilingual Client Server, Which Supports Languages Such As English. Customers Can Be Contacted By:

- Phone Support : + 44 207.193.6757

- Email : Info@tradecmx.com

These Channels Are Designed To Provide Traders With Timely Problem Resolution And Trading Support. However, According To The Information Provided By The User, Specific Service Hours (e.g. 24/7 Support) Are Not Clearly Stated.

Core Business And Services

CMX's Core Business Revolves Around Foreign Exchange And Futures Trading. The Services It Provides Include:

- PIP Rebate : Provides Additional Trading Incentives For Clients Through Rebate Mechanism.

- Introduces Broker Program : Provides Additional Rewards For IBs And Promotes Business Cooperation.

- Market Analysis Tools : Includes Market News, Financial Calendar To Help Traders Develop Strategies.

- Risk Management Tool : Provides Personalized Risk Management Settings To Help Clients Control Trading Risks.

Technical Infrastructure

CMX's Technical Infrastructure Is Based On The MT4 Platform, Which Is Known For Its Stability And User Experience. CMX Offers The Following Features Through MT4:

- Real-time Market Data

- Technical Analysis Tools

- Automated Trading Capabilities

- Multi-device Compatibility

In Addition, CMX Offers Demo Accounts That Allow New Traders To Practice In A Risk-controlled Environment.

Compliance And Risk Control System

Although CMX Is Not Regulated, Its Official Website Information Mentions A Certain Risk Management System. These Measures Include:

- Segregation Of Customer Funds : Customer Funds Are Kept In Separate Accounts To Reduce The Risk Of Asset Misappropriation.

- Risk Control Tools : Including Mandatory Position Squaring Mechanism To Ensure That Customer Accounts Are Within The Risk Control Range.

- Compliance Statement : The CMX Website Does Not Explicitly Mention Specific Compliance Measures Or Certifications, But Emphasizes Its Commitment To A Transparent Client Server.

Market Positioning And Competitive Advantage

CMX's Market Positioning Is Primarily For Traders Seeking High Leverage, Low Spreads, And Multiple Account Types. Its Competitive Advantages Include:

- Multi-type Accounts : Standard, Gold, And Diamond Accounts That Meet The Funding And Leverage Needs Of Different Traders.

- Low Spreads : Especially As Low As 0 Spreads On Diamond Accounts, Attracting Professional Traders.

- Diversified Trading Tools : Including Forex, Futures, Etc., Providing Traders With Multi-market Options.

However, Its Lack Of Regulatory Coverage Can Become A Major Disadvantage, Especially When Attracting Retail Clients Seeking Protection.

Customer Support & Empowerment

CMX Strives To Support Traders Through:

- Educational Resources : Includes Trading Guides, Analytical Reports And Market News To Help Clients Improve Their Trading Skills.

- Technical Support : Resolves Traders' Technical Problems Via Phone And Email.

- Account Management : Provides Personalized Account Settings And Risk Management Solutions To Help Clients Optimize Their Trading Experience.

Social Responsibility And ESG

CMX's Specific Practices In Corporate Social Responsibility (CSR) And Environmental, Social And Corporate Governance (ESG) Are Not Mentioned In The Information Provided By Users. However, As A Financial Services Provider, Its Performance In Transparent Operations And Customer Protection Deserves Continued Attention.

Strategic Partnership Ecosystem

Affiliates Of CMX Include:

- Climax Markets Commercial Broker LLC

- Climax Markets LTD

- Climax Markets DIS TICARET LIMITED SIRKETI

- Climax Markets LLC

Additionally, The Company Does Not Explicitly Mention Strategic Partnerships With Other Financial Institution Groups Or Technology Companies. However, It Has Expanded Its Business Network By Partnering With Multiple Introductory Brokers Through The IB Program.

Financial Health

The Financial Health Of CMX Is Not Detailed In The Information Provided By Users. However, As An Unregulated Financial Service Provider, Potential Customers Need To Be Vigilant About Its Financial Stability And Operational Continuity.

Future Roadmap

The Future Direction Of CMX Is Not Explicitly Mentioned, But Potential Plans May Include:

- Expansion Of Product Line : Adding More Trading Varieties Of Financial Products.

- Enhancing Regulatory Coverage : Seeking Appropriate Regulatory Authority Authorisation In Order To Increase Client Trust.

- Optimizing Technical Support : Continuously Improving The Trading Platform And Customer Support Services To Enhance User Experience.

However, These Plans Are Speculative Only, And The Specific Implementation Needs To Be Watched For Further Announcements From The Company.

Conclusion

CMX Markets Ltd Offers Traders A Range Of Competitive Trading Tools And Services, Especially Excelling In High Leverage And Low Spreads. However, Its Unregulated Operating Model May Become A Major Concern For Potential Clients. Traders Are Required To Conduct Adequate Due Diligence Before Selecting Such Services To Ensure That Their Risk Tolerance Is In Line With The Company's Service Model.