Corporate Profile

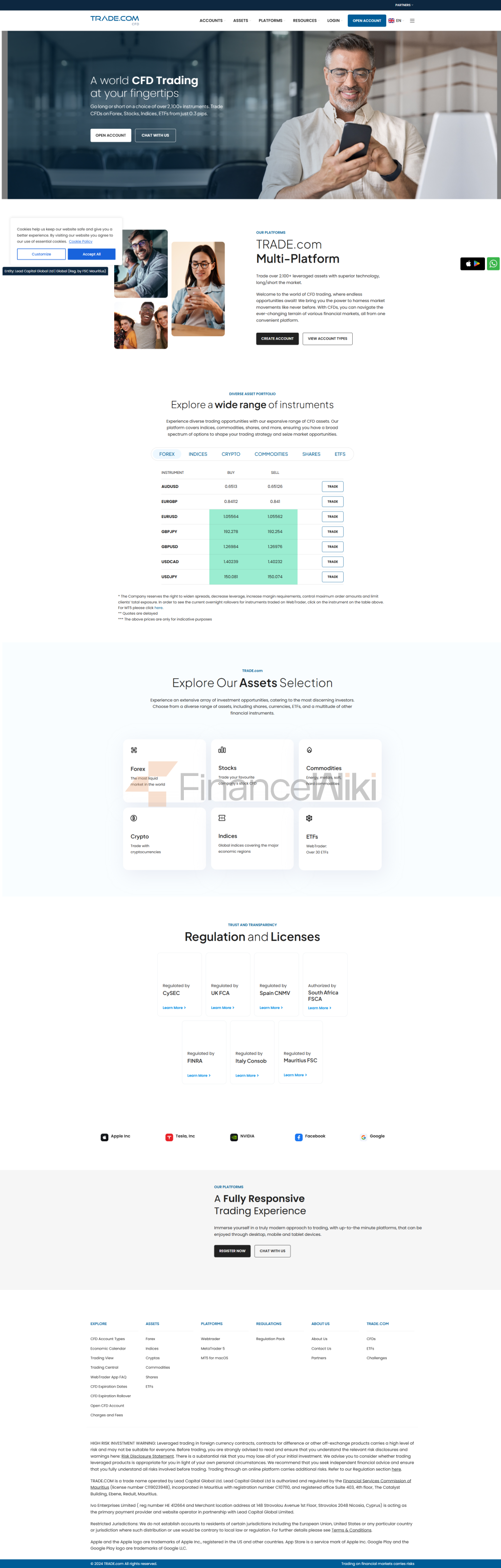

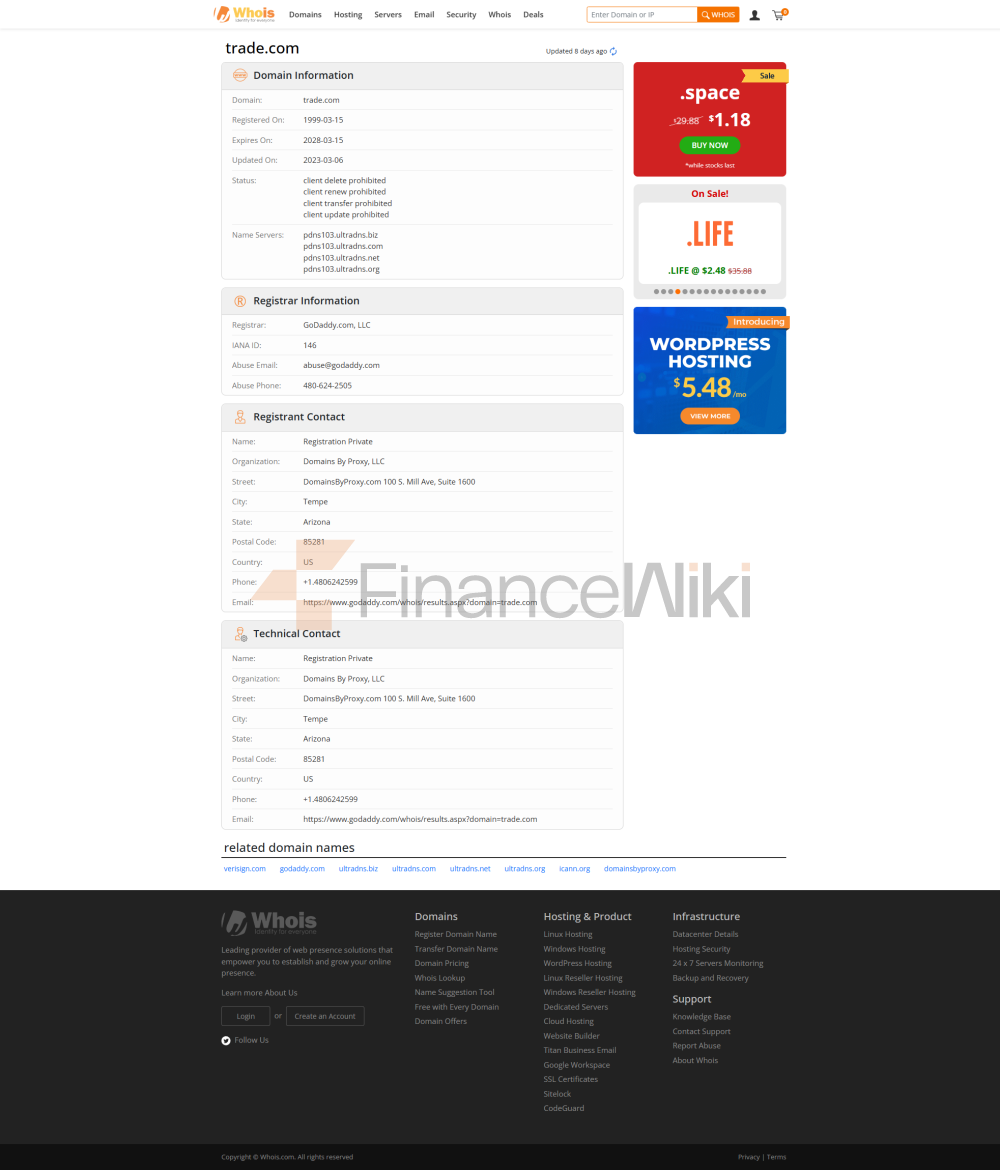

TRADE.COM Is A Cyprus-based Financial Brokerage Company Established In 2018. The Company Is Regulated By Several Authoritative Financial Regulators Including The Cyprus Securities And Exchange Commission (CySEC), The UK Financial Conduct Authority (FCA) And The South African Financial Conduct Authority (FSCA). TRADE.COM Offers A Diverse Range Of Market Instruments Covering Forex, Stocks, Commodities, Cryptocurrencies, Indices And ETFs. Traders Can Choose From Four Account Types (Silver, Gold, Platinum And Exclusive), Each With Different Minimum Deposit Requirements To Suit Different Trading Preferences. Maximum Leverage Is 1:400 And Spreads Vary Depending On Account Type And Asset. TRADE.COM Offers Three Trading Platforms: WebTrader, MetaTrader 5 (MT5) And MT5 For MacOS, Enabling Traders To Trade Flexibly On Different Devices. In Addition, The Platform Offers A Transparent Fee Structure, No Deposit Or Withdrawal Fees, And Facilitates The Flow Of Funds Through Multiple Payment Methods.

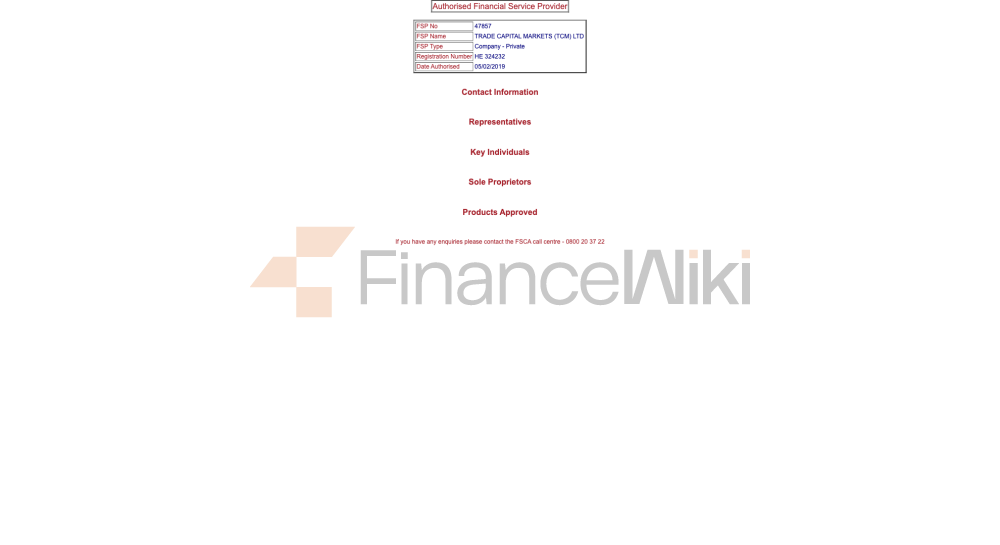

Regulatory Information

TRADE.COM Is Regulated By Multiple Financial Regulators, Ensuring That Its Operations Meet Strict Regulatory Standards, Thus Protecting The Interests Of Traders:

- Cyprus Securities And Exchange Commission (CySEC) : TRADE.COM License Number 227/14 And Operates As A Market-maker.

- UK Financial Conduct Authority (FCA) : License Number 738538, But Its Status Is Flagged As "suspicious Clone", Raising Concerns About The Identity Of The Authorization.

- South African Financial Conduct Authority (FSCA) : License Number 47857, Also Tagged As "suspicious Clone".

Oversight By These Regulators Ensures Compliance And Transparency Of The Platform, Providing Traders With A Level Of Trust And Security.

Trading Products

TRADE.COM Offers A Comprehensive Range Of Market Tools Covering Multiple Asset Classes To Meet The Needs Of Different Traders:

- Forex : Offers Trading On Major Global Currency Pairs, Including EUR/USD, USD/JPY And GBP/USD, Among Others.

- Stocks : Allows Traders To Trade Contracts For Difference (CFDs) On Stocks Of Well-known Global Companies.

- Commodities : Includes Energy (e.g. Crude Oil), Metals (e.g. Gold And Silver), And Soft And Hard Commodities (e.g. Coffee And Wheat).

- Cryptocurrencies : Offers Trading In Major Cryptocurrencies Such As Bitcoin And Ethereum.

- Indices : Covers Major Global Indices Such As Dow Jones 30, Germany DAX 40 And NASDAQ 100.

- ETFs : Offers More Than 30 ETFs On The WebTrader Platform, Covering Multiple Sectors Such As Energy, Materials, Industrials And Technology.

These Trading Products Provide Traders With Diverse Investment Options, Supporting Them To Diversify Their Portfolios In Different Market Conditions.

Trading Software

TRADE.COM Offers Three Trading Platforms To Meet The Needs Of Different Traders:

- WebTrader : A Mobile-compatible Web-based Trading Platform With Over 2,100 Assets, Built-in Multiple Analytical Tools And Intuitive Features.

- MetaTrader 5 (MT5) : A Powerful Charting Platform With Support For Automated Trading, Strategy Testing And Deep Market Analysis For Intermediate And Advanced Traders.

- MT5 For MacOS : Allows Mac Users To Download And Use The MT5 Platform.

These Platforms Allow Traders To Execute Trading Strategies Flexibly Across Different Devices And Environments, Ensuring Efficient And Precise Trade Execution.

Deposit And Withdrawal Methods

TRADE.COM Offers A Variety Of Payment Methods To Meet Traders' Fund Access Needs:

- Payment Methods : Including Bank Telegraphic Transfer, Credit/debit Cards And Online Payment Platforms.

- Fees : No Deposit Or Withdrawal Fees, And A Transparent Fee Structure Does Not Affect Traders' Returns.

In Addition, The Platform Offers Overnight Trading Fees And Inactive Account Fees To Ensure That Traders' Account Activity Complies With Regulatory Requirements.

Customer Support

TRADE.COM Offers Multiple Customer Support Channels To Ensure Traders Can Get Help In A Timely Manner:

- Email : Support Is Provided Through Support@trade.com, Available From 22:00 GMT Sunday To 22:00 Friday.

- WhatsApp : Support Traders To Communicate With The Customer Service Team In Real Time.

- Live Chat : Provides Real-time Technical Support On The Website.

These Channels Ensure That Traders Can Get Support Quickly When They Encounter Problems, Improving The Satisfaction Of Their Trading Experience.

Core Business & Services

The Core Business Of TRADE.COM Includes:

- Provides A Diverse Range Of Market Tools.

- Supports Multiple Account Types To Meet The Needs Of Different Traders.

- Offers Competitive Spreads And A Transparent Fee Structure.

The Platform Also Supports Traders With Education And Resources, Including Economic Calendars, Trading Views, And FAQs, Thus Enhancing Their Trading Knowledge And Skills.

Technical Infrastructure

TRADE.COM Technical Infrastructure Includes:

- WebTrader : A Modern Trading Platform That Offers Multiple Analytical Tools And Intuitive Features.

- MetaTrader 5 : Supports Advanced Chart Analysis And Automated Trading Features.

- MT5 For MacOS : Ensures Mac Users Have Easy Access To The Trading Platform.

These Technical Tools Enable Traders To Execute Complex Trading Strategies In Different Situations And Improve Their Trading Efficiency And Accuracy.

Compliance And Risk Control System

TRADE.COM Ensure Compliance And Risk Management By:

- Compliance With The Requirements Of Multiple Regulators.

- Provide Transparent Fee Structures And Spreads.

- Offer Multiple Account Types To Meet The Risk Preferences Of Different Traders.

In Addition, The Platform Ensures That Traders' Trading Activities Comply With Regulatory Requirements And Market Standards Through Its Technical Infrastructure And Client Server Support.

Market Positioning And Competitive Advantage

- Diverse Market Instruments And Account Types.

- Competitive Spreads And Transparent Fee Structures.

- Multi-language And Multi-device Supported Trading Platform.

However, The Limited Nature Of Its Account Types, High Minimum Deposit Requirements, And "questionable Clone" Status May Pose Challenges For Some Traders.

Customer Support & Empower

TRADE.COM Supports And Empowers Its Clients By:

- Provides Educational Tools Such As An Economic Calendar, Trading Views, And A Research Center.

- Provides Real-time Customer Support To Ensure That Traders' Issues Are Resolved Quickly.

- Offers Multiple Payment Methods To Support Traders' Money Management Needs.

These Services Ensure That Traders Can Trade In Financial Marekt With Confidence And Maximize The Efficiency And Benefits Of Their Trading Strategies.

Social Responsibility Vs. ESG

TRADE.COM Has Not Yet Made Public Clear Social Responsibility And ESG Plans, But In Its Operation, The Platform Indirectly Supports The Sustainability And Stability Of Financial Marekt By Complying With Regulatory Requirements And Providing A Transparent Trading Environment.

Strategic Cooperation Ecosystem

TRADE.COM Has Not Made Public The Details Of Its Strategic Cooperation, But Its Cooperation With Multiple Regulators Demonstrates Its Commitment To Compliance And Transparent Operations.

Financial Health

TRADE.COM Has Maintained Its Financial Health Through Its Transparent Fee Structure And Diverse Revenue Streams. However, Limitations On Its Account Types And Minimum Deposit Requirements May Pose Certain Challenges To Its Revenue Growth.

Future Roadmap

TRADE.COM Future Roadmap May Include:

- Expand Its Selection Of Account Types And Market Tools.

- Optimize Its Customer Support And Educational Resources.

- Expand Its Presence In Emerging Markets.

However, The Platform Needs To Address Its "dubious Clone" Status And High Minimum Deposit Requirements In Order To Enhance Its Market Competitiveness And Traders' Confidence.