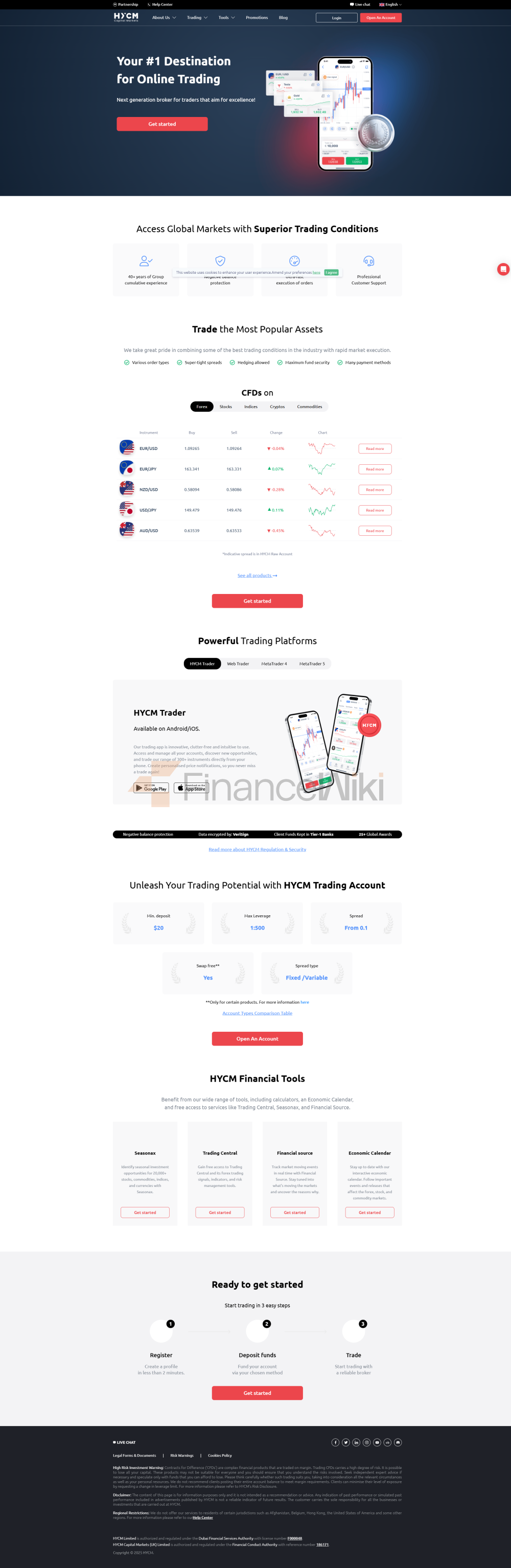

Corporate Profile

HYCM Capital Markets (UK) Limited (abbreviated As HYCM, Chinese Name: Industrial Investments) Was Established In 1993 And Is Headquartered In London, UK. As A Highly Regulated Financial Broker, HYCM Focuses On Providing Retail And Institutional Investors With Trading Services On Products Such As Online Forex, Contracts For Difference (CFDs), Indices And Commodities. With 40 Years Of Operating History, HYCM Has Excelled In Customer Satisfaction And Technology Development, Making It The Online Broker Of Choice For Global Investors.

Regulatory Information

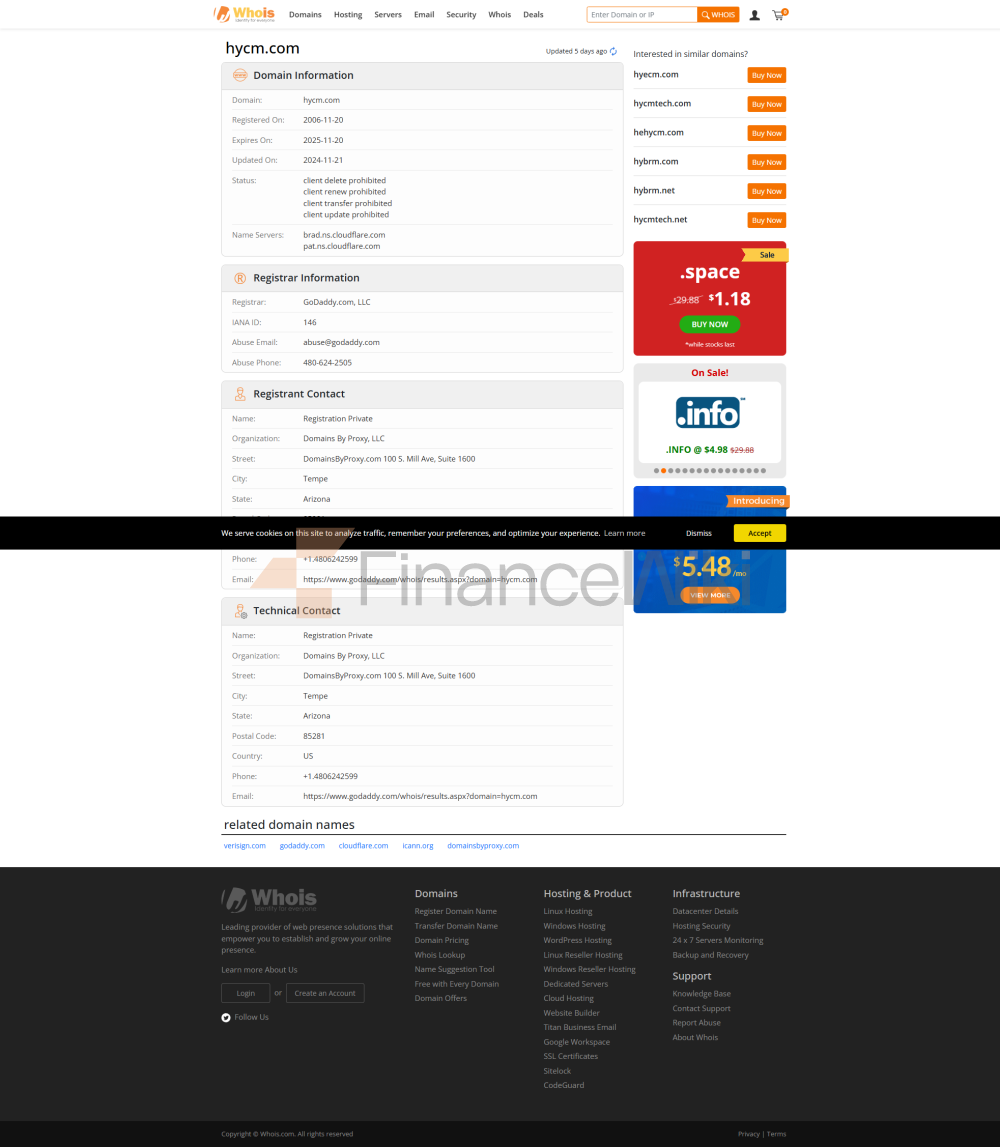

HYCM Is Overseen By Multiple International Regulatory Bodies, Ensuring That Its Operations Comply With Strict Standards And Specifications. The Following Are The Main Regulatory Licenses Of HYCM And Their Significance:

- UK Financial Conduct Authority (FCA) : HYCM Holds A Full License Issued By The FCA (license Number: 186171), Certifying Its Compliance And Professionalism.

- Cyprus Securities And Exchange Commission (CySEC) : Holds A Pass-through License Issued By CySEC (license Number: 259/14), Further Solidifying Its Position In The European Market.

- Cayman Islands Monetary Authority (CIMA) : Holds A General Financial License Issued By CIMA, Ensuring Its Lawful Operation Worldwide.

These Regulatory Licenses Not Only Reflect HYCM's Compliance, But Also Require It To Meet Stringent Standards Such As Capital Adequacy, Independent Audit, And Isolation Of Client Funds.

Trading Products

HYCM Offers A Diverse Range Of Financial Products Covering The Following Main Areas:

- Forex Trading : Including Major Currency Pairs (e.g. EUR/USD, GBP/USD) And Emerging Market Currency Pairs.

- Contracts For Difference (CFD) : CFD Trading Of Commodities Such As Crude Oil, Gold, Silver, Etc.

- Index Trading : Major Global Stock Indices, Including Dow Jones, Hang Seng And CSI 300.

- Commodity Trading : Energy, Metals And Agricultural Products, Etc.

Trading Software

HYCM Has Partnered With MetaQuotes To Provide Clients With MetaTrader 4 (MT4) And MetaTrader 5 (MT5) Trading Platforms That Support Desktop, Mobile End And Web-side Operations. These Platforms Are Known For Their Powerful Features And User-friendly Interfaces That Support Technical Analysis, Order Management And Automated Trading.

Deposit And Withdrawal Methods

HYCM Offers A Variety Of Deposit And Withdrawal Methods To Ensure The Liquidity Of Customers:

- Debit Card : Minimum Deposit Of $700, Minimum Withdrawal Of $20, Processing Fee Of $30, Processing Time Of 3 To 5 Business Days.

- Credit Card (VISA/MASTERCARD) : Minimum Deposit Of $700, Minimum Withdrawal Of $20, Processing Fee Of $30, Processing Time Of 3 To 5 Business Days.

- Bank Transfer : Minimum Deposit Of $700, Minimum Withdrawal Of $300, Processing Fee Of $30, Processing Time Of 7 To 10 Business Days.

Customer Support

HYCM Supports Customers Through Multiple Channels:

- Multilingual Customer Service : 24/7 Customer Support In Languages Such As English, Chinese, Russian, German And Spanish.

- Educational Resources : Includes Trading Guides, Market Analysis Reports And Webinars To Help Customers Improve Their Trading Skills.

Core Business And Services

HYCM's Core Business Includes:

- Forex Trading : Provides Trading Services For Major Global Currency Pairs.

- CFD Trading : Covers Indices, Commodities And Individual Stocks.

- Trading Platform : Supports MT4 And MT5, Providing A Variety Of Trading Tools And Analytical Functions.

Technical Infrastructure

HYCM Adopts Advanced Technical Infrastructure To Ensure Stable And Efficient Trading:

- Multi-platform Support : Support MT4 And MT5 To Meet The Needs Of Different Traders.

- Low Latency Trading : Ensure Fast And Accurate Trading Execution Through Optimized Server And Network Architecture.

- Security Measures : Adopt SSL Encryption Technology To Protect The Security Of Customer Data.

Compliance And Risk Control System

HYCM Follows A Strict Compliance And Risk Management System:

- Capital Adequacy Ratio : Periodically Review Capital Adequacy Ratios To Ensure Financial Soundness.

- Independent Audit : Engage Independent Auditors To Conduct Annual Audits To Ensure Transparency Of Financial Reporting.

- Client Funds Segregation : Ensure That Client Funds Are Segregated From The Company's Operating Funds To Reduce Risk.

Market Positioning And Competitive Advantage

HYCM's Market Positioning And Competitive Advantage Includes:

- Rich History : 40 Years Of Operation History, Accumulated Rich Industry Experience.

- Excellent Technology : Provide Advanced Trading Platforms And Trading Tools To Enhance The Customer Experience.

- Global Recognition : Received Multiple International Awards, Such As The Best Forex Broker Award At The Asian Capital Markets Awards.

Customer Support & Empower

HYCM Empowers Clients In A Number Of Ways:

- Educational Resources : Provides A Wealth Of Trading Education Resources To Help Clients Improve Their Skills.

- Personalized Service : Provides Customized Account And Trading Solutions According To Customer Needs.

Social Responsibility And ESG

HYCM Is Committed To Fulfilling Social Responsibility:

- Charitable Donations : Support Public Welfare Activities Such As Education, Health And Environmental Protection.

- Sustainability : Incorporate ESG (Environmental, Social And Corporate Governance) Principles Into Business Operations To Promote Sustainable Development.

Strategic Cooperation Ecology

HYCM Has Established Strategic Partnerships With Several Institutions, Including Technology Providers, Educational Institutions And Charitable Organizations. These Collaborations Help To Improve Service Quality And Expand Market Coverage.

Financial Health

HYCM Has A Sound Financial Position, Sufficient Capital And Meets Regulatory Requirements. The Annual Audit Report Demonstrates Its Financial Transparency And Health.

Future Roadmap

HYCM Will Continue To Invest In Technological Innovation And Service Optimization, Expand Market Share And Deepen Global Market Layout. Through Continuous Improvement Of Trading Technology And Customer Support, HYCM Is Committed To Becoming The World's Leading Online Broker.