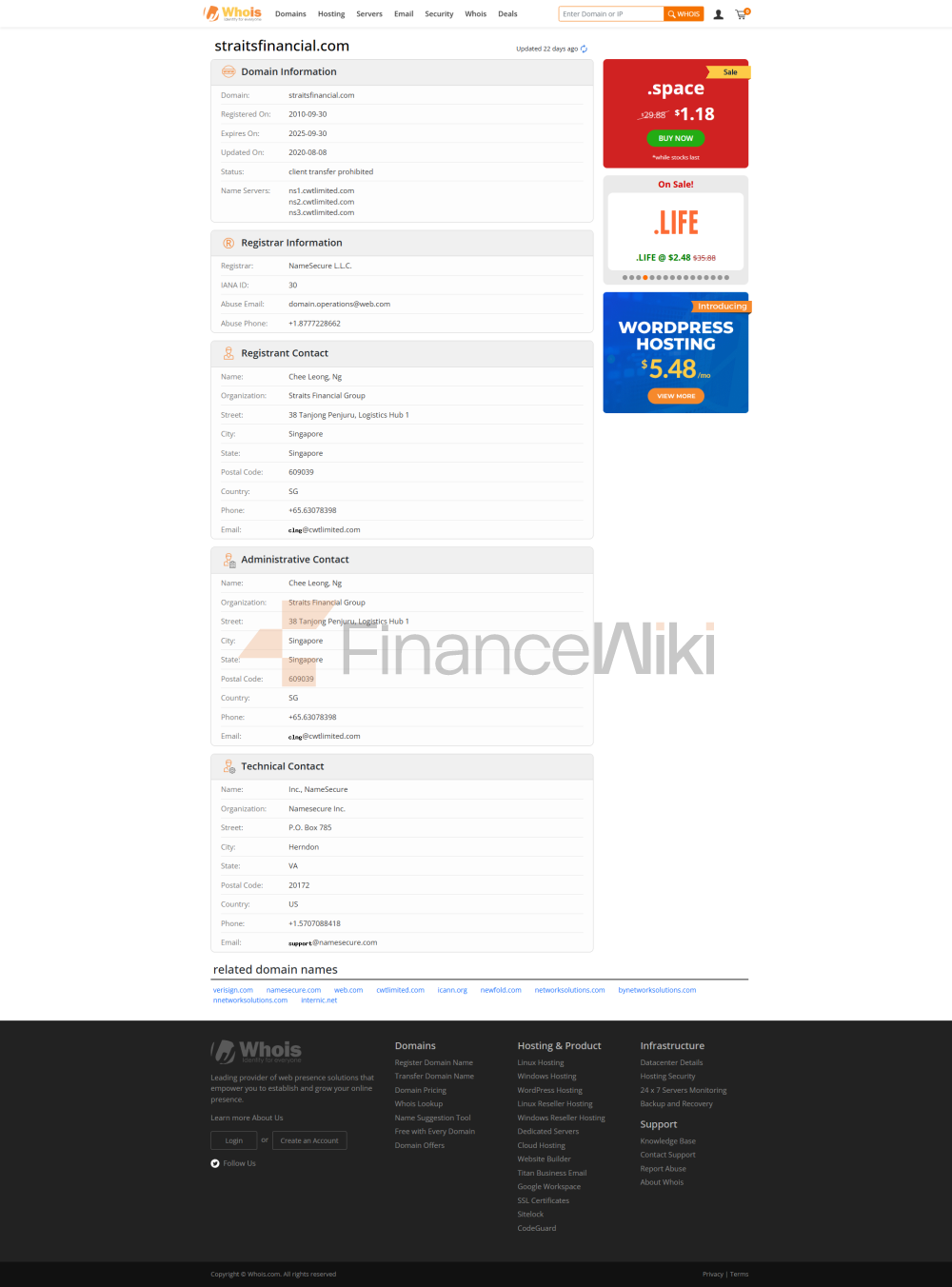

Straits Financial Group (hereinafter Referred To As "SFG") Is A Financial Services Company Specializing In Commodities Trading. It Was Established In 2018 And Is Headquartered In Hong Kong . As A Unregulated Trading Company , SFG Offers A Diverse Range Of Trading Products And Instruments To Traders And Individual Investors Worldwide. Its Core Business Areas Include Trading Services For Commodities Such As Agricultural And Sideline Products, Soft Commodities And Metals./Corporate Profile

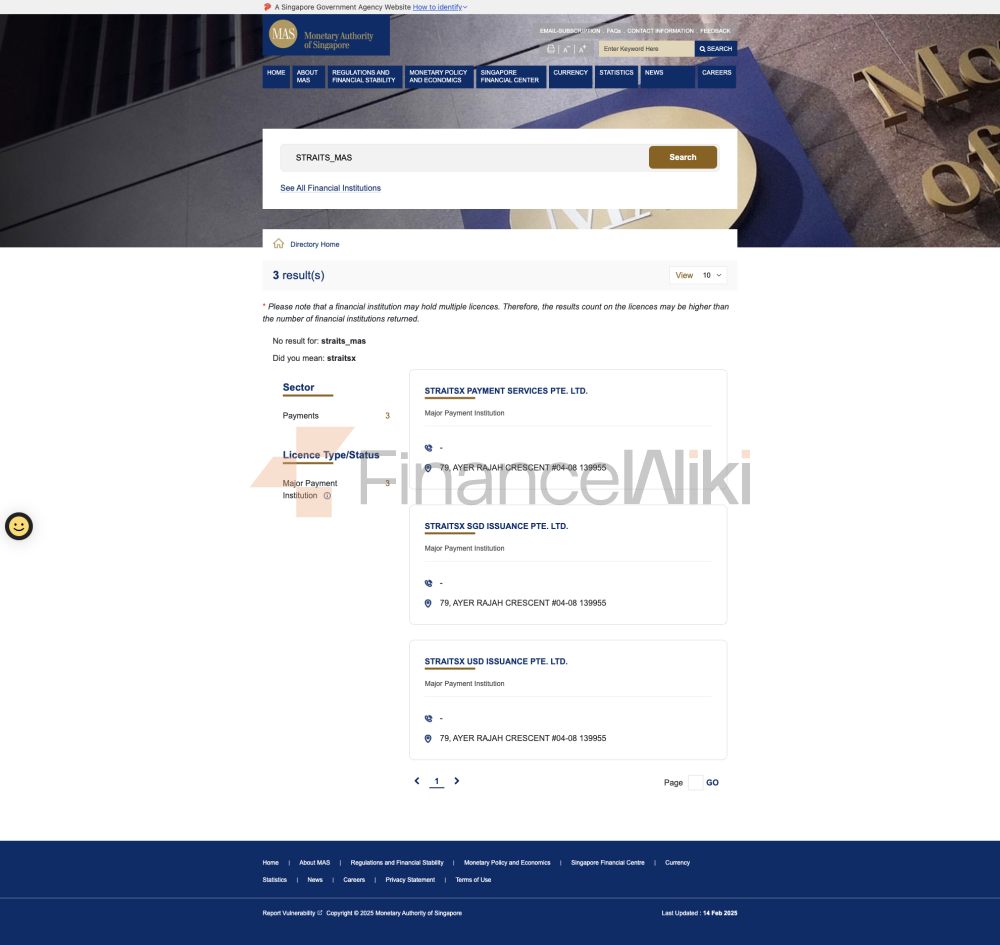

Regulatory Information As Of 2023, SFG Has Not Been Licensed Or Certified By Any Official Financial Regulator. This Means Its Operations Are Not Overseen By Regulators Such As The Hong Kong Securities Supervision Commission (SFC) Or The US Commodity Futures Trading Commission (CFTC). Despite This, SFG Says It Will Comply With Relevant Laws And Regulations To Ensure Transparency And Compliance In Trading./Regulatory Information

Trading Products SFG Offers A Wide Range Of Trading Products Covering The Following Categories:

- Agricultural And Sideline Products : Including Agricultural Commodities Such As Coffee, Sugar, Cocoa, Wheat, Etc. Soft Commodities : Covers Non-agricultural Commodities Such As Rubber, Cotton, Palm Oil, Etc.

- Metals : Provides Trading In Precious Metals Such As Gold And Silver, As Well As Industrial Metals Such As Copper And Aluminum.

- Energy Products : Includes Energy Futures Such As Crude Oil And Natural Gas.

- Indices And Forex : Provides Trading In Selected Stock Indices And Currency Pairs (e.g. USD/CNY).

Through Its Trading Platform, SFG Provides Clients With Real-time Market Data, Price Movement Analysis, And Support For Trading Tools. /Trading Products

Trading Software SFG Offers Clients A Variety Of Trading Software And Platforms, Including:

- Straits Financial Direct : A Powerful Trading End Point That Supports Intelligent Order Management And Real-time Market Analysis. The Platform Offers A Multilingual Interface That Supports Windows And Mac Users And Allows Users To Customize Charts And Trading Strategies.

- CQG Desktop : A Next-generation Trading And Data Analytics Platform That Supports Cross-asset Class Trading, Providing Deep Market Insights And Automated Trading Capabilities.

- Other Tools : Including Professional Trading Systems Such As CME Direct, TT New Generation, To Meet The Needs Of Institutional Clients And High Net Worth Investors.

All Platforms Support Multi-device Operation , Including Desktop And Mobile End Points, Ensuring That Customers Can Trade Anytime, Anywhere./Trading Software

Deposit And Withdrawal Methods SFG Provides A Variety Of Deposit And Withdrawal Methods, As Follows:

- Bank Transfer : Support For Funds Withdrawal And Withdrawal Through International Bank Cards.

- Electronic Payments : Customers Can Complete Funds Operations Through Third-party Payment Platforms Such As PayPal.

- Cash Transactions : In Certain Regions, Customers Can Choose To Withdraw And Withdraw Cash.

The Minimum Deposit Requirement Is $100 . The Specific Deposit And Withdrawal Processing Fee Will Be Determined According To The Payment Method./Deposit And Withdrawal Methods

Customer Support SFG Is Committed To Providing Customers With Comprehensive Client Server And Support. Its Service Channels Include:

- Telephone Support : Provide Telephone Service In Multiple Regions, Including Singapore, The United States And Indonesia.

- Email Support : Clients Can Contact The Customer Service Team Through Info@straitsfinancial.com.

- Online Resources : Provide Educational Resources Such As Trading Guides, Market Analysis, Trading Calendars, Etc., To Help Customers Improve Their Trading Skills.

- Demo Account : Provide A Free Simulated Trading Environment For Customers To Familiarize Themselves With The Trading Platform And Trading Strategies.

SFG's Service Hours Cover Multiple Time Zones, And Customers Can Get Help At Any Time./Customer Support

Core Business And Services SFG's Core Business Includes:

- Commodity Trading : Provides Clients With Trading Services For Agricultural And Sideline Products, Soft Commodities, And Metals.

- Institutional Client Server : Provides Customized Trading Solutions For Commercial Hedgers, Hedge Funds, And Family Offices.

- Personal Trading Services : Provides A Comprehensive Trading Program And Educational Resources For Novice Traders.

- Risk Management Services : Helps Clients Manage The Risk Of Market Volatility Through An Intelligent Risk Control System.

SFG's Goal Is To Provide A Safe, Efficient And Transparent Trading Environment For Global Traders./Core Business & Services

Technical Infrastructure SFG Employs Advanced Technical Infrastructure To Ensure Stability And Security Of Trading. Its Technical Highlights Include:

- Low-latency Trading Platform : Provides Fast Order Execution And Market Data Updates.

- Multi-cloud Backup : Ensure The Integrity And Availability Of Data.

- AI-driven Risk Early Warning System : Monitor Market Fluctuations In Real Time And Identify Latent Risks In Advance.

SFG's Technical Team Consists Of Experienced IT Experts To Ensure The Stable Operation And Continuous Optimization Of The System./Technical Infrastructure

Compliance And Risk Control System Although SFG Is Not Officially Regulated, It Still Takes A Series Of Measures To Ensure The Compliance And Security Of Transactions. Its Risk Control System Includes:

- Multi-level Authentication : Ensure The Security Of Customer Accounts.

- Real-time Risk Monitoring : Identify Abnormal Trading Behavior Through AI Algorithms.

- Archive Of Transaction Records : Keep All Transaction Records For Subsequent Review.

- Separation Of Customer Funds : Customer Funds Are Kept In Separate Accounts To Avoid Mixing With Company Operating Funds.

SFG Is Committed To Following The Highest Standards Of The International Financial Industry To Protect Customer Funds And Privacy. /Compliance And Risk Control System

Market Positioning And Competitive Advantage SFG's Positioning In The Market Is Mainly Reflected In The Following Aspects:

- Focus On Commodity Trading : Compared With Other Comprehensive Brokerages, SFG Focuses More On Agricultural And Sideline Products, Soft Commodities And Metals Markets.

- Low Threshold Entry : The Minimum Deposit Is Only $100, Suitable For Novice And Small-scale Traders.

- Strong Technical Support : Provide A Variety Of Professional Trading Software To Meet The Needs Of Different Customers.

- Globalization Services : Covering Multiple Time Zones And Markets, Providing Clients With 24/7 Trading Support.

SFG's Competitive Advantage Lies In Its Professional Market Insight And Flexible Trading Solutions./Market Positioning And Competitive Advantage

Customer Support And Empowering SFG Provides Clients With A Variety Of Empower Tools And Resources, Including:

- Market Analysis Reports : Regularly Publish Market Trend Analysis To Help Clients Develop Trading Strategies. Online Education Center : Offers Free Trading Courses And Video Tutorials.

- One-to-one Coaching : Provides Personalized Trading Advice To High Net Worth Clients.

- Simulated Trading Environment : Helps Clients Practice Their Trading Skills In A Risk-free Environment.

The Goal Of SFG Is To Help Clients Improve Their Trading Capabilities And Market Insight Through Continuous Client Empowerment./Customer Support And Empowerment

Social Responsibility And ESGSFG Have Not Explicitly Mentioned Social Responsibility And ESG (Environmental, Social, Governance) Related Commitments On Their Official Website. However, As A Financial Services Company, SFG Said It Will Keep An Eye On Future Trends In Sustainability And Green Finance And Launch Related Products And Services In Due Course./social Responsibility And ESG

Strategic Collaboration Ecology SFG Has Established Strategic Partnerships With Several Industry-leading Institutions, Including:

- CME Group : Provides Clearing Services For Standardized Futures And Options Contracts.

- Chicago Board Of Agricultural Products (CBOT) : Provides Support For Trading In Agricultural And Sideline Products.

- London Metal Exchange (LME) : Provides Liquidity Support For Trading In Metals.

These Partnerships Ensure The Depth And Breadth Of SFG's Trading Products./Strategic Cooperation Ecology

Financial Health Since SFG Has Not Made Its Financial Statements Or Audit Reports Public, Its Financial Health Cannot Be Fully Assessed. However, Through Its Stable Operations And Diversified Trading Products, It Can Be Initially Judged That It Has Strong Market Adaptability./Financial Health

Future Roadmap SFG's Future Development Plan Includes The Following Points:

- Product Diversification : Plans To Expand Into More Asset Classes, Such As Cryptocurrencies And Stock Futures.

- Geographical Expansion : Further Expansion To Emerging Markets, Such As Southeast Asia And The Middle East.

- Technological Innovation : Increase The Application Of AI And Big Data Technologies In Trading And Risk Control Systems.

- Compliance Construction : Consider Applying For An Official Regulatory License In The Future To Enhance Customer Trust.

SFG Is Committed To Becoming The World's Leading Commodity Trading Service Platform And Enhancing Market Competitiveness Through Continuous Innovation And Service Optimization./Future Roadmap