Central Tanshi · Company Profile

Central Tanshi FX Co., Ltd., Headquartered In Tokyo, Japan, Has Been An Important Player In The Financial Services Industry Since Its Establishment In March 2002. Focusing On Forex Margin Trading, The Company Offers A Diverse Range Of Trading Services And Is Regulated By The Japanese Financial Services Agency (FSA), Ensuring Strict Compliance With Financial Regulations And Consumer Protection.

Partnerships With More Than 20 Major Financial Institution Groups, Central Tanshi Offers Traders The Opportunity To Trade In 10 Currency Pairs With A Maximum Leverage Of 25x And Variable Spreads Depending On The Time Period. It Offers Multiple Trading Platforms And Flexible Deposit Methods, Designed To Meet The Diverse Needs Of Traders In The Dynamic World Of Forex Trading.

Regulatory Information

Central Tanshi Is A Legitimate Financial Services Company. It Is Regulated By The Japanese Financial Services Agency (FSA), A Reputable Regulator Known For Its Rigorous Standards. The FSA Ensures Compliance With Financial Regulations In Order To Protect Consumer Interests.

Central Tanshi's Regulatory Certificate Number Adds An Extra Layer Of Transparency And Trust. While I Am Unable To Provide Real-time Or Up-to-date Information, Based On The Information Available, Central Tanshi Does Not Exhibit Characteristics Common To Scam Operations.

Pros And Cons

Pros:

Regulated By The Financial Services Agency: Central Tanshi Is Regulated By The Japanese Financial Services Agency, Ensuring Compliance With Strict Financial Standards And Consumer Protection.

Multiple Trading Platforms: This Broker Offers Multiple Trading Platforms For Different Devices, Improving The Accessibility And Convenience Of Traders.

No Minimum Deposit Requirement: No Minimum Deposit Requirement, Allowing Traders To Start Trading With An Amount They Feel Comfortable With.

Flexible Deposits And Withdrawals: Central Tanshi Supports Multiple Currencies And Offers Options For Free Click-to-deposit And Transfer Deposits.

Trading 24/7: Certain Instruments Are Available For Trading 24 Hours A Day, 365 Days A Year, Providing Flexibility For Traders.

Cons:

Limited Currency Pairs: The Service Is Limited To 10 Currency Pairs, Which May Limit Diversification For Some Traders.

Customer Support Information: No Details About Customer Support Are Provided, Leaving Traders Feeling Unsure About The Help Available.

Lack Of Educational Resources: Lack Of Information About Educational Resources May Prevent Beginner Traders From Accessing Valuable Learning Materials.

Withdrawal Fees: Foreign Currency Withdrawals And Certain Deposit Methods May Incur Fees That Affect Traders' Overall Costs.

Market Tools

Central Tanshi Focuses Primarily On Forex Margin Trading Services. Through Its Online Platform, It Offers Specific Products Such As "FX Direct Plus" For Autonomous Trading And "Central Mirror Trader" For Automated Trading. These Products Enable Traders To Diversify Their Strategies And Take Advantage Of Market Fluctuations.

Account Types

The Information Provided Does Not Specify The Different Account Types Offered By Central Tanshi. However, Considering That They Offer Both Autonomous And Automated Trading Options, They May Offer Different Account Types To Suit Various Trading Styles.

How Do I Open An Account?

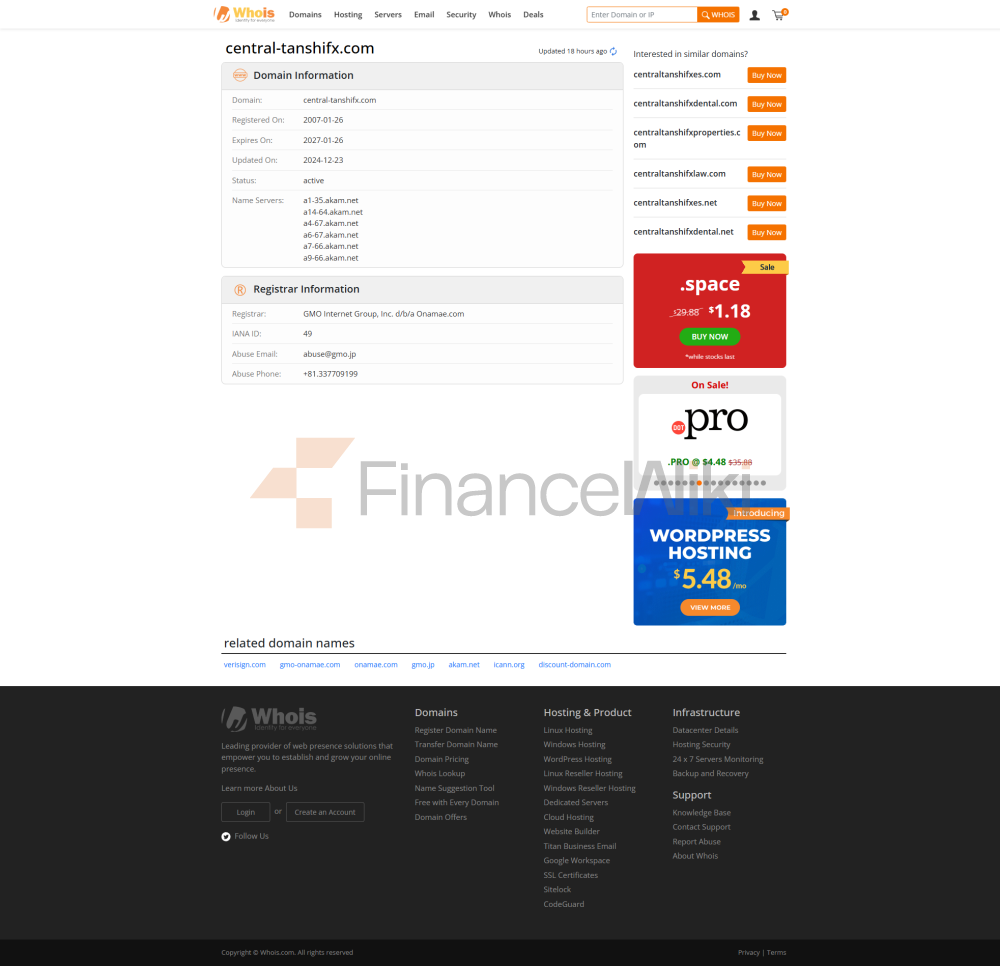

To Open An Account With Central Tanshi, You Can Follow The 3 Steps Listed Https://www.central-tanshifx.com/on Their Website:

Step 1: Apply

Please Visit The Central Tanshi Website And Fill In Your Name And Address In The Application Form.

Please Review Carefully The Documents You Will Receive During The Application Process.

You Will Receive An Email Confirming Your Application.

Step 2: Submit Files

In The Email, You Will Find Two Options To Submit Your Identity Documents:

Simple Verification With Smartphone: Open The Link On Your Phone, Follow The Instructions, And Take A Photo Of Your ID Card.

Upload Verification: Open The Link On Your Computer Or Smartphone, And Follow The Instructions To Upload Your ID Photo.

Step 3: Account Confirmation

If You Have Used The Smartphone Method, Once Central Tanshi Reviews Your Documents, They Will Email You Your User ID And Password. You Can Start Trading On The Same Day.

If You Have Chosen The Upload Method, They Will Send Your User ID And Password To Your Address Via Registered Mail.

Log Into Your Account And Complete Additional Information Such As Your Personal Number.

Please Keep In Mind That Central Tanshi May Approve Or Reject Your Account Based On The Results Of Their Review.

Leverage

Central Tanshi Offers Leverage Up To 25x. This Allows Traders To Control Larger Positions With A Smaller Initial Investment, Potentially Amplifying Gains. However, Higher Leverage Also Increases The Risk Of Significant Losses. Clients Should Be Aware That The Use Of Leverage May Increase The Volatility Of Their Portfolios, And They Should Have A Comprehensive Understanding Of The Risks Associated With Leveraged Trading.

Spreads And Commissions

Companies Operate Variable Spreads Depending On The Time Of Day. In Some Time Periods, Spreads Can Be As Low As 0.1 Pips For USD/JPY, While In Others, Spreads Can Be As High As 16.0 Pips For GBP/JPY. This Flexibility Allows Traders To Develop Trading Strategies Based On Market Timing. However, It Is Important To Note That Wider Spreads May Erode Profits And Make Some Strategies Less Viable. Information On Commissions Is Not Yet Available, So Traders Need To Inquire Directly About Any Additional Fees.

Trading Platform

Central Tanshi Offers A Versatile Trading Environment Through Four Different Versions Of The Trading Platform (Smartphone, PC, IPad And Feature Phone). The PC Version Also Offers Three Additional Options, Including Quick Chart Trading Plus And A Web-based Trading System. The Diversity Of The Trading Platform Ensures That Traders Can Execute Orders And Manage Accounts From Multiple Devices, Providing Flexibility And Convenience.

Deposits And Withdrawals

Central Tanshi Supports Multiple Deposit Currencies, Including Japanese Yen, US Dollar, Etc. Deposits Can Be Made By Clicking Deposit (free) Or By Transferring Deposits (at The Customer's Expense). Withdrawal Of Funds In Japanese Yen Is Free Of Charge, But There Is A Partial Fee For Withdrawing Funds In Foreign Currencies. This Approach Provides Flexibility In Currency And Funding Methods, But May Incur Some Fees For Foreign Clients.

Customer Support

Central Tanshi Limited Strictly Restricts Its Contact Information To An Online Contact Form And Does Not Accept Telephone Inquiries. It Is Important To Note That Central Tanshi Limited Operates As An Independent Entity And Therefore Does Not Accept Any Other Means Of Company-related Inquiries Other Than The Online Contact Form Provided.