Corporate Profile

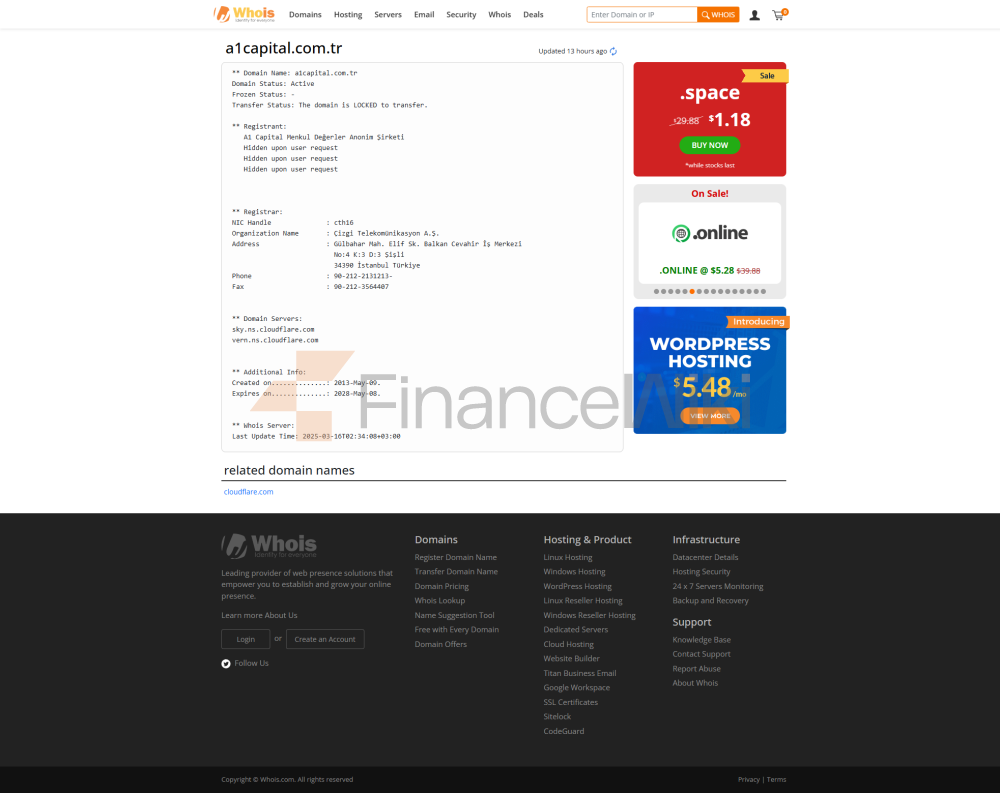

A1 Capital Yatırım Menkul Degerler A.S. (commonly Referred To As A1 Capital) Is A Financial Services Company Headquartered In Istanbul, Turkey. Since Its Establishment, The Company Has Always Focused On Providing Customers With A Diverse Range Of Financial Products And Services, Including Foreign Exchange Trading, Stock Brokerage, Investment Consulting, Project Finance , Etc. Although The Company Offers A Wide Range Of Financial Services, Is Currently Not Regulated By Any Recognized Regulatory Body , Which May Pose A Risk To Potential Investors.

The Official Website Of The Company Mainly Provides Services In Turkish, Which May Create Certain Language Barriers For Customers Who Are Not Native Speakers Of Turkish. In Addition, The Production Level Of The Website Interface Is Average, Which May Have Some Impact On The User Experience.

Regulatory Information

A1 Capital Is Currently Not Regulated By Any International Or Local Regulators , Which Means That The Company Is Not Bound By Relevant Financial Regulations And Does Not Need To Undergo Regular Compliance Audits. Potential Investors Are Responsible For Their Own High Risks When Choosing This Platform.

Trading Products

A1 Capital Offers Clients The Following Main Trading Products:

- Stock Brokerage Services: Allows Clients To Buy And Sell Stocks On The Borsa Istanbul Stock Exchange.

- Futures And Options Trading: Provides Trading Services For Derivatives Such As VIOP (Volatility Index Options).

- Foreign Exchange Trading: Provides Trading Services For Multiple Currency Pairs.

- Debt Instrument Issuance: Supports The Issuance Of Corporate Bonds And Notes.

Trading Software

A1 Capital Offers The MetaTrader 5 (MT5) Trading Platform, A Widely Used Trading Tool Worldwide That Supports Technical Analysis, Automated Trading, And Flexible Trading Operations . In Addition To The Desktop Version, A1 Capital Also Offers The Mobile Application , Which Allows Customers To Trade Anytime, Anywhere Through Their Smartphones.

Deposit And Withdrawal Methods

The Minimum Deposit Amount For A1 Capital Is $2,000 . The Specific Deposit Requirements Vary Depending On The Account Type. Customers Can Complete Deposits And Withdrawals In A Variety Of Ways, Including Bank Transfers, Credit/debit Card Payments , Etc. A1 Capital Offers Different Leverage Levels For Different Account Types, Up To 1:10 , Which Means Customers Can Make Larger Transactions With Lower Margins.

Customer Support

A1 Capital Supports Clients Through Multiple Channels:

- Tel: + 90 850 532 21 21 Fax: + 90 212 371 18 00

- WhatsApp: + 90 545 371 2121

- Email: Info@a1capital.com.tr

- Social Media: Twitter, Instagram, YouTube, LinkedIn, Facebook

In Addition, Customers Can Also Make Detailed Inquiries Through The Contact Form Provided By The Company On The Official Website.

Core Business And Services

A1 Capital's Core Business And Services Include:

- Investment Consulting: Provide Professional Investment Strategies And Advice.

- Portfolio Management: Provides Personalized Portfolio Management Services Based On Clients' Risk Tolerance, Financial Objectives, And Investment Preferences.

- Initial Public Offering (IPO): Assists Companies In Completing Listing Financing.

- Project Finance: Provides Financing Solutions For Large-scale Projects.

- Corporate Valuation: Provides Valuation Services For Corporate Mergers, Acquisitions, And Other Transactions.

- Corporate Acquisitions And Mergers: Provides Advisory Services On M & A Transactions.

- Financing And Mediation Of Telephone Trading: Provides Intermediary Services For The Financing Activities Of Enterprises.

Technical Infrastructure

A1 Capital Has Adopted MetaTrader 5 As Its Primary Trading Platform, Which Is Known For Its Efficiency, Reliability And Extensive Technical Analysis Tools . MT5 Supports Automated Trading, Economic Calendar And Real-time Market Data , Making It Ideal For Both Professional And Novice Traders.

Compliance And Risk Control System

As A1 Capital Is Currently Not Regulated By Any Regulator , The Details Of Its Compliance And Risk Control System Cannot Be Made Public. Potential Investors Are Required To Evaluate The Risks Of The Platform Themselves And Take Appropriate Risk Management Measures.

Market Positioning And Competitive Advantage

A1 Capital's Market Positioning Is Mainly Concentrated In Turkish Financial Marekt. Its Competitive Advantages Include:

- Diversified Products And Services: Provides Comprehensive Services From Foreign Exchange Trading To Company Valuation.

- MT5 Trading Platform: Provides Efficient And Flexible Trading Tools.

- Localization Services: Focuses On The Turkish Market And Is Able To Meet The Needs Of Local Clients.

Customer Support And Empowerment

A1 Capital Provides 24/7 Support To Clients Through Multiple Channels, Including Phone, WhatsApp, Email And Social Media. In Addition, The Company Also Provides Investment Consulting And Educational Services To Help Clients Improve Their Investment Skills.

Social Responsibility And ESG

At Present, A1 Capital Has Less Public Information On Social Responsibility And ESG (environmental, Social, Governance) . Potential Investors Need To Know More About The Company's Performance In These Aspects.

Strategic Cooperation Ecology

A1 Capital Has Not Yet Made Public Information On Its Strategic Partners. Potential Investors Need To Know More About The Company's Partnerships Through Other Channels.

Financial Health

Because A1 Capital Is Not Regulated, Specific Information On Its Financial Health Cannot Be Made Public. Potential Investors Need To Evaluate The Company's Financial Situation By Themselves.

Future Roadmap

The Future Roadmap Of A1 Capital Has Not Been Made Public. Potential Investors Need To Pay Attention To The Company's Announcements And Industry Trends For More Information.

The Above Content Is The Corporate Introduction Of A1 Capital, Covering The Company's Basic Information, Core Business, Development Milestones, Technical Infrastructure, Customer Support, Compliance And Risk Control System . Potential Investors Need To Fully Consider Its Non-regulatory Status And Possible Risks When Choosing The Platform.