Company Profile

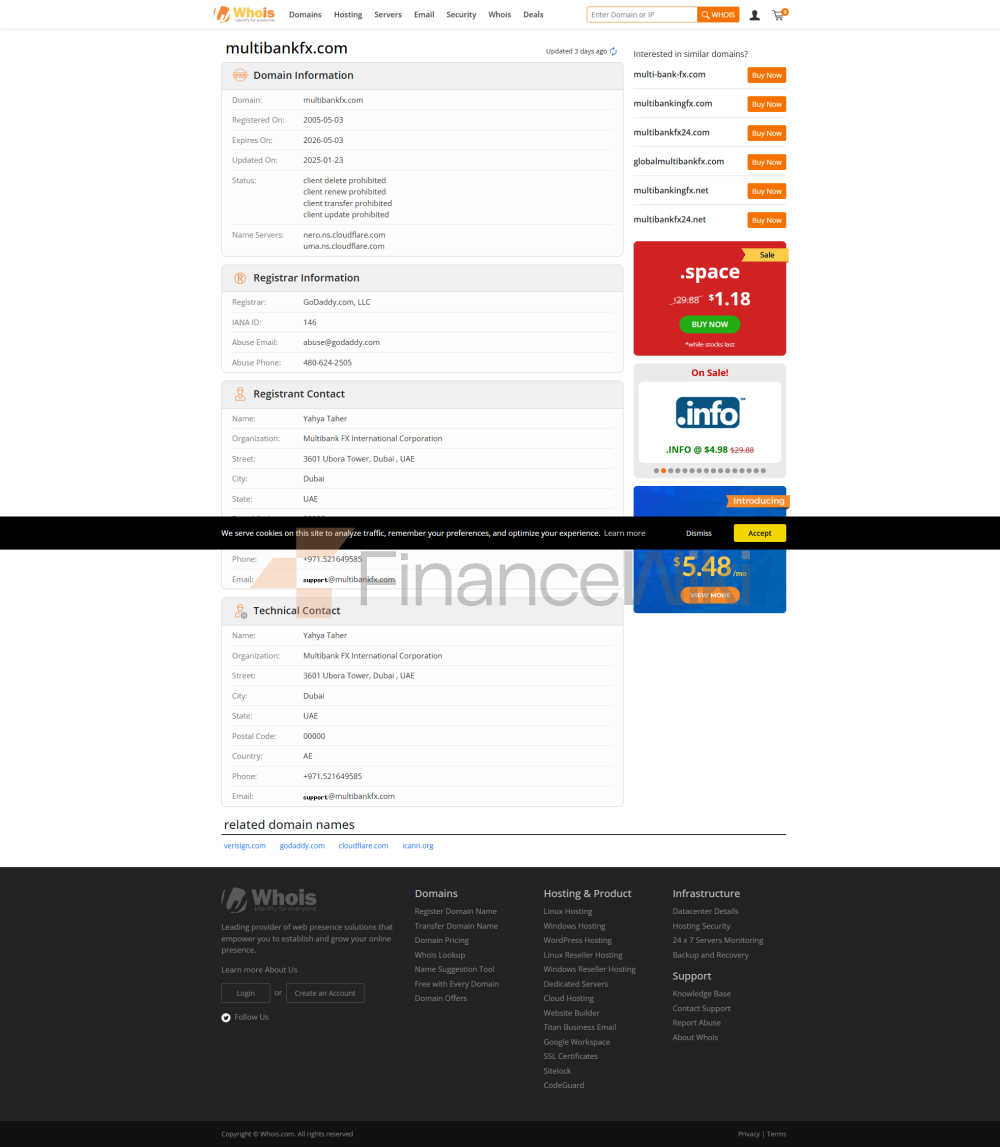

- Established: 2005, Headquartered In California, USA, A Global Financial Broker, Covering Foreign Exchange, Precious Metals, Stocks, Indices, Commodities And Cryptocurrency Trading.

- Global Layout: Asia Pacific Is The Core Market, With Offices In China, The Philippines, Malaysia And Other Places To Serve Over 200,000 Customers.

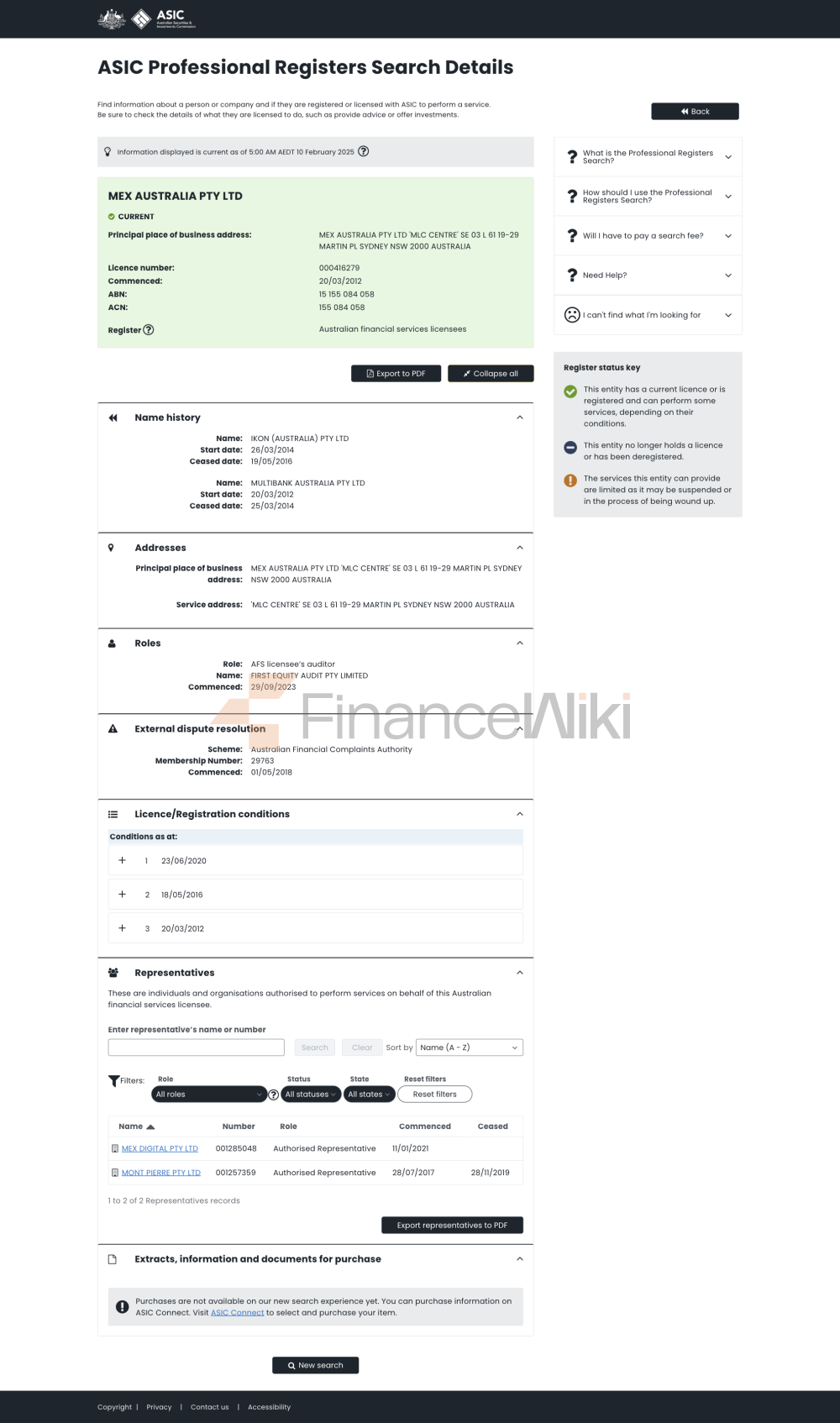

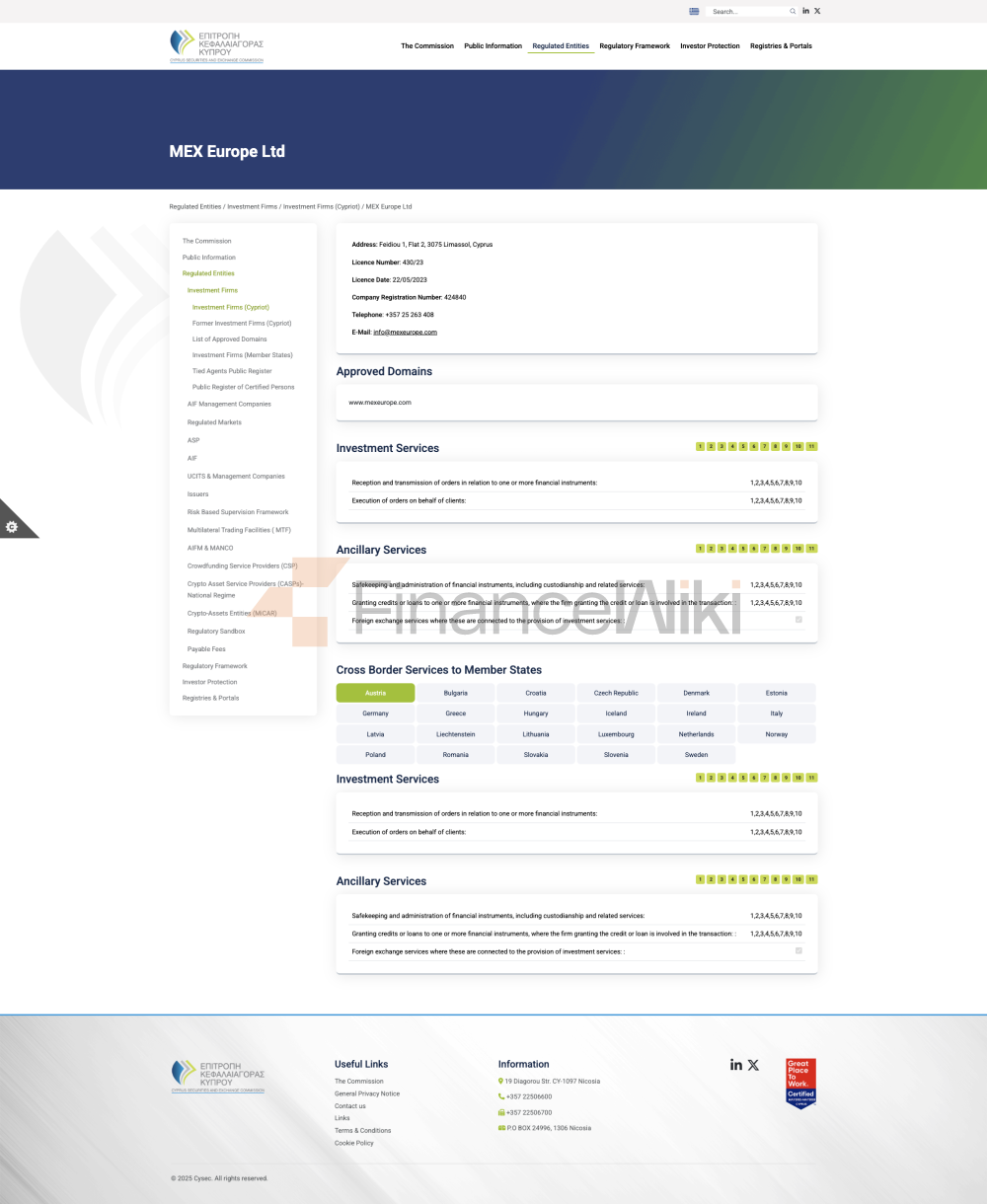

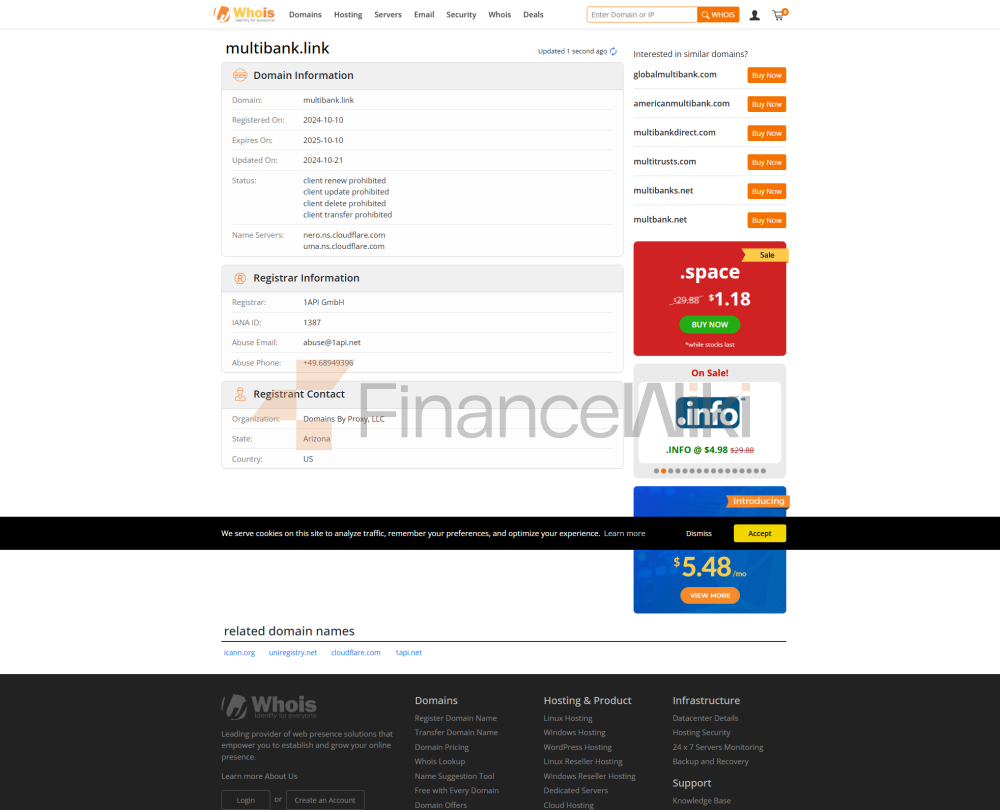

- Regulatory Qualifications (Core Strengths): ASIC (Australia, License Number 416279) CYSEC (Cyprus, License Number 430/23) MAS (Singapore, License Number CMS101174) SCA (UAE, License Number 20200000045)

Core Business And Trading Products

Tradable Assets :

- Forex: 60 + Currency Pairs Covering Major, Minor And Emerging Currencies.

- Precious Metals: Gold, Silver Spot And CFD Trading With Spreads As Low As 0.1 Pip.

- Stock Indices/Stocks: S & P 500, Nasdaq And Other Global Indices, And Individual Stocks Such As Apple And Tesla CFD.

- Commodities: Crude Oil, Natural Gas, Agricultural Products, Etc.

- Cryptocurrencies: BTC, ETH And Other Mainstream Currencies, Support 24/7 Trading.

Account Type (Differentiated Service):

- Standard Account: Starting At $50, Suitable For Beginners, With A Spread Of 1.2 Points.

- Professional Account: $1,000 Threshold, With A Spread Of 0.8 Points, Supports Advanced Order Types.

- ECN Account: From $10,000, Directly Connected To Liquidity, Spreads From 0.0 Pips + Commission 3.5 Dollars/lot.

- Islamic Account: Swap-Free, Sharia-compliant.

Trading Platform And Technical Facilities

Platform Support :

- MetaTrader4/5 (MT4/MT5): Support Expert Advisors, Multi-chart Analysis And Algorithmic Strategies.

- MultiBank-Plus (self-developed Platform): Web/mobile End Compatible, Integrated With Real-time News And Economic Calendar.

- VPS Service: Ensure <50mslowlatency,suitableforhigh-frequencyandautomatedtrading.

Technical Advantages :

- AIoT Risk Control System: Real-time Monitoring Of Market Anomalies, Triggering Automatic Stop Loss.

- Redundant System: Multi-data Center Deployment, Guaranteeing 99.99% Platform Availability.

Funds Withdrawal And Fees

Deposit Method :

- Zero Handling Fee: Credit Card (Visa/Mastercard), Bank Transfer (SEPA/Swift), E-wallet.

- Instant Arrival: Cryptocurrency (BTC/ETH) Deposit Confirmation In Seconds.

Withdrawal Rules :

- Processing Timeliness: E-wallet Within 24 Hours, Bank Transfer 1-3 Working Days.

- Security: Customer Funds Are Isolated And Stored In Top Banks Such As Standard Chartered And HSBC.

Compliance Risk Control System

- Segregation Of Funds: Strict Separation Of Client Funds And Operating Accounts, In Line With ASIC/CYSEC Requirements.

- Excess Insurance: Each Account Enjoys $1 Million Excess Loss Insurance (underwritten By Lloyd's).

- Independent Audit: Annual Financial Report Is Audited By PwC To Ensure Financial Transparency.

Market Positioning And Competitive Advantage

Core Advantage :

- Top Liquidity: Directly Connected To 10 + Top LPs Such As JPMorgan And GoldmanSachs, With The Lowest Spreads In The Industry.

- Product Breadth: 20,000 + Trading Instruments, Covering 6 Asset Classes.

- Multi-regulatory Compliance: 4 Major Mainstream Licenses, Fund Safety And Compliance Far Exceed Those Of The Industry.

- Customer Support: 24/5 Multilingual Service (including Chinese), Response Time <2minutes.

Customer Empowerment And Educational Resources

- Free Resources: Demo Account: $100,000 Virtual Funds, Risk-free Testing Strategies. Trading Academy: Video Lessons, Technical Analysis Manuals And Weekly Market Reports.

- Exclusive Services: ECN Account Users Are Supported By 1 To 1 Account Managers.

Social Responsibility And ESG

- Environmental Commitment: Green Energy In Data Centers, Carbon Reduction Target Reduced By 40% By 2030. Funding For Renewable Energy Projects In South East Asia.

- Social Good: Sponsorship Of Financial Education Programs Reaching 10,000 + Youth In Developing Countries. Donations For Disaster Relief Exceed $5 Million (2020-2023).

Strategic Cooperation And Financial Health

Partners :

- Liquidity Network: Deep Cooperation With UBS, Barclays, Etc.

- Technology Alliance: Collaborating With IBM And Oracle To Optimize AI Risk Control And Data Security.

Financial Data :

- Asset Management Scale (AUM): $5 Billion (2023Q3).

- Credit Rating: S & P "B" Rating With Stable Outlook.

- Capital Adequacy Ratio: 15% (3 Times Over Regulatory Requirements).

Future Planning

- Technology Innovation: Launch Of AI Trading Assistant In 2024, Integrating Machine Learning With Market Forecasting.

- Market Expansion: Focus On Africa And Latin America, Adding Localized Payment Channels.

- ESG Deepening: Issuance Of Green Bonds To Support Carbon Neutrality Projects.

Summary

MultiBankGroup Ranks Among The World's Top Brokers With Multi-license Supervision , Top Liquidity And 20,000 + Trading Tools . Its ECN Account And Islamic Account Meet Professional And Specific Needs, 1 Million USD Insurance And ASIC Compliance Enhance Fund Security. Despite The Low Leverage Of Cryptocurrencies (1:10), Its Comprehensive Strength Is Still Preferred By Investors.